Income Tax Rebate On Medical Reimbursement Web 12 juin 2020 nbsp 0183 32 i want to know that medical reimbursement given to employee as Rs 1 lakh how rebate he gets or whether this is a income added to his gross income for

Web 6 mars 2019 nbsp 0183 32 While Medical Reimbursement on any disease was tax free up to Rs 15 000 u s 17 2 of the Income Tax Act till last year Medical Allowance was fully taxable Web 9 f 233 vr 2023 nbsp 0183 32 Medical Reimbursement is tax free perquisites under Section 17 2 till INR 15000 However the employee can incur an amount higher than INR 15 000 on medical

Income Tax Rebate On Medical Reimbursement

Income Tax Rebate On Medical Reimbursement

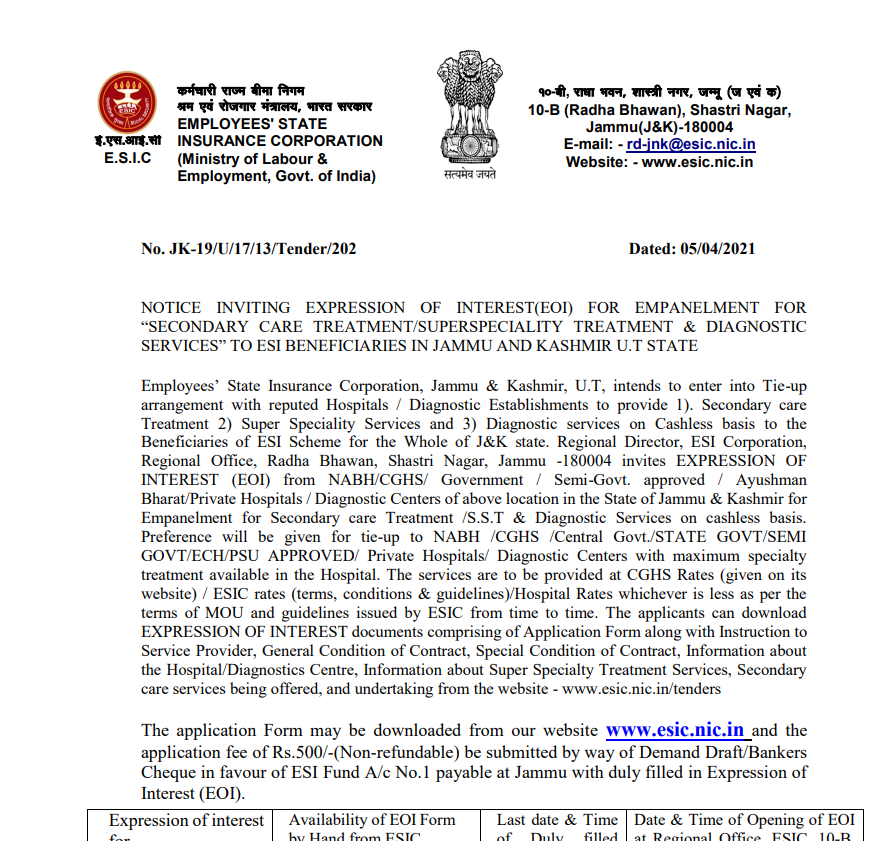

https://printablerebateform.net/wp-content/uploads/2022/10/Reimbursement-Form-Esic-PDF.png

