Income Tax Rebate On Medical Expenses Web 17 juil 2019 nbsp 0183 32 Specified diseases covered u s 80DDB are defined under rule 11DD of the income tax The following are the medical conditions diseases for which one can claim

Web 20 sept 2020 nbsp 0183 32 Provisions u s 80D If no member of your family i e self spouse and children is a senior citizen you may claim deductions up to Rs 25 000 on health Web 14 juin 2018 nbsp 0183 32 Deduction of Medical Expenses for Senior Citizens Section 80D For the welfare of senior citizens Resident aged 60 or above who don t have health

Income Tax Rebate On Medical Expenses

Income Tax Rebate On Medical Expenses

https://i.pinimg.com/originals/93/fc/e8/93fce8e4872e20094e9c7743332faf81.jpg

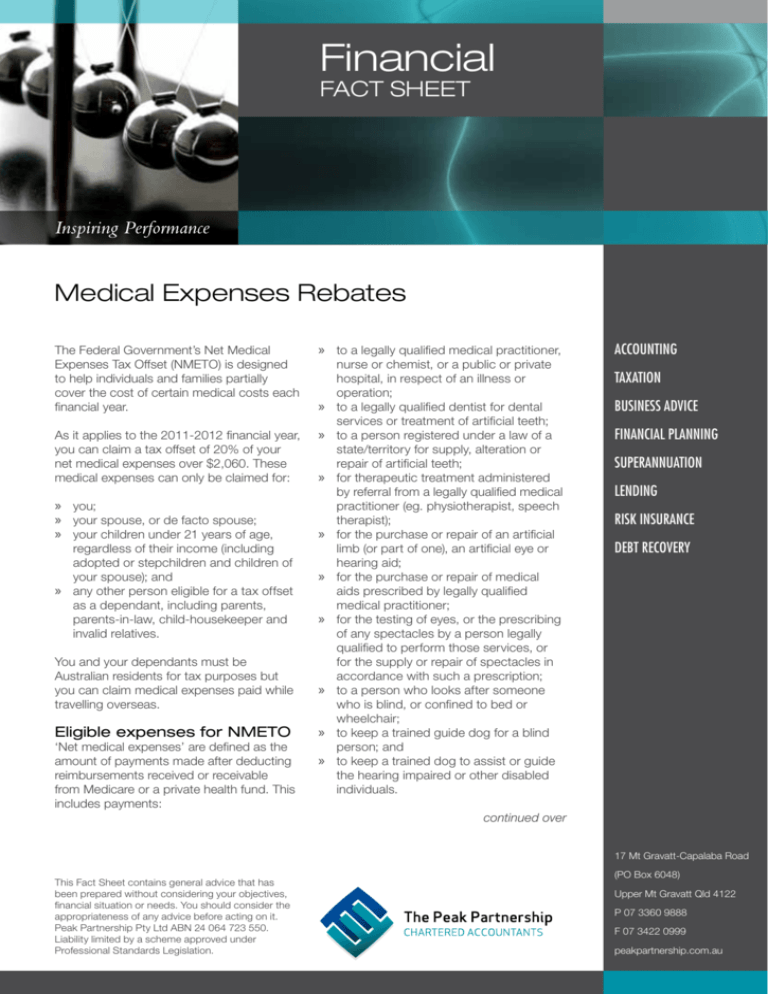

Medical Expenses Rebates

https://s3.studylib.net/store/data/008082010_1-c32f4bdb4afdf54db3e7d4bebd5ba95a-768x994.png

