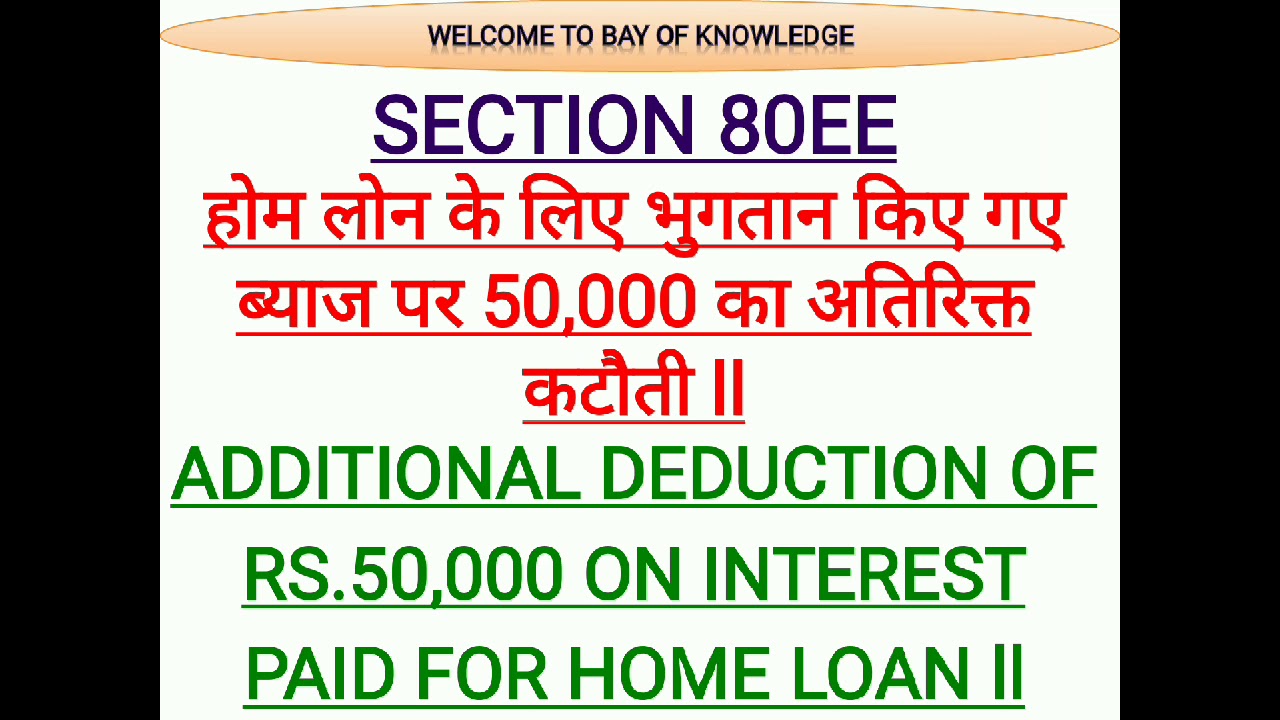

Income Tax Rebate Section 80ee Web 20 juil 2019 nbsp 0183 32 The Income Tax 1961 under Section 80EE helps taxpayers to claim a deduction of up to Rs 50 000 per financial year

