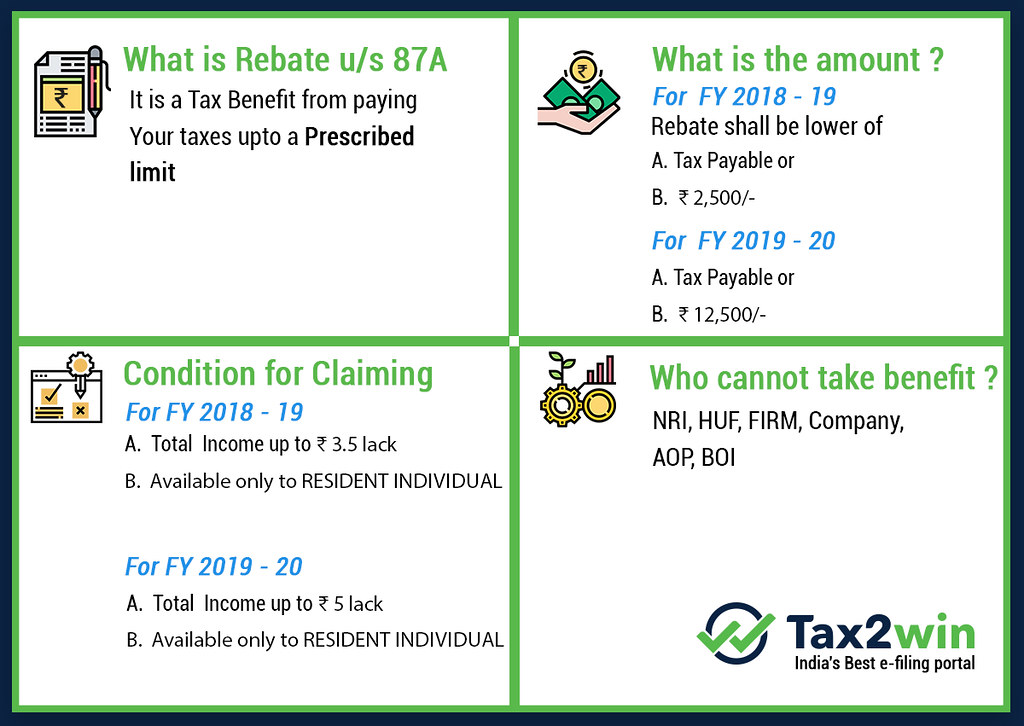

Income Tax Rebate U S 87a Web 3 f 233 vr 2023 nbsp 0183 32 87a Rebate To make the new tax regime more attractive the rebate under Section 87A has been hiked to Rs 25 000 for taxable income up to Rs 7 lakh Thus an

