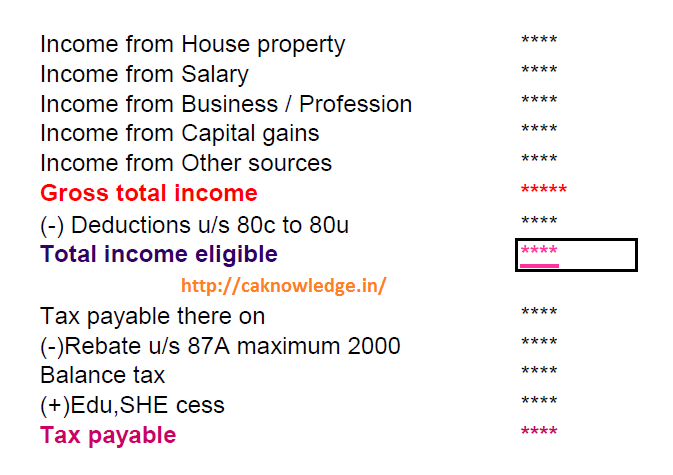

Income Tax Rebate U S 87a For Ay2017 18 Web 26 janv 2017 nbsp 0183 32 The Union Budget 2017 18 was presented on 1st February 2017 With a reduction of tax rate to 5 in place of existing 10 the Government has reduced the rebate u s 87A to Rs 2500 for

Web 3 f 233 vr 2022 nbsp 0183 32 Rebate u s 87A A resident Individual whose Taxable Income does not exceed Rs 3 50 000 after deductions is eligible for rebate of 100 of Income tax or Web 17 juil 2018 nbsp 0183 32 One more question which comes to mind is amount of Rebate Available under section 87A i e is it Rs 2000 or Rs 5000 or Rs

Income Tax Rebate U S 87a For Ay2017 18

Income Tax Rebate U S 87a For Ay2017 18

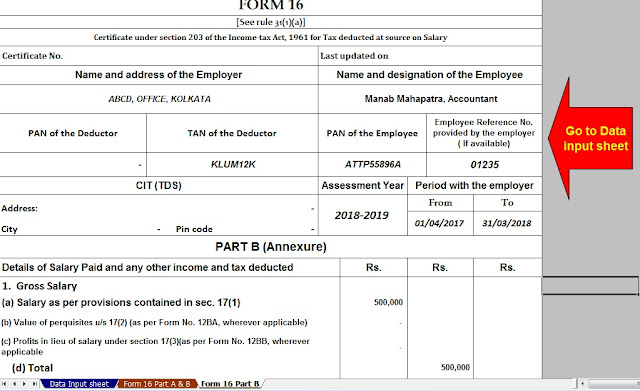

https://1.bp.blogspot.com/-tC64BIUhKp8/Whrfb7j8QoI/AAAAAAAAF5s/o4IhOBNXA9opvrbrGqin_xE-Q_nGHK9wACLcBGAs/s640/Form%2B16%2BPart%2BB.jpg