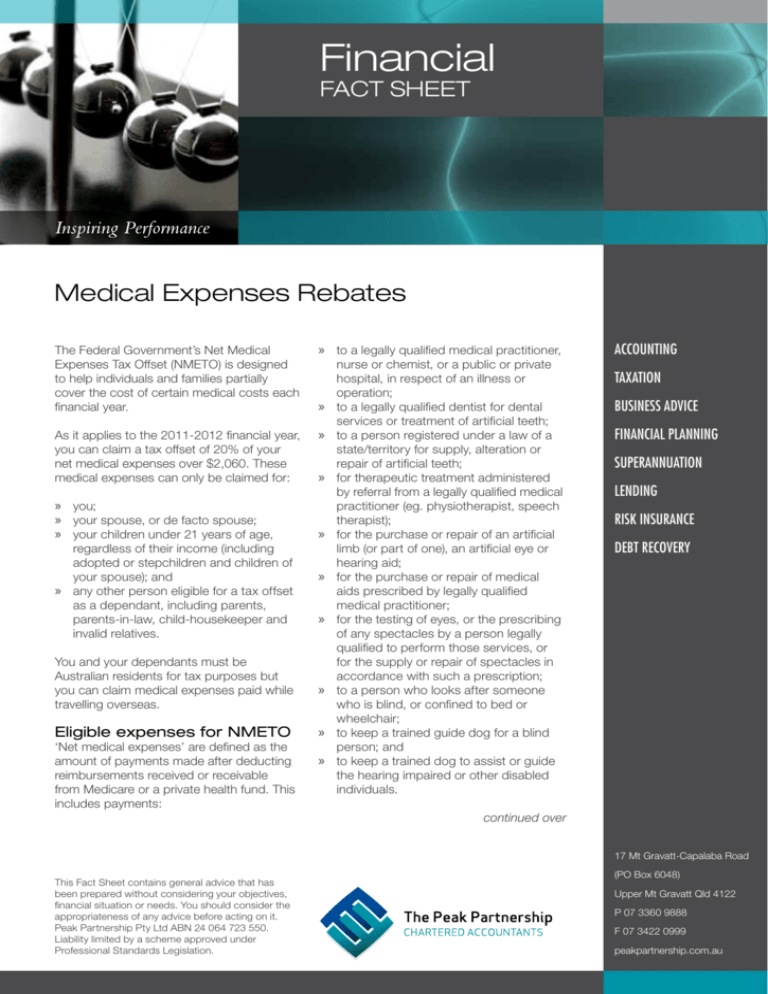

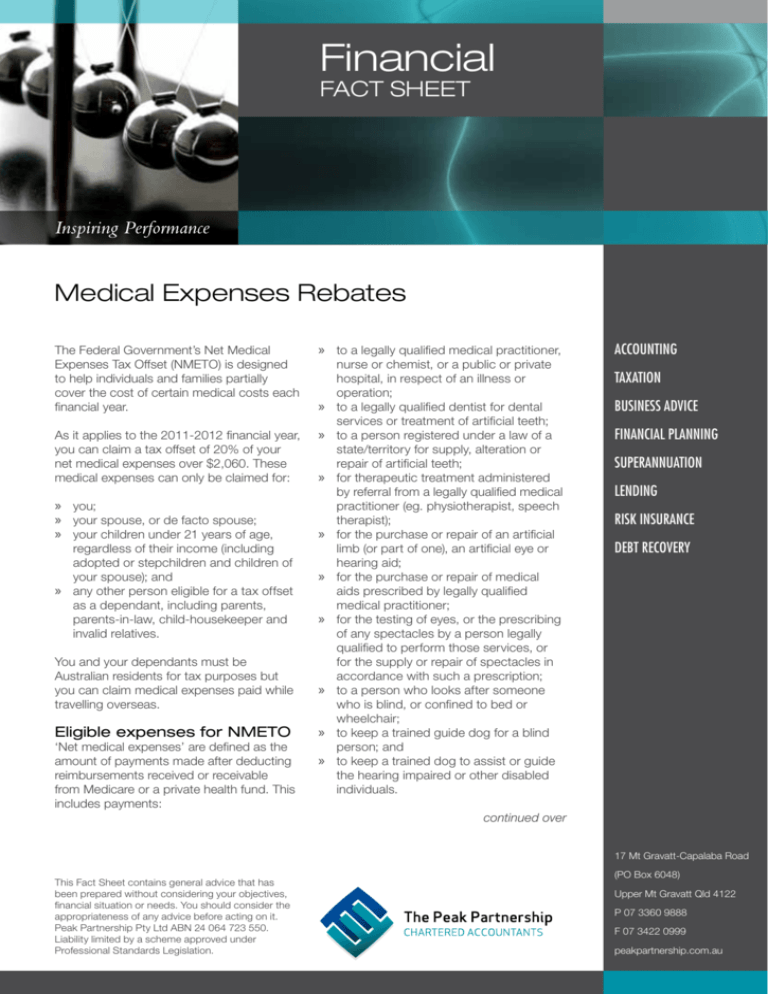

Medical Expenses Rebates

https://s3.studylib.net/store/data/008082010_1-c32f4bdb4afdf54db3e7d4bebd5ba95a-768x994.png

