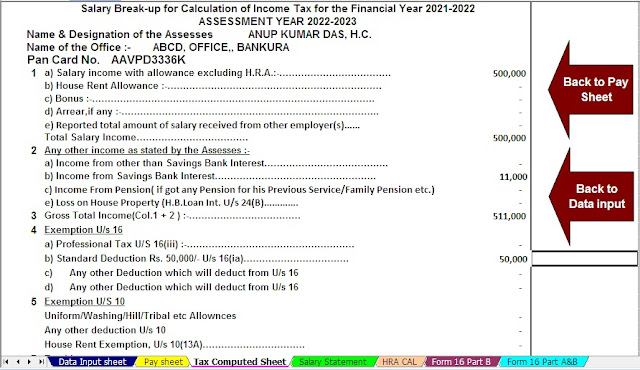

Income Tax Rebate U S 80d Web 4 ao 251 t 2020 nbsp 0183 32 Section 80D provides that the single premium paid should be divided over the years for which the benefit of health insurance is available While filing the Income Tax

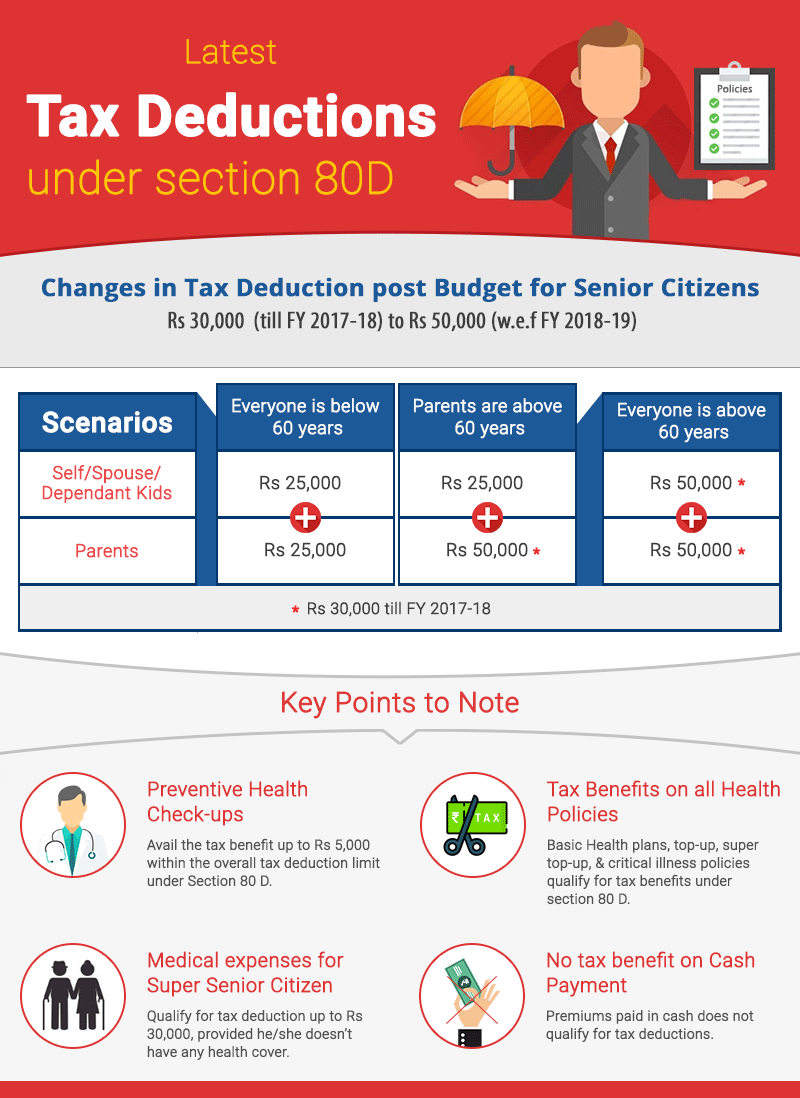

Web Income Tax Department gt Tax Tools gt Deduction under section 80D As amended upto Finance Act 2023 Deduction Under Section 80D Assessment Year Status Assessee Web 15 f 233 vr 2023 nbsp 0183 32 Section 80D of the Income tax Act 1961 allows an individual to claim deduction from gross taxable income The deduction can be claimed if an individual

