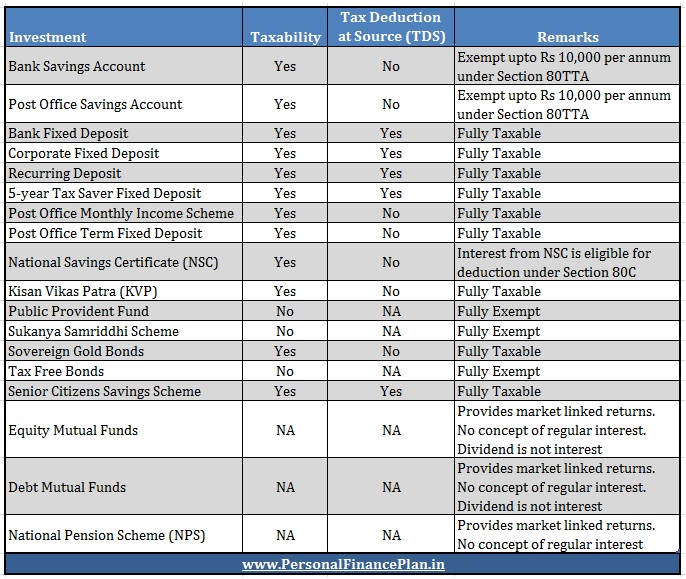

Income Tax Rebate On Interest Web 14 avr 2017 nbsp 0183 32 Senior citizens can claim a tax deduction up to Rs 50 000 on FD interest income while filing their income tax return What is the TDS rate on FDs Interest

Web However under Section 244A of the Income Tax Act the IT department must pay an interest of 0 5 of the refund amount per month or part thereof This means your Web 17 juil 2019 nbsp 0183 32 What is section 80TTA Section 80TTA of the Income Tax Act 1961 provides a deduction on the interest earned on your savings

Income Tax Rebate On Interest

Income Tax Rebate On Interest

http://www.personalfinanceplan.in/wp-content/uploads/2017/04/20170420-Taxation-of-interest-income-tax.jpg

Income Tax Rebate On Home Loan Applicable Sections Under I T Act

https://assets-news.housing.com/news/wp-content/uploads/2022/09/09092126/Income-tax-rebate-on-home-loan.jpg

