Income Tax Rebate On Investment In Infrastructure Bonds Web 23 oct 2021 nbsp 0183 32 The long term infrastructure bonds that were issued in the Financial Year 2011 12 to offer deductions of up to Rs 20 000 from taxable income under section

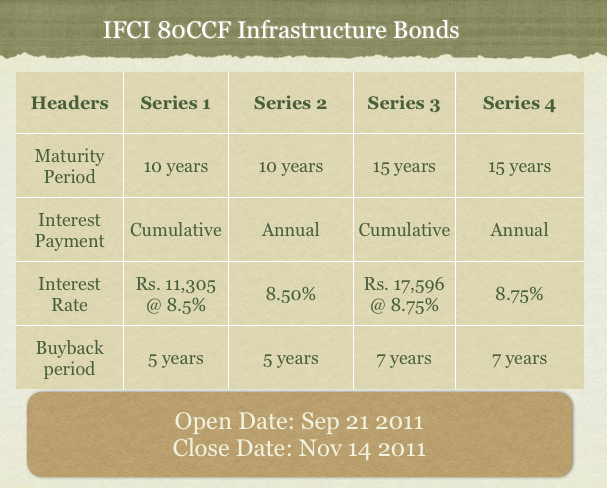

Web 5 ao 251 t 2022 nbsp 0183 32 05 Aug 2022 The government of India in a bid to attract investors money into the infrastructure sector introduced section 80CCF of the Income tax Act more than a Web Investing in infrastructure bonds is encouraged by the government by providing tax benefits under Section 80C of the Income Tax Act Tax deductions can be to a

