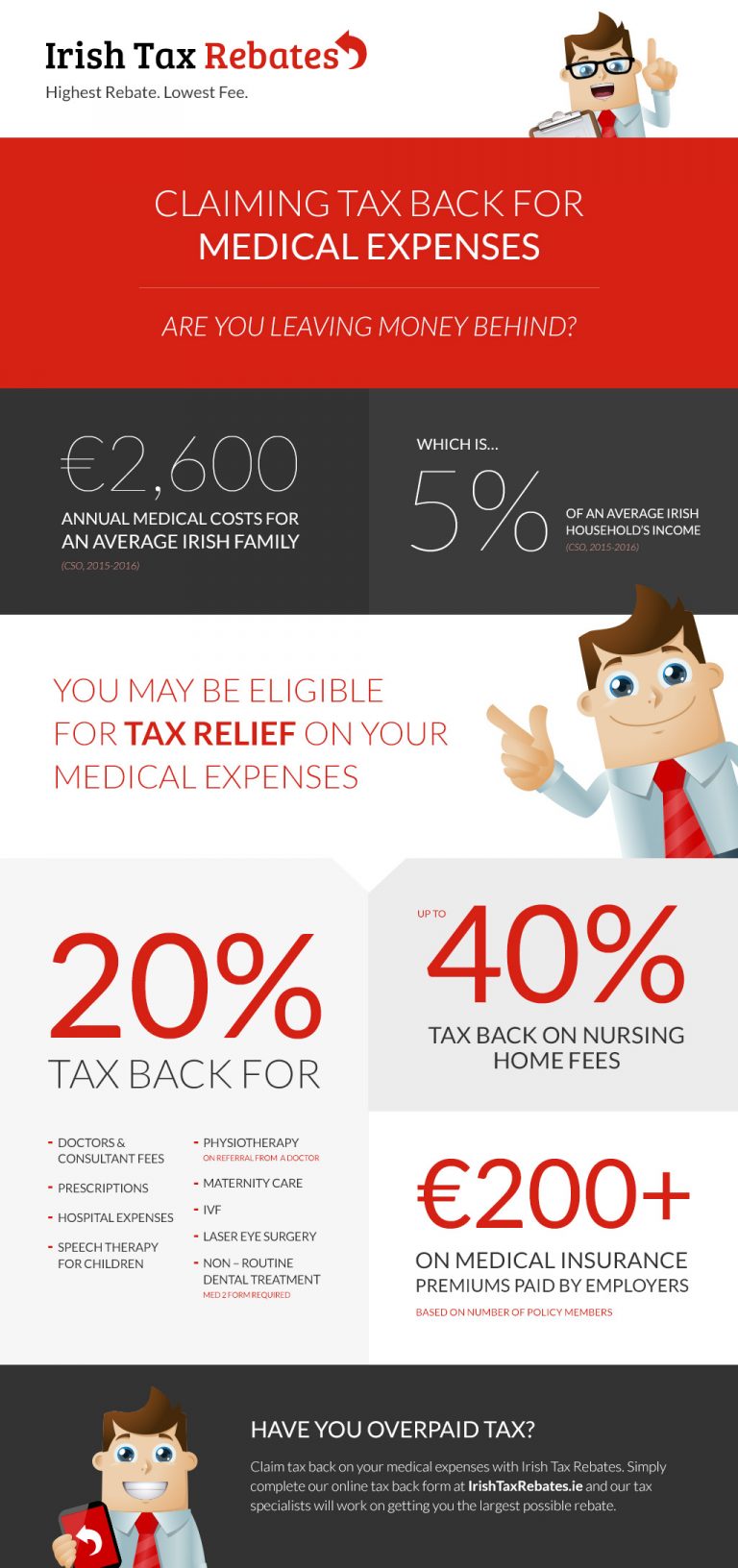

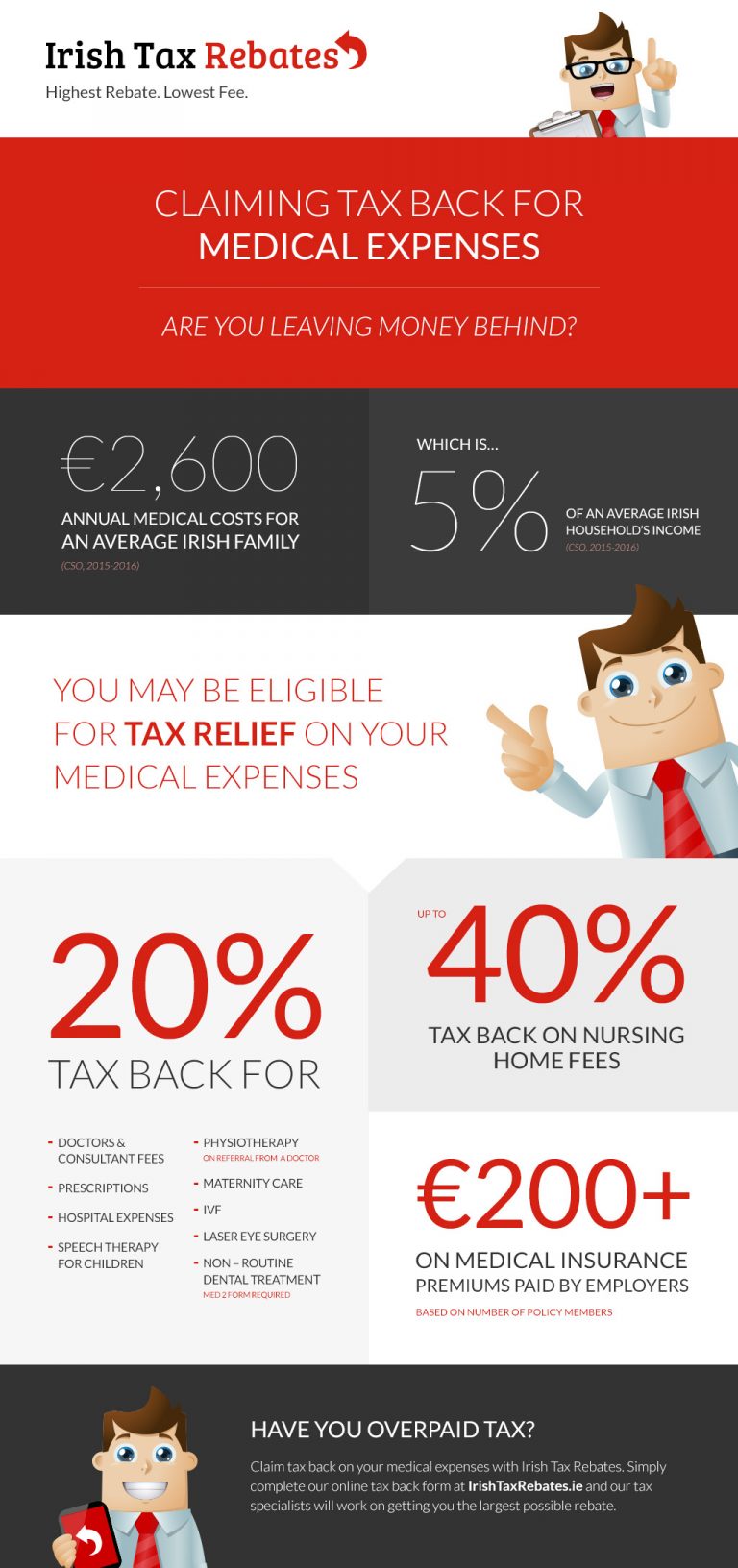

Income Tax Rebate On Medical Treatment Web Overview As an employer providing medical or dental treatment or insurance to your employees you have certain tax National Insurance and reporting obligations What s

Web 24 oct 2022 nbsp 0183 32 Medical Tax Relief Types Amount Medical treatment special needs and carer expenses for parents Medical condition certified by medical practitioner Web An assessee is eligible for tax deduction of Rs 40 000 or the actual amount paid for medical treatment whichever is lower Senior citizens between the ages of 60 years

Income Tax Rebate On Medical Treatment

Income Tax Rebate On Medical Treatment

https://blog.irishtaxrebates.ie/wp-content/uploads/2018/04/itr-infographic-1-768x1632.jpg

Data Note 2022 Medical Loss Ratio Rebates California Partnership For

https://www.caaccess.org/wp-content/uploads/2022/06/Screen-Shot-2022-06-07-at-2.18.42-PM-1220x597.png