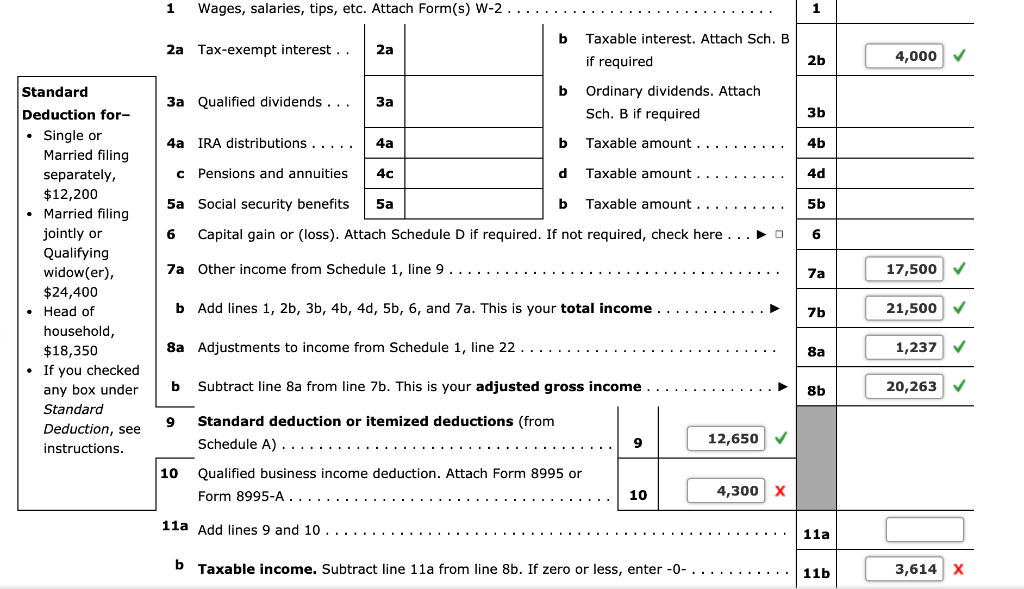

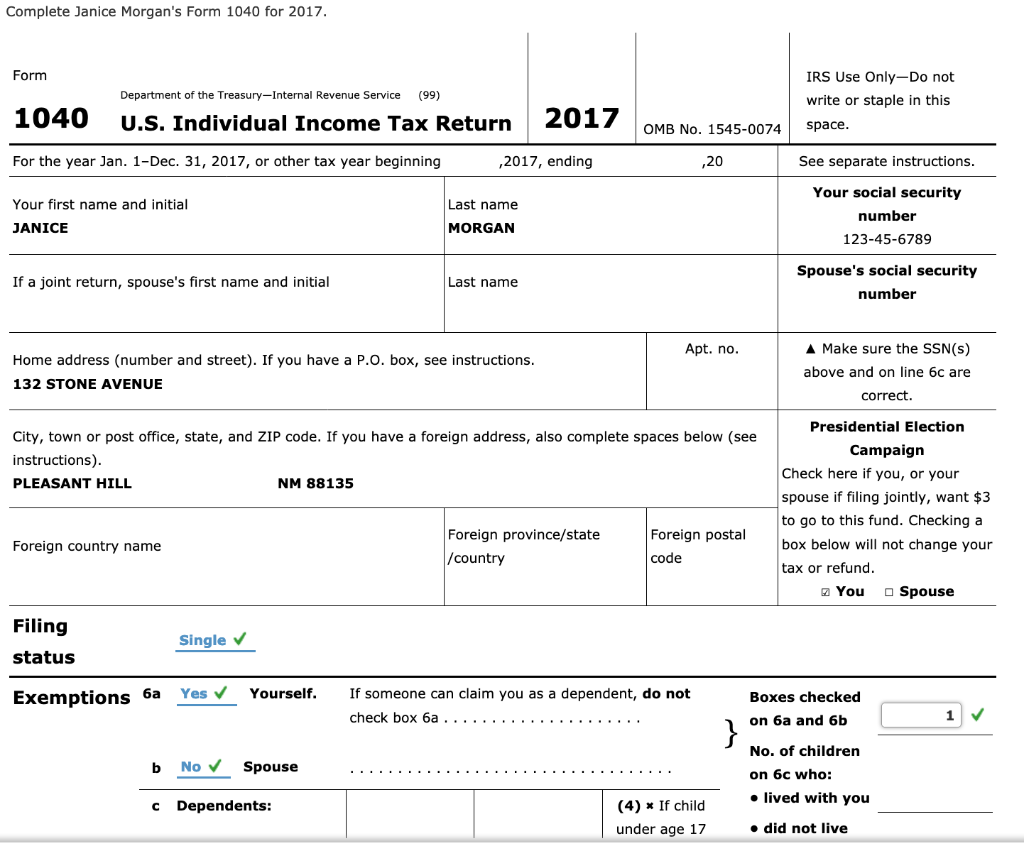

Solved Janice Morgan Age 24 Is Single And Has No Chegg

https://media.cheggcdn.com/media/5f4/5f446443-3876-4bdf-af30-bd53ed6ed3da/phpQaHDkw

Web 9 d 233 c 2022 nbsp 0183 32 This form will have all the information you need to add the income to your tax return Once you hit the 1 500 of earned interest income for the year you can report all of your taxable interest on Web 22 f 233 vr 2023 nbsp 0183 32 22 February 2023 No changes from last year From 1 March 2015 2016 tax year a final withholding tax at a rate of 15 will be charged on interest from a

