Income Tax Rebate On Joint Housing Loan Web For one self occupied property you can claim interest benefits upto a limit of Rs 2 lakhs in case of each of the joint owners For home loan repayment each co borrower can claim

Web 7 avr 2022 nbsp 0183 32 What are the Joint Home Loan Tax Advantages 1 For a Self Contained Dwelling In their Income Tax Return each co owner who is a loan co applicant can Web 26 juil 2019 nbsp 0183 32 1 Income Tax benefits on a joint home loan can be claimed by all the joint owners 2 Ownership is required for joint owners i e Co owner 3 Joint owners have

Income Tax Rebate On Joint Housing Loan

Income Tax Rebate On Joint Housing Loan

https://lh3.googleusercontent.com/-m3Y3HavWnbc/YgqSD7tknxI/AAAAAAAAYdw/PRErS72JdeIE0B2a37gG1CvGAfWFlQvHwCNcBGAsYHQ/s1600/1644859917358770-0.png

Latest Income Tax Rebate On Home Loan 2023

https://www.homebazaar.com/knowledge/wp-content/uploads/2022/10/table_Rebate-for-Joint-House-Loan.png

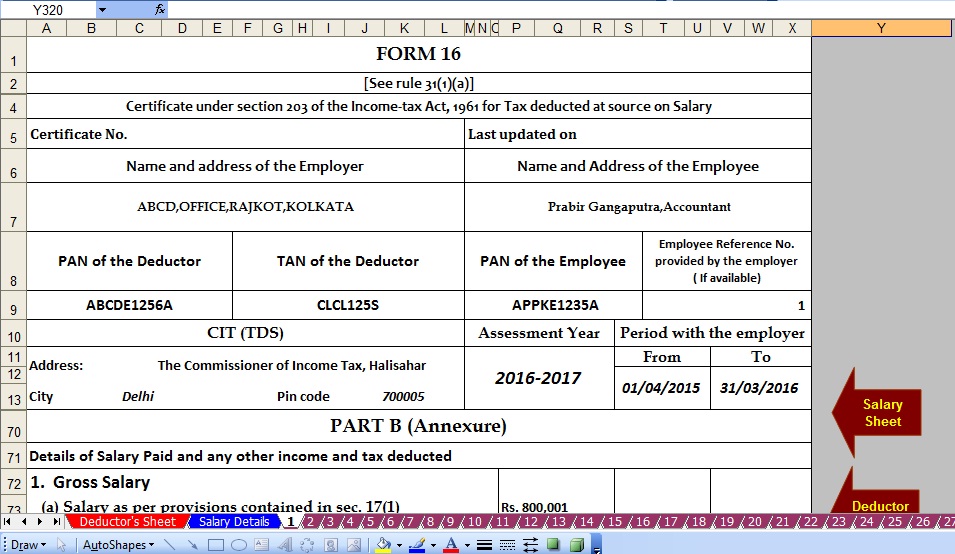

Joint Home Loan Declaration Form For Income Tax Savings And Non

https://lh3.googleusercontent.com/-pWSLuq4buU8/YgqSC60pH3I/AAAAAAAAYds/gMCrObm9nqoSd_ngGI_lj0MQT9LaKz7KACNcBGAsYHQ/s1600/1644859913400453-1.png

Web 28 mars 2017 nbsp 0183 32 If the loan is taken jointly each loan holder can claim a deduction for home loan interest up to Rs 2 lakh each and principal repayment under Section 80C up to Rs Web 16 mars 2021 nbsp 0183 32 These benefits are available under Section 80C for principal prepayment and under Section 24 b for interest paid But at times there is some confusion about

Web 11 avr 2023 nbsp 0183 32 Deductions per section 24 b of the Income Tax Act Section 24 b of the Income Tax Act allows for a deduction of up to Rs 2 lakh on the interest paid towards a Web Having a joint home loan is advantageous when both the co borrowers are tax payers But do keep in mind that to claim income tax benefits in joint home loan all the co

