Income Tax Rebate On Second Home Loan Web 24 janv 2022 nbsp 0183 32 For maintenance purposes and general upkeeps the owner of that let out property can claim a tax rebate of 30 Under Section 24 of IT Act one can avail income tax benefit on interest payment of the

Web Calculate the tax benefit on a second Home Loan in advance to save time and unnecessary hassles in the future You can also use the free home loan tax benefit calculator available on the official website of Web 9 janv 2021 nbsp 0183 32 Income Tax Benefits Deductions on Second Home Loan CA ILA JINDAL Income Tax Articles Download PDF 09 Jan 2021 39 636 Views 41 comments

Income Tax Rebate On Second Home Loan

Income Tax Rebate On Second Home Loan

https://media.cheggcdn.com/media/5f4/5f446443-3876-4bdf-af30-bd53ed6ed3da/phpQaHDkw

Income Tax Rebate On Personal Loan Claim Tax Rebate For Personal Loan

https://i.ytimg.com/vi/d7NE7aZzU2Q/maxresdefault.jpg

Complete Guide On Second Home Loan Tax Benefit In India

https://favesblog.com/wp-content/uploads/2023/02/Featured-Image.jpg

Web 11 janv 2023 nbsp 0183 32 Yes you claim deductions on two home loans within the specific limit under Section 24 Rs 2 lakhs per annum if the properties are self occupied Only for your first Web 5 f 233 vr 2023 nbsp 0183 32 know about Tax benefit on Home loan Housing loan interest deduction Income Tax rebate on Home loan Find out Income tax exemption and home loan tax

Web 15 juin 2023 nbsp 0183 32 The interest paid on the home loan EMI for the year can be claimed as a deduction from your total income up to a maximum of Rs 2 lakh under Section 24 From Web So if you own and occupy upto two houses the maximum deduction with respect to interest payment is restricted to Rs 2 lakhs per annum for both the houses taken together

Download Income Tax Rebate On Second Home Loan

More picture related to Income Tax Rebate On Second Home Loan

How To Calculate Tax Rebate On Home Loan Grizzbye

https://lh5.googleusercontent.com/proxy/_to2OsQ67tRR4OwClZoiK8C99OHj3utcTVj3Q3bWbdpZVdQj_PtSnOS_64ZT2jiqSPfBqvnDWsCyETNMDekbIwWLP_7zi7sagEKJarz_V0esJDVAQsIgvY3jjvwKYw=w1200-h630-p-k-no-nu

Income Tax Rebate For Housing Loan Form No 12C Pallikalvi Teachers News

https://1.bp.blogspot.com/-oW8FNR-IJDU/XikG4UEcNwI/AAAAAAAAHps/3fzchCO4L400lsdyUEyhQ4S0xHA0wQ9tQCLcBGAsYHQ/s1600/FORM12C_2015_16_001.jpg

Home Loan Tax Benefit What Is The Income Tax Rebate On Home Loan

https://i.ytimg.com/vi/XkpSV0LrRSU/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AHUBoAC4AOKAgwIABABGHIgSShAMA8=&rs=AOn4CLBKOFRJ5AEKmvS89fKVIw-BGAzxdw

Web Income tax rebate on home loan Perks of tax advantaged home loans with second homes Second homeowners may take advantage of tax breaks on interest that become Web 5 ao 251 t 2016 nbsp 0183 32 income tax rebate on second home will be as follows Full interest on home loan is allowed as deduction for the let out property so there is no limit of Rs 2 0 lakh

Web 21 mars 2021 nbsp 0183 32 Under the income tax laws there are no restrictions on the number of houses for which you can claim the tax benefits for home loan Whether you have one home loan or more the Web There are two possibilities here Both residences are self occupied According to the most recent budget provisions the second property cannot be considered rent As a result

How To Claim Tax Benefit For Second Home Loan

https://qph.fs.quoracdn.net/main-qimg-c7b2ac726b60b6fa2aeaea32e58e3c6e

Exemption Of Up To 2 Lacks In Tax From These Schemes The Viral News

https://theviralnewslive.com/wp-content/uploads/2023/02/for-income-tax-rebate-home-loan-Exemption_11zon.jpg

https://navi.com/blog/second-home-loan

Web 24 janv 2022 nbsp 0183 32 For maintenance purposes and general upkeeps the owner of that let out property can claim a tax rebate of 30 Under Section 24 of IT Act one can avail income tax benefit on interest payment of the

https://www.icicibank.com/blogs/home-loan/t…

Web Calculate the tax benefit on a second Home Loan in advance to save time and unnecessary hassles in the future You can also use the free home loan tax benefit calculator available on the official website of

/home-equity-loan-tax-deduction-3155014-e80945d7d6d74f0590138363f188d23b.png)