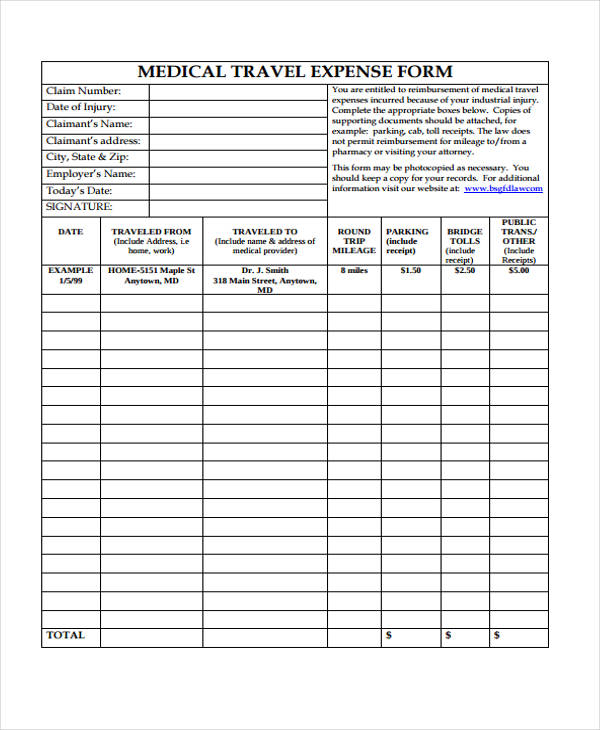

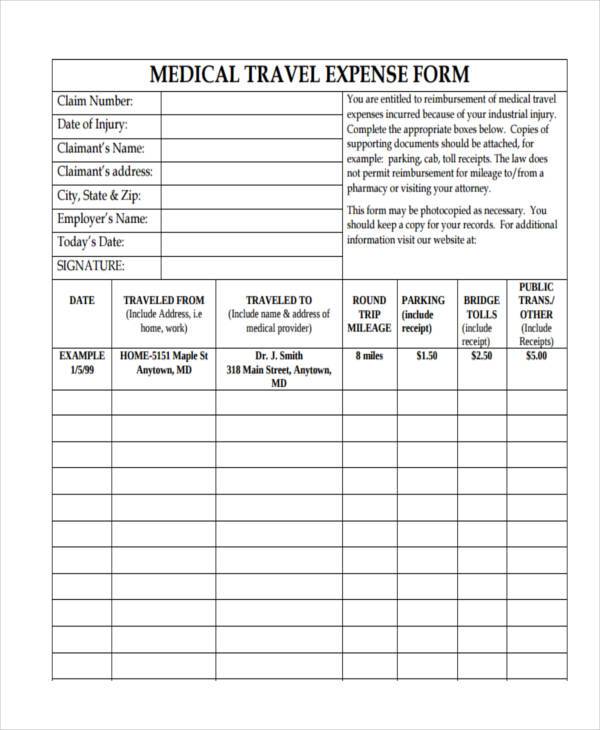

FREE 11 Medical Expense Forms In PDF MS Word

https://images.sampleforms.com/wp-content/uploads/2017/04/Medical-Travel-Expense-Form.jpg

Web 13 f 233 vr 2020 nbsp 0183 32 Income Tax Deduction for Medical Expenses Last updated February 13th 2020 05 46 pm This article provides a list of all income tax deductions and other Web 26 nov 2020 nbsp 0183 32 Section 80D of the IT Act provides a deduction to the extent of 25 000 in respect of the premium paid towards an insurance on the health of self spouse and dependent children Income tax

Web 29 mai 2023 nbsp 0183 32 Deductions Under Section 80DDB can be claimed with respect to the expenses incurred in medical expenses Know more on how to claim and whom to take Web 24 oct 2022 nbsp 0183 32 Written by Haziq Alfian Part of the struggle of doing your taxes is figuring out which expenses you can claim for tax relief It s a struggle that you have to do as

Download Income Tax Rebate On Medical Expenses

More picture related to Income Tax Rebate On Medical Expenses

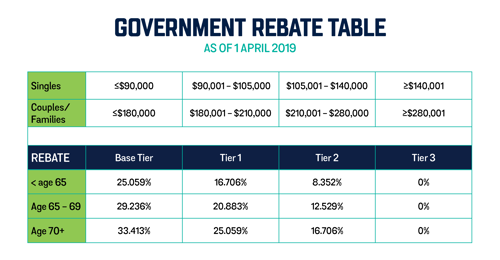

Tax Time And Private Health Insurance Teachers Health

https://www.teachershealth.com.au/media/2111/2019-govt-rebate-table2.png?width=500&height=260.4838709677419

FREE 44 Expense Forms In PDF MS Word Excel

https://images.sampleforms.com/wp-content/uploads/2017/03/Medical-Travel-Expense-Form1.jpg

Printable Yearly Itemized Tax Deduction Worksheet Fill Out Sign

https://www.pdffiller.com/preview/391/382/391382225/large.png

Web 29 juin 2018 nbsp 0183 32 Deductions of expenses on medical treatment of specified ailments such as AIDS cancer and neurological diseases can be claimed under Section 80DDB The maximum amount of deduction allowed from Web 13 f 233 vr 2019 nbsp 0183 32 In case 1 as no reimbursement is received by you either from the employer or insurer therefore from Rs 60 000 expenditure you can claim a maximum deduction of Rs 40 000 In case 2 amount of Rs

