Income Tax Rebate On Partnership Firm Web 22 avr 2022 nbsp 0183 32 The remuneration paid by the firm to its partners can be claimed as deduction from the total income of the firm as per section 40 b of the Act provided the following

Web 6 sept 2018 nbsp 0183 32 taxation of partnership firms issues anish thacker nashik 9th june 2018 the chamber of tax consultants contents computation of book profit remuneration to Web Flat rate of 30 on the total income after deduction of interest and remuneration to partners Designated Partners at the specified rates Surcharge of 12 if Total Income exceeds 1 Crore and will be further

Income Tax Rebate On Partnership Firm

Income Tax Rebate On Partnership Firm

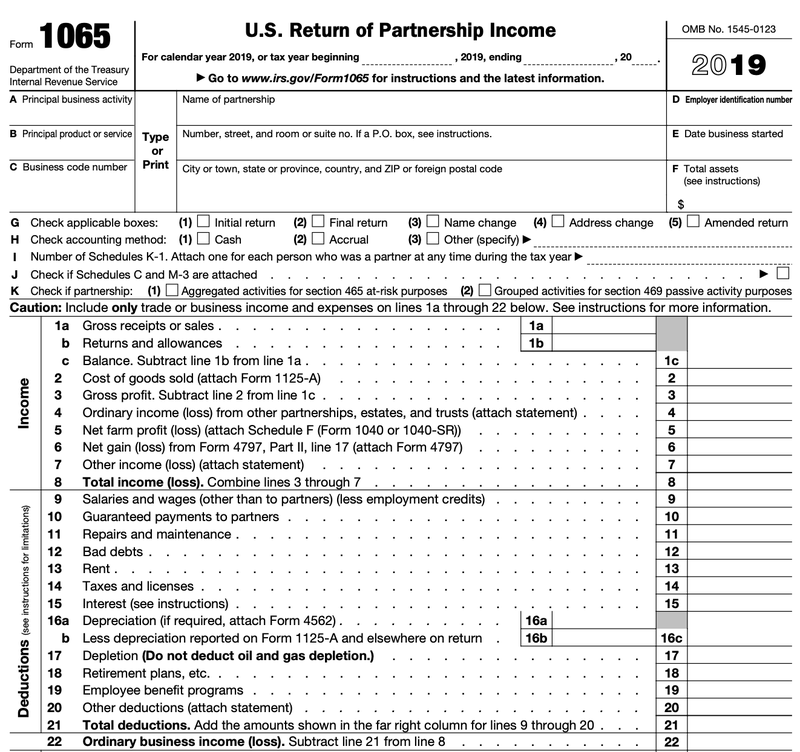

https://m.foolcdn.com/media/the-blueprint/images/Partnership_Taxation_-_01_-_Form_1065.width-800.png

