Income Tax Rebate On Saving Account Web 3 janv 2023 nbsp 0183 32 Deductions Under Section 80TTA If you have earned interest from your savings account then you can claim the Deduction under Section 80TTA It provides a

Web You can now avail tax rebate on interest on savings up to Rs 10 000 from 1 st April 2013 under Section 80TTA provided the interest is lesser than the amount Individuals and Web 8 mai 2023 nbsp 0183 32 Using that information the tax on your savings account interest would generally be 2 200 On the other hand if you have 20 000 in your high yield savings account and earn 3 75 interest you

Income Tax Rebate On Saving Account

Income Tax Rebate On Saving Account

https://tradebrains.in/wp-content/uploads/2019/02/income-tax-rebate-min.png

Revised Tax Rebate Under Sec 87A After Budget 2019 BasuNivesh

https://www.basunivesh.com/wp-content/uploads/2019/02/Revised-Tax-Rebate-under-Sec.87A-after-Budget-2019.jpg

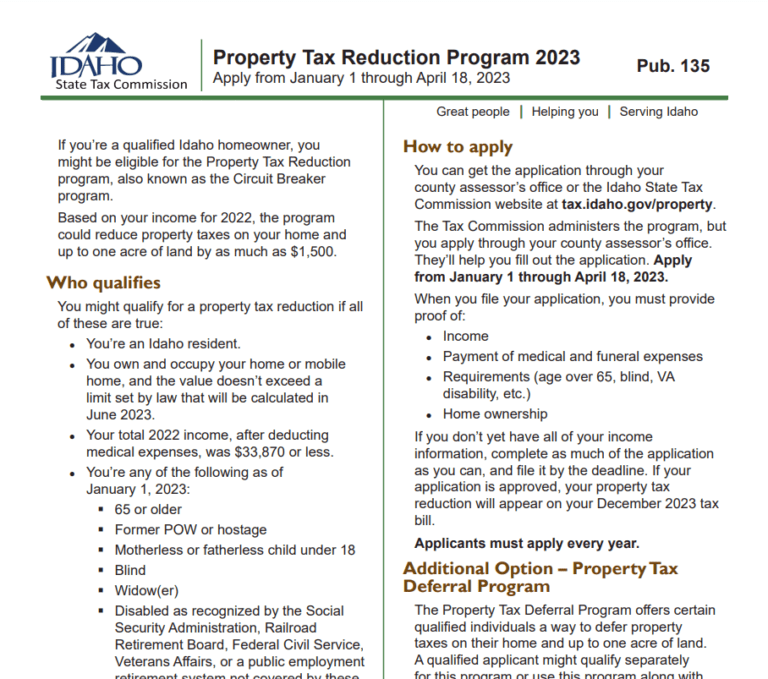

Idaho Tax Rebate 2023 Your Comprehensive Guide To Saving Money

https://printablerebateform.net/wp-content/uploads/2023/03/Idaho-Tax-Rebate-2023-768x679.png

Web 26 avr 2023 nbsp 0183 32 Any interest earned on a savings account is taxable income Your bank will send you a 1099 INT form for any interest earned over 10 but you should report any interest earned even if it s Web 10 mars 2022 nbsp 0183 32 The interest you earn from the money in a savings account is taxable In the U S the principal balance in your savings account is not taxable Your interest

Web 22 oct 2022 nbsp 0183 32 You can avail deduction of up to Rs 10 000 on the total savings account interest income earned This deduction can be availed under Section 80TTA of the Income Tax Act and is available to an Web 6 avr 2023 nbsp 0183 32 This 163 5 000 starting rate for savings means anyone with total taxable income under the personal income tax allowance plus 163 5 000 will not pay any tax on your savings This means if your total taxable

Download Income Tax Rebate On Saving Account

More picture related to Income Tax Rebate On Saving Account

Income Tax Rebate On Home Loan Applicable Sections Under I T Act

https://assets-news.housing.com/news/wp-content/uploads/2022/09/09092126/Income-tax-rebate-on-home-loan.jpg

10 Savings Accounts That Come With Sweet Tax Breaks

https://www.money-rates.com/imagesvr_ce/679/10 Savings Accounts with Tax Breaks graphic-min.jpg

Income Tax And Rebate For Apartment Owners Association

https://image.slidesharecdn.com/incometaxandrebateforapartmentownersassociation-091116034252-phpapp01/95/income-tax-and-rebate-for-apartment-owners-association-6-728.jpg?cb=1258343000

Web Breaker box 4 000 limit Electric wiring 2 500 limit Insulation and weatherization 1 600 Unlike the tax credits these rebates are based on your income level If you Web 11 mai 2023 nbsp 0183 32 Apply for a repayment of tax on your savings interest using form R40 if you do not complete a Self Assessment tax return From HM Revenue amp Customs Published

Web 26 juil 2022 nbsp 0183 32 If you opt for the old existing income tax regime while filing ITR for FY 2022 23 AY 2023 24 then you can claim a tax deduction of up to Rs 10 000 on savings Web 11 mai 2020 nbsp 0183 32 Federal tax law provides substantial tax incentives for retirement saving These include the deferral of taxes on contributions to retirement savings accounts by

Tax Rebate On Income Upto 5 Lakh Under Section 87A

https://blog.saginfotech.com/wp-content/uploads/2021/04/income-tax-rebate.jpg

Budget 2019 Income Tax Rebate Hiked For Income Up To Rs 5 Lakh Here

https://www.firstpost.com/wp-content/uploads/large_file_plugin/2019/02/1549021404_Salarytable.jpg

https://www.fincash.com/l/tax/income-tax-on-savings-bank-interest

Web 3 janv 2023 nbsp 0183 32 Deductions Under Section 80TTA If you have earned interest from your savings account then you can claim the Deduction under Section 80TTA It provides a

https://www.bankbazaar.com/tax/tax-rebate.html

Web You can now avail tax rebate on interest on savings up to Rs 10 000 from 1 st April 2013 under Section 80TTA provided the interest is lesser than the amount Individuals and

4 TAX REBATE U s 87A New TAX REBATE EXAMPLES Income Tax

Tax Rebate On Income Upto 5 Lakh Under Section 87A

Revised Tax Rebate Under Section 87A FY 2019 2020 Explained

Individual Income Tax Rebate

Ohio Tax Rebate 2023 Maximize Your Tax Savings Printable Rebate Form

2022 State Of Illinois Tax Rebates EzTaxReturn Blog

2022 State Of Illinois Tax Rebates EzTaxReturn Blog

Section 87A Tax Rebate Under Section 87A

2007 Tax Rebate Tax Deduction Rebates

Maximize Your Savings New Jersey Tax Rebate 2023 Tax Rebate

Income Tax Rebate On Saving Account - Web Your Personal Allowance is 163 12 570 It s used up by the first 163 12 570 of your wages The remaining 163 3 430 of your wages 163 16 000 minus 163 12 570 reduces your starting rate for