Income Tax Rebate U S 80d

Income Tax Rebate U S 80d

https://www.fincash.com/b/wp-content/uploads/2017/01/80c-deductions.png

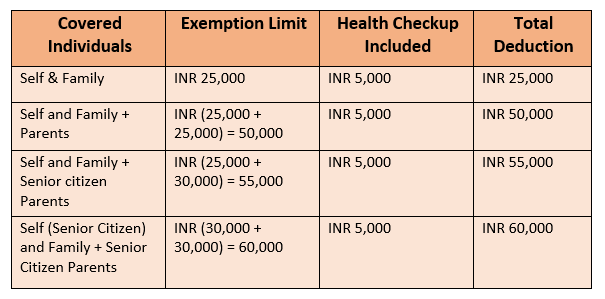

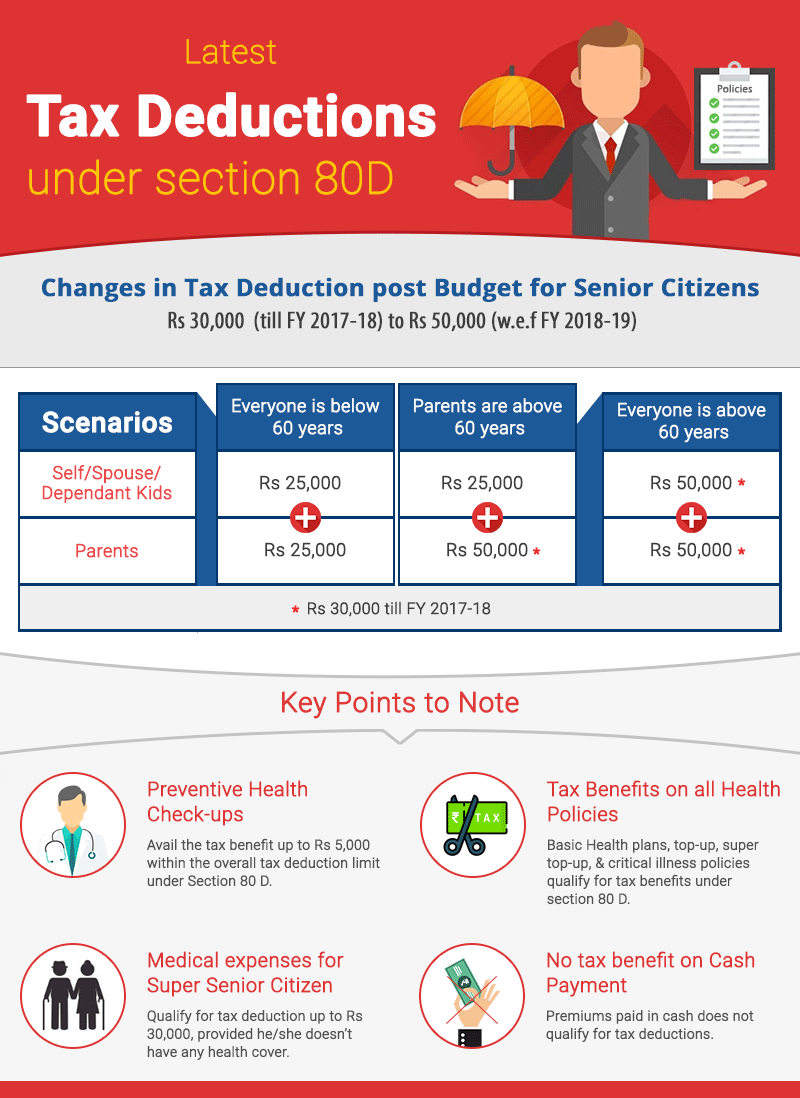

Health Insurance Tax Benefits Under Section 80D

https://www.policybazaar.com/images/IncomeTax/section-80d-income-tax-act.jpg

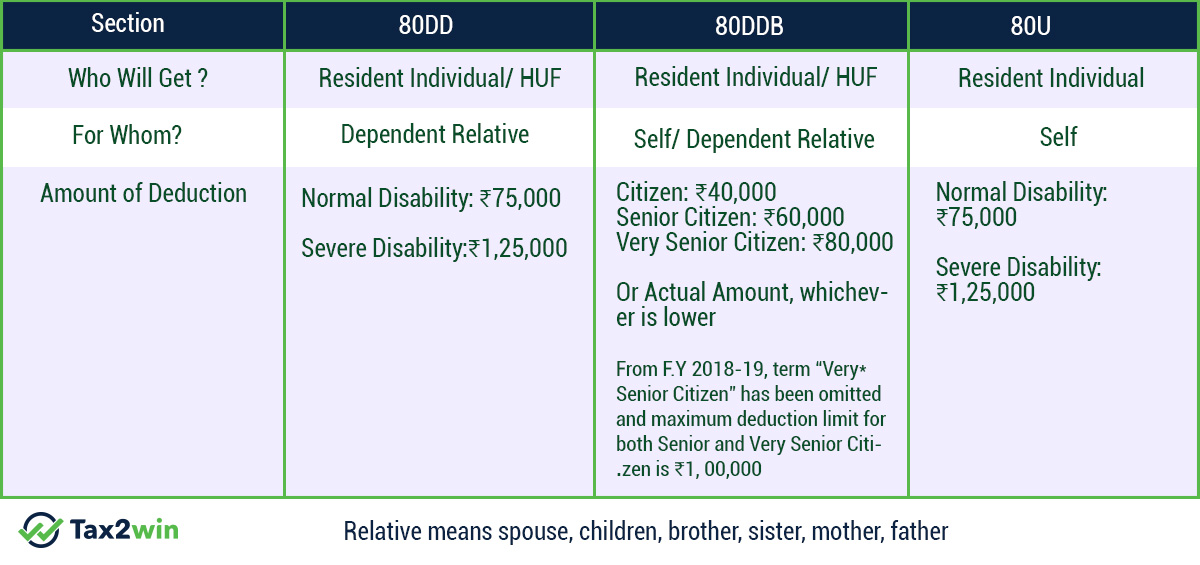

