Income Tax Rebate On Salary Web Tax rebate under Section 87A of the Income Tax Act 1961 is eligible for people whose taxable income is less than Rs 5 lakh in Financial Year 2022 23 The maximum amount

Web 5 avr 2017 nbsp 0183 32 Use this service to estimate how much Income Tax and National Insurance you should pay for the current tax year 6 April 2023 to 5 April 2024 This tells you your Web 22 f 233 vr 2023 nbsp 0183 32 On this page you will see Individuals tax table as well as the Tax Rebates and Tax Thresholds scroll down 2024 tax year 1 March 2023 29 February 2024 22

Income Tax Rebate On Salary

Income Tax Rebate On Salary

https://www.firstpost.com/wp-content/uploads/large_file_plugin/2019/02/1549021404_Salarytable.jpg

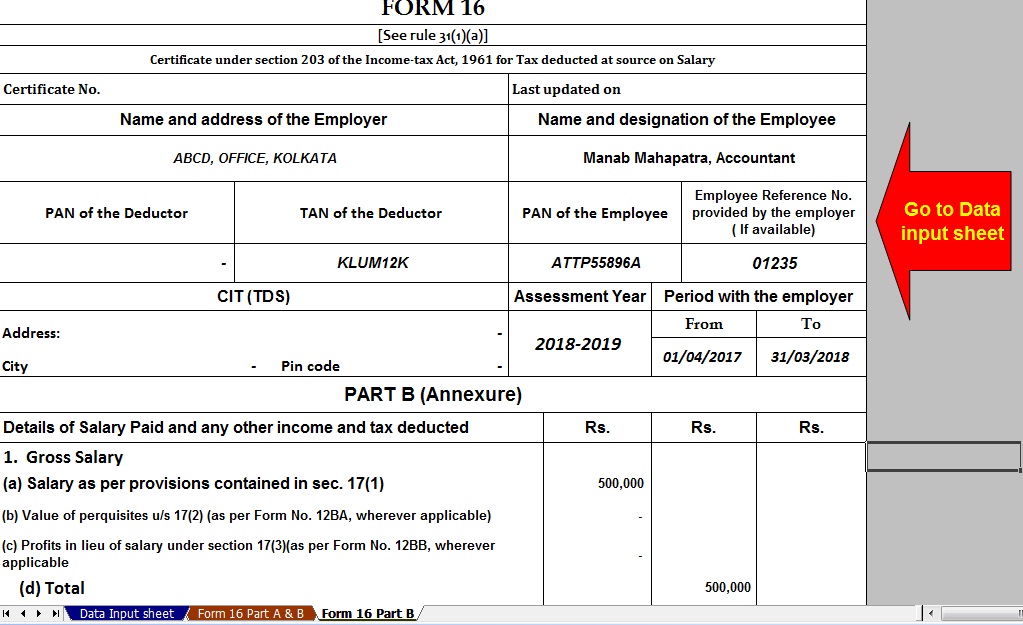

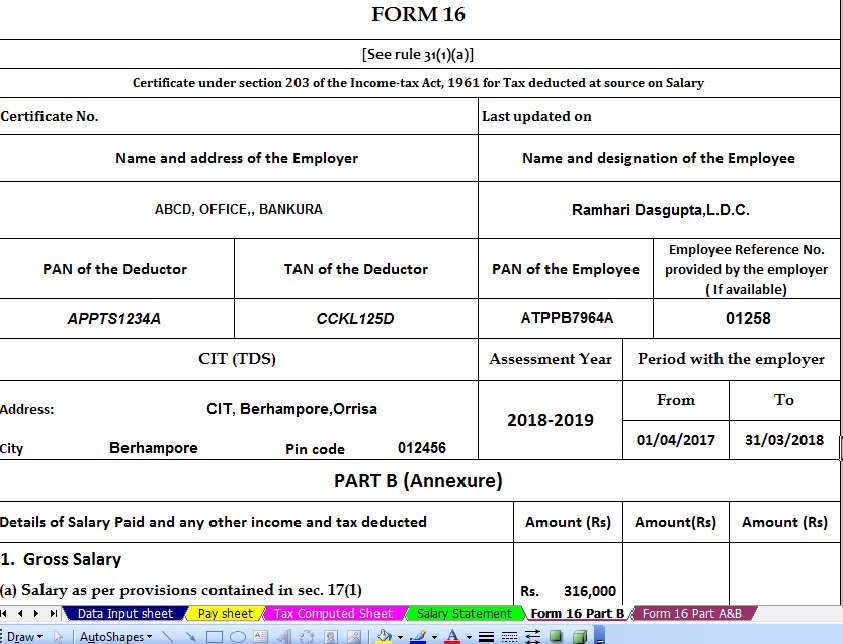

Raised The Income Tax Rebate U s 87A For F Y 2019 20 With Automated

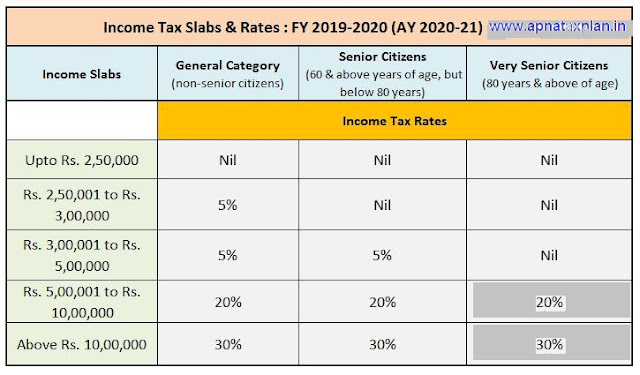

https://1.bp.blogspot.com/-qh1AR8nq79Y/XSdFFK--RCI/AAAAAAAAJ88/-dhKKjr_UCce2k6QpcrxXwK6TKpllSbuACLcBGAs/s640/Tax%2BSlab%2Bfor%2BA.Y.%2B20120-21.jpg

How To Calculate Income Tax On Salary With Example

https://razorpay.com/learn-content/uploads/2022/02/Facebook-post-15-1-1024x538.png

Web 27 d 233 c 2022 nbsp 0183 32 For salaried employees Section 10 of the Income Tax details a wide range of allowances that can be used to reduce their tax outgo Let us examine some allowances on which you can claim income Web 4 avr 2023 nbsp 0183 32 Net income from salary 3 10 000 Income from other sources Interest on savings account 12 000 Gross total income 3 22 000 Taxable income 3 22 000 Income tax thereon 0 Rs