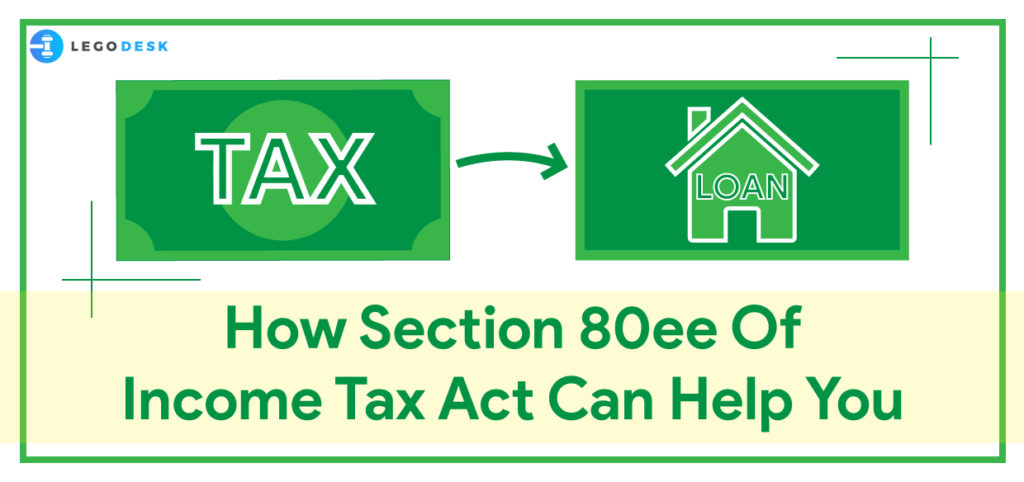

Web Section 80EE of the Income Tax Act allows additional benefits for first time home buyers in India if they borrow funds from a bank to purchase a Web 29 mai 2023 nbsp 0183 32 Section 80EE of the Income Tax Act introduced in the Financial Year 2013 14 offers an additional deduction on interest payments made towards home loans This

Income Tax Rebate Section 80ee

Income Tax Rebate Section 80ee

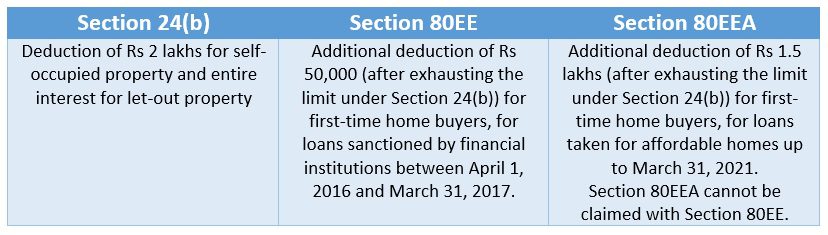

https://assets-news.housing.com/news/wp-content/uploads/2020/03/04181558/Section-80EEA-24b-80EE.jpg

Section 80EE Income Tax Deduction For Interest On Home Loan Housing News

https://assets-news.housing.com/news/wp-content/uploads/2020/02/26180556/Section-80EE.jpg

