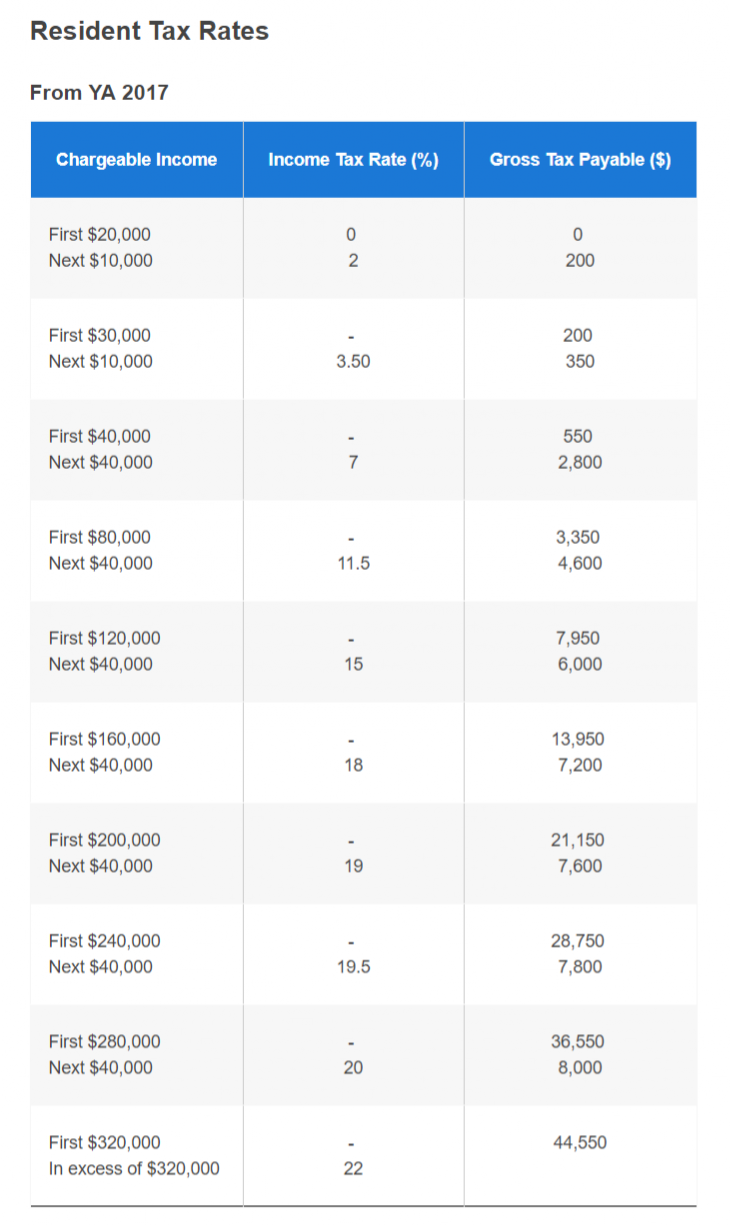

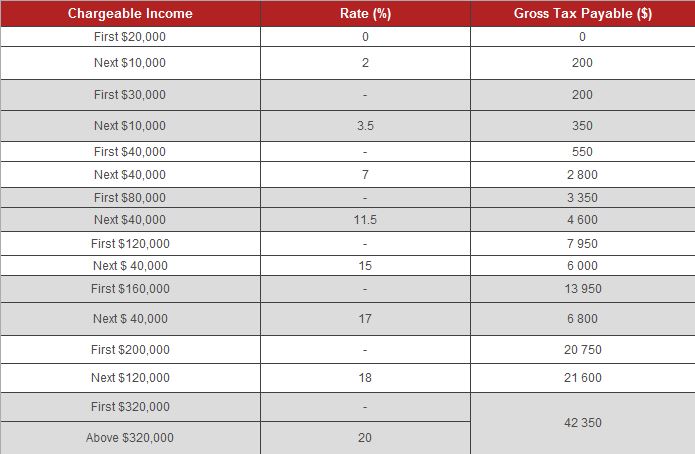

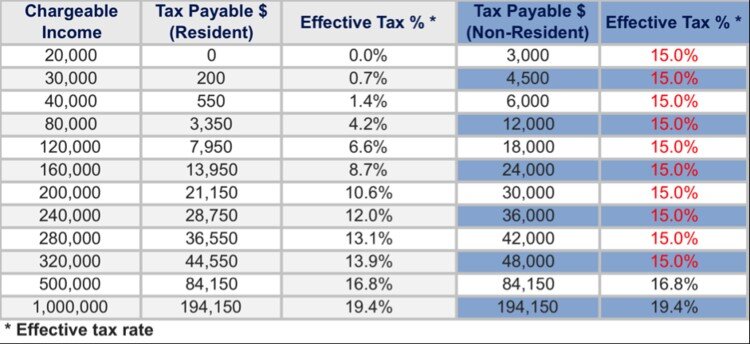

Income Tax Rebate Singapore Web 13 mars 2023 nbsp 0183 32 You will have to pay taxes if you re a Singapore citizen earning an annual income of S 20 000 or more and the filing deadline for individuals is 18 April annually The income tax is assessed based on

Web 24 janv 2020 nbsp 0183 32 An SGD5 000 tax rebate is granted for the first child and SGD10 000 is granted for the second child SGD20 000 is granted for Web 15 lignes nbsp 0183 32 3 mai 2023 nbsp 0183 32 Non resident individuals are taxed at a flat rate of 22 24

Income Tax Rebate Singapore

Income Tax Rebate Singapore

https://i.pinimg.com/originals/02/cc/ee/02cceeb8209cfe3f959b1480f37a5c15.jpg