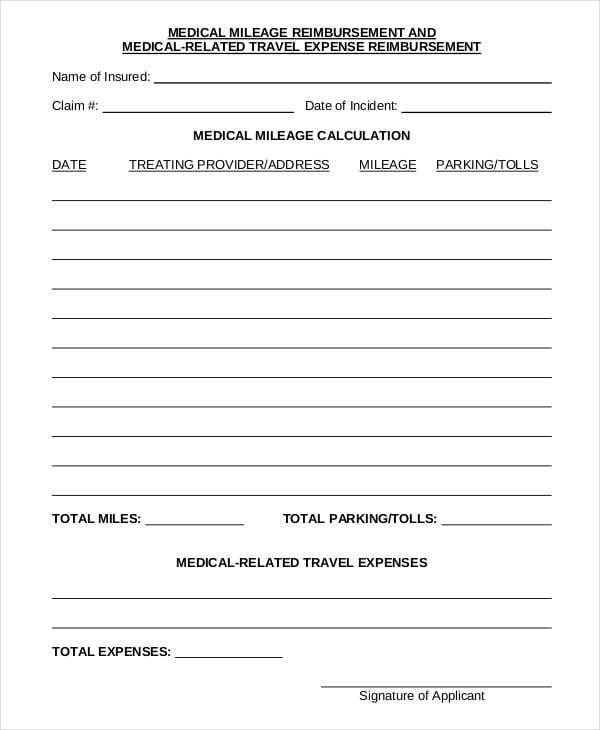

Reimbursement Form 12 Free Templates In PDF Word Excel Download

http://www.formsbirds.com/formimg/insurance-reimbursement-form/1719/state-univerisity-of-new-york-medical-reimbursement-form-d1.png

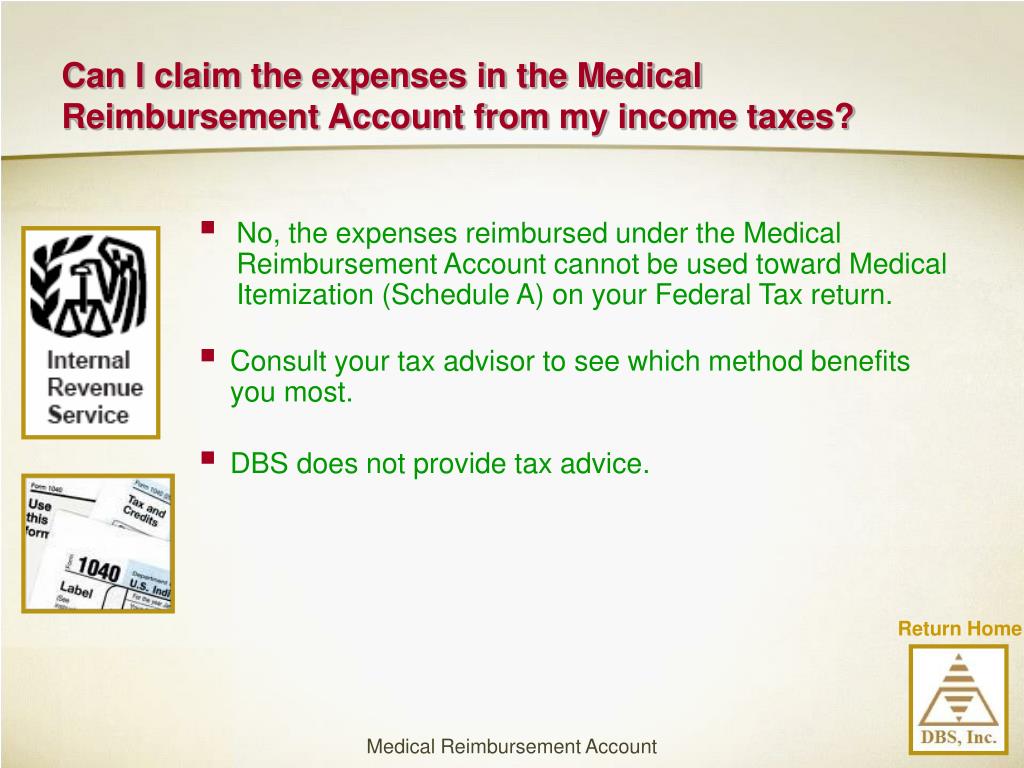

Web 20 sept 2020 nbsp 0183 32 Section 80DDB allows deductions up to Rs 40 000 on medical expenditure for specified diseases for self or dependent Rs 1 00 000 if self or dependent is a senior Web After determining that it is required to pay MLR rebates on both types of policies issued by Insurance Company during 2011 Insurance Company pays the rebates to the individual