DEDUCTION FOR MEDICAL INSURANCE PREMIUM PREVENTIVE HEALTH CHECK UP

https://3.bp.blogspot.com/-4Id9T3np6TI/W7YTc5WnDBI/AAAAAAAASjk/QbYRDVMQcsQoXHoU4geurcLL1b1We92VgCLcBGAs/s1600/DEDUCTION%2BFOR%2BMEDICAL%2BINSURANCE%2BPREMIUM-PREVENTIVE%2BHEALTH%2BCHECK%2BUP%2B-MEDICAL%2BTREATMENT%2BSECTION%2B80D.png

Web 29 juin 2018 nbsp 0183 32 Deductions of expenses on medical treatment of specified ailments such as AIDS cancer and neurological diseases can be Web 15 mars 2019 nbsp 0183 32 Section 80D of the Income tax Act allows you to save tax by claiming medical expenditures incurred as a deduction from income before levy of tax You can claim this deduction if these two conditions

Web 12 juin 2020 nbsp 0183 32 1 Income Tax treatment in case of self financed medical expenses In case of self financed medical expenses i e from own source there is no income to the person who has incurred expenses Hence the Web 29 mai 2023 nbsp 0183 32 Deduction under section 80DDB is allowed for medical treatment of a dependant who is suffering from a specified disease listed in the table below Can be

Download Income Tax Rebate On Medical Treatment

More picture related to Income Tax Rebate On Medical Treatment

Section 80D Tax Benefits Health Or Mediclaim Insurance FY 2017 18

http://www.relakhs.com/wp-content/uploads/2016/03/Section-80D-Health-insurance-premium-Income-Tax-Deductions-FY-2016-17-pic.jpg