Web 16 nov 2022 nbsp 0183 32 33 3 of the fees paid by the person to a registered medical scheme or similar qualifying foreign fund as exceeds three times the amount of the MTC to which Web 5 sept 2023 nbsp 0183 32 As per an amendment in the Budget 2018 tax exemption on medical reimbursement amounting to Rs 15 000 and transport allowance amounting to Rs 19 200

Solved Janice Morgan Age 24 Is Single And Has No Chegg

https://media.cheggcdn.com/media/5f4/5f446443-3876-4bdf-af30-bd53ed6ed3da/phpQaHDkw

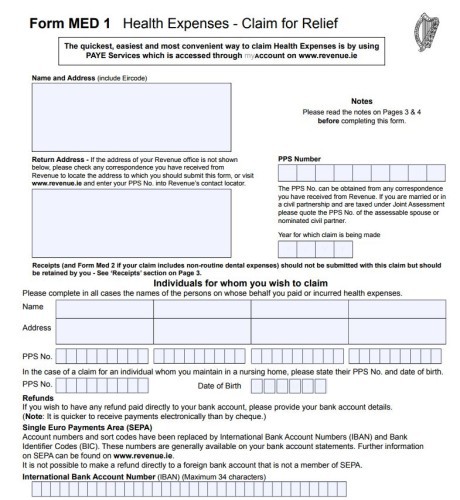

Why Do So Few Irish People Claim Back Their Medical Expenses

https://img2.thejournal.ie/inline/3477222/original/?width=460&version=3477222

https://tax2win.in/guide/section-80ddb

Web 17 juil 2019 nbsp 0183 32 Specified diseases covered u s 80DDB are defined under rule 11DD of the income tax The following are the medical conditions diseases for which one can claim

https://www.financialexpress.com/money/income-tax-income-tax-return...

Web 20 sept 2020 nbsp 0183 32 Provisions u s 80D If no member of your family i e self spouse and children is a senior citizen you may claim deductions up to Rs 25 000 on health

Section 80D Tax Benefits Health Or Mediclaim Insurance FY 2017 18

Solved Janice Morgan Age 24 Is Single And Has No Chegg

Deferred Tax And Temporary Differences The Footnotes Analyst

10 Pay Stub Format Sampletemplatess Sampletemplatess C83

SCE OFFERS REBATES TO CUSTOMERS WHO ARE MEDICAL BASELINE BASED ON LOWER

Printable Itemized Deductions Worksheet Customize And Print

Printable Itemized Deductions Worksheet Customize And Print

Bonus Tax Rate 2018 Museumruim1op10 nl

Form It 2023 Income Allocation And Apportionment Printable Pdf Download

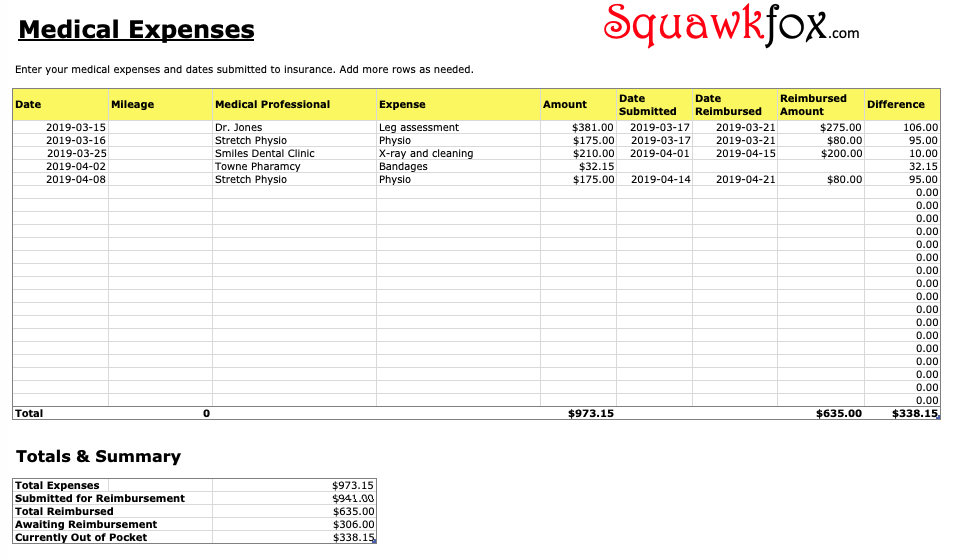

Printable Excel Spreadsheet For Medical Expenses To Track Template

Income Tax Rebate On Medical Expenses - Web 13 f 233 vr 2020 nbsp 0183 32 Income Tax Deduction for Medical Expenses Last updated February 13th 2020 05 46 pm This article provides a list of all income tax deductions and other