Section 80 Deduction Deduction U s 80DD 80DDB 80U Tax2win Blog

https://blog.tax2win.in/wp-content/uploads/2018/07/80DD-80DDB-80U.jpg

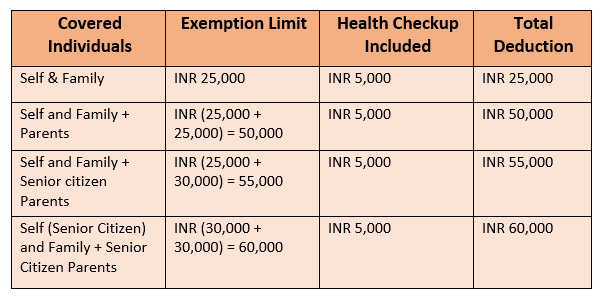

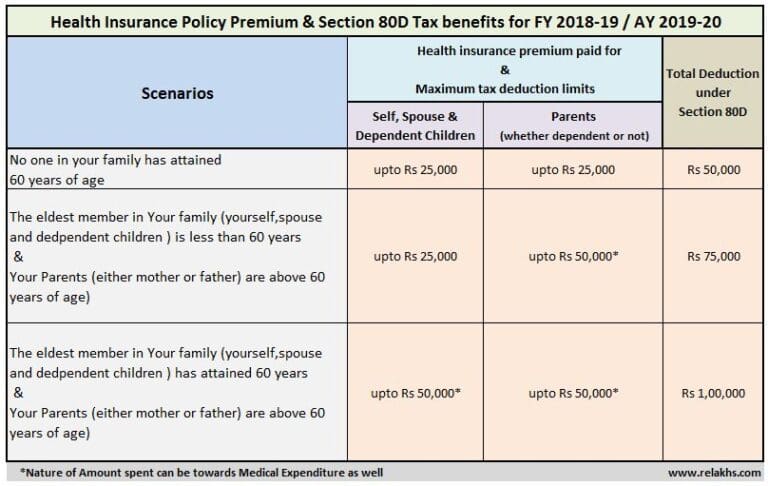

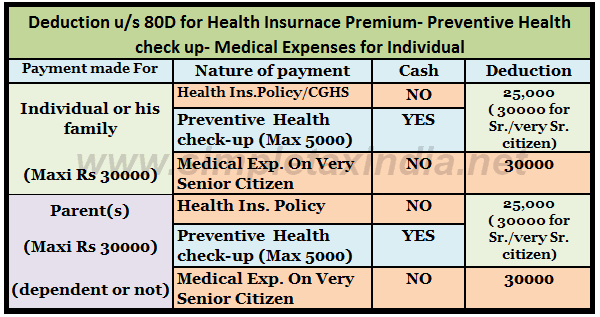

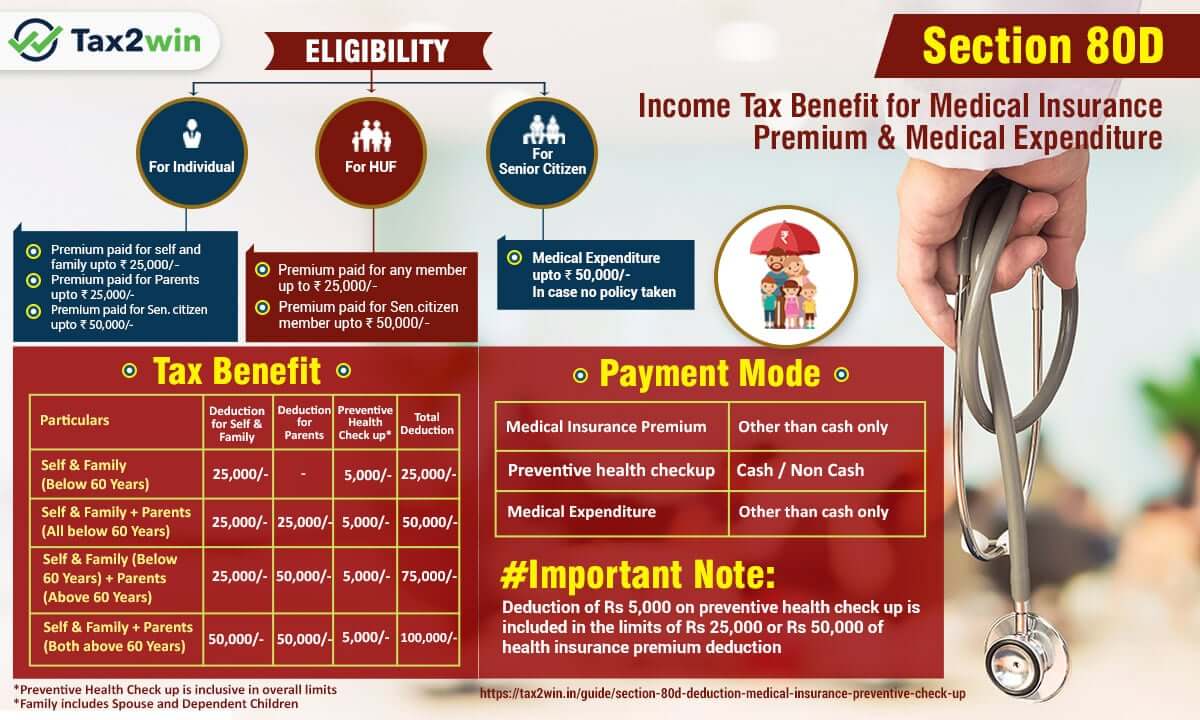