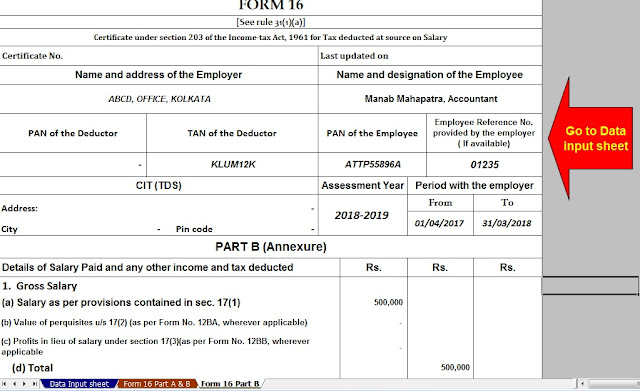

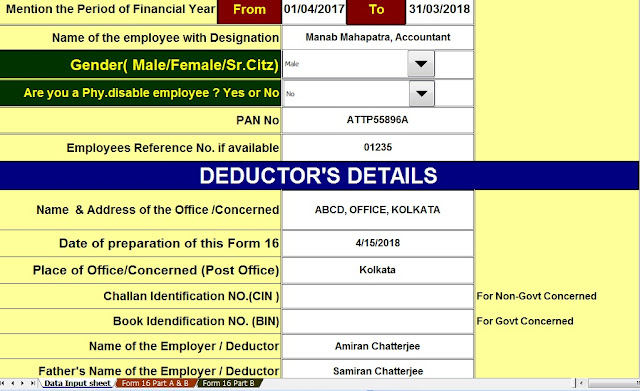

Rebate U S 87A For FY 2017 18 AY 2018 19 All You Need To Know With

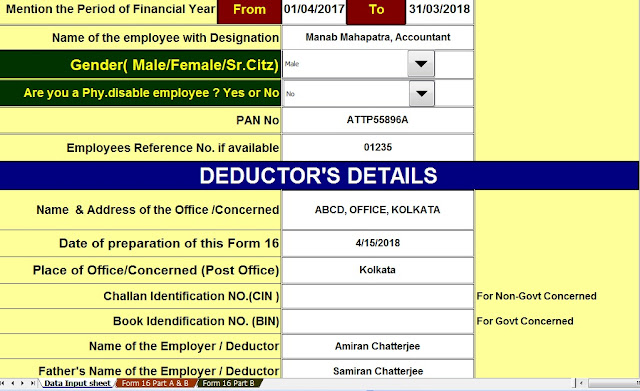

https://3.bp.blogspot.com/-naU0LtBHqSk/WhrfJ053CUI/AAAAAAAAF5k/ccFv6o7m8jE-ljtYFcq6HqIQ46KgQ9y-gCLcBGAs/s640/One%2Bby%2BOne%2BForm%2B16%2BPage%2B1.jpg

Rebate U S 87A For FY 2017 18 AY 2018 19 All You Need To Know With

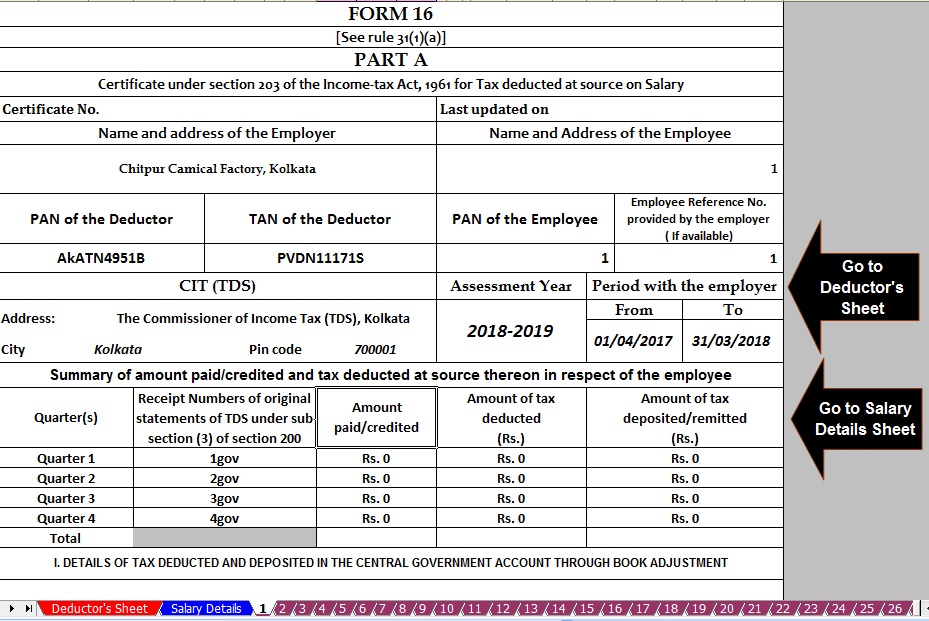

https://3.bp.blogspot.com/-4ZbVXkADr6g/WhrfWzJfxpI/AAAAAAAAF5o/S5m-5Ew-xTwrLlSQqmmByiMGUXld-nSOwCLcBGAs/s1600/Form%2B16%2BPart%2BA%2526B%2BPage%2B3.jpg

