Income Tax Rebate Under 80d Web Income Tax Department gt Tax Tools gt Deduction under section 80D As amended upto Finance Act 2023 Deduction Under Section 80D Assessment Year Status Assessee Spouse amp dependent Children Assesee s parents Payment for medical insurance

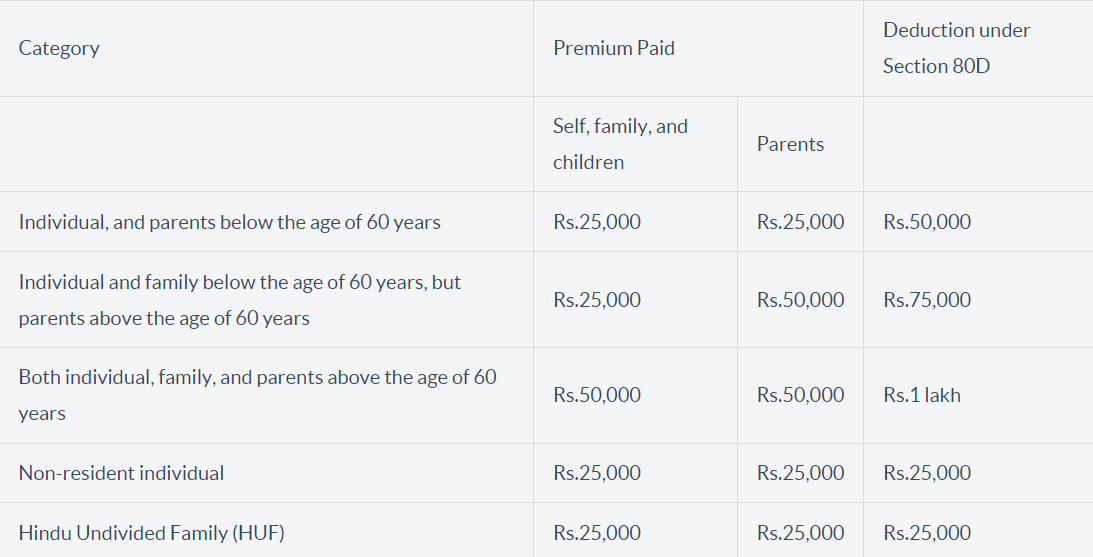

Web How much can be saved under Section 80D The total tax deduction that can be claimed under Section 80D is based on members insured and Web 15 mars 2019 nbsp 0183 32 Section 80D of the Income tax Act allows you to save tax by claiming medical expenditures incurred as a deduction from income

Income Tax Rebate Under 80d

Income Tax Rebate Under 80d

https://www.policybazaar.com/images/IncomeTax/section-80d-income-tax-act.jpg

80D Tax Deduction Under Section 80D On Medical Insurance

https://www.bajajfinservmarkets.in/content/dam/bajajfinserv/banner-website/tax-savings/section-80d.png

Deduction For Health Insurance U s 80D Of Income Tax 91 7838904326

https://www.mohindrainvestments.com/wp-content/uploads/2022/06/tax-us-80d-chart.png