Web 11 avr 2023 nbsp 0183 32 Exclude income that is exempt or not included in the total income calculation Apply the rebate If your total income is equal to or less than Rs 5 lakh you Web Rebate u s 87A Resident Individual whose Total Income is not more than 5 00 000 is also eligible for a Rebate of up to 100 of income tax or 12 500 whichever is less

Download Income Tax Rebate On Salary

More picture related to Income Tax Rebate On Salary

Rebate U s 87A Of The Income Tax As Per Budget 2017 Plus Automated TDS

https://1.bp.blogspot.com/-ukdlrYRmTMc/WQbkOMQJlQI/AAAAAAAAEiM/TC62ekVAOgAT1yD1rLaI_v9ibEZKD5JcgCLcB/s1600/Form%2B16%2BPart%2BB.jpg

How To Calculate Income Tax On Salary With Example

https://razorpay.com/learn-content/uploads/2022/02/Facebook-post-17-1024x908.png

Income Tax Rates TDS On Salaries And Rebate Under Section 87A

https://www.govtstaff.com/wp-content/uploads/2023/02/income-tax-rates-tds-on-salaries-and-rebate-under-section-87a-finance-bill-2023-budget-2023-24-400x518.jpg

Web rebates and Income tax payable on taxable income is gross income tax calculated on taxable income by applying applicable rate of income tax as reduced by following tax Web rebate shall be 100 of income tax or Rs 12 500 whichever is less The Rates for Charging Income Tax for Financial Year 2020 21 i e AY 2021 22 Other than Senior