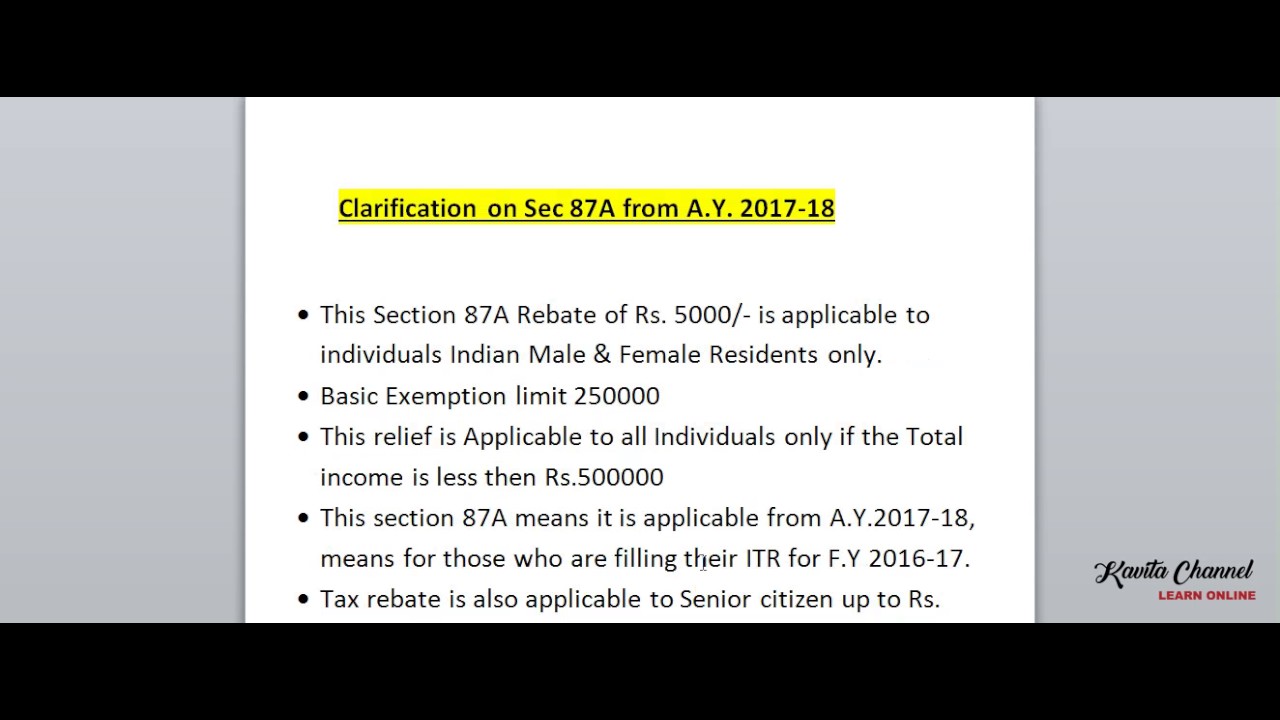

Web 14 sept 2019 nbsp 0183 32 The rebate amount under Section 87A allows a tax rebate of up to Rs 12 500 for individuals with taxable income up to Rs 5 00 000 FY 2022 23 Under Web 1 ITR 1 SAHAJ Applicable for Individual This return is applicable for a Resident other than Not Ordinarily Resident Individual having Total Income from any of the following

Income Tax Rebate U S 87a

Income Tax Rebate U S 87a

https://www.basunivesh.com/wp-content/uploads/2019/02/Revised-Tax-Rebate-under-Sec.87A-after-Budget-2019.jpg

Rebate U s 87A For F Y 2019 20 And A Y 2020 21 ArthikDisha

https://i2.wp.com/arthikdisha.com/wp-content/uploads/2019/02/pdfresizer.com-pdf-crop-page-001.jpg?resize=720%2C400&ssl=1

Revised Tax Rebate Under Section 87A FY 2019 2020 Explained

https://freefincal.com/wp-content/uploads/2019/02/Screen-Shot-2019-02-02-at-8.49.53-AM.png

Web 2 f 233 vr 2023 nbsp 0183 32 Arrive at your net taxable income after claiming the tax deductions If your net taxable income is up to INR 5 00 000 then you are eligible to claim a rebate under Web 6 f 233 vr 2023 nbsp 0183 32 Updated on 6 Feb 2023 The tax rebate u s 87A allows a taxpayer to reduce his her tax liability marginally depending on the net total income In this article we will cover the eligibility steps to claim

Web 28 d 233 c 2019 nbsp 0183 32 As we all are aware that there is an amendment under section 87A i e Rebate of Income Tax which is meant for Assessee being an individual resident in India Web 25 janv 2022 nbsp 0183 32 Taxpayers with income up to Rs 5 lakh can claim a tax rebate of up to Rs 12 500 for AY 2021 22 or as 87A rebate for FY 2020 21 This means that if your annual

Download Income Tax Rebate U S 87a

More picture related to Income Tax Rebate U S 87a

Income Tax Rebate U s 87A For The Financial Year 2022 23

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEhjaMWWuh9Yw1oHqfkfrIaYbLGaB376RebKDTPXR4-jMTYYQRhPBXomiwY9EVzEmXIgQ2oXuDWoror_llXVa0a4CVcBPyG3JecnKbrFpU1YAcL3BqdldNxiSh81eUspfAXJiNGbHbVcluzwXjoIUmqkZimUhTYHrQKq1Zu6xuaat2LRf6h-UCOGnP3s/w640-h596/87a.jpg

Rebate us 87A infographic Income Tax Rebate Under Section Flickr

https://live.staticflickr.com/7850/32304200437_b8b18b3f1c_b.jpg

Rebate U s 87A For F Y 2018 2019 Taxable Income Not Exceed 3 5

https://i.ytimg.com/vi/OS6nlwtzz-A/maxresdefault.jpg

Web 10 mars 2020 nbsp 0183 32 Rebate u s Section 87A of the Income Tax Act was introduced in the year 2013 with the objective of reducing the tax liability of the assessees whose income is Web 9 d 233 c 2022 nbsp 0183 32 As per the Income Tax Act 1961 if you have gross taxable income below 5 lakhs per year you can claim a tax rebate u s 87A We can also easily claim an income tax rebate of around 12 500 via tax

Web The available tax rebate under Section 87A of the Income Tax Act 1961 offers the benefit of nil taxation if you have a limited income However before claiming the rebate here Web 12 avr 2022 nbsp 0183 32 Rebate u s 87A refers to the relief from paying taxes for certain individuals Till FY 2018 19 the resident individuals with a total taxable income of less than equal to

Rebate U s 87A A Y 2019 20 Section 87A Of Income Tax How To Claim

https://i.ytimg.com/vi/KqZNdnxM0Bo/maxresdefault.jpg

Income Tax Rebate U s 87 A Increased By 500 From FY 2019 20

https://financialcontrol.in/wp-content/uploads/2018/06/Rebate-87A.jpg

https://economictimes.indiatimes.com/wealth/tax/who-is-eligible-for...