Download Income Tax Rebate On Joint Housing Loan

More picture related to Income Tax Rebate On Joint Housing Loan

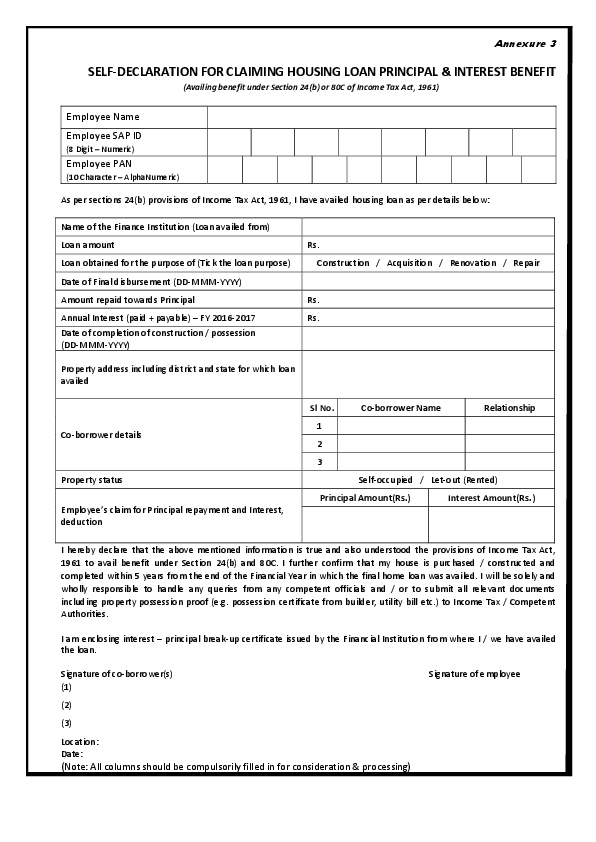

Income Tax Rebate For Housing Loan Form No 12C Pallikalvi Teachers News

https://1.bp.blogspot.com/-oW8FNR-IJDU/XikG4UEcNwI/AAAAAAAAHps/3fzchCO4L400lsdyUEyhQ4S0xHA0wQ9tQCLcBGAsYHQ/w1200-h630-p-k-no-nu/FORM12C_2015_16_001.jpg

Housing Loans Joint Declaration Form For Housing Loan

https://2.bp.blogspot.com/-sEZi3B4NgBo/VpntlQpZH5I/AAAAAAAAA0Q/gBvZ8XGhTUU/s1600/16%2BPart%2BB.jpg

How To Calculate Tax Rebate On Home Loan Grizzbye

https://lh5.googleusercontent.com/proxy/_to2OsQ67tRR4OwClZoiK8C99OHj3utcTVj3Q3bWbdpZVdQj_PtSnOS_64ZT2jiqSPfBqvnDWsCyETNMDekbIwWLP_7zi7sagEKJarz_V0esJDVAQsIgvY3jjvwKYw=w1200-h630-p-k-no-nu

Web if you have taken a home loan but continue to reside in a rented property you can claim tax benefits against HRA as well in the case of a joint home loan both borrowers can claim Web 16 oct 2012 nbsp 0183 32 As per the Income Tax Act provisions in case of joint loans all the co borrowers can avail tax benefits The maximum stipulated limit of Rs 150000 is

Web Under Section 80 EEA the government has allowed first time homebuyers to deduct an extra Rs 1 5 lakhs from their taxable income if they pay interest on a house loan This is Web 11 janv 2023 nbsp 0183 32 Tax deductions allowed on home loan principal stamp duty registration charge Relevant Section s in the income tax law Section 80C Upper limit on tax

Home Loan Tax Benefit Calculator FrankiSoumya

https://emailer.tax2win.in/assets/guides/deductions_infographics/section-80ee.jpg

Income Tax Rebate On Home Loan Applicable Sections Under I T Act

https://assets-news.housing.com/news/wp-content/uploads/2022/09/09092126/Income-tax-rebate-on-home-loan.jpg

https://housing.com/news/claim-tax-benefits-joint-home-loans

Web For one self occupied property you can claim interest benefits upto a limit of Rs 2 lakhs in case of each of the joint owners For home loan repayment each co borrower can claim

https://www.pnbhousing.com/blog/joint-home-loan-tax-benefits-and-other...