Web 27 lignes nbsp 0183 32 Rebate u s 87A for AY 2018 19 FY 2017 18 as per Budget 2017 With reduction in tax rate of 5 for the income group in Rs 2 50 lakhs to rs 3 00 lakhs Web 15 nov 2017 nbsp 0183 32 Surcharge 15 of tax where total income exceeds Rs 1 crore Education cess 3 of tax plus surcharge Note A resident individual is entitled for rebate u s 87A

Web 3 f 233 vr 2023 nbsp 0183 32 Section 87A of the Income tax Act 1961 allows an individual to claim tax rebate provided their taxable income does not increase the specified level This tax Web 3 ao 251 t 2023 nbsp 0183 32 The rebate amount under Section 87A allows a tax rebate of up to Rs 12 500 for individuals with taxable income up to Rs 5 00 000 FY 2022 23 Under Budget

Download Income Tax Rebate U S 87a For Ay2017 18

More picture related to Income Tax Rebate U S 87a For Ay2017 18

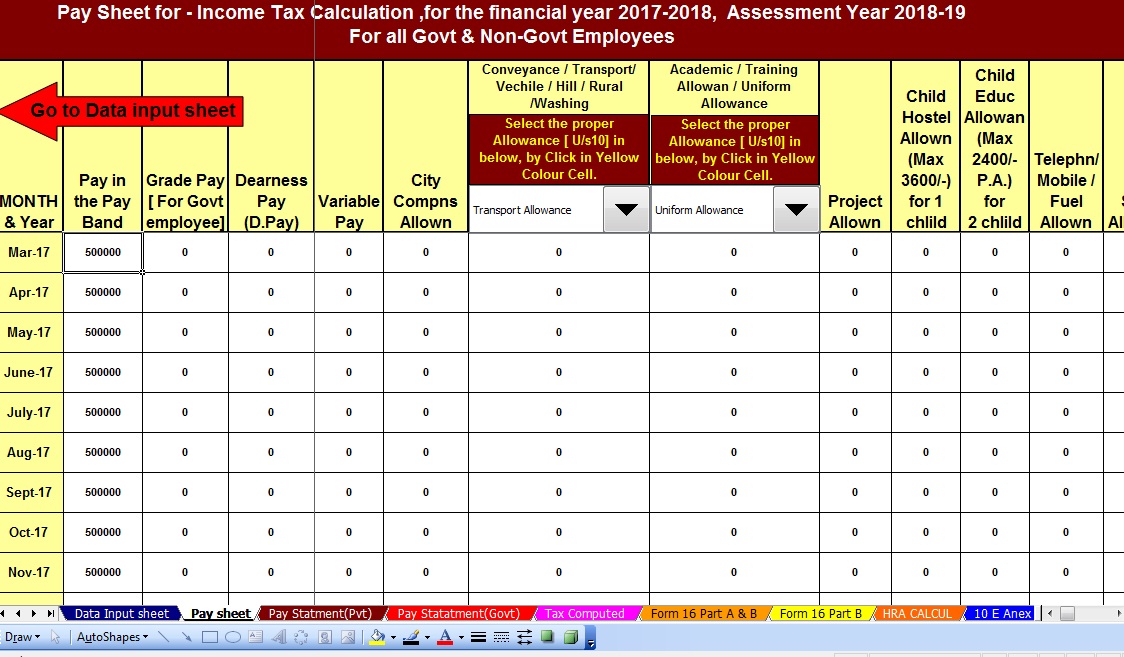

Rebate U s 87A Of The Income Tax As Per Budget 2017 Plus Automated TDS

https://4.bp.blogspot.com/-t1m3eDQUAcE/WQbgmdUorJI/AAAAAAAAEhs/5azXe2bZDHYxffMXRPiXtXZ0v88DBNTXgCLcB/s1600/Govt%2BNon%2BGovt%2BPage%2B2.jpg