Web 12 avr 2023 nbsp 0183 32 Income From Salary How To Calculate Income Tax On Salary With Example FY 2022 23 By Shivaprasad Updated on Apr 12th 2023 21 min read CONTENTS Show New Income Tax Regime From Web 27 mars 2023 nbsp 0183 32 How to check your tax code You should be able to find your tax code on your payslip You could also find it on a P60 or P45 form that you may have been sent by

Income Tax Rebate U s 87 A Increased By 500 From FY 2019 20

https://financialcontrol.in/wp-content/uploads/2018/06/Rebate-87A.jpg

Interim Budget 2019 20 The Talk Of The Town Trade Brains

https://tradebrains.in/wp-content/uploads/2019/02/income-tax-rebate-min.png

https://www.bankbazaar.com/tax/tax-rebate.html

Web Tax rebate under Section 87A of the Income Tax Act 1961 is eligible for people whose taxable income is less than Rs 5 lakh in Financial Year 2022 23 The maximum amount

https://www.gov.uk/estimate-income-tax

Web 5 avr 2017 nbsp 0183 32 Use this service to estimate how much Income Tax and National Insurance you should pay for the current tax year 6 April 2023 to 5 April 2024 This tells you your

2007 Tax Rebate Tax Deduction Rebates

Income Tax Rebate U s 87 A Increased By 500 From FY 2019 20

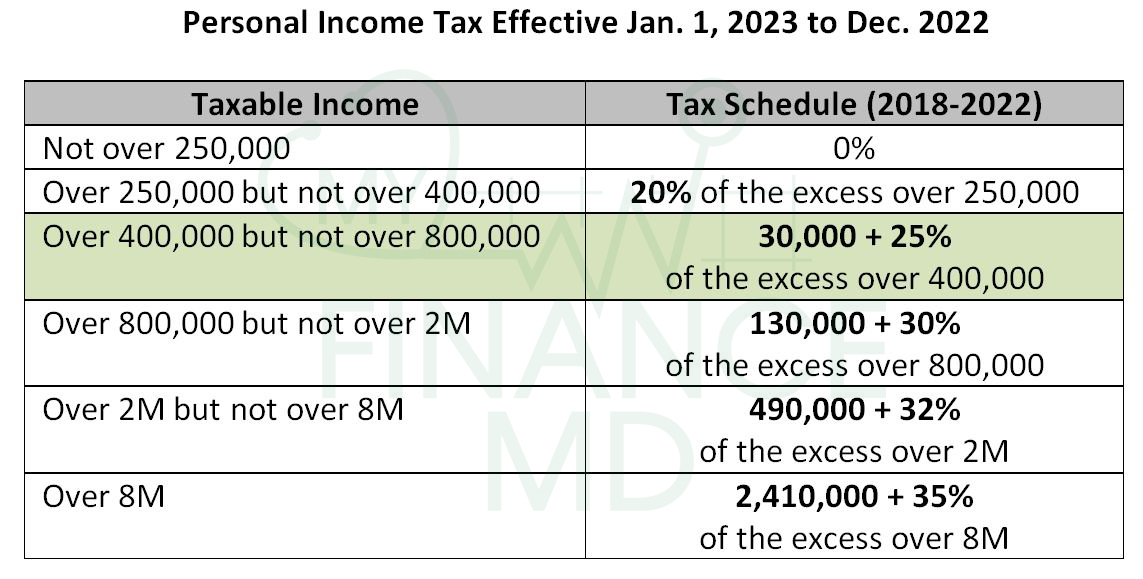

How To Compute And File The 2nd Quarter Income Tax Return TRAIN

How To Check Whether You Are Eligible For The Tax Rebate On Rs 5 Lakhs

When Tax Rebate 2020 QATAX

Income Tax Deductions List FY 2019 20 How To Save Tax For AY 20 21

Income Tax Deductions List FY 2019 20 How To Save Tax For AY 20 21

Income Tax Rebate Rs 2500 U s 87A Tdstaxindia

How To Calculate Federal Social Security And Medicare Taxes

Incometax Individual Income Taxes Urban Institute This Service

Income Tax Rebate On Salary - Web 27 d 233 c 2022 nbsp 0183 32 For salaried employees Section 10 of the Income Tax details a wide range of allowances that can be used to reduce their tax outgo Let us examine some allowances on which you can claim income