Web 12 sept 2023 nbsp 0183 32 A taxpayer can claim the deductions u s 80D The health insurance premium paid for the following members in a family are eligible for deductions Self Spouse Web 9 mars 2022 nbsp 0183 32 For individuals under 60 years of age the maximum limit of tax deduction is 40 000 whereas for senior citizens the maximum limit of tax deductions is 1 00 000

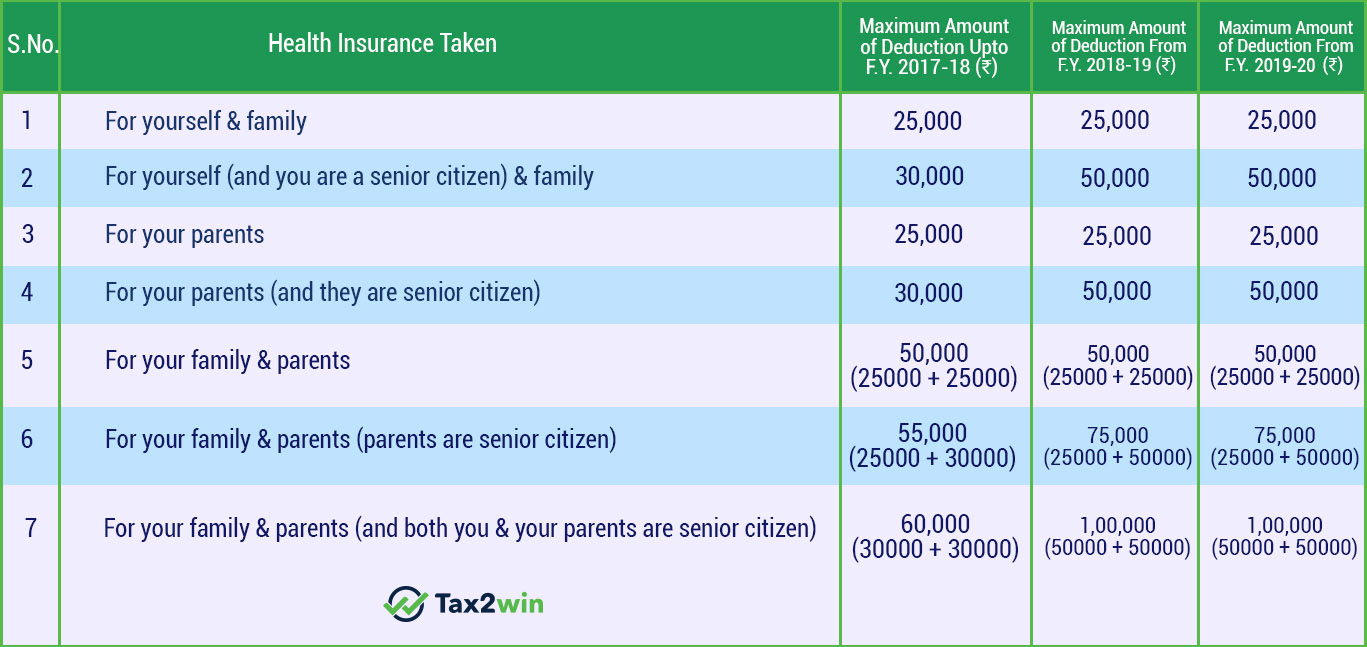

Web If you invest in health insurance you can get deduction up to 25 000 under Section 80D for yourself and your family 50 000 if age of insured is 60 years or above and up to Web 2 d 233 c 2022 nbsp 0183 32 Section 80D of the Indian Income Tax Act 1961 enables income tax rebate for senior citizens on the medical expenses that they may have incurred Even adults can