Union Budget 2017 18 Proposed Tax Slabs For FY 2017 18 Taxing Tax

http://taxingtax.com/wp-content/uploads/2017/02/Capture6.png

Revised Tax Rebate Under Sec 87A After Budget 2019 BasuNivesh

https://www.basunivesh.com/wp-content/uploads/2019/02/Revised-Tax-Rebate-under-Sec.87A-after-Budget-2019.jpg

Web 29 f 233 vr 2016 nbsp 0183 32 The section provides for a income tax rebate up to Rs 2000 for assessees having Taxable Income not exceeding Rs 5 lakhs In his direct tax proposals the Web If you are earning below Rs 5 lakh you can save an additional Rs 3 000 in taxes Tax rebate under Section 87A has been raised from Rs 2 000 to Rs 5 000 for FY 2016 17 AY 2017 18 In case if your tax liability is less

Web INR 12 500 By applying the amount of tax rebate your tax liability would become zero Things to remember when claiming a tax rebate under 87A The available tax rebate Web You can claim the 87A rebate on your gross tax liability before cess and arrive at the net tax liability In case your total income is below 5 lakhs the maximum rebate under

Income Tax Rebate U s 87A For The Financial Year 2022 23

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhjaMWWuh9Yw1oHqfkfrIaYbLGaB376RebKDTPXR4-jMTYYQRhPBXomiwY9EVzEmXIgQ2oXuDWoror_llXVa0a4CVcBPyG3JecnKbrFpU1YAcL3BqdldNxiSh81eUspfAXJiNGbHbVcluzwXjoIUmqkZimUhTYHrQKq1Zu6xuaat2LRf6h-UCOGnP3s/w640-h596/87a.jpg

Tax Rebate Under Section 87A Claim Income Tax Rebate For FY 2018 19

https://assets1.cleartax-cdn.com/s/img/2019/02/01163903/Budget-2019-middle-class-1024x536.png

https://abcaus.in/income-tax/rebate-under-se…

Web 26 janv 2017 nbsp 0183 32 The Union Budget 2017 18 was presented on 1st February 2017 With a reduction of tax rate to 5 in place of existing 10 the Government has reduced the rebate u s 87A to Rs 2500 for

https://help.myitreturn.com/hc/en-us/articles/115001863031-Income-tax...

Web 3 f 233 vr 2022 nbsp 0183 32 Rebate u s 87A A resident Individual whose Taxable Income does not exceed Rs 3 50 000 after deductions is eligible for rebate of 100 of Income tax or

Section 87A Tax Rebate Under Section 87A Rebates Financial

Income Tax Rebate U s 87A For The Financial Year 2022 23

Rebate Of Income Tax Under Section 87A YouTube

What Is Rebate Under Section 87A For AY 2020 21 Financial Control

Is Rebate U s 87A Available For Financial Year 2016 17

How To Check Whether You Are Eligible For The Tax Rebate On Rs 5 Lakhs

How To Check Whether You Are Eligible For The Tax Rebate On Rs 5 Lakhs

Income Tax Slab Rates FY 2017 2018 For All Category AY 2018 2019

Rebate U s 87A For F Y 2019 20 And A Y 2020 21 ArthikDisha

Rebate U s 87A A Y 2019 20 Section 87A Of Income Tax How To Claim

Income Tax Rebate U S 87a For Ay2017 18 - Web 6 f 233 vr 2023 nbsp 0183 32 The income tax rebate will be up to Rs 12 500 on the total tax liability before adding the health and education cess of 4 New Tax Regime With effect from the FY