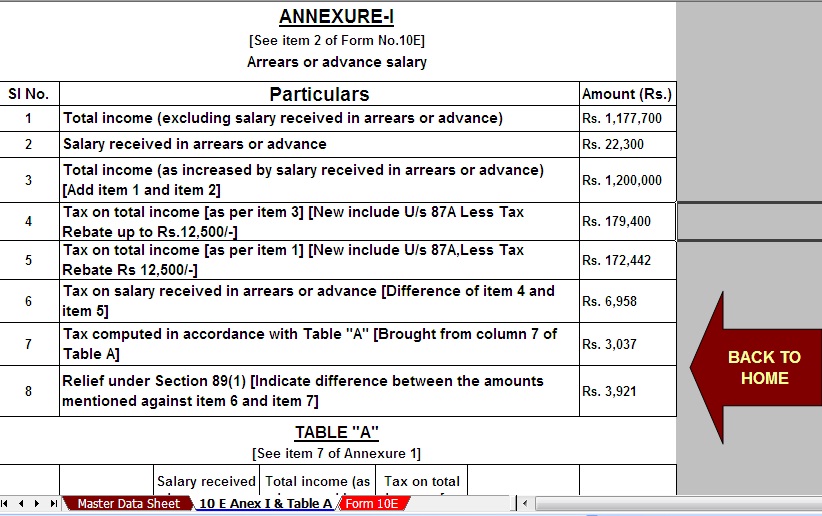

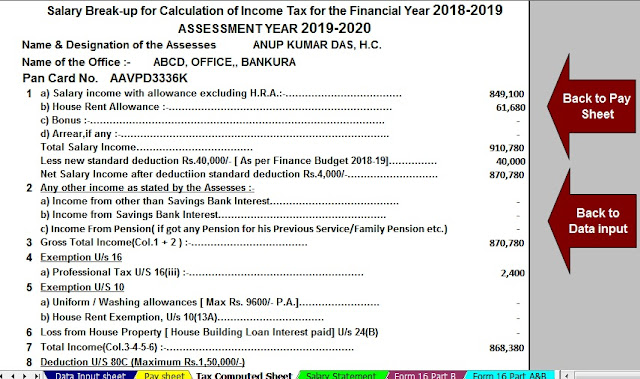

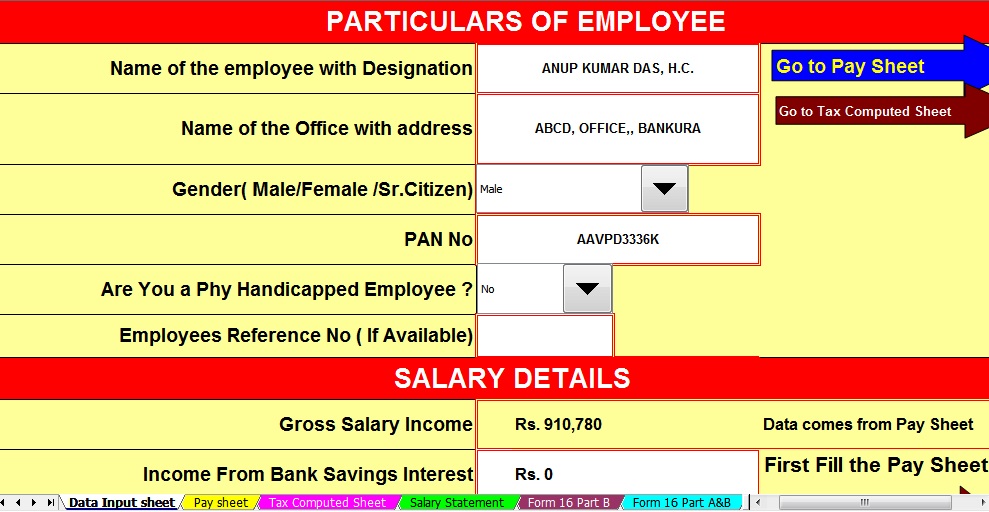

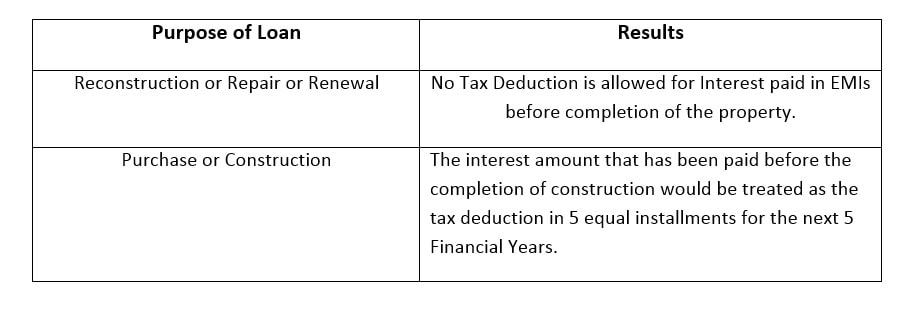

Tax Benefit On Home Loan Section 24 80EEA 80C With Automated

https://1.bp.blogspot.com/-1hmzbVNZKYo/XSHkKoX1yfI/AAAAAAAAJ48/rH6dqw_ChNcMLHBhRqZVUOtTkyFQPjeOQCLcBGAs/s1600/Picture-4%2Bof%2BArrears%2BRelief%2BCalculator%2B19-20.jpg