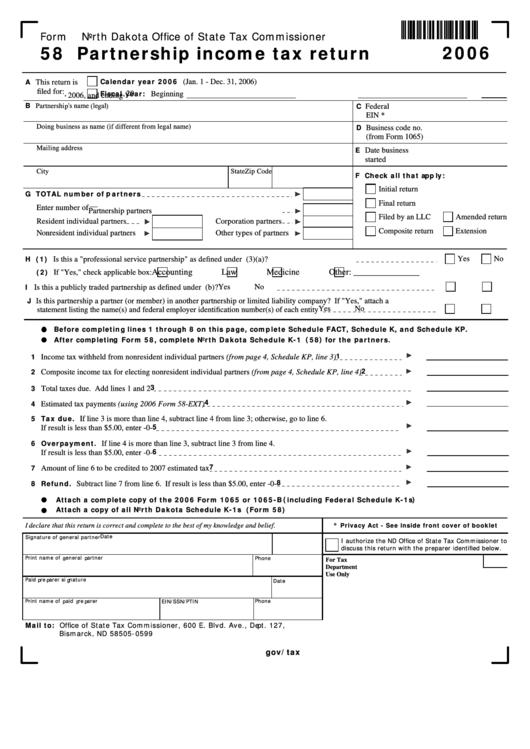

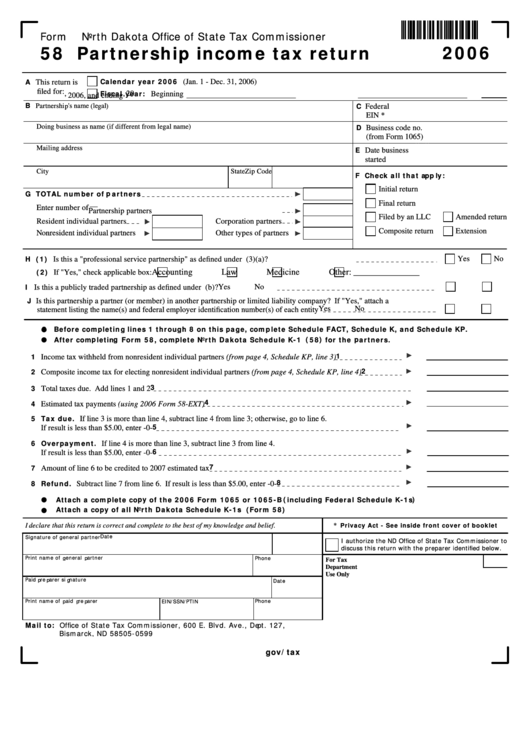

Fillable Form 58 Partnership Income Tax Return 2006 Printable Pdf

https://data.formsbank.com/pdf_docs_html/172/1725/172538/page_1_thumb_big.png

Tax Audit For Partnership Firm Applicablity Due Date Penalty

https://www.anbca.com/wp-content/uploads/2020/03/Tax-Audit-Partnership-firm.jpg

Web 14 f 233 vr 2022 nbsp 0183 32 Can a partnership firm or HUF claim rebate under section 87A Rebate under section 87A is available only to an individual hence any person other than an Web 18 avr 2022 nbsp 0183 32 The partnership firm need not deduct TDS on remuneration paid to the partners under section 192 of the Income Tax Act Conclusion The partnership firm

Web 10 juin 2019 nbsp 0183 32 For the Financial Year 2020 21 maximum tax rebate available under section 87A is 12 500 Tax rebate is available only to the resident individual proprietor earning net taxable income up to 5 Web 29 nov 2022 nbsp 0183 32 Income tax is imposed by the government on income made by individuals corporations and partnership firms Taxpayers are required by law to file an income tax return each year in order to fulfil their tax

Download Income Tax Rebate On Partnership Firm

More picture related to Income Tax Rebate On Partnership Firm

Partnership Tax Return Due Date TaxProAdvice

https://www.taxproadvice.com/wp-content/uploads/business-tax-return-due-date-by-company-structure.jpeg