Web 11 janv 2023 nbsp 0183 32 Tax deduction on the principal component is limited to Rs 1 50 lakhs per annum under Section 80C while rebate towards interest is capped at Rs 2 lakhs Additional tax benefits are also offered to first time Web Insulation and weatherization 1 600 Unlike the tax credits these rebates are based on your income level If you make less than 80 of your area s median income you can

Download Income Tax Rebate On Interest

More picture related to Income Tax Rebate On Interest

Tax Rebate For Individual Deductions For Individuals reliefs

https://2.bp.blogspot.com/-g9VZoH0Ab_0/XFpOxmUGmyI/AAAAAAAAFUM/ICy1j3WB8_stsbqaWTnl-lNqcgayVPNBACLcBGAs/s1600/rebate%2Bunder%2Bsection%2B87A%2Bafter%2Bbudget%2B2019.png

Difference Between Income Tax Exemption Vs Tax Deduction Vs Rebate

https://www.relakhs.com/wp-content/uploads/2019/03/Difference-between-Income-Tax-Exemption-Vs-Tax-Deduction-Income-Tax-Rebate-TDS-Tax-Relief-Tax-Benefit-pic.jpg

2007 Tax Rebate Tax Deduction Rebates

https://i.pinimg.com/originals/ba/b1/ac/bab1aca6df77531e309ff2affe669be8.jpg

Web 30 juil 2023 nbsp 0183 32 This deduction would facilitate individuals having an electric vehicle for personal use to claim the interest paid on the vehicle loan In case of business use an Web 26 juil 2022 nbsp 0183 32 Income tax return ITR filing How savings bank interest is taxed and can you save the income tax on it Here s your answer Anshul Jul 26 2022 1 47 37 PM IST

Web Section 24 under Section 24 of the Income Tax Act you can claim a maximum tax rebate of up to 2 lakh on the interest payable on your home loan however note that these Web 3 sept 2023 nbsp 0183 32 Almost every bank offers a rebate on FD interest for senior citizens FD Interest Taxable You might think is FD tax free No it s not tax free Nevertheless you

Budget 2019 Income Tax Rebate Hiked For Income Up To Rs 5 Lakh Here

https://www.firstpost.com/wp-content/uploads/large_file_plugin/2019/02/1549021404_Salarytable.jpg

Interim Budget 2019 20 The Talk Of The Town Trade Brains

https://tradebrains.in/wp-content/uploads/2019/02/income-tax-rebate-min.png

https://cleartax.in/s/income-tax-on-fixed-deposit-interest

Web 14 avr 2017 nbsp 0183 32 Senior citizens can claim a tax deduction up to Rs 50 000 on FD interest income while filing their income tax return What is the TDS rate on FDs Interest

https://www.idfcfirstbank.com/finfirst-blogs/finance/is-tax-refund...

Web However under Section 244A of the Income Tax Act the IT department must pay an interest of 0 5 of the refund amount per month or part thereof This means your

Income Tax Rebate U s 87A For A Y 2017 18 F Y 2016 17

Budget 2019 Income Tax Rebate Hiked For Income Up To Rs 5 Lakh Here

Tax Rebate Under Section 87A Investor Guruji Tax Planning

Solved Janice Morgan Age 24 Is Single And Has No Chegg

Retirement Income Tax Rebate Calculator Greater Good SA

Income Tax Benefits On Housing Loan Interest And Principal House Poster

Income Tax Benefits On Housing Loan Interest And Principal House Poster

Singapore Corporate Tax Rates Budget 2016 Announces Higher Tax Rebates

Income Tax Rebate Under Section 87A

Military Journal Nm State Rebate 2022 According To The Department

Income Tax Rebate On Interest - Web 22 f 233 vr 2023 nbsp 0183 32 22 February 2023 No changes from last year From 1 March 2015 2016 tax year a final withholding tax at a rate of 15 will be charged on interest from a