Income Tax Rebate To Cancer Patient Web 17 juil 2019 nbsp 0183 32 Q Is cancer covered under section 80DDB of the Income Tax Act Yes section 80DDB of the income tax act specifically includes Malignant cancers and

Web 8 janv 2023 nbsp 0183 32 Under Section 80DDB of Income Tax Act taxpayers are eligible for tax deductions on expenses incurred for the treatment of a set of specified medical conditions or ailments This can be availed by both Web 14 d 233 c 2022 nbsp 0183 32 Cancer patients eligible for the federal income tax credit save thousands of dollars off their medical bills by filing jointly with their spouses Cancer patients who

Income Tax Rebate To Cancer Patient

Income Tax Rebate To Cancer Patient

https://www.thetaxadviser.com/content/tta-home/issues/2019/dec/charitable-deduction-rules-trusts-estates-lifetime-transfers/_jcr_content/contentSectionArticlePage/article/articleparsys/image.img.jpg/1574370826491.jpg

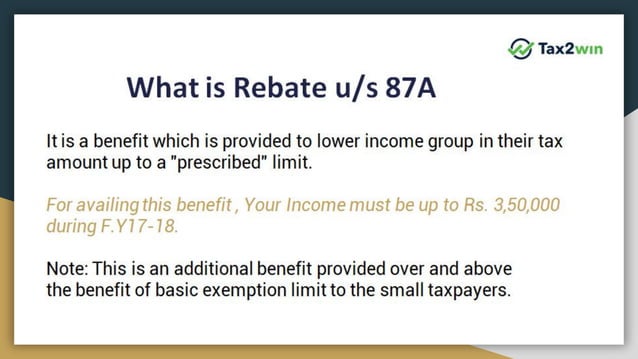

Income Tax Rebate Under Section 87A

https://image.slidesharecdn.com/incometaxrebateundersection87a2017-2018-180420103021/85/income-tax-rebate-under-section-87a-2-638.jpg?cb=1666685634

Difference Between Income Tax Exemption Vs Tax Deduction Vs Rebate

https://www.relakhs.com/wp-content/uploads/2019/03/Difference-between-Income-Tax-Exemption-Vs-Tax-Deduction-Income-Tax-Rebate-TDS-Tax-Relief-Tax-Benefit-pic.jpg

Web 13 juil 2023 nbsp 0183 32 You may qualify for government benefits if you have cancer or care for someone with cancer If you have a disability or your cancer is advanced you might Web 31 mars 2016 nbsp 0183 32 You can claim tax deductions on expenses on medical treatment of specified ailments such as cancer under Section 80DDB The maximum amount of

Web 24 ao 251 t 2020 nbsp 0183 32 If you are able to itemize your tax deductions your medical costs must exceed 7 5 of Adjusted Gross Income AGI and in 2019 the threshold goes back to 10 AGI In 2018 someone whose AGI is Web Income tax refund You may be able to get a tax refund if you give up work or if your income decreases It is also worth checking whether you are still paying the correct

Download Income Tax Rebate To Cancer Patient

More picture related to Income Tax Rebate To Cancer Patient

How To Celebrate With Rebate Planning For Incomes PRACTICAL TAX

https://www.practicaltaxplanning.com/ptp/wp-content/uploads/2022/06/7PY4cfZG8ZE.jpg

80DDB

https://www.paisabazaar.com/wp-content/uploads/2017/10/Section-80DDB-Form-Format.png

Income Tax Exemption For Cancer Patients CancerWalls

http://www.sankshema.org/images/12a.jpg

Web 1 ao 251 t 2020 nbsp 0183 32 Medical tax deductions can be greatly beneficial to those that struggle with the huge burden of cancer treatment But not everyone is eligible for such benefits As of Web These could include claiming benefits to help with your housing costs making changes to your mortgage claiming on an insurance policy Claiming benefits You may be able to get

Web Most cancer patients use the simplified method for claiming their travel expenses on their tax return With this method you calculate the total kilometres travelled by a km rate for Web 29 juin 2018 nbsp 0183 32 Deductions of expenses on medical treatment of specified ailments such as AIDS cancer and neurological diseases can be claimed under Section 80DDB The

What To Know About Montana s New Income And Property Tax Rebates

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/AA18ZJcd.img?w=1280&h=720&m=4&q=50

Georgia Income Tax Rebate 2023 Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/03/Georgia-Tax-Rebate-2023-768x683.png

https://tax2win.in/guide/section-80ddb

Web 17 juil 2019 nbsp 0183 32 Q Is cancer covered under section 80DDB of the Income Tax Act Yes section 80DDB of the income tax act specifically includes Malignant cancers and

https://www.bqprime.com/personal-finance/pf…

Web 8 janv 2023 nbsp 0183 32 Under Section 80DDB of Income Tax Act taxpayers are eligible for tax deductions on expenses incurred for the treatment of a set of specified medical conditions or ailments This can be availed by both

