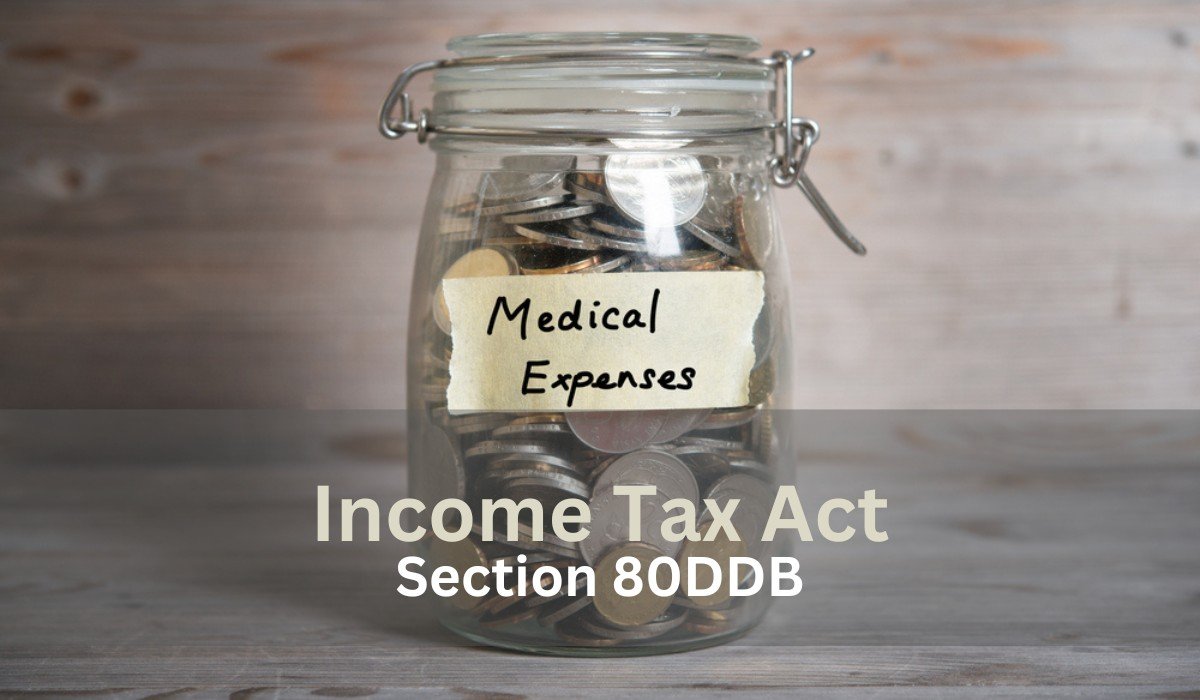

Income Tax Rebate On Medical Expenses Of Parents Web 17 juil 2019 nbsp 0183 32 Section 80DDB provides a deduction for the expenditure actually incurred on the treatment of specified diseases for self spouse children parents and siblings

Web 28 f 233 vr 2019 nbsp 0183 32 Can medical bills help me save tax under section 80D Yes medical bills of your senior citizen parents or of yourself if you are Web 26 nov 2020 nbsp 0183 32 Section 80D of the IT Act provides a deduction to the extent of 25 000 in respect of the premium paid towards an insurance on the

Income Tax Rebate On Medical Expenses Of Parents

Income Tax Rebate On Medical Expenses Of Parents

https://media.cheggcdn.com/media/5f4/5f446443-3876-4bdf-af30-bd53ed6ed3da/phpQaHDkw