Tax Services Singapore File Tax Returns On Time Company Taxation

https://www.accountingsolutionssingapore.com/wp-content/uploads/CIT-2018.jpg

30s 50s Chitchat Club Part 66 Page 806 HardwareZone Forums

https://www.rikvin.com/wp-content/uploads/personal-income-tax-rates-for-singapore-residents.jpg

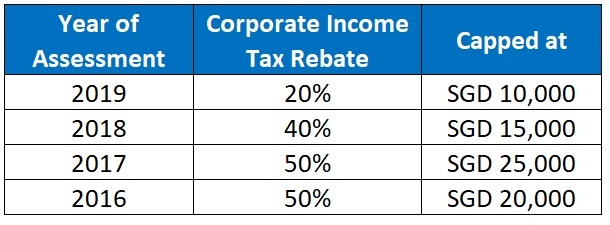

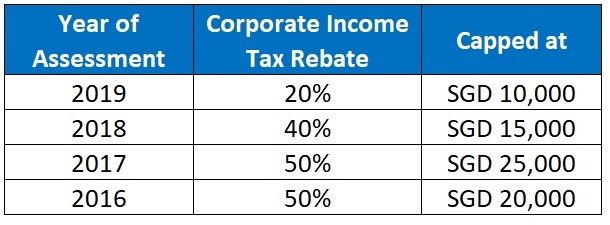

Web How to reduce income tax in Singapore This article provides the answer to this question by listing out the key tax saving schemes and instruments Singapore offers businesses Web 14 mars 2023 nbsp 0183 32 Singapore Corporate Income Tax Rebate CIT Rebate Foreign Sourced Income Exemption Scheme FSIE Although foreign sourced income for Singaporean companies is subject to Pioneer

