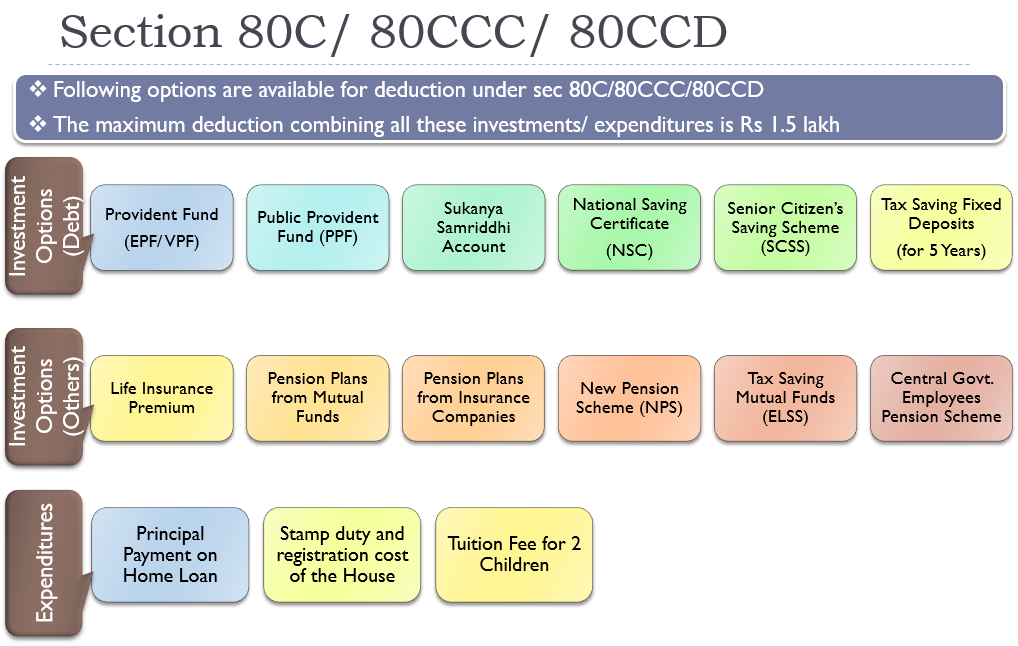

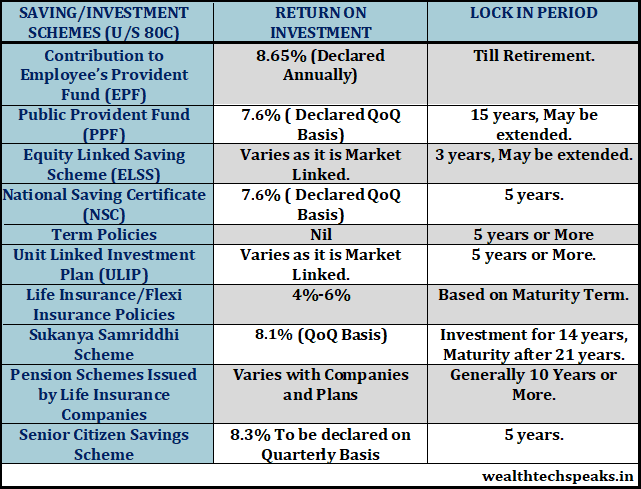

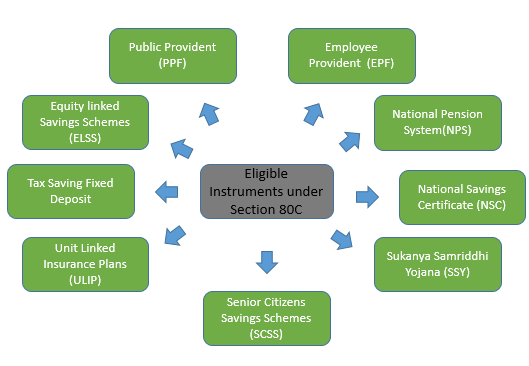

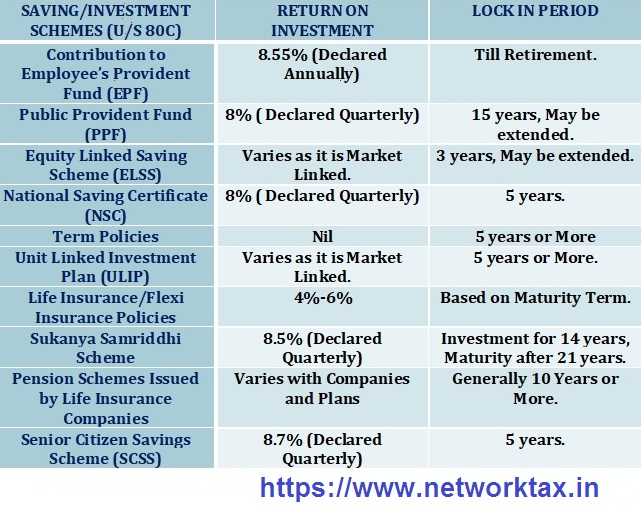

Income Tax Rebate Under 80c Web 28 mars 2019 nbsp 0183 32 Section 80C This section provides a deduction of up to Rs 1 5 lakh for investments in specified instruments such as EPF PPF NSC ELSS tax saving fixed

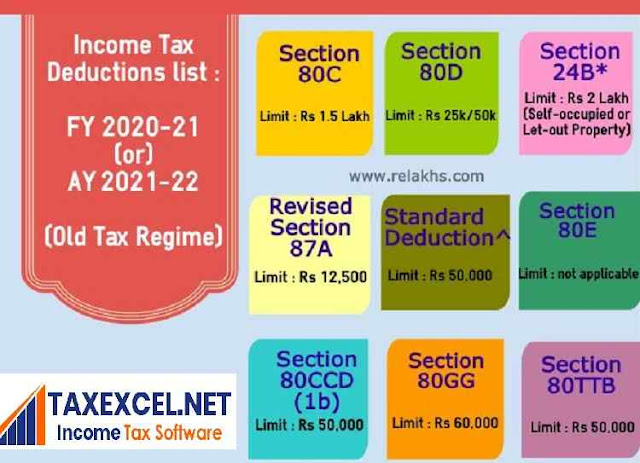

Web 11 sept 2023 nbsp 0183 32 Section 80C of the Income Tax Act allows for certain expenditures and investments to be exempt from income tax If you plan your investments across different Web 11 janv 2023 nbsp 0183 32 How to maximise tax rebate under Section 80C Deductions allowed on home loan interest Deductions under Section 24 Terms and conditions for home buyers to avail of benefits under Section 24 Deduction under Section 24 is also available to buyers who do not use home loan How to maximise tax rebate under Section 24 Deductions

Income Tax Rebate Under 80c

Income Tax Rebate Under 80c

https://www.relakhs.com/wp-content/uploads/2018/03/Income-Tax-Deductions-List-FY-2018-19-Income-tax-exemptions-tax-benefits-Fy-2018-19-AY-2019-20-Section-80c-limit-80D-80E-NPS-Home-loan-interest-loss-standard-deduction.jpg

80C TO 80U DEDUCTIONS LIST PDF