Download Income Tax Rebate U S 80d

More picture related to Income Tax Rebate U S 80d

Health Insurance Tax Benefits u s 80D For FY 2018 19 AY 2019 20

https://www.relakhs.com/wp-content/uploads/2018/02/Medical-Insurance-Premium-Tax-Benefits-Section-80D-Health-insurance-premium-Income-Tax-Deductions-FY-2018-19-AY-2019-20-Medical-treatment-expenditure-bills-768x486.jpg

Anything To Everything Income Tax Guide For Individuals Including

http://www.relakhs.com/wp-content/uploads/2016/03/Section-80D-Health-insurance-premium-Income-Tax-Deductions-FY-2016-17-pic.jpg

Income Tax Act 80D Deduction For Medical Expenditure INVESTIFY IN

https://www.investify.in/wp-content/uploads/2020/08/Income-Tax-Act-80D-1.jpg

Web 8 juil 2020 nbsp 0183 32 The amount of deduction on health insurance premium paid ranges from 25 000 to a maximum of 1 00 000 deduction eligible if Self Senior Citizen and family Web Democratic sponsors of the legislation said it s also aimed at wealthy individuals cheating their taxes with 46 billion of the 80 billion earmarked for audits

Web Which EVs are eligible for the full 7 500 tax credit The Inflation Reduction Act broke the credit into two halves You can claim 3 750 if at least half of the value of your vehicle s Web 3 ao 251 t 2023 nbsp 0183 32 If you have medical insurance and want to maximize your tax savings through deductions under section 80D Filing your Income Tax Return with us is easy and

How To Claim Health Insurance Under Section 80D From 2018 19

https://myinvestmentideas.com/wp-content/uploads/2018/04/80C-Deductions-list-min.jpg

Section 80d Preventive Health Check Up Tax Deduction The Gray Tower

https://4.bp.blogspot.com/-2BihF6FG36E/WIbyy4F5x1I/AAAAAAAAPlM/kPJoPX-nK148RZ2z3EoRedH3Vrs1_6p5ACLcB/s1600/DEDUCTION%2BSECTION%2B%2B80D%2BHEALTH%2BINSURANCE%2BPREVENTIVE%2BHEALTH%2BCHECK%2BUP%2BMEDICAL%2BEXP..png

https://www.financialexpress.com/money/income-tax/tax-benefits-u-s-80d...

Web 4 ao 251 t 2020 nbsp 0183 32 Section 80D provides that the single premium paid should be divided over the years for which the benefit of health insurance is available While filing the Income Tax

https://incometaxindia.gov.in/Pages/tools/deduction-under-section-80d.aspx

Web Income Tax Department gt Tax Tools gt Deduction under section 80D As amended upto Finance Act 2023 Deduction Under Section 80D Assessment Year Status Assessee

INCOME TAX REBATE U S 80 D incometax itr 80d finance shorts

How To Claim Health Insurance Under Section 80D From 2018 19

Section 80D Income Tax Deduction For Medical Insurance Preventive

Section 80D Income Tax Deduction For Medical Insurance Preventive

Deduction For Medical Insurance Premium U S 80D With Income Tax

New Tax Benefits Under Section 80D ComparePolicy

New Tax Benefits Under Section 80D ComparePolicy

Section 80d Of Income Tax Act Ay 2020 21 Worthen Althiche

80D Tax Deduction Under Section 80D On Medical Insurance

Section 80d Preventive Health Check Up Tax Deduction The Gray Tower

Income Tax Rebate U S 80d - Web 20 sept 2019 nbsp 0183 32 1 Amount paid towards medical insurance premium or amount paid for preventive health check up of the assessee or his family here family means spouse and