Income Tax Rebate On Retirement Benefits Web The Standard Personal Allowance is 163 12 570 2023 24 This means you re able to earn or receive up to 163 12 570 in the 2023 24 tax year 6 April to 5 April and not pay any tax

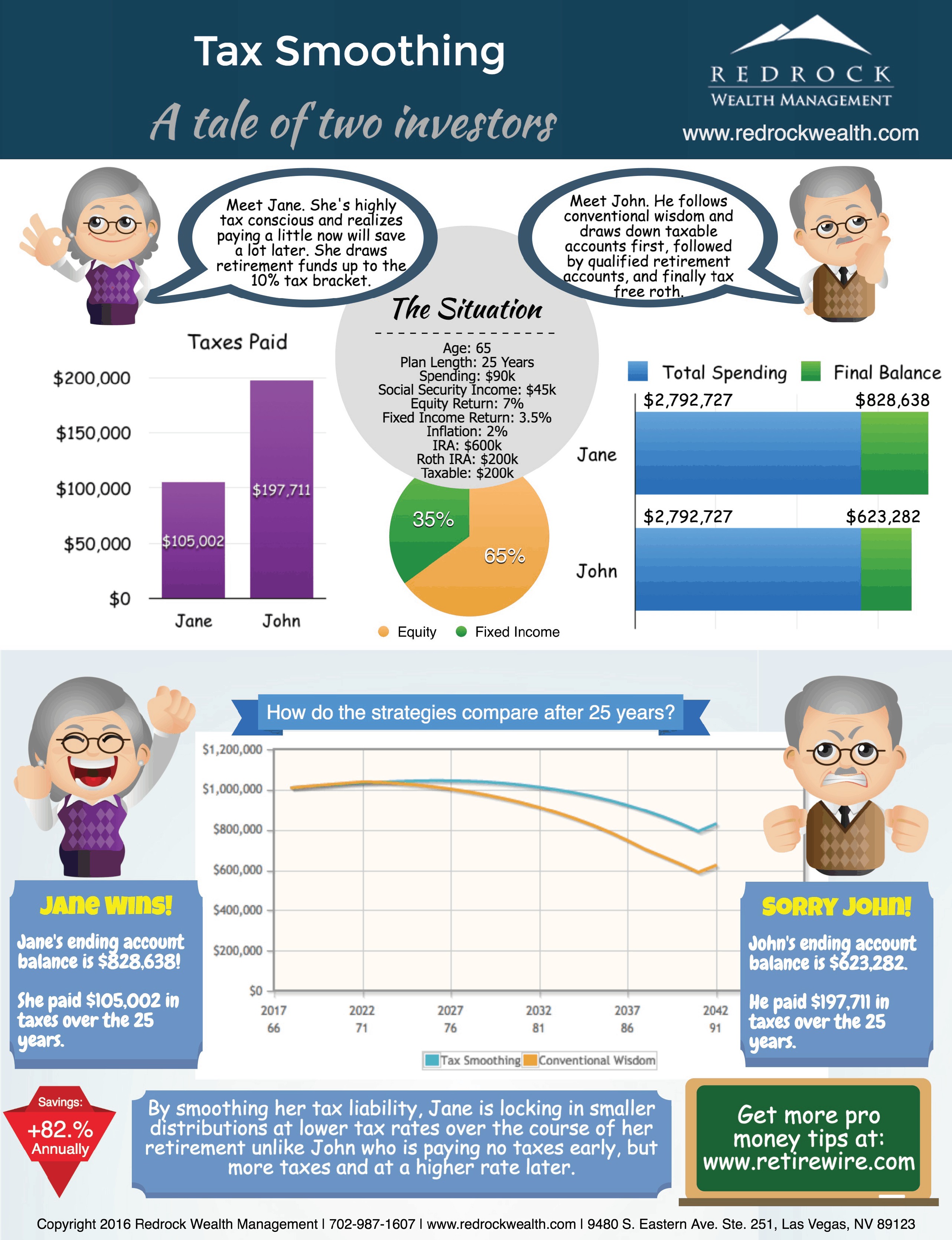

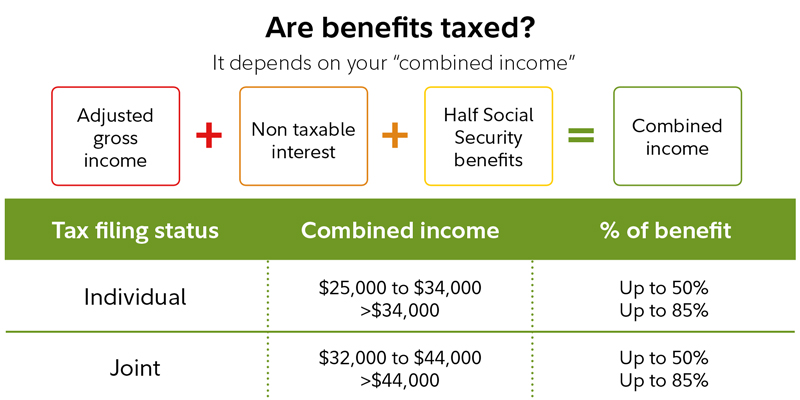

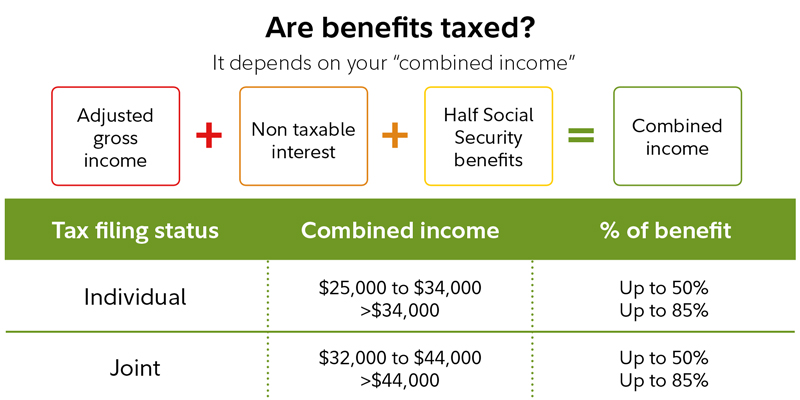

Web 17 ao 251 t 2023 nbsp 0183 32 Income Taxes And Your Social Security Benefit Request to Withhold Taxes from your Social Security Benefits Retirement Plans Pensions and Individual Web 8 juin 2023 nbsp 0183 32 Retirement income from pensions also called defined benefit plans is generally taxable Income from annuities is usually taxable too It s rare but if you made after tax contributions to a

Income Tax Rebate On Retirement Benefits

Income Tax Rebate On Retirement Benefits

https://gg.myggsa.co.za/how_to_calculate_tax_rebate_for_retirement_annuity_south_africa.pnJFwS5NsgwzDjQtZcjDf9sR_wTndXTKWakA_IzLSfZHvkGnDxIMjTWOn4h_qpnCoymGxeORadFt6dq56FOJNQWinH22TSkj=w1200-h630-pd