Web 7 avr 2022 nbsp 0183 32 What are the Joint Home Loan Tax Advantages 1 For a Self Contained Dwelling In their Income Tax Return each co owner who is a loan co applicant can

Section 80EE Income Tax Deduction For Interest On Home Loan Housing News

Home Loan Tax Benefit Calculator FrankiSoumya

Georgia Income Tax Rebate 2023 Printable Rebate Form

What Are Reuluations About Getting A Home Loan On A Forclosed Home

PDF SELF DECLARATION FOR CLAIMING HOUSING LOAN PRINCIPAL INTEREST

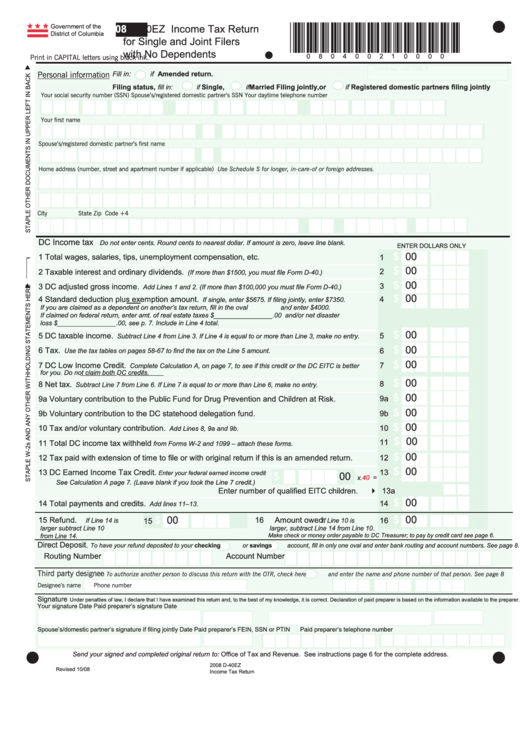

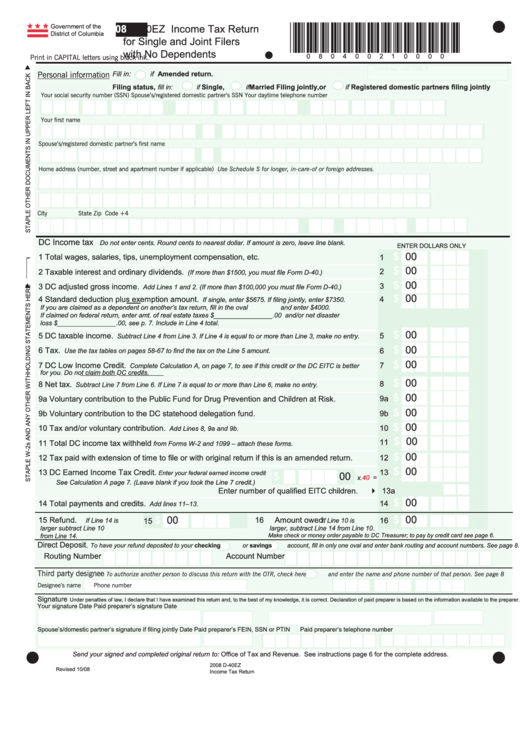

Form D 40ez Income Tax Return For Single And Joint Filers With No

Form D 40ez Income Tax Return For Single And Joint Filers With No

Latest Income Tax Rebate On Home Loan 2023

Property Tax Rebate Application Printable Pdf Download

Affordable Housing Low Ceiling On Value Limits Income Tax Benefits

Income Tax Rebate On Joint Housing Loan - Web By applying jointly for a home loan tax deduction available on home loan can be enjoyed by the co applicants separately provided they are co owners of the property and each of