Income Tax Rebate On Maintenance Of House Web 5 sept 2018 nbsp 0183 32 1 You can claim 30 on NAV as said by Kaushal Sir NAV means Gross Annual Value or say Rent Municipal Taxes even if you do not carry on any

Web 15 janv 2018 nbsp 0183 32 The deduction amount for self occupied property is capped at 30 000 a year If the property is rented then full interest shall be allowed for renovation Web 11 d 233 c 2020 nbsp 0183 32 If you are receiving maintenance payments and you also have income that is subject to PAYE it may be possible to collect some or all of the tax due on the

Income Tax Rebate On Maintenance Of House

Income Tax Rebate On Maintenance Of House

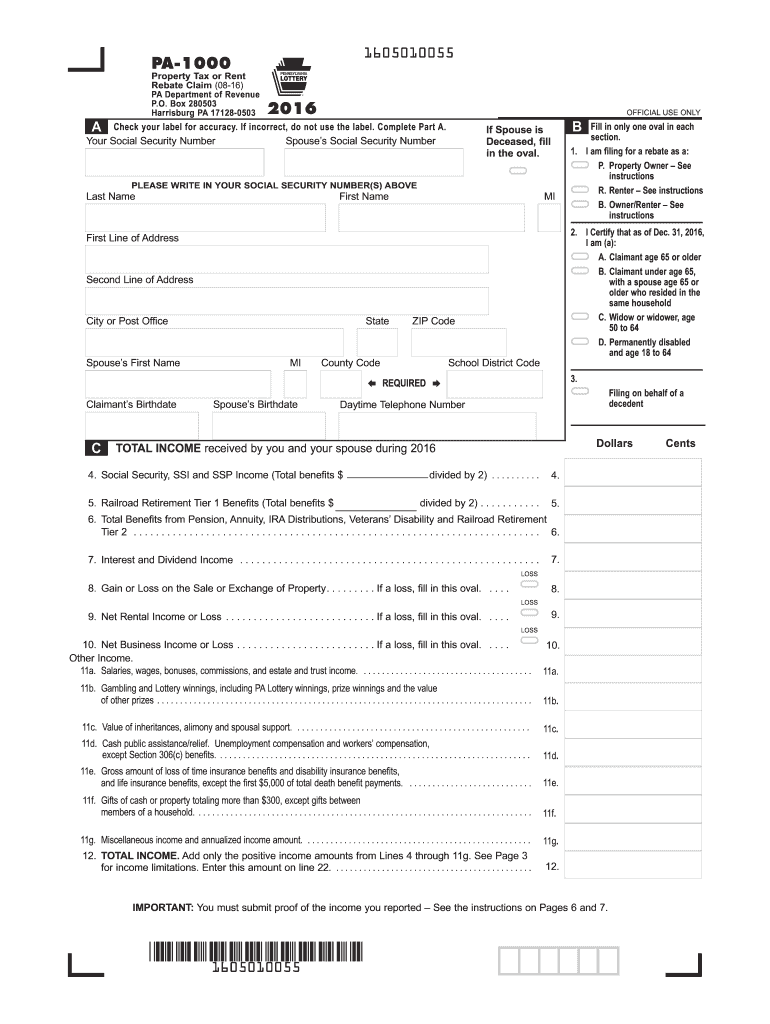

https://www.pdffiller.com/preview/101/125/101125610/large.png

Tax Rebate On Income Upto 5 Lakh Under Section 87A

https://blog.saginfotech.com/wp-content/uploads/2021/04/income-tax-rebate.jpg

4 TAX REBATE U s 87A New TAX REBATE EXAMPLES Income Tax

https://i.ytimg.com/vi/DwFvkMZgBmc/maxresdefault.jpg

Web 22 juin 2023 nbsp 0183 32 You ll get a refund if you pay more in taxes say through your paycheck withholdings than you actually owe Tax rebate These are retroactive tax decreases Web 26 f 233 vr 2020 nbsp 0183 32 Query 1 I am paying a house rent for Rs 14 000 per month and additional Rs 1 200 towards maintenance for which receipt is being given to me every month Will I get House Rent Allowance HRA

Web 18 mai 2021 nbsp 0183 32 INCOME TAX As per provisions of section 23 annual value shall be deemed to be actual rent received or receivable by assessee and proviso provides for deduction of municipal taxes levied by any local Web 29 ao 251 t 2023 nbsp 0183 32 Yes up to Rs 7 500 in maintenance fees paid by residents to the Resident Welfare Association are exempt GST is applicable to the full amount charged if it