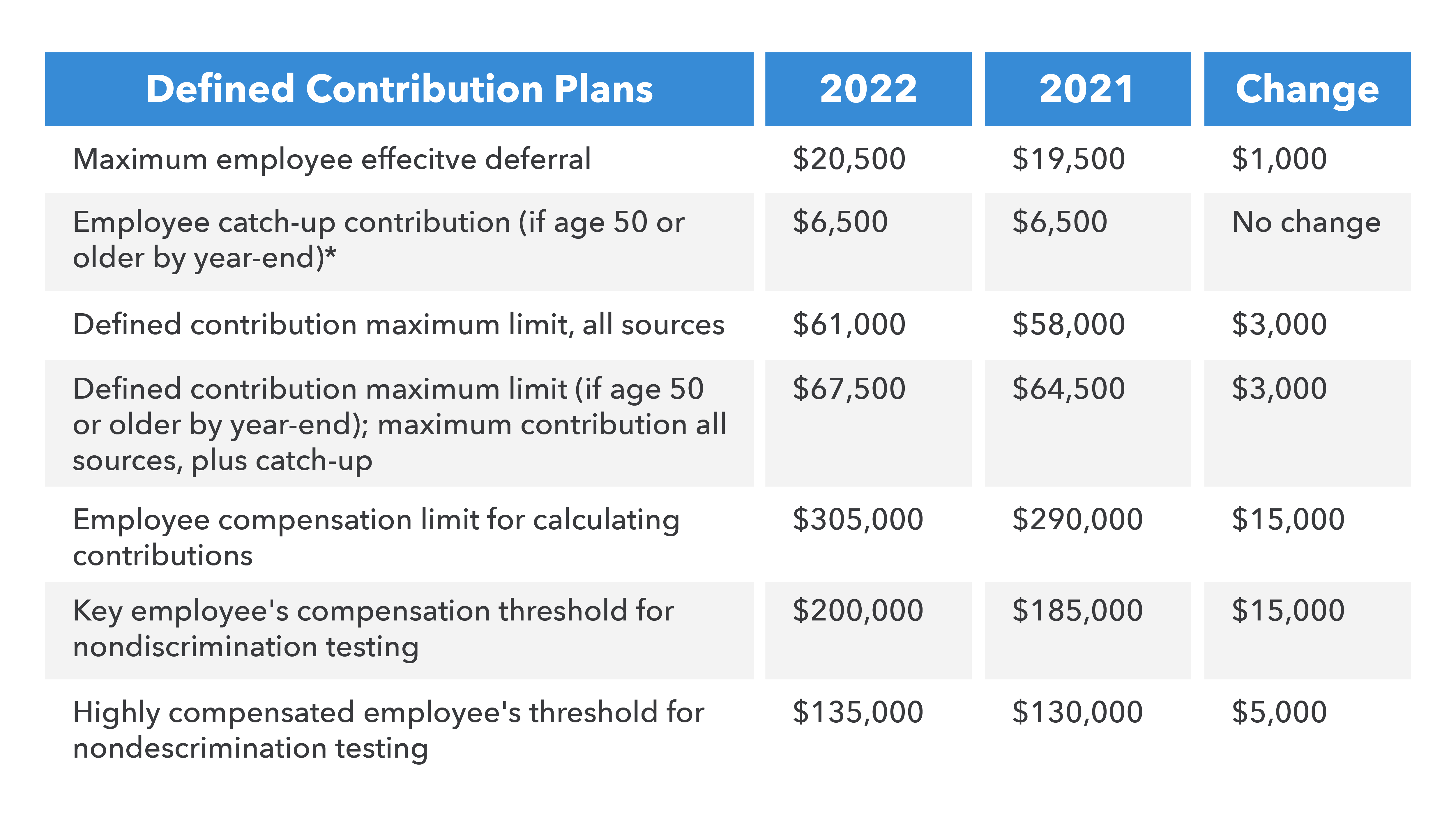

What s The Maximum 401k Contribution Limit In 2022 2023

https://blog.mint.com/wp-content/uploads/2019/08/Mint-page-updates-quick-wins.png?w=5000

Income Tax IT Benefits Rebates For Senior Citizens Website For Andhra

https://1.bp.blogspot.com/-d8vHwIDCAgs/YO0G5DDkc2I/AAAAAAAAPMM/lt0uwqs-BicHDIFCG1xMLW38tssq4hDpQCLcBGAsYHQ/w1200-h630-p-k-no-nu/Screenshot_20210713-082223_WPS%2BOffice.jpg