https://wealthtechspeaks.in/wp-content/uploads/2017/04/Tax-Deduction-Under-Section-80C.png

Complete Guide On Income Tax Deduction U s 80C 80CCD 80CCC 80CCG

https://financialcontrol.in/wp-content/uploads/2018/08/Deduction-under-section-80C.jpg

Web 13 juin 2019 nbsp 0183 32 Section 80C Income Tax Deduction under Section 80C Updated on 03 Aug 2023 01 19 PM Section 80C is the most popular income tax deduction for tax Web 3 lignes nbsp 0183 32 6 sept 2023 nbsp 0183 32 Rebate under section 80C is only available for HUF and individuals Apart from 80C there

Web Section 80C of the Income Tax Act of India is a clause that points to various expenditures and investments that are exempted from Income Tax It allows for a maximum deduction Web 22 juin 2018 nbsp 0183 32 Investors can invest up to 1 50 000 in an ELSS fund and deduct the investment from their taxable income under section 80C of Income Tax Act thereby effectively reducing their tax liability Long term capital gains and dividends received on these investments are tax free in the hands of the investor as per the current tax laws

Download Income Tax Rebate Under 80c

More picture related to Income Tax Rebate Under 80c

80ccc Pension Plan Investor Guruji

https://enskyar.com/img/Blogs/Tax-deduction-under-section-80C-80CCC-and-80CCD.jpg