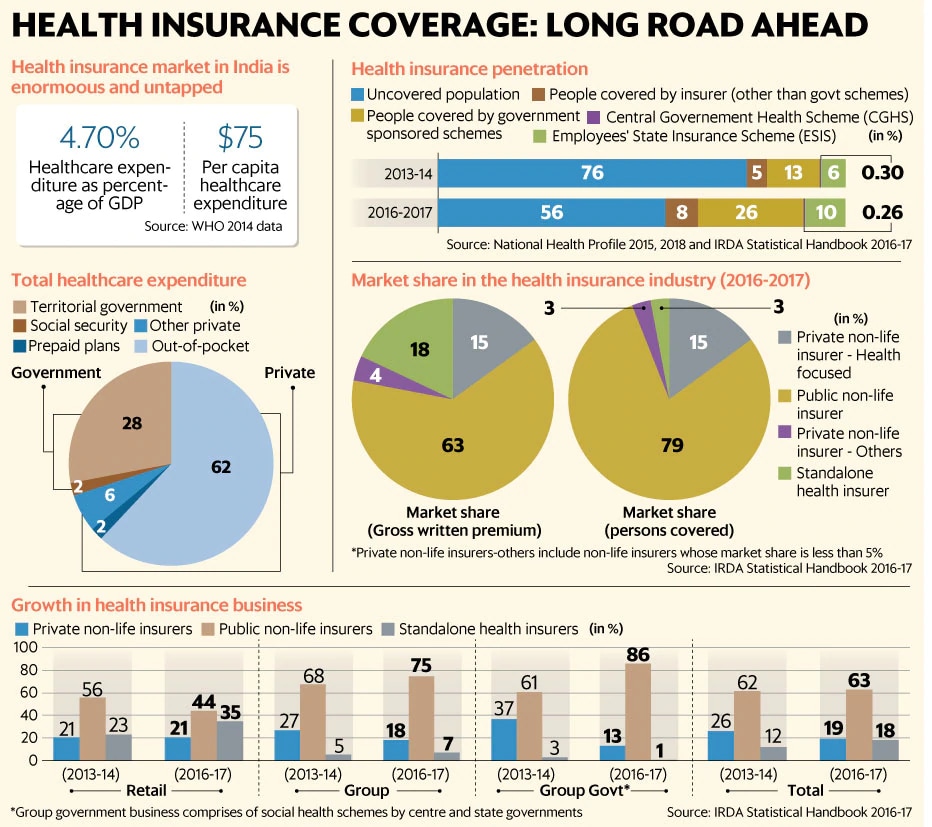

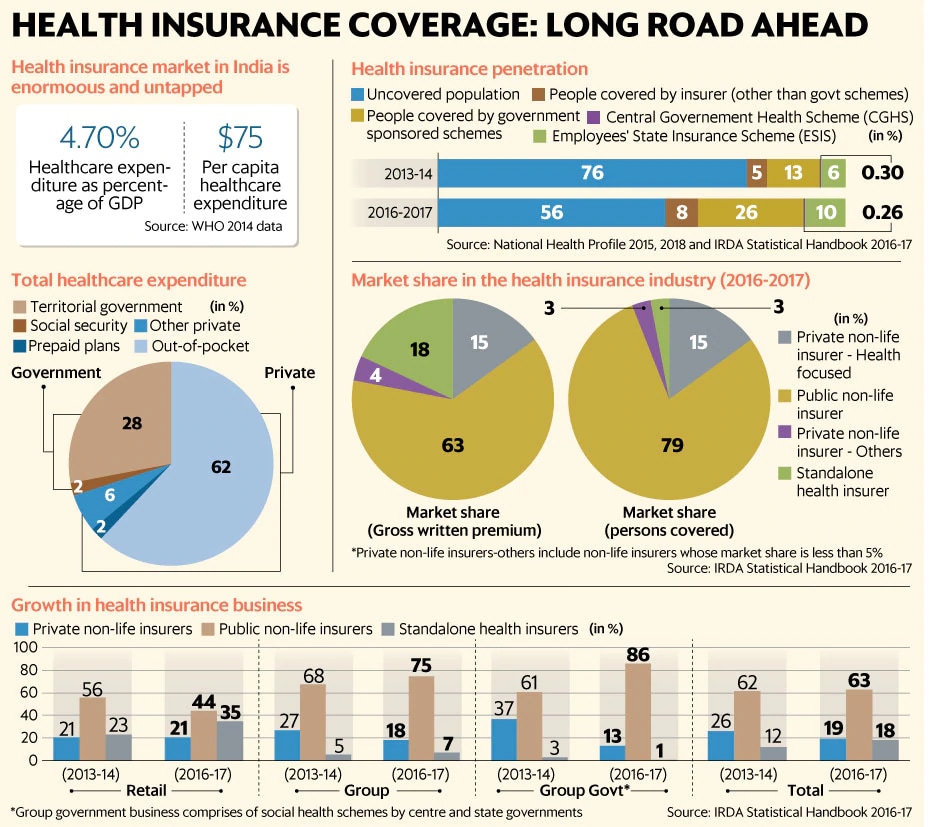

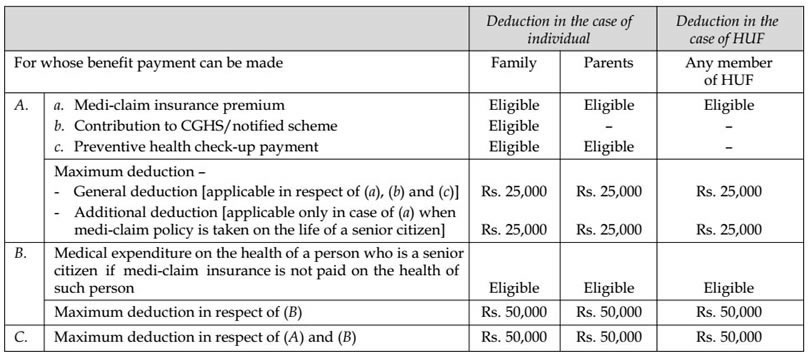

Web 4 ao 251 t 2020 nbsp 0183 32 Section 80D provides that the single premium paid should be divided over the years for which the benefit of health insurance is available While filing the Income Tax Return ITR Arup Sahay Web 9 mars 2023 nbsp 0183 32 The limits to claim tax deduction under Section 80D depends on who is included under the health insurance coverage Hence depending on the taxpayer s family situation the limit could be Rs 25 000 Rs 50 000 Rs 75 000 or Rs 1 lakh See Section

Web 1 f 233 vr 2023 nbsp 0183 32 As per the Income Tax provisions the tax assessees can claim a deduction under section 80D of the Income Tax for the premium paid towards a mediclaim insurance In this article we will discuss in Web 8 juil 2020 nbsp 0183 32 Tax Deductions Available for Health Insurance under Section 80D The amount of deduction on health insurance premium paid ranges from 25 000 to a maximum of 1 00 000 deduction eligible if Self Senior Citizen and family includes senior Citizen

Download Income Tax Rebate Under 80d

More picture related to Income Tax Rebate Under 80d

6 Tax Saving Tips And Tricks For Salaried Employees RTDS Blog

https://www.myrealdata.in/wp-content/uploads/2019/07/tax-deductions-under-section-80D.png

Section 80D Income Tax Deduction For Medical Insurance Preventive

https://blog.tax2win.in/wp-content/uploads/2019/03/Section-80D-Income-Tax-Deduction-For-Medical-Insurance-Preventive-Check-Up-1024x866.jpg

How To Claim Health Insurance Under Section 80D From 2018 19

https://i0.wp.com/myinvestmentideas.com/wp-content/uploads/2018/04/80C-Deductions-list-min.jpg