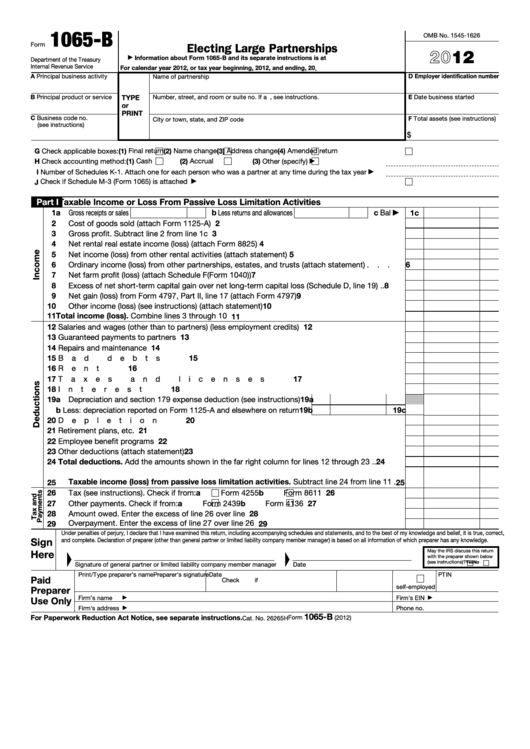

Fillable Form 1065 B U s Return Of Income For Electing Large

https://data.formsbank.com/pdf_docs_html/321/3217/321735/page_1_thumb_big.png

How To Fill Out Form 1065 US Return Of Partnership Income LLC Initial

https://i.ytimg.com/vi/lRZWDgcqOOA/maxresdefault.jpg

Web 24 f 233 vr 2021 nbsp 0183 32 Taxation of partnership firm Income tax on partnership firm partnership tax Taxationofpartnershipfirm Incometaxonpartnership firm Web First because no employer withholds these taxes from partners paychecks partners must pay them with their regular income taxes Also partners must pay twice as much as

Web Coming to deduction toward remuneration to the partner in case of retirement from the firm it may be noted that section 40 b of the Income Tax Act 1961 don t place any Web Partnership Tax Reporting Net income tax payments must be paid by the partners of a partnership Since partnership is a pass through entity any amount partner does not

All You Need To Know About ITR Filing For A Partnership Firm Ebizfiling

https://ebizfiling.com/wp-content/uploads/2023/02/Your-paragraph-text-4-1.png

Interim Budget 2019 20 The Talk Of The Town Trade Brains

https://tradebrains.in/wp-content/uploads/2019/02/income-tax-rebate-min.png

https://tax2win.in/guide/tax-on-partner-renumeration

Web 22 avr 2022 nbsp 0183 32 The remuneration paid by the firm to its partners can be claimed as deduction from the total income of the firm as per section 40 b of the Act provided the following

https://ctconline.org/wp-content/uploads/pdf/2019/seminar-pr…

Web 6 sept 2018 nbsp 0183 32 taxation of partnership firms issues anish thacker nashik 9th june 2018 the chamber of tax consultants contents computation of book profit remuneration to

Partnership Income Tax Malaysia Faith Knox

All You Need To Know About ITR Filing For A Partnership Firm Ebizfiling

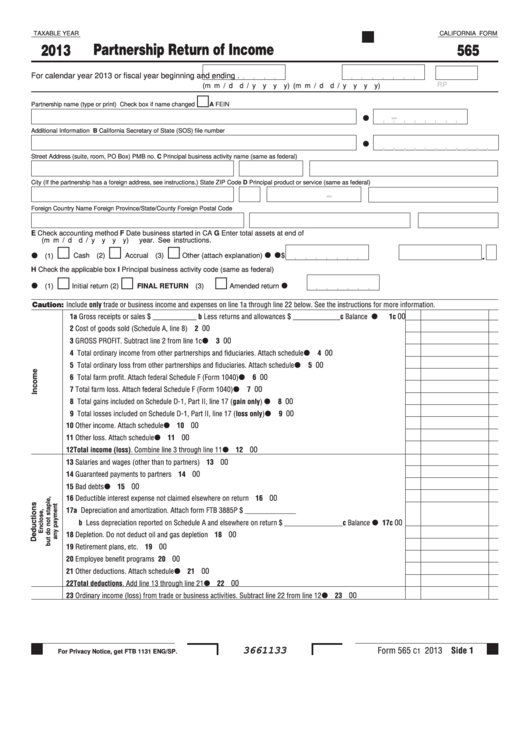

Fillable California Form 565 Partnership Return Of Income 2013

Individual Income Tax Rebate

All You Need To Know About Tax Rebate Under Section 87A By Enterslice

Fortune India Business News Strategy Finance And Corporate Insight

Fortune India Business News Strategy Finance And Corporate Insight

Zru nos Do Toho Ob ianstvo Tax Return Calculator Ontario 2019

Difference Between Income Tax Exemption Vs Tax Deduction Vs Rebate

Pin On Tigri

Income Tax Rebate On Partnership Firm - Web 6 janv 2020 nbsp 0183 32 Article explains about Taxation of Partnership Firms and LLPs and includes discussion on Computation of Income of Partnership Firms and LLP s Income Tax