How To Claim Health Insurance Under Section 80D From 2018 19

https://myinvestmentideas.com/wp-content/uploads/2018/04/80C-Deductions-list-min.jpg

Download Complete Tax Planning Guide In PDF For Salaried And Professionals

https://www.apnaplan.com/wp-content/uploads/2018/03/Tax-Saving-Investment-Option-under-Section-80C-or-80CCC-or-80CCD.png

Web 4 janv 2020 nbsp 0183 32 Section 80C of the Income Tax Act is the section that deals with these tax breaks It states that qualifying investments up to a maximum of Rs 1 50 Lakh are deductible from your income This means that Web Tax benefit of 54 600 46 800 under Section 80C amp 7 800 under Section 80D is calculated at the highest tax slab rate of 31 2 including Cess excluding surcharge on

Web Tax Saving Calculator Calculate Deductions under 80C Lower your tax liability through tax exemptions Section 80C allows you to be eligible for tax deduction up to Rs 1 5 lakh Web 30 janv 2022 nbsp 0183 32 Premium qualifies for deduction under section 80C maturity proceeds or death claim is tax free when the annual premium does not exceed 2 5 lakh and partial

Deduction Under Section 80C Its Allied Sections

https://www.taxhelpdesk.in/wp-content/uploads/2022/07/DEDUCTIONS-UNDER-SECTION-80C-80CCC-80CCD1-80CCD1b-80CCD2--819x1024.png

Budget 2014 Impact On Money Taxes And Savings

http://i1.wp.com/apnaplan.com/wp-content/uploads/2014/07/Investments-to-Save-Tax-under-Section-80C.png?fit=757%2C475

https://tax2win.in/guide/deductions

Web 28 mars 2019 nbsp 0183 32 Section 80C This section provides a deduction of up to Rs 1 5 lakh for investments in specified instruments such as EPF PPF NSC ELSS tax saving fixed

https://www.bankbazaar.com/tax/deductions-under-80c.html

Web 11 sept 2023 nbsp 0183 32 Section 80C of the Income Tax Act allows for certain expenditures and investments to be exempt from income tax If you plan your investments across different

TAX DEDUCTION UNDER SECTION 80C Subrata Tax Blog

Deduction Under Section 80C Its Allied Sections

Deduction Under Section 80C A Complete List BasuNivesh

Common Tax Benefits Under Section 80C Of Income Tax Act 1961 With

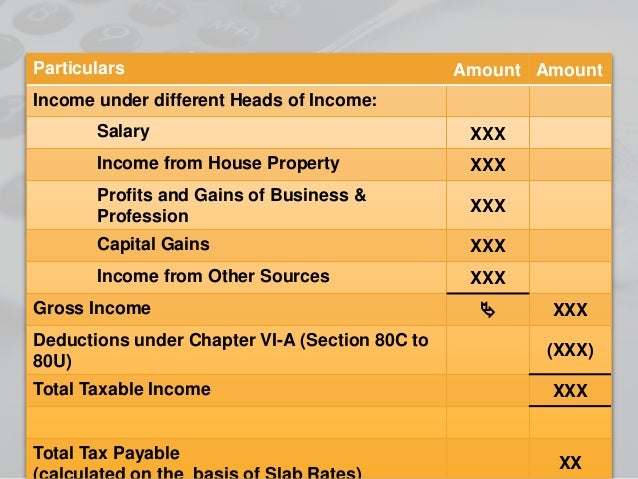

Deduction Under Chapter VI A section 80C 80U Income Tax 1961

Income Tax For Under Construction House The Property Files

Income Tax For Under Construction House The Property Files

List Of Different Derivations Under Section 80C With Automated Income

Tax Benefits Under Sec 80C 80CCF 80D 80G And 80E Rediff Getahead

Section 80 Deduction Income Tax Deductions Under Section 80C 80CCD

Income Tax Rebate Under 80c - Web The maximum limit of deduction available under Section 80C Section 80CCC and Section 80 CCD 1 for a contribution towards the National Pension System is INR 1 5 lakhs Deduction under Section 80D of the Income Tax Act Section 80D is available if you invest in LIC s health plans If you opt for LIC s Jeevan Arogya or Cancer Cover Plans