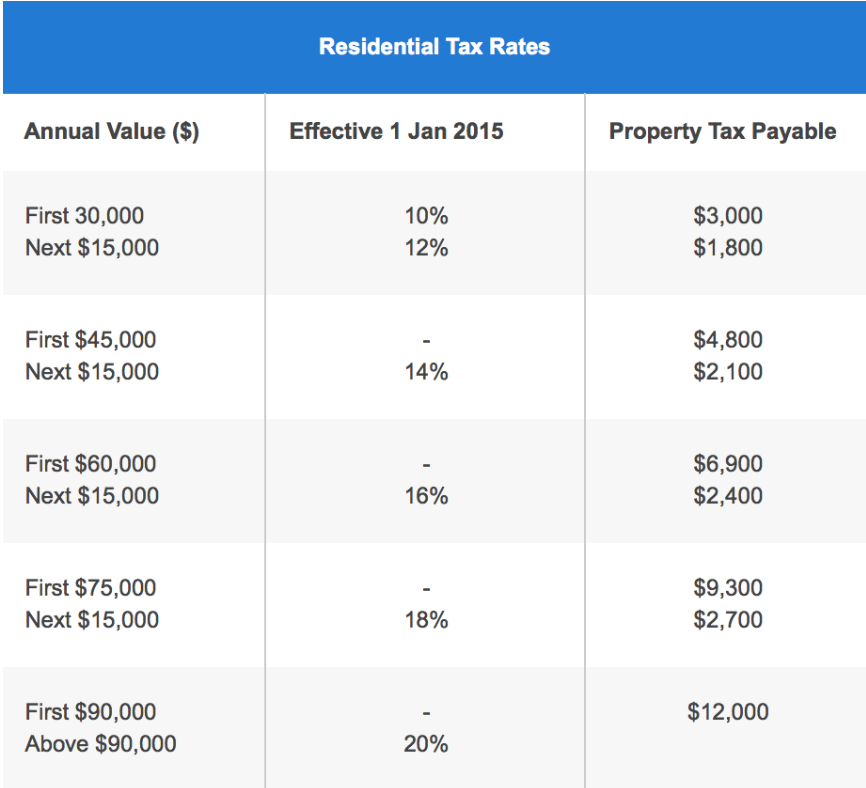

Web 6 sept 2023 nbsp 0183 32 The arrears rate for income tax Goods and Services Tax GST and property tax meanwhile fell to S 363 1 million or 0 59 per cent compared with 0 64 Web 15 mars 2020 nbsp 0183 32 All companies will receive a 25 CIT rebate for the Year of Assessment YA 2020 The rebate is capped at S 15 000 The CIT rebate is available to all

Download Income Tax Rebate Singapore

More picture related to Income Tax Rebate Singapore

Singapore Personal Tax Singapore Income Tax Rates Brapp

https://www.asiabriefing.com/site-mgmt/userfiles/resources/infographic/2015/05/Personal_Income_Tax_Singapore_for_2017.png

How Much Taxes To Pay In Singapore If You re An Expat

https://blogassets.singsaver.com.sg/wp-content/uploads/sites/2/2018/03/16085251/screenshot-www.iras_.gov_.sg-2018.03.07-14-37-13.png

Singapore Personal Income Tax Filing For YA 2015

http://www.singaporeincorporationservices.com/wp-content/uploads/2015/04/Table.jpg

Web 23 f 233 vr 2022 nbsp 0183 32 The corporate income tax rate would remain at 17 for year of assessment 2022 with no corporate income tax rebate proposed A minimum effective tax rate Web Singapore budget Budget 2021 Overview of Tax Changes Budget 2021 Overview of Tax Changes The following tax changes were announced by Deputy Prime Minister and

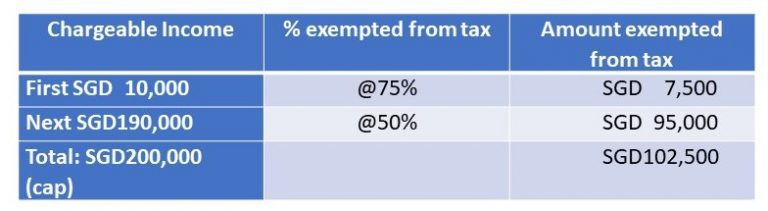

Web February 2 2022 What s in the article Corporate Income Tax Exemption Schemes Corporate Income Tax CIT Rebate for YAs 2013 to 2020 There s no denying that Web 28 f 233 vr 2023 nbsp 0183 32 Corporate Tax Relief Partial Tax Exemption PTE For All Companies In Singapore All companies in Singapore enjoy a Partial Tax Exemption PTE From

