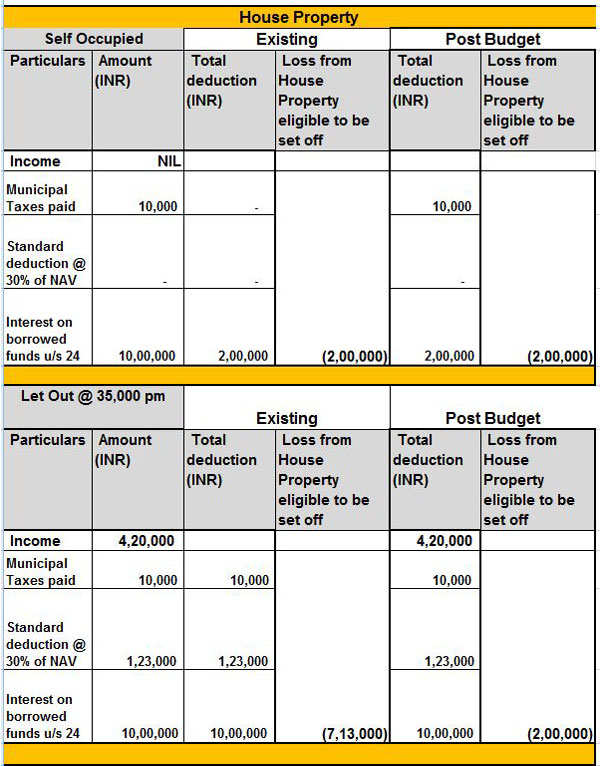

Income Tax Rebate On Interest Paid On Housing Loan Web 12 juin 2023 nbsp 0183 32 From the assessment year 2018 19 onwards the maximum deduction for interest paid on self occupied house property is Rs 2 lakh For let out property there is

Web The housing loan EMI consists of principal amount as Rs 1 50 000 deductible under section 80C and interest amount as Rs 2 000 00 deductible under section 24 of the Web You can avail deduction on the interest paid on your home loan under section 24 b of the Income Tax Act For a self occupied house the maximum tax deduction of Rs 2 lakh

Income Tax Rebate On Interest Paid On Housing Loan

Income Tax Rebate On Interest Paid On Housing Loan

https://www.relakhs.com/wp-content/uploads/2017/02/Budget-2017-2018-loss-income-from-house-property-limited-to-2-Lakh-interest-on-home-loan-Section-24-rental-income-pic.jpg

Income Tax Rebate On Home Loan Applicable Sections Under I T Act

https://assets-news.housing.com/news/wp-content/uploads/2022/09/09092126/Income-tax-rebate-on-home-loan.jpg