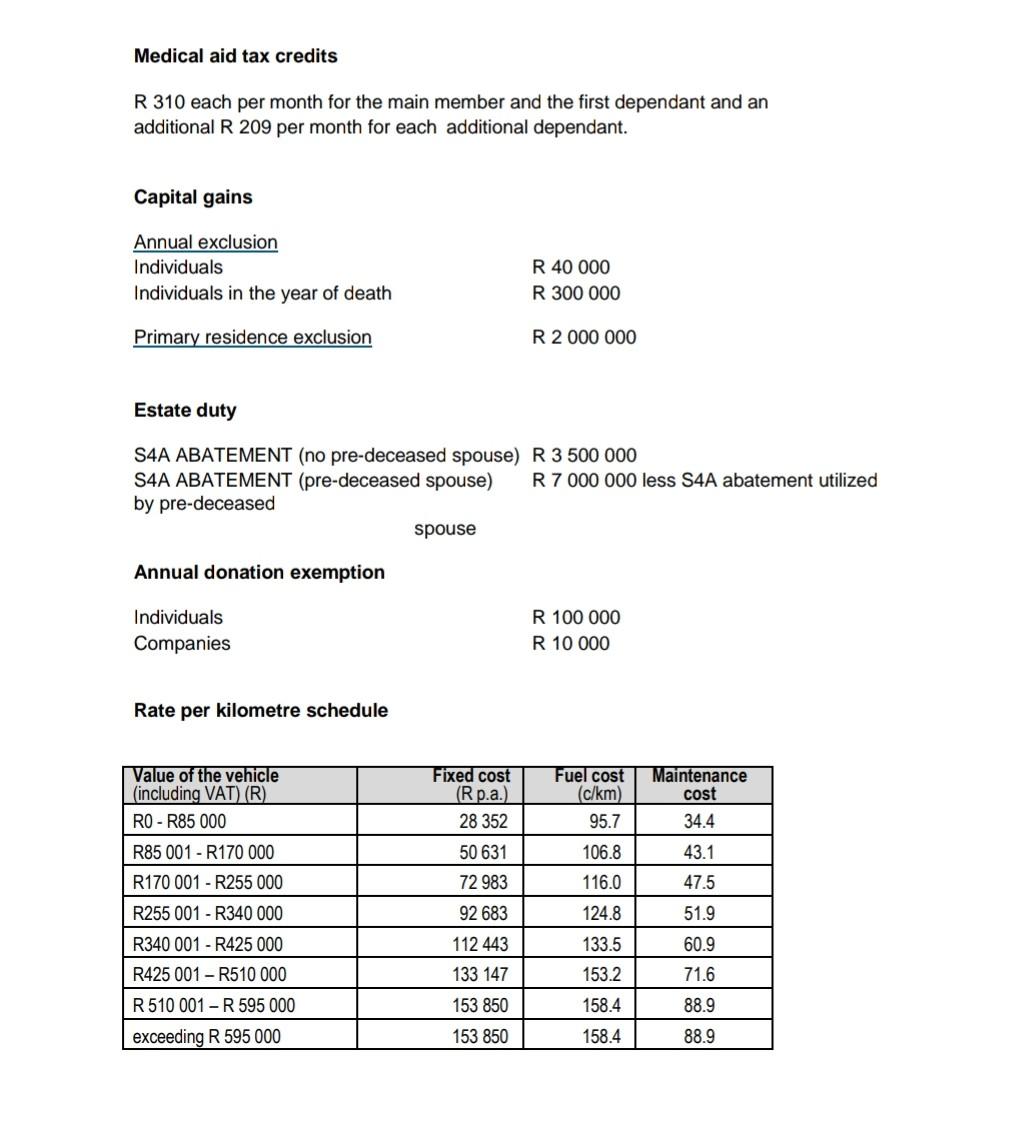

Medical Expenses Rebates

https://s3.studylib.net/store/data/008082010_1-c32f4bdb4afdf54db3e7d4bebd5ba95a-768x994.png

Health Insurance Tax Benefits u s 80D For FY 2018 19 AY 2019 20

https://www.relakhs.com/wp-content/uploads/2018/02/Medical-Insurance-Premium-Tax-Benefits-Section-80D-Health-insurance-premium-Income-Tax-Deductions-FY-2018-19-AY-2019-20-Medical-treatment-expenditure-bills.jpg

Web 2 nov 2015 nbsp 0183 32 Income Tax Rebate for Deduction in respect of medical treatment etc November 2 2015 Section 80DDB Income tax Act 1961 2015 Medical Treatment Web Provided that no such deduction shall be allowed unless the assessee furnishes with the return of income a certificate in such form as may be prescribed56 from a neurologist

Web 23 avr 2020 nbsp 0183 32 Under the Income Tax Act there is a tax exemption of up to Rs 15 000 on medical reimbursements Medical Reimbursement Rules The Income Tax Act Web 13 f 233 vr 2020 nbsp 0183 32 Any money paid by an employee for obtaining medical treatment for him or her or family upto a maximum of Rs 15 000 will be tax free Also the expenses incurred

2019 Edition Of Parenthood Tax Rebate Qualifying Child Relief

https://i0.wp.com/www.theastuteparent.com/wp-content/uploads/2019/02/53287756_1898285556949795_4177201277018570752_n-1.jpg?resize=654%2C960&ssl=1