Download Income Tax Rebate On Maintenance Of House

More picture related to Income Tax Rebate On Maintenance Of House

P55 Tax Rebate Form By State Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/09/P55-Tax-Rebate-Form-768x735.png

Ptr Tax Rebate Libracha

https://data.formsbank.com/pdf_docs_html/203/2033/203353/page_1_thumb_big.png

Georgia Income Tax Rebate 2023 Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/03/Georgia-Tax-Rebate-2023-768x683.png

Web 13 janv 2023 nbsp 0183 32 Are home repairs or maintenance costs deductible SOLVED by TurboTax 1880 Updated January 13 2023 On rental property yes On a personal Web If you re building a new patio in your backyard or revamping the kitchen in your home don t expect to get a tax break Home improvements are generally not tax deductible under the US tax code

Web The standard deduction on income from house property is an income tax deduction which can be claimed even if you have not incurred any expenditure in the form of repairs Web 6 juin 2020 nbsp 0183 32 Similarly income from maintenance services was shown at Rs 1 80 37 643 against which the maintenance expenses claimed were shown at Rs 2 11 03 333 and

Tax Rebate Checks Come Early This Year Yonkers Times

https://yonkerstimes.com/wp-content/uploads/2018/09/check-2-2.jpg

2007 Tax Rebate Tax Deduction Rebates

https://i.pinimg.com/originals/ba/b1/ac/bab1aca6df77531e309ff2affe669be8.jpg

https://www.caclubindia.com/forum/rebate-towards-repair-and...

Web 5 sept 2018 nbsp 0183 32 1 You can claim 30 on NAV as said by Kaushal Sir NAV means Gross Annual Value or say Rent Municipal Taxes even if you do not carry on any

https://www.ndtv.com/business/budget-2018-house-renovation-cost-can...

Web 15 janv 2018 nbsp 0183 32 The deduction amount for self occupied property is capped at 30 000 a year If the property is rented then full interest shall be allowed for renovation

Individual Income Tax Rebate

Tax Rebate Checks Come Early This Year Yonkers Times

Income Tax And Rebate For Apartment Owners Association

Interim Budget 2019 20 The Talk Of The Town Trade Brains

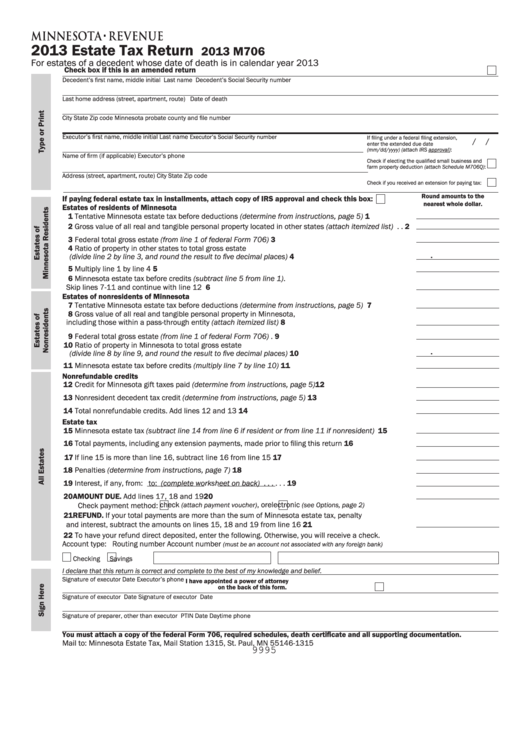

Fillable Form M706 Estate Tax Return Minnesota Department Of

How To Calculate Tax Rebate On Home Loan Grizzbye

How To Calculate Tax Rebate On Home Loan Grizzbye

Income Tax Rebate U s 87A For A Y 2017 18 F Y 2016 17

FY 2020 21 Income Tax Sections Of Deductions And Rebates For Resident

Revised Tax Rebate Under Sec 87A After Budget 2019 BasuNivesh

Income Tax Rebate On Maintenance Of House - Web 18 mai 2021 nbsp 0183 32 INCOME TAX As per provisions of section 23 annual value shall be deemed to be actual rent received or receivable by assessee and proviso provides for deduction of municipal taxes levied by any local