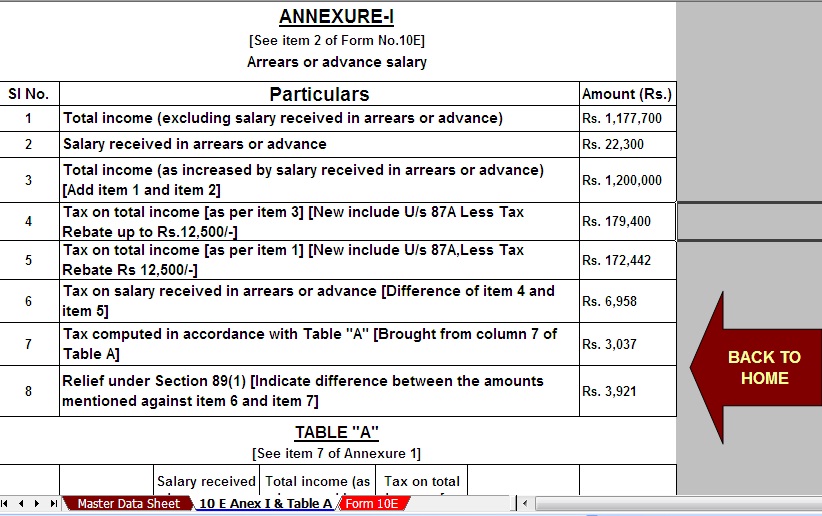

Income Tax Exemption Calculator For Interest Paid On Housing Loan With

https://tdstax.files.wordpress.com/2016/12/8bb32-non2bgovt2bemployees2b2.jpg

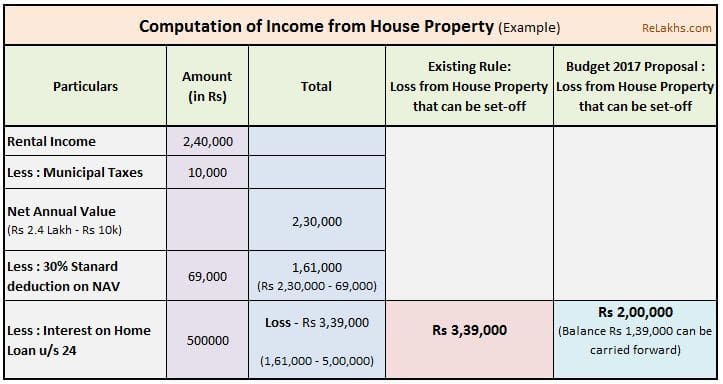

Web 31 mai 2022 nbsp 0183 32 2 Section 24 b Tax Deduction On Interest Paid You can enjoy home loan tax exemptions of up to Rs 2 lakh on the interest payment component This is useful during the initial repayments of your Web 24 ao 251 t 2023 nbsp 0183 32 Tax Deduction on Home Loan Interest Payment under Section 24 b As per Section 24 b of the Income Tax Act You can claim a tax deduction of up to Rs 2 lakh

Web 25 mars 2016 nbsp 0183 32 20 OF TOTAL Rs 56 741 74 Principle and Interest on Home Loan paid during the current financial year in which I got the possession of the second flat is as follows Financial Year Principle on Web 13 janv 2023 nbsp 0183 32 If you bought the house before December 16 2017 you can deduct the interest you paid during the year on the first 1 million of the mortgage 500 000 if married filing separately

Download Income Tax Rebate On Interest Paid On Housing Loan

More picture related to Income Tax Rebate On Interest Paid On Housing Loan

Home Loan Tax Benefit Calculator FrankiSoumya

https://emailer.tax2win.in/assets/guides/deductions_infographics/section-80ee.jpg

Tax Benefit On Home Loan Section 24 80EEA 80C With Automated

https://1.bp.blogspot.com/-1hmzbVNZKYo/XSHkKoX1yfI/AAAAAAAAJ48/rH6dqw_ChNcMLHBhRqZVUOtTkyFQPjeOQCLcBGAs/s1600/Picture-4%2Bof%2BArrears%2BRelief%2BCalculator%2B19-20.jpg

Home Loan Tax Saving Claiming Home Loan Interest Tax Break On Rented

http://img.etimg.com/photo/56914831/house-tax.jpg

Web Introduction Section 24b of income tax act allows deduction of interest on home loan from the taxable income Such loan should be taken for purchase or construction or repair or Web 28 janv 2014 nbsp 0183 32 The rebate is available from the financial year in which you have taken the possession of the property All the interest paid in that financial year can be claimed