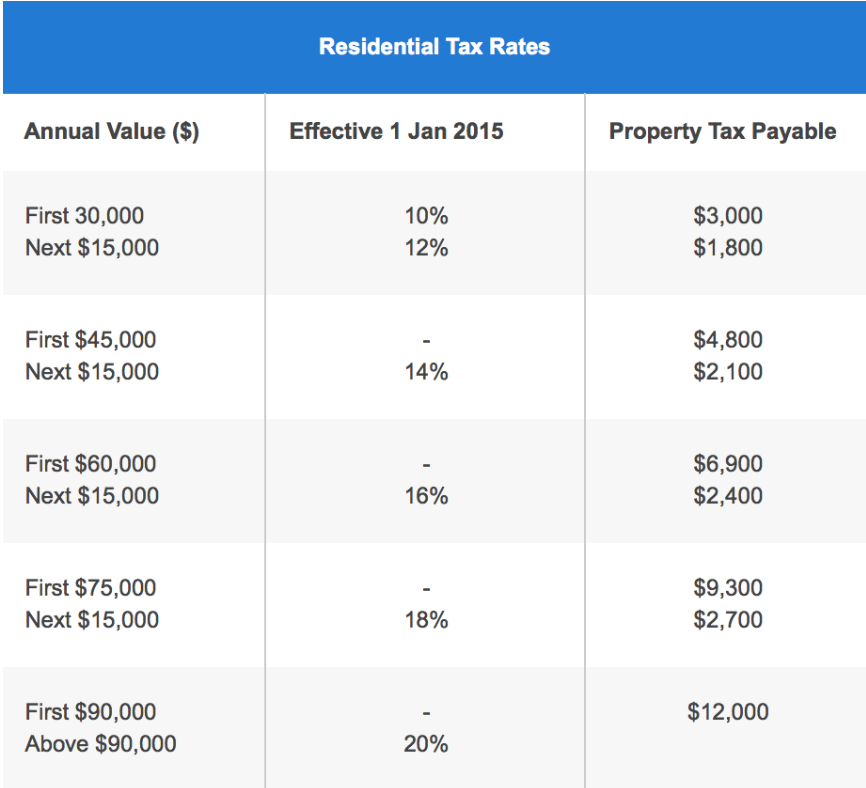

Property Tax For Homeowners In Singapore How Much To Pay Rebates

https://www.99.co/singapore/insider/wp-content/uploads/2016/04/Screen-Shot-2016-04-06-at-11.54.40.png

Overview Of Singapore Corporate Taxation System JSE Office

https://jseoffices.com/wp-content/uploads/2018/06/no-11-768x211.jpg

https://www.singsaver.com.sg/blog/income-ta…

Web 13 mars 2023 nbsp 0183 32 You will have to pay taxes if you re a Singapore citizen earning an annual income of S 20 000 or more and the filing deadline for individuals is 18 April annually The income tax is assessed based on

https://pwco.com.sg/guides/tax-relief-singapore

Web 24 janv 2020 nbsp 0183 32 An SGD5 000 tax rebate is granted for the first child and SGD10 000 is granted for the second child SGD20 000 is granted for

Income Tax Rates 2020 For Singapore Tax Residents Rikvin

Property Tax For Homeowners In Singapore How Much To Pay Rebates

A Guide To Singapore Personal Tax

Personal Income Tax 2017 Julianagwf

Ca Individual Tax Rate Table 2021 2020 Brokeasshome

Singapore Personal Income Tax Guide Tax Rebate And Reliefs 2022

Singapore Personal Income Tax Guide Tax Rebate And Reliefs 2022

Singapore Tax Rates

Singapore Budget 2019 GST Vouchers More CHAS Subsidies Income Tax

Personal Income Tax Rates For Singapore Tax Residents YA 2010 2019

Income Tax Rebate Singapore - Web Understanding the latest Singapore income tax reliefs 2022 Updated 3 Nov 2022 published 4 Dec 2020 While Singapore has one of the lowest personal income tax