Income Tax Rebate On Rented House Web 15 juin 2019 nbsp 0183 32 For e g in FY 2017 18 you took a home loan of Rs 1 crore amp paid Rs 5 lac as interest in the same year As per Sec 24 only Rs 2 lac will be allowed as interest

Web 4 janv 2023 nbsp 0183 32 You can deduct the cost of replacing domestic items from your rental income tax when calculating your net profit for the year on which you pay tax So say you replace a number of items in your Web 20 juil 2016 nbsp 0183 32 Final Income Tax 163 9 000 Brian s tax reduction is calculated as 20 of the lower of finance costs 163 15 000 of the current year and 163 2 000 brought forward 163 17 000

Income Tax Rebate On Rented House

Income Tax Rebate On Rented House

https://www.pdffiller.com/preview/47/686/47686220/large.png

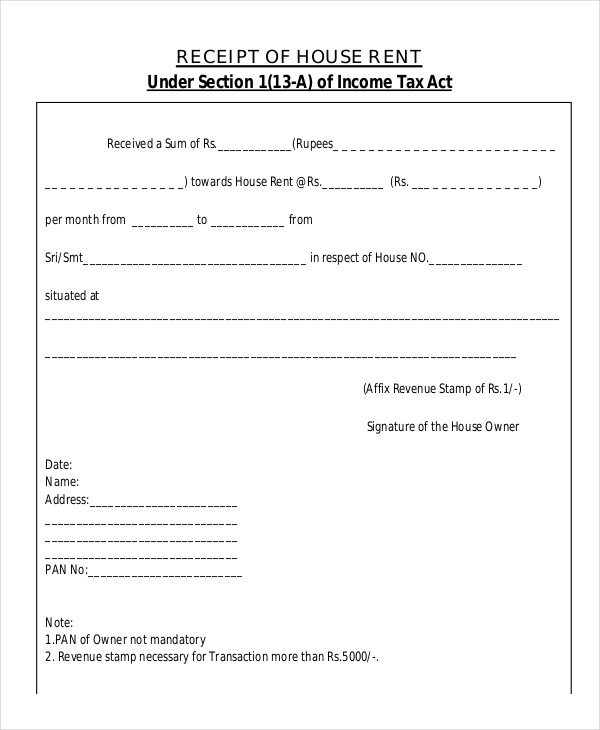

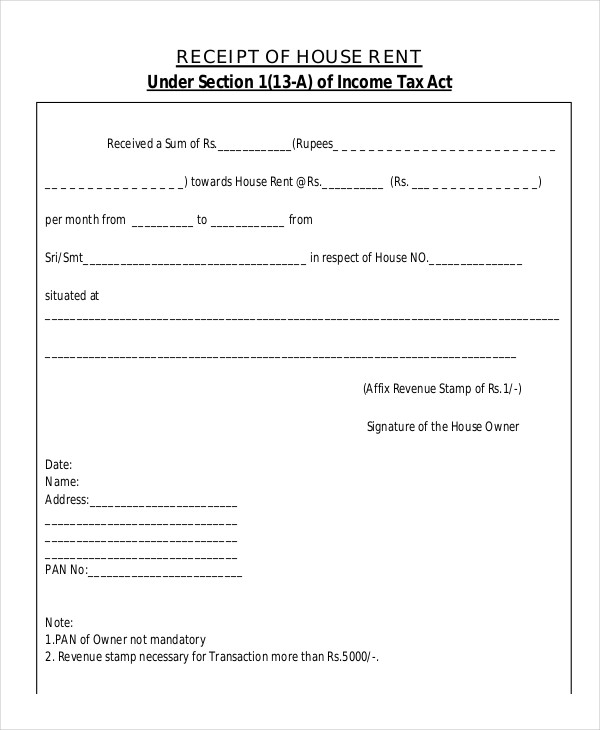

Rent Receipt 26 Free Word PDF Documents Download

https://images.template.net/wp-content/uploads/2016/11/18132953/House-Rent-Receipt-for-Income-Tax.jpg