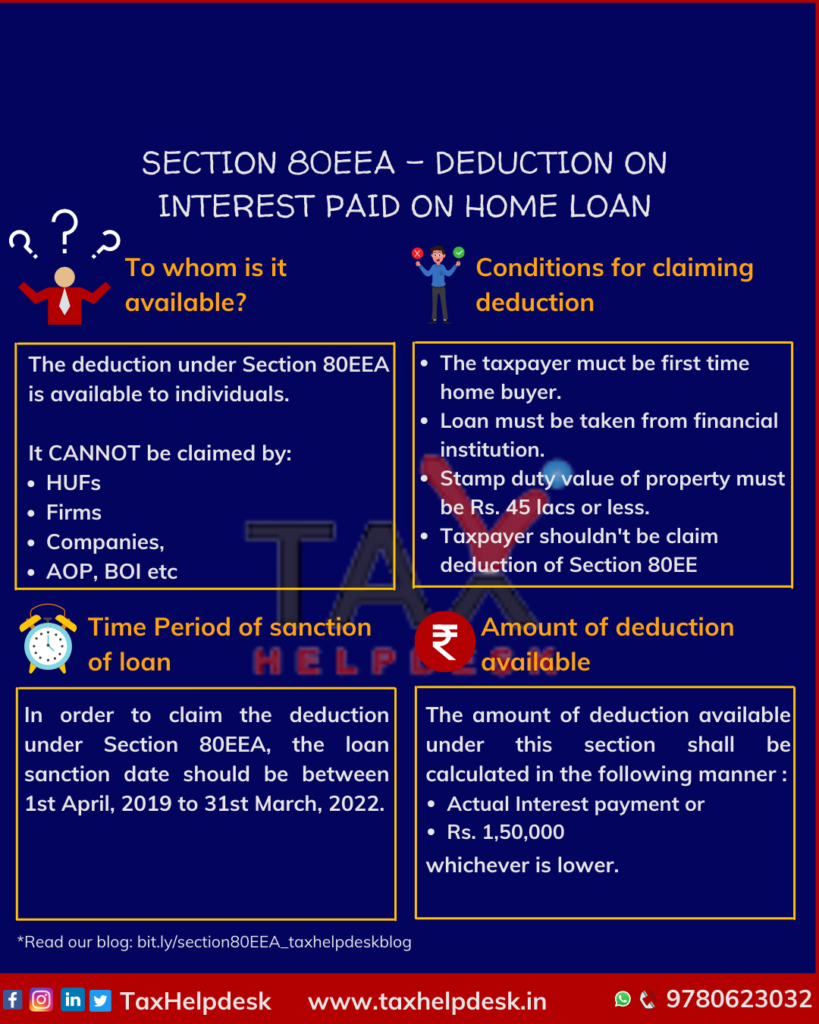

Web The maximum deduction on interest paid for self occupied houses is Rs 2 lakh This rule has been in effect from 2018 19 onwards However if your property is a let out then Web Income tax benefit on home loan is available under Section 80 EEA which provides income tax benefits of up to Rs 1 5 lakh on the home loan interests paid These home

What Are Reuluations About Getting A Home Loan On A Forclosed Home

https://www.paisabazaar.com/wp-content/uploads/2017/11/Tax-benefits-of-home-loan_2.jpg

