Income Tax Rebate On Under Construction Property Web 1 oct 2014 nbsp 0183 32 Income Tax Rebate On an Under Construction Property Reality or Illusion October 01 2014 Proptiger Significant price advantage and ease of payment has made

Web 28 janv 2023 nbsp 0183 32 Income tax return Rebate on home loan interest paid before possession can be claimed over a period of five years after getting possession says Section 24 B Web 4 ao 251 t 2021 nbsp 0183 32 Or as many people call it income tax rebate on home loans for under construction property No doubt this is a very important aspect when purchasing a

Income Tax Rebate On Under Construction Property

Income Tax Rebate On Under Construction Property

https://assetyogi.b-cdn.net/wp-content/uploads/2017/08/income-tax-rebate-on-home-loan-for-under-construction-property-1024x576.jpg

How To Get Tax Benefit On Under Construction Property Stroymaster

https://www.ammacement.in/wp-content/uploads/2022/12/bekuhynyby.jpg

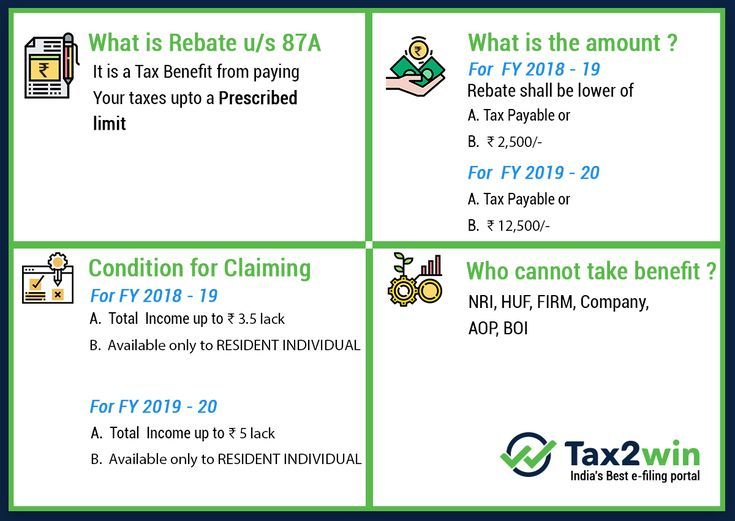

Income Tax Rebate Under Section 87A

https://image.slidesharecdn.com/incometaxrebateundersection87a2017-2018-180420103021/85/income-tax-rebate-under-section-87a-2-638.jpg?cb=1666685634

Web 28 janv 2014 nbsp 0183 32 3 Answers Sorted by 1 The rebate is available from the financial year in which you have taken the possession of the property All the interest paid in that Web 30 janv 2023 nbsp 0183 32 The different sections which can be used to get tax rebates on the under construction property are Section 24B of the IT Act 1961 Under this section a

Web 14 d 233 c 2021 nbsp 0183 32 In order to claim Home Loan Tax Benefits on an under construction property the borrower must look for the Deductions section at the time of filing the Web VDOM DHTML tml gt Can we claim tax benefit on a under construction property

Download Income Tax Rebate On Under Construction Property

More picture related to Income Tax Rebate On Under Construction Property

GST On Under Construction Property Quick Guide InstaFiling

https://instafiling.com/wp-content/uploads/2022/12/GST-on-Under-Construction-Property-980x551.png

Application For Rebate Of Property Taxes Niagara Falls Ontario

https://img.yumpu.com/48273006/1/500x640/application-for-rebate-of-property-taxes-niagara-falls-ontario-.jpg

Illinois To Begin Sending Out Property Tax And Income Tax Rebates

https://i0.wp.com/www.propertyrebate.net/wp-content/uploads/2023/05/illinois-to-begin-sending-out-property-tax-and-income-tax-rebates-youtube-2.jpg?resize=1024%2C576&ssl=1

Web 19 avr 2023 nbsp 0183 32 Income Tax Rebate On Under Construction Property If you own a property in Pennsylvania you can apply for a Property Tax Rebate The program is a Web 31 janv 2023 nbsp 0183 32 Pankaj Mathpal MD amp CEO at Optima Money Managers explained how a home loan borrower can claim an income tax rebate on home loan interest paid before

Web 23 mars 2019 nbsp 0183 32 The tax benefit under section 24 is reduced from Rs 2 lakhs to Rs 30 000 if the property is not acquired or construction is not completed within 3 years from the Web 24 avr 2017 nbsp 0183 32 If you have a home loan for an under construction property then it is possible to claim for tax deductions A tax deduction up to 2 Lakhs on the interest

From GST On Under construction Flats To Income Tax Rebate Key Changes

https://vihangadcon.com/wp-content/uploads/2021/09/csm_Consultinghouse-Teaser-Strategy-Consulting-Germany_d36de4df30-800x432.jpg

Section 87A Tax Rebate Under Section 87A Rebates Financial

https://www.propertyrebate.net/wp-content/uploads/2023/05/section-87a-tax-rebate-under-section-87a-rebates-financial.jpg

https://www.proptiger.com/guide/post/income-tax-rebate-on-an-under...

Web 1 oct 2014 nbsp 0183 32 Income Tax Rebate On an Under Construction Property Reality or Illusion October 01 2014 Proptiger Significant price advantage and ease of payment has made

https://www.livemint.com/money/personal-finance/itr-filing-how...

Web 28 janv 2023 nbsp 0183 32 Income tax return Rebate on home loan interest paid before possession can be claimed over a period of five years after getting possession says Section 24 B

Know New Rebate Under Section 87A Budget 2023

From GST On Under construction Flats To Income Tax Rebate Key Changes

Illinois Property Tax Rebate Form 2023 Printable Rebate Form

Property Tax Rebate New York State Printable Rebate Form

Theme Presentation1

Income Tax Slabs Overhauled Under New Regime Rebate Limit Up Check

Income Tax Slabs Overhauled Under New Regime Rebate Limit Up Check

DEDUCTION UNDER SECTION 80C TO 80U PDF

Income Tax Rebate 2023 Illinois LatestRebate

Illinois Income And Property Tax Rebates Will Be Issued Starting Monday

Income Tax Rebate On Under Construction Property - Web 30 janv 2023 nbsp 0183 32 The different sections which can be used to get tax rebates on the under construction property are Section 24B of the IT Act 1961 Under this section a