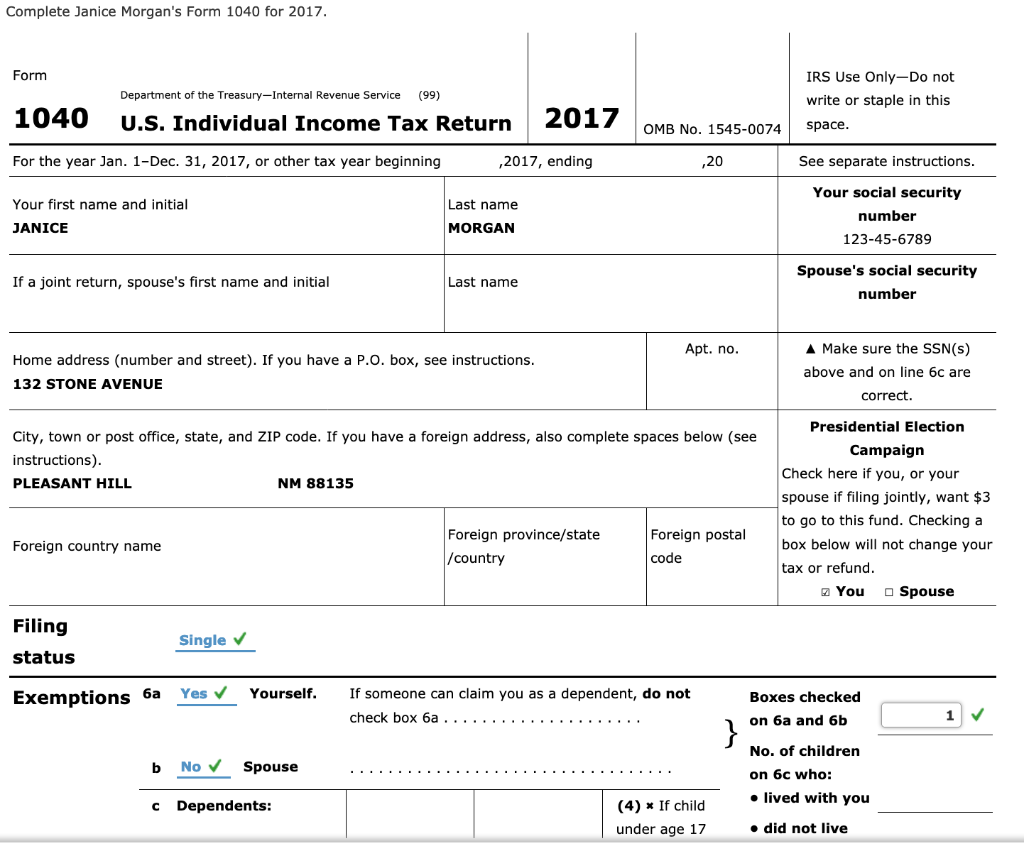

Solved Janice Morgan Age 24 Is Single And Has No Dependents She Is

https://www.coursehero.com/qa/attachment/24027424/

Medical Expenses Rebate YouTube

https://i.ytimg.com/vi/2HdkaQh6wiI/maxresdefault.jpg

Web 29 juin 2018 nbsp 0183 32 Deduction under section 80DDB can be claimed by an individual or a HUF who is resident in India Deduction is available in Web 24 oct 2022 nbsp 0183 32 Medical Tax Relief Types Amount Medical treatment special needs and carer expenses for parents Medical condition certified by medical practitioner

Web 15 mars 2019 nbsp 0183 32 Section 80D of the Income tax Act allows you to save tax by claiming medical expenditures incurred as a deduction from income before levy of tax You can claim this deduction if these two conditions Web 21 f 233 vr 2022 nbsp 0183 32 Section 80D of Income Tax Act allows deduction of up to Rs 50 000 for medical expenses incurred for senior citizens self spouses or dependent children If you are making payment of

Download Income Tax Rebate On Medical Expenses Of Parents

More picture related to Income Tax Rebate On Medical Expenses Of Parents

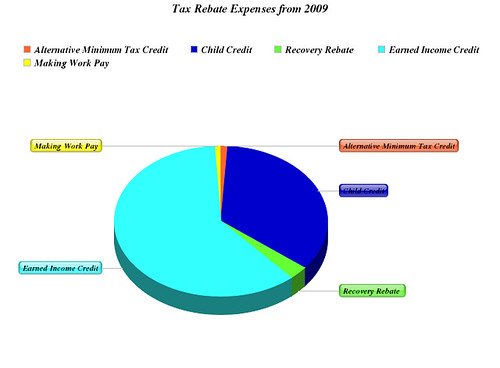

Tax Rebate Expenses From 2009 Maddogg41283 Flickr

https://live.staticflickr.com/4036/4711289081_54db022a57.jpg

SCE OFFERS REBATES TO CUSTOMERS WHO ARE MEDICAL BASELINE BASED ON LOWER

https://us1-photo.nextdoor.com/post_photos/14/87/148718885ba5f67f6cbd45ed001c07b7.png