Web 3 f 233 vr 2023 nbsp 0183 32 87a Rebate To make the new tax regime more attractive the rebate under Section 87A has been hiked to Rs 25 000 for taxable income up to Rs 7 lakh Thus an

https://tax2win.in/guide/section-87a

Web 14 sept 2019 nbsp 0183 32 The rebate amount under Section 87A allows a tax rebate of up to Rs 12 500 for individuals with taxable income up to Rs 5 00 000 FY 2022 23 Under

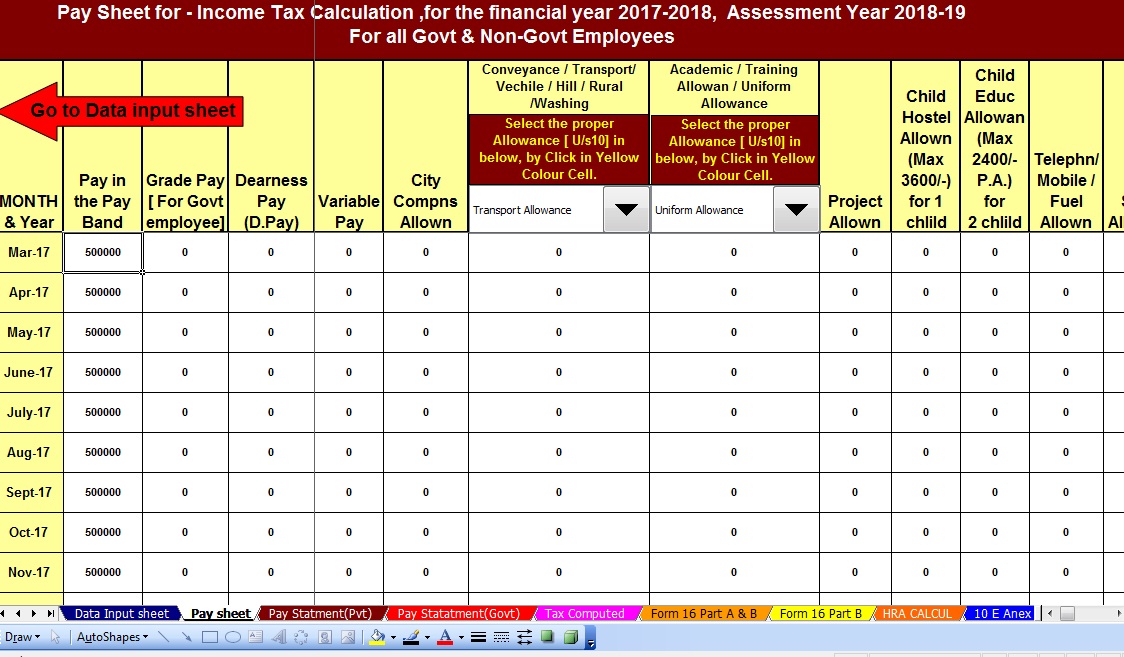

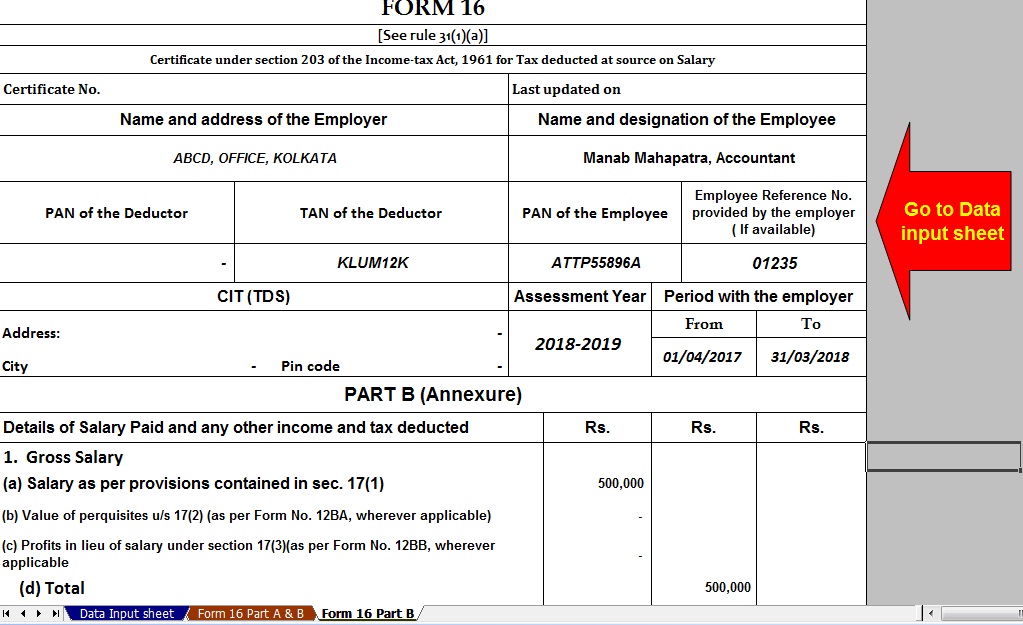

Rebate U s 87A Of The Income Tax As Per Budget 2017 Plus Automated TDS

Rebate U s 87A A Y 2019 20 Section 87A Of Income Tax How To Claim

How To Check Whether You Are Eligible For The Tax Rebate On Rs 5 Lakhs