Web 26 d 233 c 2022 nbsp 0183 32 Taxpayers would be required to pay income tax on expenses that surpass Rs 15 000 if they exceed that amount For reimbursement of medical expenses up to Web There is no income tax levied by the Income Tax Department on medical reimbursements of up to Rs 15 000 The exemption allowed is the cumulative exemption for the fiscal

Download Income Tax Rebate On Medical Reimbursement

More picture related to Income Tax Rebate On Medical Reimbursement

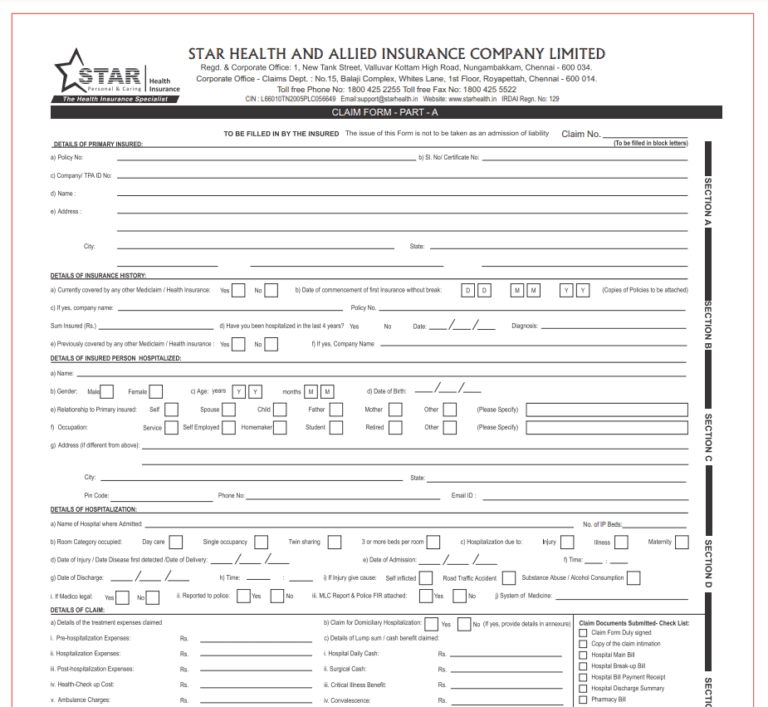

Star Health Reimbursement Policy Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/09/Reimbursement-Form-Star-Health-768x707.png

PPT Section 125 Plan Flexible Benefit PowerPoint Presentation Free

https://image1.slideserve.com/3298614/can-i-claim-the-expenses-in-the-medical-reimbursement-account-from-my-income-taxes-l.jpg

Affordable Care Act Rebate Amounts For Kansas Health Medical

https://i.pinimg.com/originals/ea/4e/3d/ea4e3def47a43f83902ac70ec7fbe1f9.jpg

Web No Income Tax on Medical Reimbursement up to Rs 15 000 Some employers provide medical reimbursement facility to their employees for the medical expenses incurred Web If you have spent less than Rs 15 000 then only the incurred expense is tax free E g if your medical expense in a year with supporting bills was Rs 9 000 you will get a tax

Web 23 avr 2020 nbsp 0183 32 Under the Income Tax Act there is a tax exemption of up to Rs 15 000 on medical reimbursements Medical Reimbursement Rules The Income Tax Act Web Accord entente pr 233 alable Tiers payant Remboursement par type de d 233 pense Consultation m 233 dicale d un enfant T 233 l 233 consultation Hospitalisation M 233 dicaments Frais