Income Tax Rebate On Investment In Insurance Premium 2020 Tariq Mahmood

https://i.ytimg.com/vi/jZcpVwGx4EE/maxresdefault.jpg

Web The Income Tax Act allows you to claim a maximum deduction of Rs 50 000 as of FY 2021 22 on medical expenses incurred on the healthcare of senior citizens eligible Web The tax deduction limit increases to Rs 50 000 per fiscal year for senior citizens aged 60 years and above Individuals can claim tax deductions under Section 80D on a health

Web 31 oct 2020 nbsp 0183 32 1 Taxpayer must be resident in India 2 Taxpayer is an Individual or HUF 3 Amount actually paid for the medical treatment of such disease or ailment as specified in Web 28 juin 2020 nbsp 0183 32 As per Section 80D a deduction is available towards the amount paid on account of medical expenditure incurred on any parent who are senior citizens to the

Solved Janice Morgan Age 24 Is Single And Has No Chegg

https://media.cheggcdn.com/media/3b6/3b6e0b0f-5f0b-4b1a-993f-e6359e2d4ede/phpXXJUd2

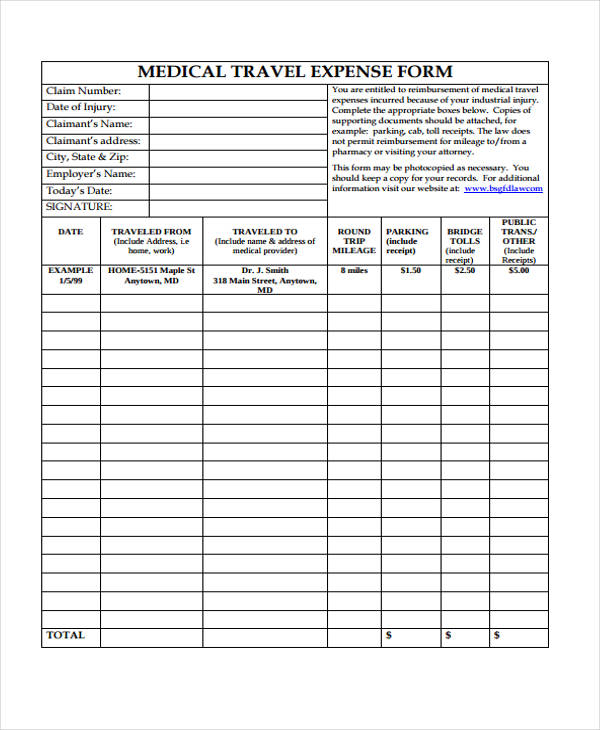

FREE 11 Medical Expense Forms In PDF MS Word

https://images.sampleforms.com/wp-content/uploads/2017/04/Medical-Travel-Expense-Form.jpg

https://tax2win.in/guide/section-80ddb

Web 17 juil 2019 nbsp 0183 32 Section 80DDB provides a deduction for the expenditure actually incurred on the treatment of specified diseases for self spouse children parents and siblings

https://economictimes.indiatimes.com/wealth/t…

Web 28 f 233 vr 2019 nbsp 0183 32 Can medical bills help me save tax under section 80D Yes medical bills of your senior citizen parents or of yourself if you are

Http www anchor tax service financial tools deductions medical

Solved Janice Morgan Age 24 Is Single And Has No Chegg

Deferred Tax And Temporary Differences The Footnotes Analyst

Income Tax Rebate Under Section 87A

Is It Possible To Stop Paying Property Taxes By Removing Your Property

/ScreenShot2021-02-12at3.32.18PM-40b79df9059346d4aaef488825e16a46.png)

2022 1040 Schedule A

/ScreenShot2021-02-12at3.32.18PM-40b79df9059346d4aaef488825e16a46.png)

2022 1040 Schedule A

Tax Rebate For Individual Deductions For Individuals reliefs

Section 80DDB Tax Deduction For Critical Illness Medical Expense

Military Journal Nm State Rebate 2022 According To The Department

Income Tax Rebate On Medical Expenses Of Parents - Web 21 f 233 vr 2022 nbsp 0183 32 Section 80D of Income Tax Act allows deduction of up to Rs 50 000 for medical expenses incurred for senior citizens self spouses or dependent children If you are making payment of