Rebate Of Income Tax Under Section 87A YouTube

Raised The Income Tax Rebate U s 87A For F Y 2019 20 With Automated

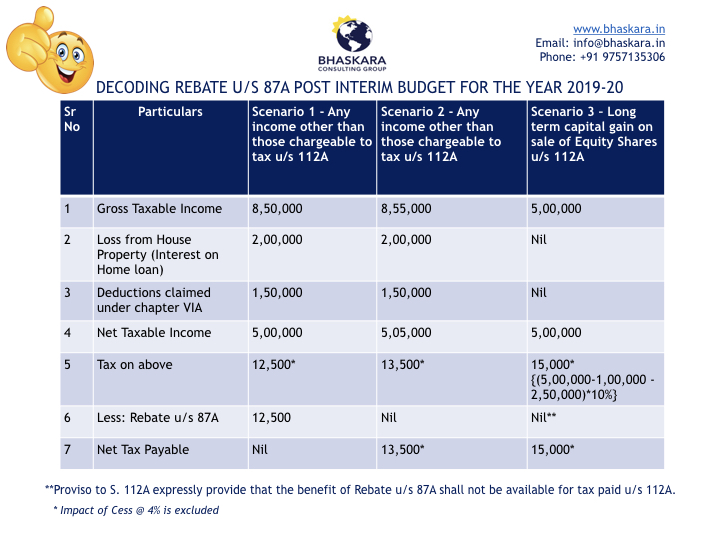

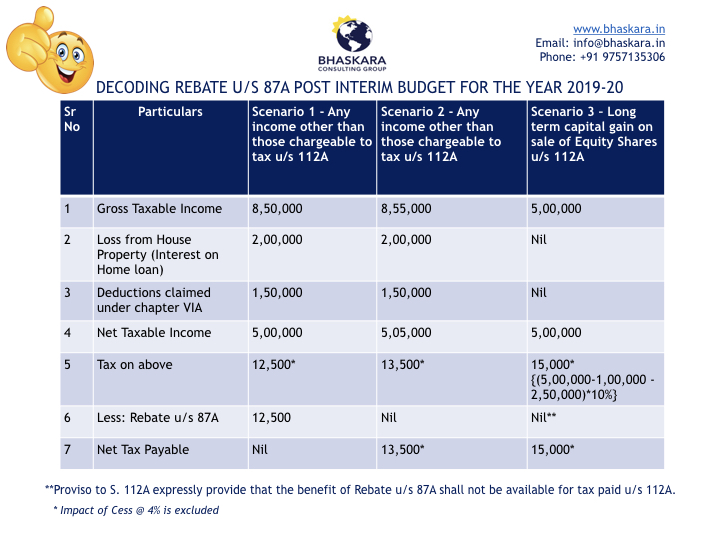

Decoding Rebate U s 87A Post Interim Budget For The F Y 2019 20

Decoding Rebate U s 87A Post Interim Budget For The F Y 2019 20

What Is Rebate Under Section 87A For AY 2020 21 Financial Control

Rebate U s 87A For F Y 2019 20 And A Y 2020 21 ArthikDisha

Rebate U s 87A Of The Income Tax As Per Budget 2017 Plus Automated TDS

Income Tax Rebate U S 87a - Web 25 janv 2022 nbsp 0183 32 Taxpayers with income up to Rs 5 lakh can claim a tax rebate of up to Rs 12 500 for AY 2021 22 or as 87A rebate for FY 2020 21 This means that if your annual