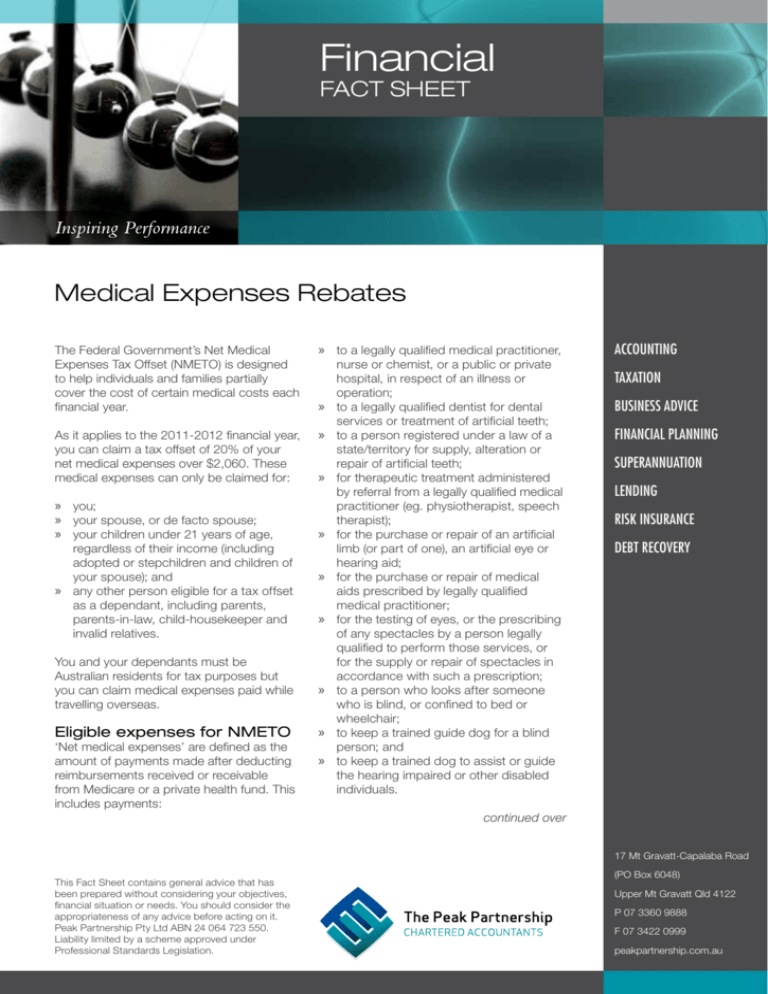

Solved QUESTION TWO 30 MARKS The Following Information Is Chegg

https://media.cheggcdn.com/study/ae2/ae2e3510-2d3b-40ee-8f9c-99f39b17ccc4/image

https://www.gov.uk/expenses-and-benefits-medical-treatment

Web Overview As an employer providing medical or dental treatment or insurance to your employees you have certain tax National Insurance and reporting obligations What s

https://www.imoney.my/articles/what-can-claim-tax-relief-medical

Web 24 oct 2022 nbsp 0183 32 Medical Tax Relief Types Amount Medical treatment special needs and carer expenses for parents Medical condition certified by medical practitioner