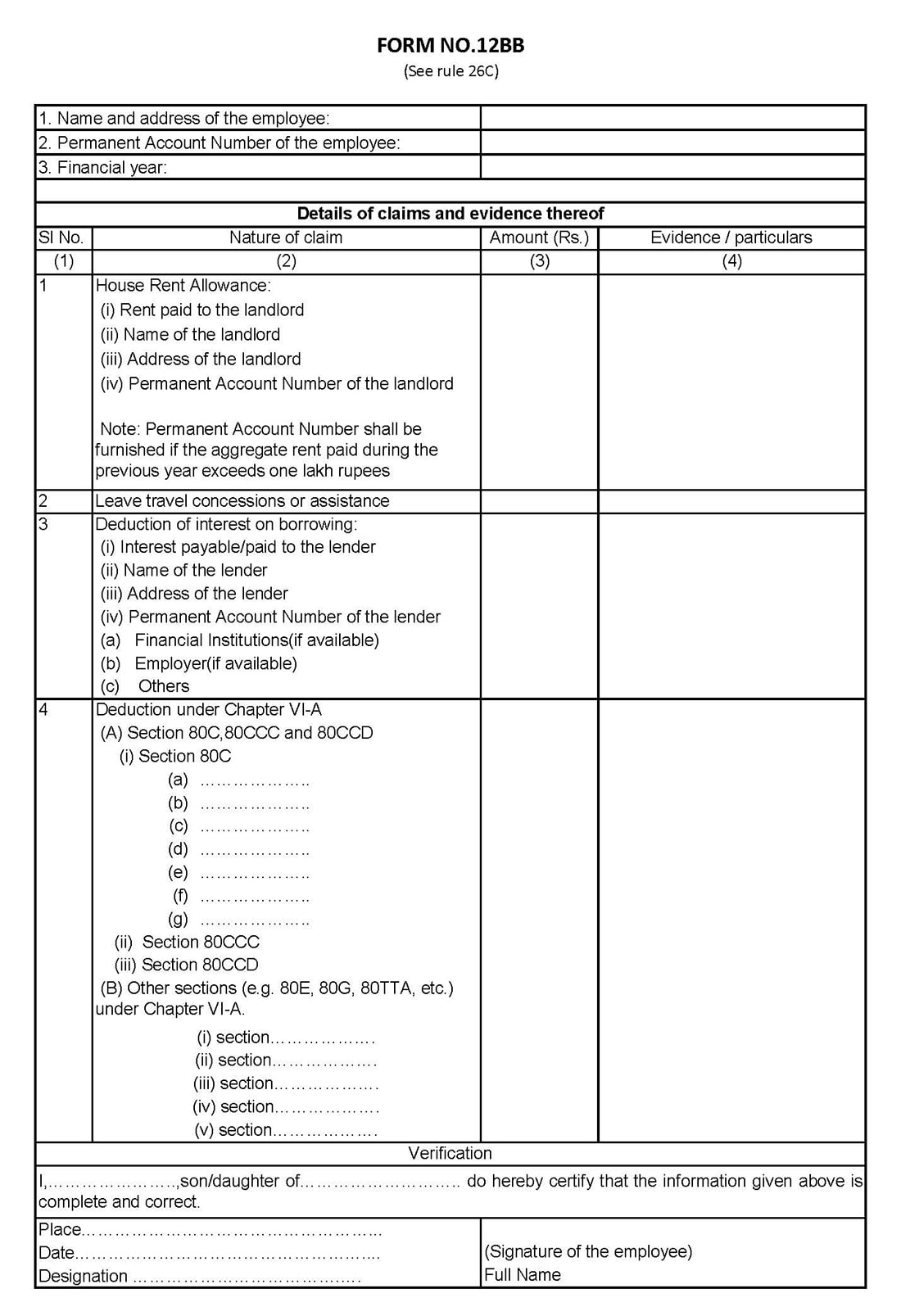

Form 12BB New Form To Claim Income Tax Benefits Rebate

https://www.relakhs.com/wp-content/uploads/2016/05/Income-Tax-Deduction-home-loan-interest-payment-form-12bb-home-loan-lender-details-pic.jpg

https://cleartax.in/s/home-loan-tax-benefits

Web 12 juin 2023 nbsp 0183 32 From the assessment year 2018 19 onwards the maximum deduction for interest paid on self occupied house property is Rs 2 lakh For let out property there is

https://www.iifl.com/blogs/have-you-calculated-income-tax-rebate-your...

Web The housing loan EMI consists of principal amount as Rs 1 50 000 deductible under section 80C and interest amount as Rs 2 000 00 deductible under section 24 of the

Section 80EEA Deduction On Interest Paid On Home Loan TaxHelpdesk

What Are Reuluations About Getting A Home Loan On A Forclosed Home

Home Loan Interest Tax Benefit 2019 20 Home Sweet Home Insurance

Home Loan Tax Benefit What Is The Income Tax Rebate On Home Loan

Tax Rebate 2019 Malaysia Homebuyers To Get Income Tax Rebate On

How To Show Home Loan Interest For Self Occupied House In ITR 1 Tax

How To Show Home Loan Interest For Self Occupied House In ITR 1 Tax

Paying Off Student Loans Don t Forget This 2500 Deduction Frugaling

Solved Janice Morgan Age 24 Is Single And Has No Chegg

Unemployment Tax Calculator JeremyMaiya

Income Tax Rebate On Interest Paid On Housing Loan - Web You can claim an income tax rebate on home loan on the amount paid towards stamp duty and registration charges under section 80C of the ITA However the benefit is only