Web 11 sept 2023 nbsp 0183 32 The number of months worth of benefits you gave up is 15 15 000 divided by 1 000 Your benefits will then be recalculated as if you filed for benefits 15 months Web 11 sept 2023 nbsp 0183 32 The above changes could have an impact on your 2023 tax year returns depending on how much money you earn But the biggest impact will be felt by this

Web 15 f 233 vr 2023 nbsp 0183 32 4 Maximize your tax benefits with Roth IRA distributions Contributions you make to a Roth IRA account are made with after tax dollars and you don t have the Web 31 mai 2022 nbsp 0183 32 You may have to pay income tax on up to 50 of your benefits if you file as an individual and your combined income is between 25 000 and 34 000 You may pay income tax on up to 85 of your

Download Income Tax Rebate On Retirement Benefits

More picture related to Income Tax Rebate On Retirement Benefits

Income Taxes On Social Security Benefits 2022 BenefitsTalk

https://www.benefitstalk.net/wp-content/uploads/breaking-down-social-security-retirement-benefits-by-age-simplywise-scaled.jpeg

56 Of Social Security Households Pay Tax On Their Benefits Will You

http://seniorsleague.org/assets/TSCL_SocialSecurity_Chart.jpg

Retirement Income Tax Smoothing Save Thousands In Taxes

https://retirewire.com/wp-content/uploads/2016/09/tax-smoothing-retirement-income-infographic.png

Web Il y a 2 jours nbsp 0183 32 There had to be consequences There is an assessable penalty under Code Section 6700 on promoters and others involved in the organization of or sale of abusive Web 31 juil 2023 nbsp 0183 32 Income Tax on Taxable Income Low of 2 on up to 500 for single filers and 1 000 for joint filers and a high of 5 on more than 3 000 for single filers and 6 000 for joint filers