Web 9 juil 2019 nbsp 0183 32 Section 80EEB of the Income Tax Act allows you to claim tax savings of up to Rs 1 5 lakh on interest paid on a loan made specifically to purchase an electric car Web 5 sept 2023 nbsp 0183 32 Section 80EE Section 80EEA Property value Up to Rs 50 lakh Up to Rs 45 lakh Loan amount Up to Rs 35 lakh Not specified Loan period covered April 1

Web 2 avr 2022 nbsp 0183 32 So from 1st April 2022 first time home buyers won t be able to claim income tax benefit on up to 1 50 lakh home loan interest payment under Section 80EEA of the Web Tax deduction under Section 80EE of the Income Tax Act 1961 can be claimed by first time home buyers for the amount they pay as interest on home loan The maximum

Download Income Tax Rebate Section 80ee

More picture related to Income Tax Rebate Section 80ee

Section 80EE Of The Income Tax Act

https://i2.wp.com/www.phoenixtax.in/wp-content/uploads/2021/10/section-80ee-of-income-tax-act.jpg?fit=1280%2C720&ssl=1

Section 80EEA Deduction For Interest Paid On Affordable Home Loan

https://emailer.tax2win.in/assets/guides/all_guides/80eea-claim-condition.jpg

Deduction U s 80C To 80 U Part 10 In Tamil deductionu s80ee

https://i.ytimg.com/vi/hdLips4HJRw/maxresdefault.jpg

Web To be eligible for the tax incentives under Section 80EE the individual must be a first time homebuyer and the value of the property must not exceed 45 lakh Additionally the loan amount must not exceed 35 lakh and Web 11 janv 2023 nbsp 0183 32 By Sunita Mishra January 11 2023 Home loan tax benefits in 2023 The government offers various tax rebates especially if the property has been purchased using a home loan to make property purchases

Web 3 mars 2023 nbsp 0183 32 To provide relief on interest on home loan Section 80EE of income tax act was implemented which enables first time home buyers to claim an additional deduction Web Individuals are eligible for income tax benefits under Section 80EE of the Income Tax Act on the interest component of residential property loans obtained from any financial

Section 80EE Additional Deduction Upto 50000 Of Home Loan Interest

https://i.ytimg.com/vi/GP34x3jDGT4/maxresdefault.jpg

SECTION 80EE SECTION 80EE OF INCOME TAX ACT DEDUCTION UNDER SECTION

https://i.ytimg.com/vi/n2PhWZ6WhNI/maxresdefault.jpg

https://tax2win.in/guide/section-80ee

Web 20 juil 2019 nbsp 0183 32 The Income Tax 1961 under Section 80EE helps taxpayers to claim a deduction of up to Rs 50 000 per financial year

https://housing.com/news/section-80ee-inco…

Web Section 80EE of the Income Tax Act allows additional benefits for first time home buyers in India if they borrow funds from a bank to purchase a

Income Tax Section 80EE Wage Expense Conclusion For Enthusiasm On Home

Section 80EE Additional Deduction Upto 50000 Of Home Loan Interest

Deduction Under Section 80EEA Of The Income Tax Act 2019

Section 80DD 80U 80DDB 80E 80EE 80EEA 80EEB 80G Deductions In

Section 80EE Of Income Tax Act 1961 Know How Can It Help You

Live Fill Section 80EA 80EE In Income Tax Return Claim Deduction

Live Fill Section 80EA 80EE In Income Tax Return Claim Deduction

Income Tax Section 80EE Wage Expense Conclusion For Enthusiasm On Home

DEDUCTION UNDER SECTION 80C TO 80U PDF

Know The Tax Benefits Of Home Loan Under Section 80C 24 And 80EE

Income Tax Rebate Section 80ee - Web Section 80EEA of the Income Tax Act allows additional deductions up to Rs 50 000 for home buyers on the interest paid It is important to know that this Section was valid till