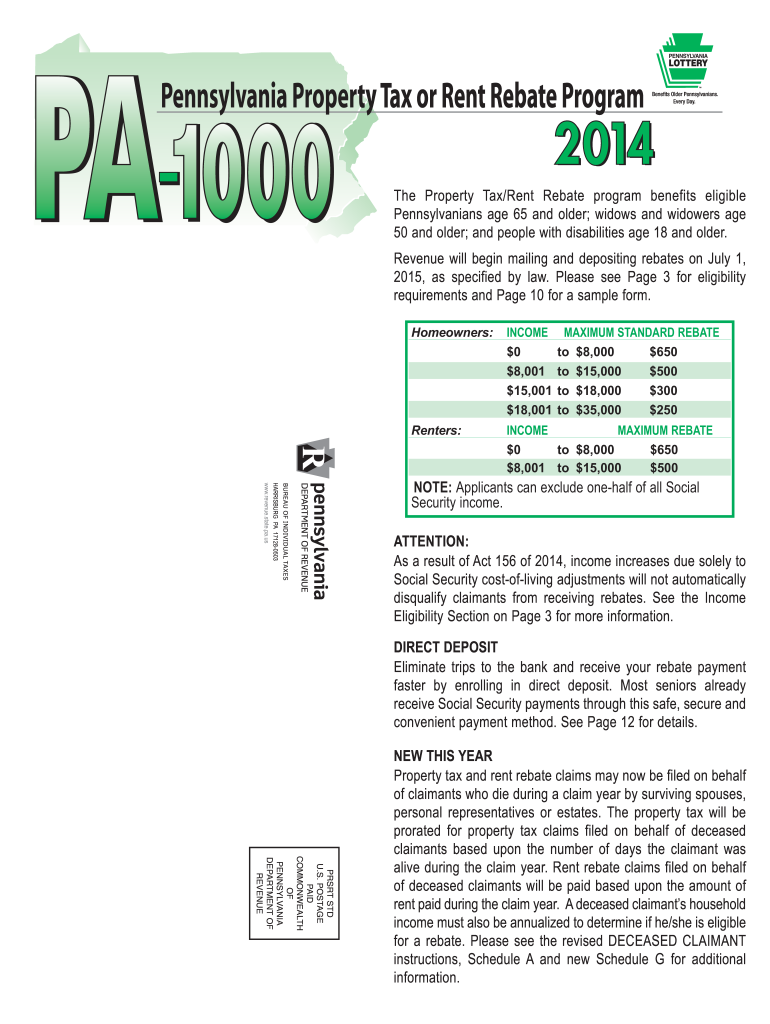

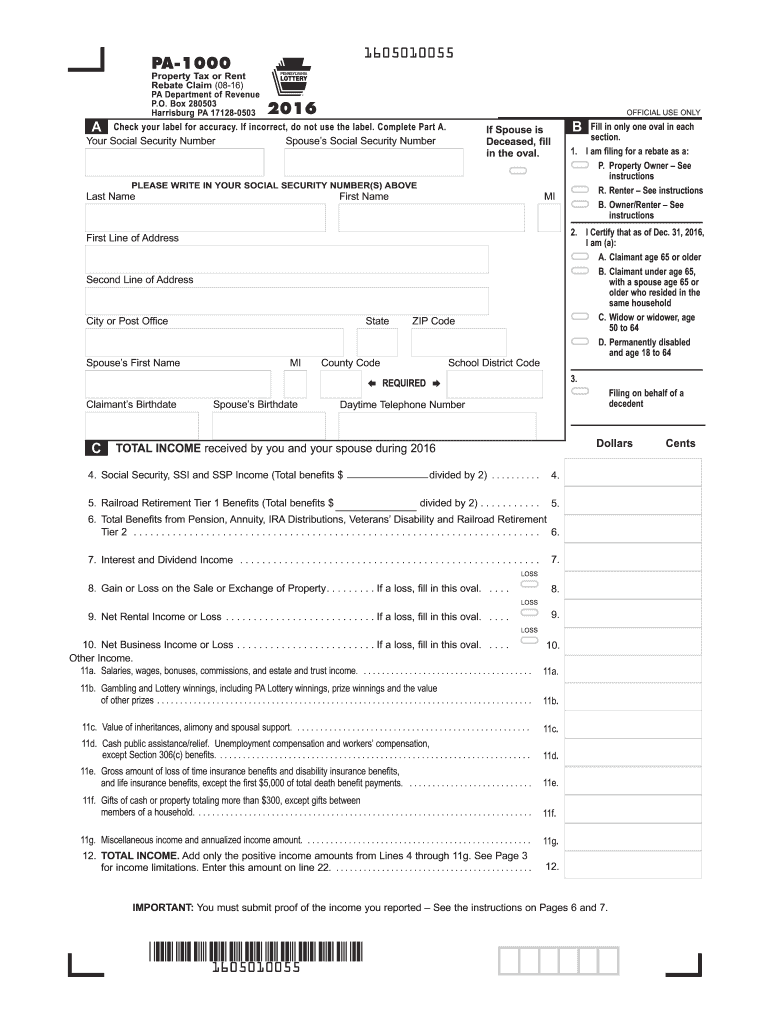

Pennsylvania Property Tax Rent Rebate 5 Free Templates In PDF Word

http://www.formsbirds.com/formimg/pennsylvania-property-taxrent-rebate/21102/pa-1000-2014-property-tax-or-rent-rebate-claim-d1.png

Web 26 juil 2023 nbsp 0183 32 From the rental income a property owner is allowed to deduct municipal taxes on the property rent that is not realised a 30 standard deduction on the annual value of the property as well as Web 22 sept 2022 nbsp 0183 32 1 What is HRA or House Rent Allowance HRA or house rent allowance is a benefit provided by employers to their employees to help the latter cover their

Web Moreover the maximum deduction that can be claimed in a year is Rs 60 000 and Rs 5 000 per month This 10 deduction is not based on the period for which you occupy the rented premises Hence you can claim Web The first 163 1 000 of your income from property rental is tax free This is your property allowance Contact HM Revenue and Customs HMRC if your income from property