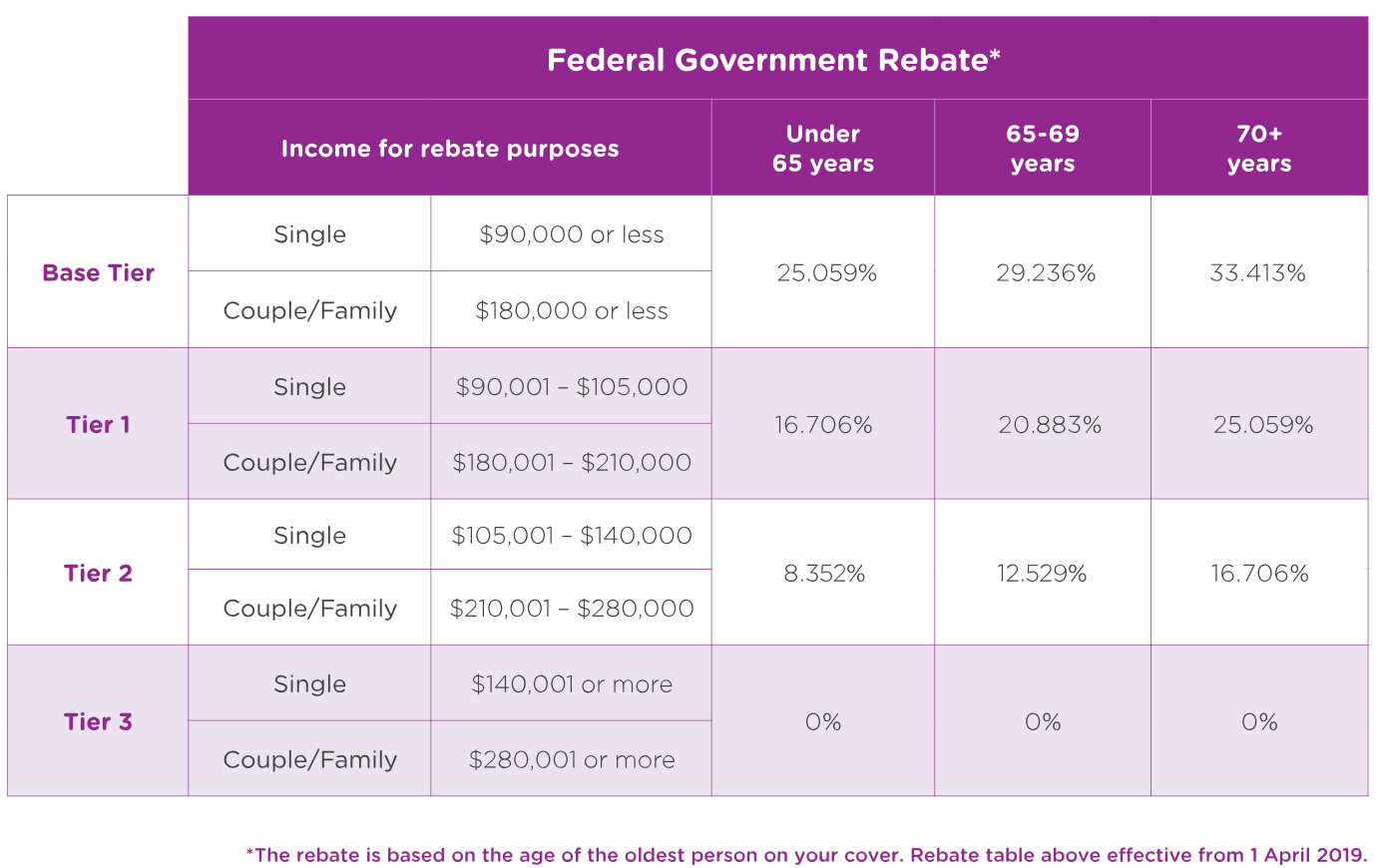

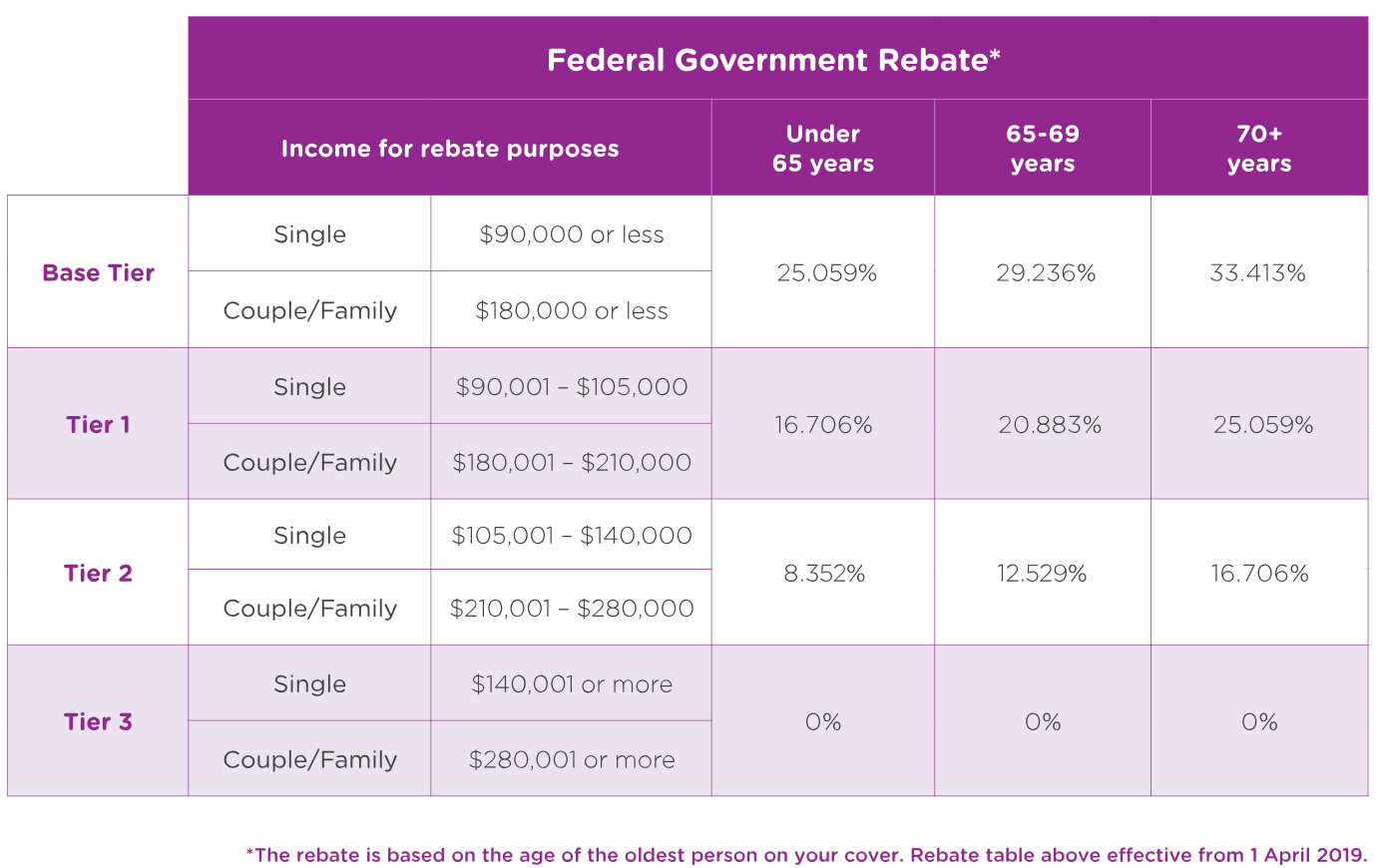

Private Health Insurance Rebate Navy Health

https://navyhealth.com.au/wp-content/uploads/2018/03/Federal-Government-Rebate-1-APR-2019.png

Section 80D Tax Benefits Health Or Mediclaim Insurance FY 2017 18

http://www.relakhs.com/wp-content/uploads/2014/11/Medical-allowance-form-16.jpg

https://taxguru.in/income-tax/taxability-medical-reimbursement...

Web 12 juin 2020 nbsp 0183 32 i want to know that medical reimbursement given to employee as Rs 1 lakh how rebate he gets or whether this is a income added to his gross income for

https://www.financialexpress.com/money/are-medical-reimbursements...

Web 6 mars 2019 nbsp 0183 32 While Medical Reimbursement on any disease was tax free up to Rs 15 000 u s 17 2 of the Income Tax Act till last year Medical Allowance was fully taxable

Mileage Reimbursement Form 10 Free Sample Example Format

Private Health Insurance Rebate Navy Health

Section 87A Tax Rebate Under Section 87A

Standard Deduction For Salaried Employees Transport Medical Reimbursem

/the_balance_tax2019_color3-5c2d16dbc9e77c00016c7202.png)

84 MEDICAL FORM FOR TAXES MedicalForm

All You Need To Know About Tax Rebate Under Section 87A By Enterslice

All You Need To Know About Tax Rebate Under Section 87A By Enterslice

Rent Reimbursement Form 2014 Fill Out Sign Online DocHub

Tax Rebate On Income Upto 5 Lakh Under Section 87A

Individual Income Tax Rebate

Income Tax Rebate On Medical Reimbursement - Web After determining that it is required to pay MLR rebates on both types of policies issued by Insurance Company during 2011 Insurance Company pays the rebates to the individual