Income Tax Rebate On Investment In Infrastructure Bonds

Income Tax Rebate On Investment In Infrastructure Bonds

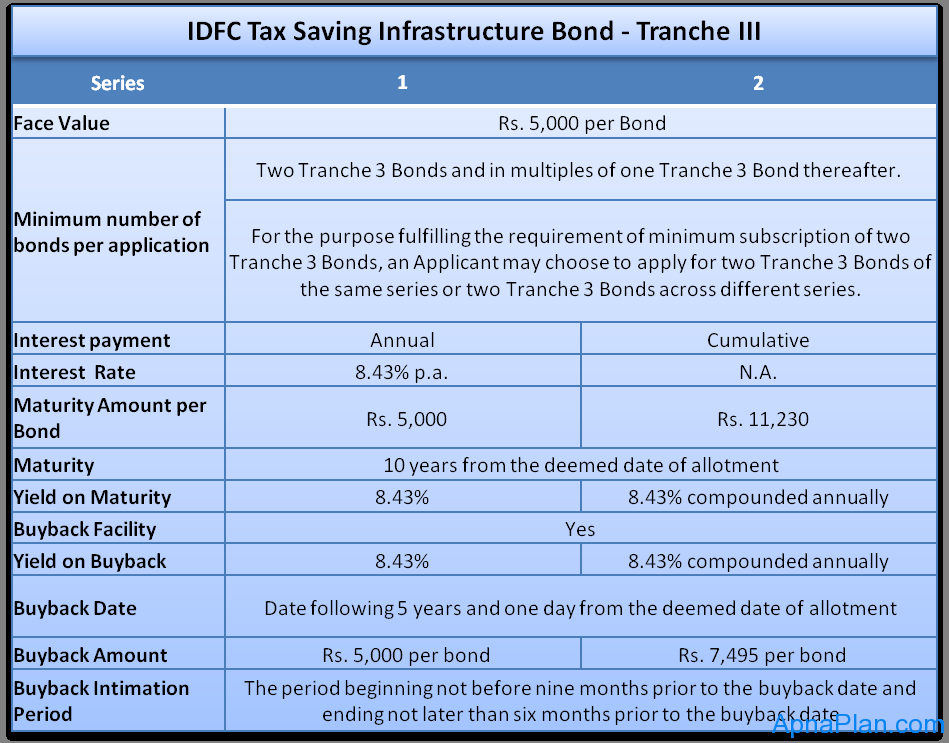

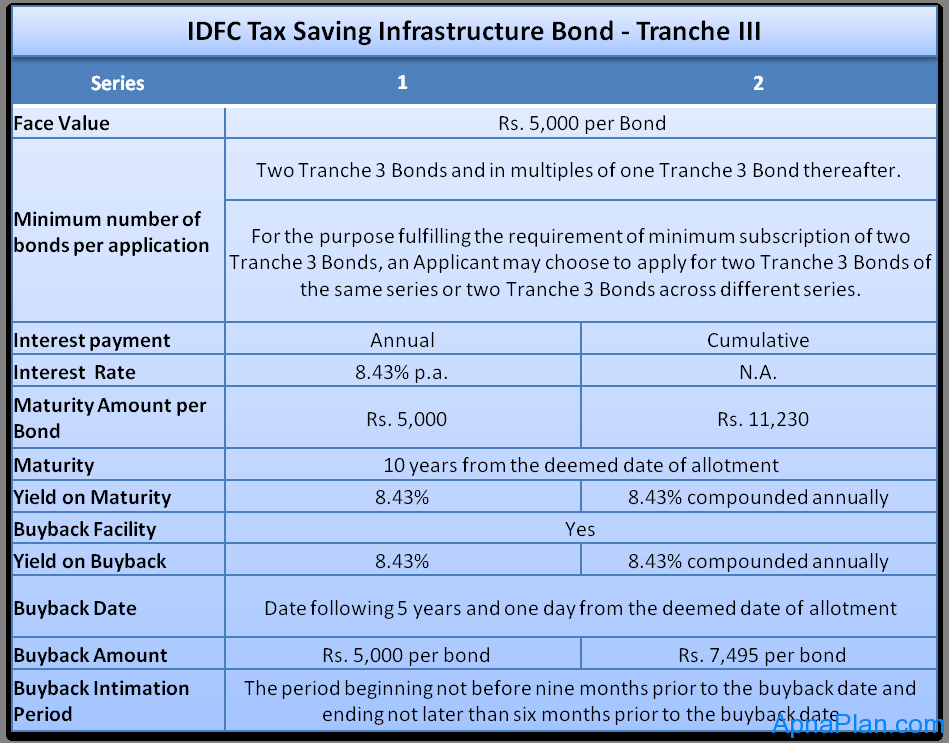

https://www.apnaplan.com/wp-content/uploads/2012/03/IDFC-Tax-Saving-Infrastructure-Bond-Tranche-III.png

Stock And Number REC Long Term Infrastructure Bonds Are Tax Rebate U s

http://2.bp.blogspot.com/-VoDYpl970BM/Txw2dcllJsI/AAAAAAAAC6E/a0m5JyoPDcI/w1200-h630-p-k-no-nu/image001.gif

Tax Rebate RM20 000 X 3 Years On Investment Holding Company Apr 20

https://cdn1.npcdn.net/image/1618905210e3b8bb075144f9faf8856b273237113c.jpg?md5id=956f9d4b926a8af07bf32de21edd8eee&new_width=1600&new_height=1600&w=-62170009200

Web 27 mars 2021 nbsp 0183 32 It will result in a total tax liability of Rs 6 960 excluding cess on maturity while he availed tax benefit of Rs 2 000 by investing in the tax saving long term Web The maximum amount of deduction that can be availed by an individual under this section is INR 20 000 per annum A deduction shall be for specified infrastructure bonds and

Web 9 juil 2010 nbsp 0183 32 The government today notified one more avenue for saving tax investment in infrastructure bonds Web 24 janv 2017 nbsp 0183 32 The federal government incurs a cost from these bonds in terms of foregone tax revenue Advantages These bonds can be used for all types of publicly owned infrastructure The tax exempt bond market

Download Income Tax Rebate On Investment In Infrastructure Bonds

More picture related to Income Tax Rebate On Investment In Infrastructure Bonds

IFCI 80CCF Tax Saving Infrastructure Bonds Review OneMint

http://www.onemint.com/wp-content/uploads/2011/10/IFCI-80CCF-Infrastructure-Bonds.png

Interim Budget 2019 20 The Talk Of The Town Trade Brains

https://tradebrains.in/wp-content/uploads/2019/02/income-tax-rebate-min.png

Income Tax Rebate On Personal Loan Claim Tax Rebate For Personal Loan

https://i.ytimg.com/vi/d7NE7aZzU2Q/maxresdefault.jpg

Web To avail of tax rebate on the total limit of Rs 1 lakh an individual had to invest Rs 30 000 in infrastructure bonds The Section 80C introduced now allows a tax saver to invest the Web 30 janv 2020 nbsp 0183 32 As per this section deduction from income would be available to individuals for investing in notified long term infrastructure bonds up to a sum of Rs 20 000 This

