Income Tax Rebate On Rd Web 11 sept 2023 nbsp 0183 32 Tax savings for investments made in Post Office RDs are not available under Section 80C of the Income Tax Act of 1961 Investors may claim the tax benefit on their ITRs The applicable income tax rate

Web IRS Free File Prepare and file your federal income tax return for free 2020 Recovery Rebate Credit Must file a 2020 tax return to claim if eligible Get My Payment When Web Report on the OECD R amp D Tax Incentives Database 2022 edition June 2023 Design features of income based tax incentives for R amp D and innovation OECD Taxation

Income Tax Rebate On Rd

Income Tax Rebate On Rd

https://freefincal.com/wp-content/uploads/2019/02/Screen-Shot-2019-02-02-at-8.49.53-AM.png

Interim Budget 2019 20 The Talk Of The Town Trade Brains

https://tradebrains.in/wp-content/uploads/2019/02/income-tax-rebate-min.png

How To Fill Form 10 E For Income Tax Rebate On Arrears Paid

https://i0.wp.com/www.askbanking.com/wp-content/uploads/2016/03/form-10E.jpg?fit=848%2C1200&ssl=1

Web 4 oct 2017 nbsp 0183 32 R amp D tax relief for small and medium sized enterprises SMEs SME R amp D tax relief allows companies to deduct an extra 86 of their qualifying costs in addition to the Web 28 f 233 vr 2023 nbsp 0183 32 Income tax on interest earned on a recurring deposit RD The interest on recurring deposits is compounded on a quarterly basis You receive the interest and

Web What are R amp D tax credits and deductions Congress has enacted two important incentives for a business to invest in research activities in the United States the ability to elect to Web Tax deduction on investment in Bank Recurring Deposit RD is not allowed under Section 80C of the Income Tax Act 1961 Consequently it is impossible to avail of a tax benefit

Download Income Tax Rebate On Rd

More picture related to Income Tax Rebate On Rd

Difference Between Income Tax Exemption Vs Tax Deduction Vs Rebate

https://www.relakhs.com/wp-content/uploads/2019/03/Difference-between-Income-Tax-Exemption-Vs-Tax-Deduction-Income-Tax-Rebate-TDS-Tax-Relief-Tax-Benefit-pic.jpg

2007 Tax Rebate Tax Deduction Rebates

https://i.pinimg.com/originals/ba/b1/ac/bab1aca6df77531e309ff2affe669be8.jpg

Tax Rebate For Individual It Is The Refund Which An Individual Can

https://data.formsbank.com/pdf_docs_html/140/1407/140793/page_1_bg.png

Web 17 f 233 vr 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your Web Fiscal Incentives for Innovation under Income tax Act 1961 the Act Benefit u s 35 2AB Pre requisites for claiming weighted super deduction Beneficiary Eligible tax payer

Web De tr 232 s nombreux exemples de phrases traduites contenant quot income tax rebate quot Dictionnaire fran 231 ais anglais et moteur de recherche de traductions fran 231 aises Web As of 2023 preowned plug in electric and fuel cell EVs qualify for a credit of up to 30 of their purchase price maxing out at 4 000 The used EV tax credit can only be claimed

Income Tax Rebate U s 87A For A Y 2017 18 F Y 2016 17

http://taxguru.in/wp-content/uploads/2016/05/87A-Computation.jpg

Income Tax Rebate Under Section 87A For Income Up To 5 Lakh

https://i0.wp.com/www.propertyrebate.net/wp-content/uploads/2023/05/income-tax-rebate-under-section-87a-for-income-up-to-5-lakh.jpeg?w=512&ssl=1

https://www.bankbazaar.com/recurring-deposit/…

Web 11 sept 2023 nbsp 0183 32 Tax savings for investments made in Post Office RDs are not available under Section 80C of the Income Tax Act of 1961 Investors may claim the tax benefit on their ITRs The applicable income tax rate

https://www.irs.gov/coronavirus/coronavirus-tax-relief-and-economic...

Web IRS Free File Prepare and file your federal income tax return for free 2020 Recovery Rebate Credit Must file a 2020 tax return to claim if eligible Get My Payment When

Tax Rebate Checks Come Early This Year Yonkers Times

Income Tax Rebate U s 87A For A Y 2017 18 F Y 2016 17

Deferred Tax And Temporary Differences The Footnotes Analyst

Malaysia Personal Income Tax Guide 2020 YA 2019

Revised Tax Rebate Under Sec 87A After Budget 2019 BasuNivesh

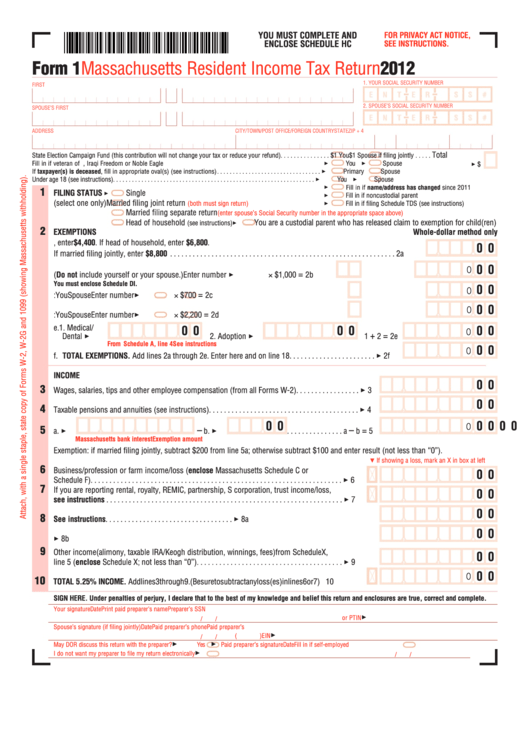

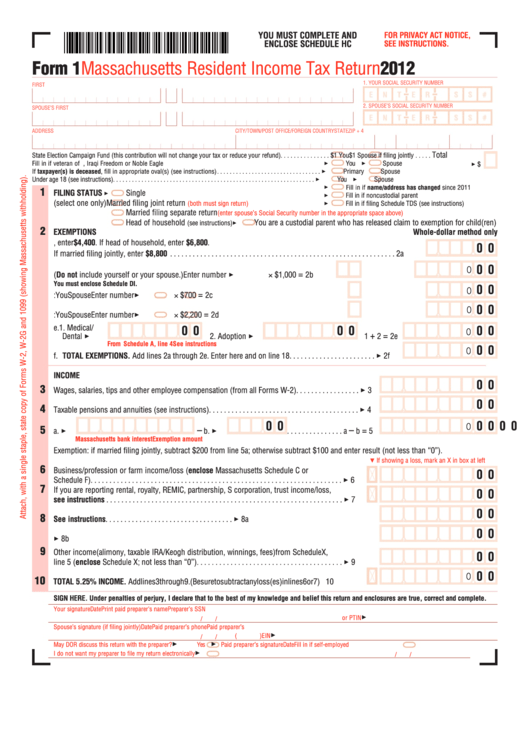

Fillable Form 1 Massachusetts Resident Income Tax Return 2012

Fillable Form 1 Massachusetts Resident Income Tax Return 2012

Tax Rebate On Income Upto 5 Lakh Under Section 87A

Raised The Income Tax Rebate U s 87A For F Y 2019 20 With Automated

Income Tax Rebate On Home Loan Applicable Sections Under I T Act

Income Tax Rebate On Rd - Web 28 f 233 vr 2023 nbsp 0183 32 Income tax on interest earned on a recurring deposit RD The interest on recurring deposits is compounded on a quarterly basis You receive the interest and