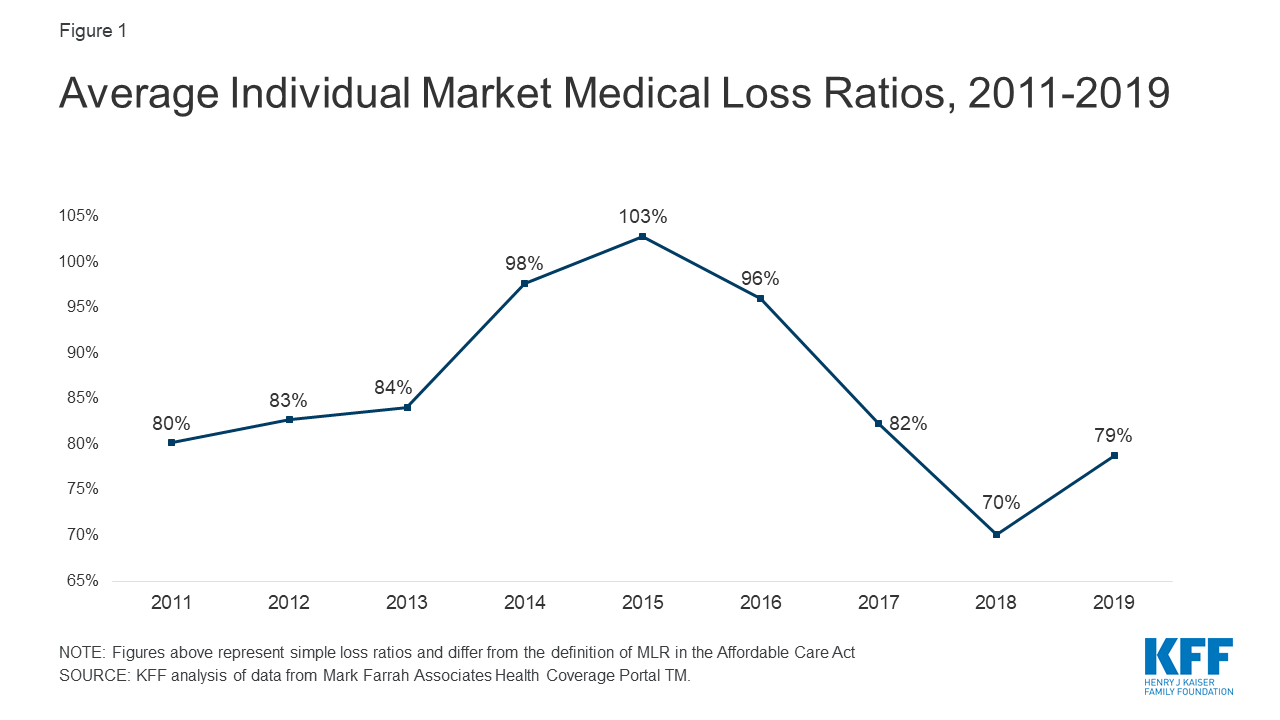

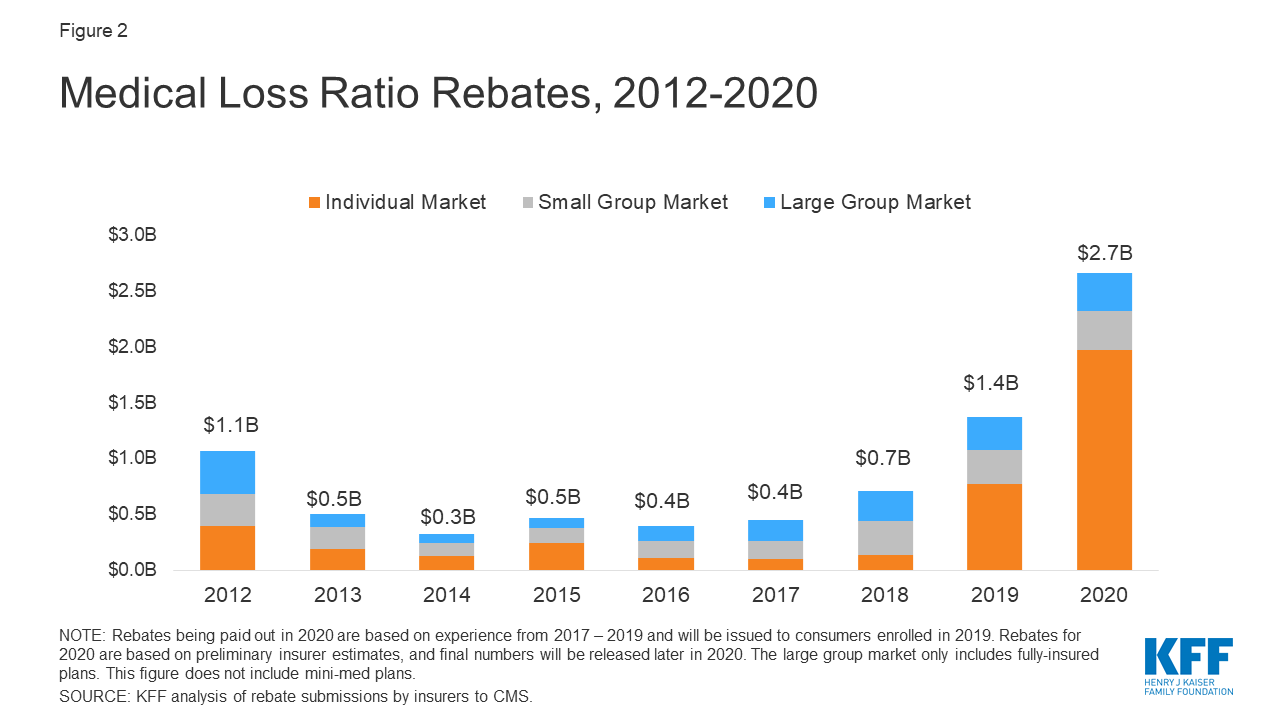

Data Note 2020 Medical Loss Ratio Rebates KFF

2019 Edition Of Parenthood Tax Rebate Qualifying Child Relief

Data Note 2020 Medical Loss Ratio Rebates KFF

In SA Tax Credits For Medical Aid Contributions eBiz Money

Potential Tax Rebate For Medical Card Holders

National Budget Speech 2022 SimplePay Blog

National Budget Speech 2022 SimplePay Blog

SCE OFFERS REBATES TO CUSTOMERS WHO ARE MEDICAL BASELINE BASED ON LOWER

/the_balance_tax2019_color3-5c2d16dbc9e77c00016c7202.png)

84 MEDICAL FORM FOR TAXES MedicalForm

Income Tax Rebate On Personal Loan Claim Tax Rebate For Personal Loan

Income Tax Rebate On Medical Treatment - Web 21 f 233 vr 2022 nbsp 0183 32 Section 80D of Income Tax Act allows deduction of up to Rs 50 000 for medical expenses incurred for senior citizens self spouses or dependent children If