Web 5 sept 2010 nbsp 0183 32 All in all infrastructure bonds seem to be an attractive investment for taxpayers in the 30 and 20 tax slabs One only wishes that the permitted investment Web 21 mars 2012 nbsp 0183 32 Taxpayers may have got some relief through the increase in the basic exemption limit but the govt has taken away a crucial tax saving option

How To Celebrate With Rebate Planning For Incomes PRACTICAL TAX

https://www.practicaltaxplanning.com/ptp/wp-content/uploads/2022/06/7PY4cfZG8ZE.jpg

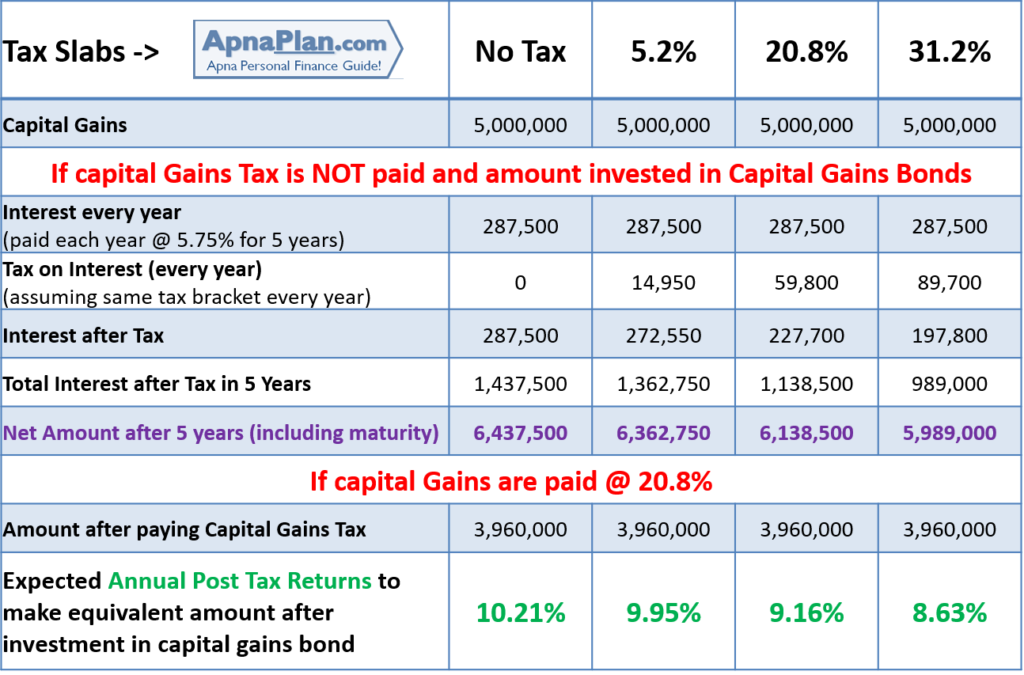

Should You Invest In Capital Gains Bond To Save Taxes

https://www.apnaplan.com/wp-content/uploads/2019/06/Invest-in-Capital-Gains-Tax-Saving-Bond-to-Save-Taxes-2019-1024x675.png

https://certicom.in/tax-saving-infrastructure-bonds-tax-you-have-to...

Web 23 oct 2021 nbsp 0183 32 The long term infrastructure bonds that were issued in the Financial Year 2011 12 to offer deductions of up to Rs 20 000 from taxable income under section

https://www.valueresearchonline.com/stories/51139/what-is-the-tax...

Web 5 ao 251 t 2022 nbsp 0183 32 05 Aug 2022 The government of India in a bid to attract investors money into the infrastructure sector introduced section 80CCF of the Income tax Act more than a

Income Tax Rebate Under Section 87A Eligibility To Claim Rebate

How To Celebrate With Rebate Planning For Incomes PRACTICAL TAX

2007 Tax Rebate Tax Deduction Rebates

Where Invest Money For Return Income Tax

Home Loan Tax Benefit What Is The Income Tax Rebate On Home Loan

Income Tax Rebate U s 87A For A Y 2017 18 F Y 2016 17

Income Tax Rebate U s 87A For A Y 2017 18 F Y 2016 17

Difference Between Income Tax Exemption Vs Tax Deduction Vs Rebate

)

Invest In These Schemes Of The Government Then You Will Not Have To

INCOME TAX REBATE ON INVESTMENT

Income Tax Rebate On Investment In Infrastructure Bonds - Web The maximum amount of deduction that can be availed by an individual under this section is INR 20 000 per annum A deduction shall be for specified infrastructure bonds and