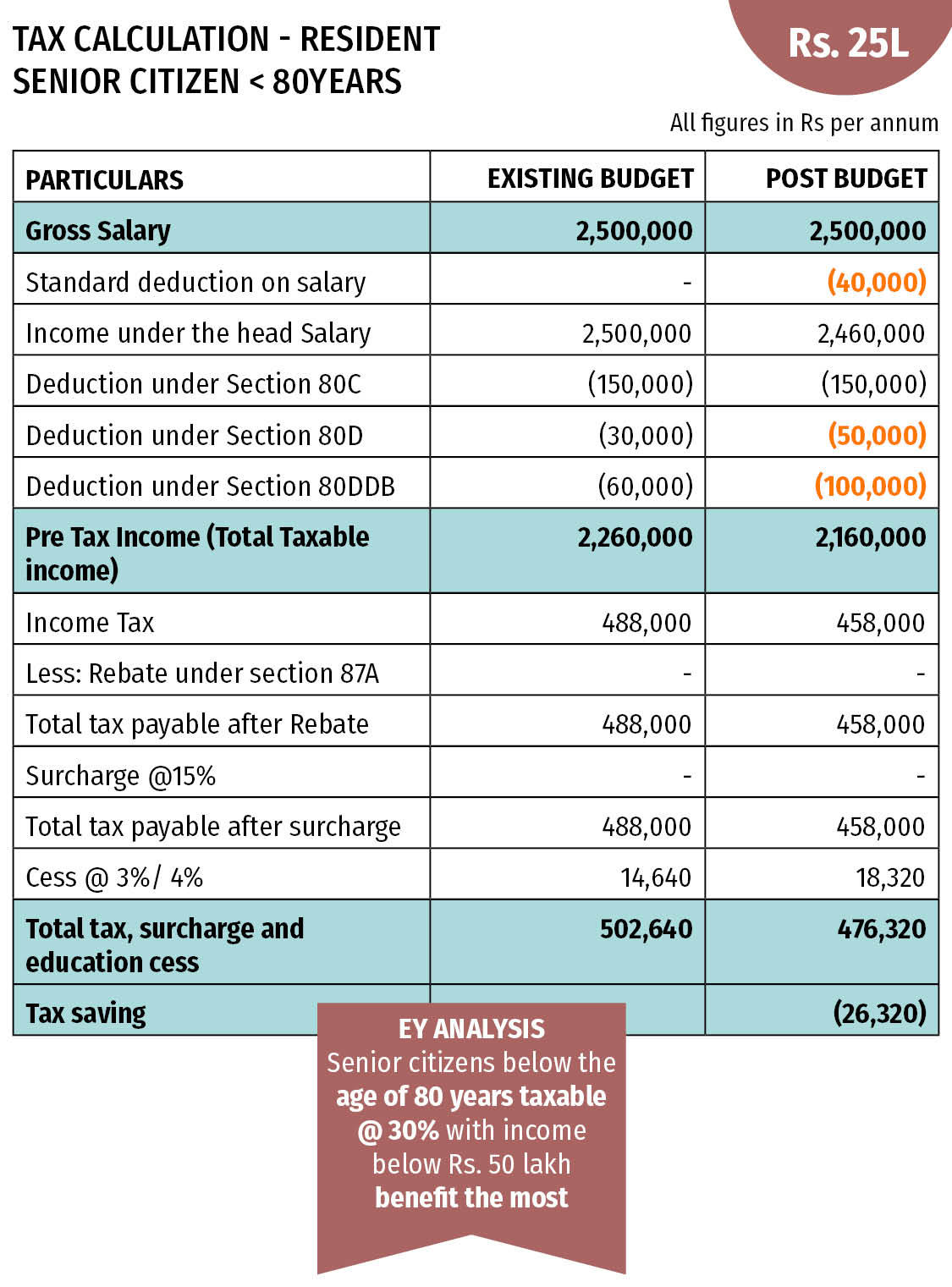

Web INCOME TAX RATE SLABS FOR SENIOR CITIZENS FROM 60 TO 80 YEARS OF AGE INCOME SLAB RATE OF TAX Upto Rs 3 00 000 Nil Rs 3 00 001 to Rs 5 00 000 5 Web 9 sept 2023 nbsp 0183 32 Military retiree tax benefit The Virginia budget proposal would remove the 55 or older requirement for subtracting military benefits from taxable income If the budget

Working In Retirement Social Security Taxes Fidelity

https://www.fidelity.com/bin-public/060_www_fidelity_com/images/Viewpoints/RET/social_security_working_2019_info_2.jpg

Retirement Income Tax Rebate Calculator Greater Good SA

https://gg.myggsa.co.za/how_much_tax_do_i_get_back_from_retirement_annuity.PNG

https://www.moneyhelper.org.uk/en/pensions-and-retirement/tax-and...

Web The Standard Personal Allowance is 163 12 570 2023 24 This means you re able to earn or receive up to 163 12 570 in the 2023 24 tax year 6 April to 5 April and not pay any tax

https://www.irs.gov/individuals/seniors-retirees

Web 17 ao 251 t 2023 nbsp 0183 32 Income Taxes And Your Social Security Benefit Request to Withhold Taxes from your Social Security Benefits Retirement Plans Pensions and Individual

Difference Between Income Tax Exemption Vs Tax Deduction Vs Rebate

Working In Retirement Social Security Taxes Fidelity

DEDUCTION UNDER SECTION 80C TO 80U PDF

Tax Benefits For Senior Citizens Budget 2018 Proposes Tax Other

How To Celebrate With Rebate Planning For Incomes PRACTICAL TAX

Income Tax Rebate On Home Loan Applicable Sections Under I T Act

Income Tax Rebate On Home Loan Applicable Sections Under I T Act

Income Tax Rebate Under Section 87A

Income Tax Rules For Senior Citizens Senior Citizens Income Tax Slabs

Home Loan Tax Benefit What Is The Income Tax Rebate On Home Loan

Income Tax Rebate On Retirement Benefits - Web 31 mai 2022 nbsp 0183 32 You may have to pay income tax on up to 50 of your benefits if you file as an individual and your combined income is between 25 000 and 34 000 You may pay income tax on up to 85 of your