Deduct Property Taxes On Second Home

How To Claim Tax Benefit For Second Home Loan

DEDUCTION UNDER SECTION 80C TO 80U PDF

Individual Income Tax Rebate

Georgia Income Tax Rebate 2023 Printable Rebate Form

Know How To Claim Tax Benefits On Second Home Loan PNB Housing

Know How To Claim Tax Benefits On Second Home Loan PNB Housing

Income Tax Rebate Under Section 87A

Income Tax Rebate On Investment In Insurance Premium 2020 Tariq Mahmood

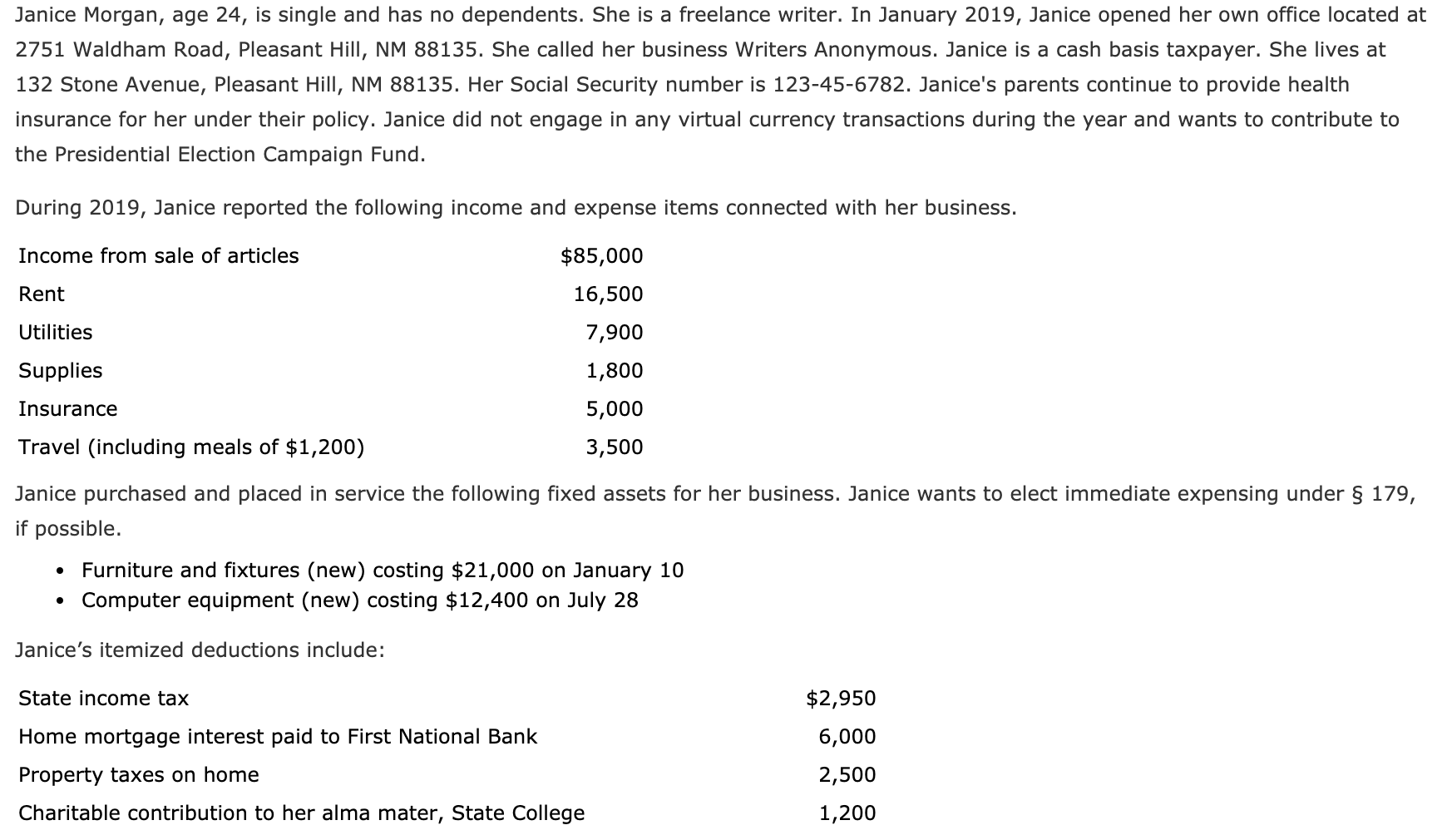

Solved Janice Morgan Age 24 Is Single And Has No Chegg

Income Tax Rebate On Second Home Loan - Web 5 f 233 vr 2023 nbsp 0183 32 know about Tax benefit on Home loan Housing loan interest deduction Income Tax rebate on Home loan Find out Income tax exemption and home loan tax