Income Tax Rebate Is A Bait Video Dailymotion

What To Know About Montana s New Income And Property Tax Rebates

Retirement Income Tax Rebate Calculator Greater Good SA

Individual Income Tax Rebate

Income Tax Rebate U s 87A For A Y 2017 18 F Y 2016 17

Revised Tax Rebate Under Section 87A FY 2019 2020 Explained

Revised Tax Rebate Under Section 87A FY 2019 2020 Explained

REMINDER Illinois Tax Rebate Program Filing Due Date Is October 17

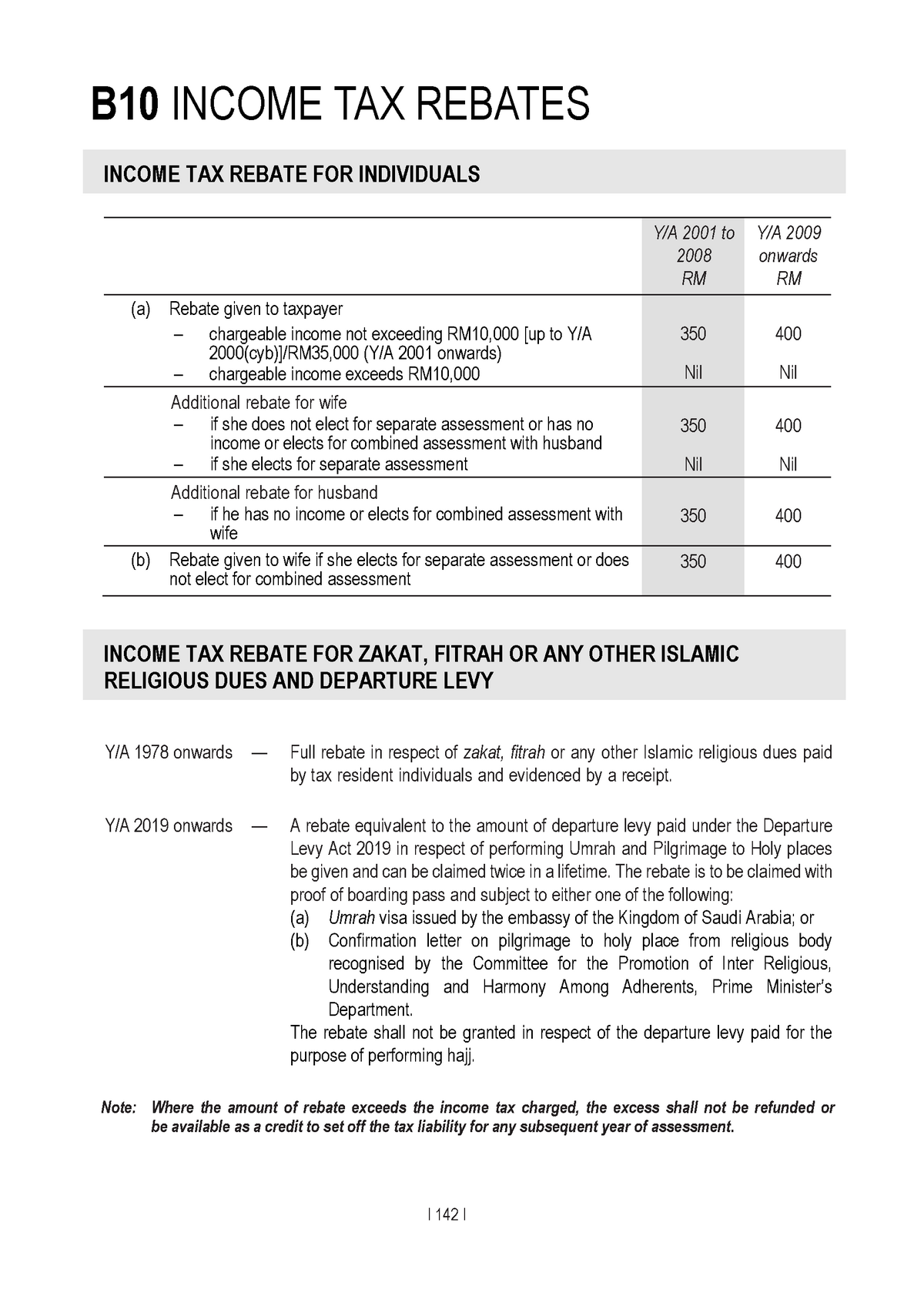

Additional Reading Income Tax Rebates Taxation Studocu

Automated Income Tax Software All In One For Govt Non Govt Employees

Income Tax Rebate To Cancer Patient - Web 23 janv 2021 nbsp 0183 32 The permissible Standard Deduction for the US citizens is 12 000 for those who are filing using Single status and is 24 000 for those citizens who are married