Download Income Tax Rebate On Rented House

More picture related to Income Tax Rebate On Rented House

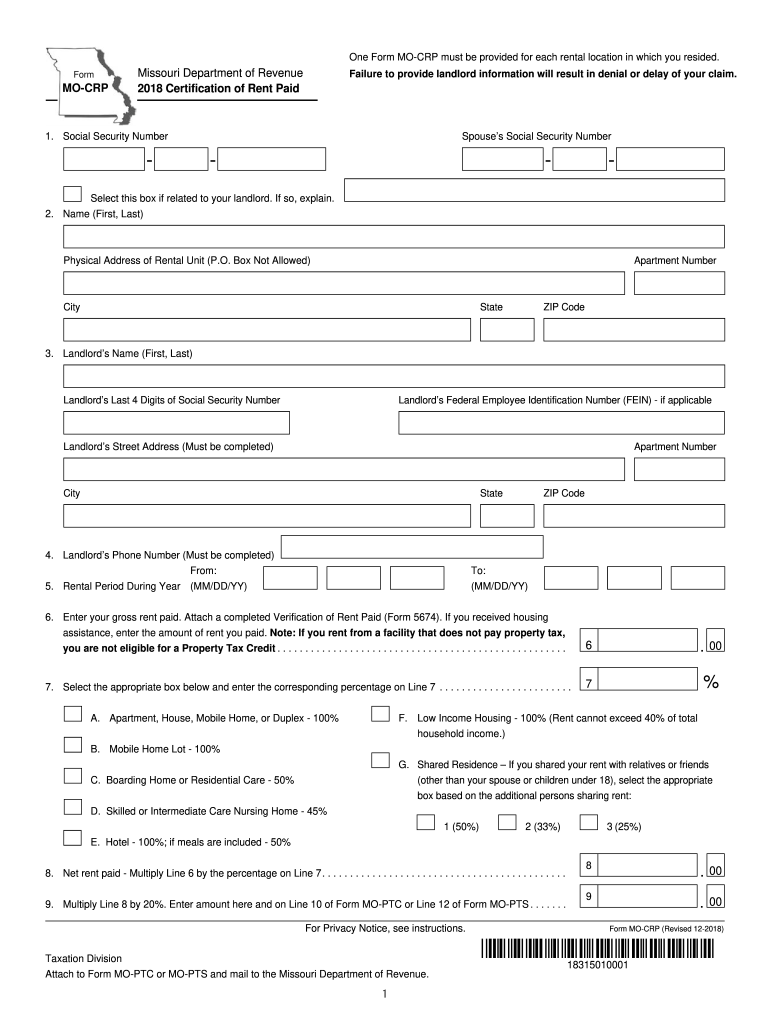

Rent Rebate Tax Form Missouri Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2021/08/Rent-Rebate-Form-Missouri-2021.jpg

Property Tax Rent Rebate Program Maximizing Savings And Support For

https://i0.wp.com/www.rentrebates.net/wp-content/uploads/2023/05/Property-Tax-Rent-Rebate-Program.jpg?ssl=1

Renters Rebate Sample Form Free Download

http://www.formsbirds.com/formimg/rent-rebate-form/218/renters-rebate-sample-form-l2.png

Web The income tax laws provide for certain tax benefits on rent paid depending on whether the tax payer is self employed or a salaried person The law also requires you to deduct tax from the rent being paid under Web HRA or the House Rent Allowance is one of the sub components of the employee s salary for which deductions are fully or partially taxable under Section 10 13A of the Income

Web 15 oct 2020 nbsp 0183 32 Most salaried individuals who stay in rented accommodations are eligible to claim tax deduction on rent paid out of the House Rent Allowance HRA they get As Web For example if your basic salary including Dearness Allowance is INR 50 000 month you receive a HRA of INR 12 000 month and the actual rent paid is Rs 15 000 month the

Renters Rebate 2021 Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2021/07/Minnesota-Renters-Rebate-Form-2021.jpg

Pa Renters Rebate Status RentersRebate

https://i0.wp.com/www.rentersrebate.net/wp-content/uploads/2022/10/pa-1000-2014-property-tax-or-rent-rebate-claim-free-download-1.png?fit=728%2C943&ssl=1

https://tax2win.in/guide/interest-deduction-on-rented-house-property

Web 15 juin 2019 nbsp 0183 32 For e g in FY 2017 18 you took a home loan of Rs 1 crore amp paid Rs 5 lac as interest in the same year As per Sec 24 only Rs 2 lac will be allowed as interest

https://www.which.co.uk/money/tax/income-t…

Web 4 janv 2023 nbsp 0183 32 You can deduct the cost of replacing domestic items from your rental income tax when calculating your net profit for the year on which you pay tax So say you replace a number of items in your

Form Pa 1000 Property Tax Or Rent Rebate Claim Benefits Older

Renters Rebate 2021 Printable Rebate Form

Missouri Rent Rebate 2019 Form Fill Out And Sign Printable PDF

Mass Save Rebate Forms 2022 Mass Save Rebate

Form For Renters Rebate RentersRebate

FREE 44 Receipt Forms In PDF

FREE 44 Receipt Forms In PDF

PA Rent Rebate Form Printable Rebate Form

Pa 1000 Fill Out And Sign Printable PDF Template SignNow

Microfinance Loan Application Form

Income Tax Rebate On Rented House - Web 26 juil 2023 nbsp 0183 32 From the rental income a property owner is allowed to deduct municipal taxes on the property rent that is not realised a 30 standard deduction on the annual value of the property as well as