Web How much Deduction is allowed under Section 80D The Deduction that can be claimed under Sec 80D at the time of filing of income tax return is the sum of the following In case the payment of medical insurance premium is paid by the assesse for himself Web Section 80D of the Income Tax Act 1961 offers tax deductions of up to Rs 25 000 on health insurance premiums paid in a financial year The tax deduction limit increases to Rs 50 000 per fiscal year for senior citizens aged 60 years and above

Web 12 juil 2023 nbsp 0183 32 The maximum deduction to be claimed under section 80D depends on how many people are covered under the insurance cover Depending on the taxpayer s family situation and the respective people covered under the policy the limit could be Rs Web Section 80D offers tax deductions on health insurance premiums of up to a maximum limit of 25 000 in a financial year You can claim deductions for a policy bought for yourself your spouse and your dependent children

Income Tax Deductions FY 2016 17 AY 2017 18 Details

http://www.relakhs.com/wp-content/uploads/2016/03/Section-80D-Health-insurance-premium-Income-Tax-Deductions-FY-2016-17-pic.jpg

Income Tax Act 80D Deduction For Medical Expenditure INVESTIFY IN

https://www.investify.in/wp-content/uploads/2020/08/Income-Tax-Act-80D-1.jpg

https://incometaxindia.gov.in/Pages/tools/deduction-under-section-80d.a…

Web Income Tax Department gt Tax Tools gt Deduction under section 80D As amended upto Finance Act 2023 Deduction Under Section 80D Assessment Year Status Assessee Spouse amp dependent Children Assesee s parents Payment for medical insurance

https://www.forbes.com/advisor/in/tax/section …

Web How much can be saved under Section 80D The total tax deduction that can be claimed under Section 80D is based on members insured and

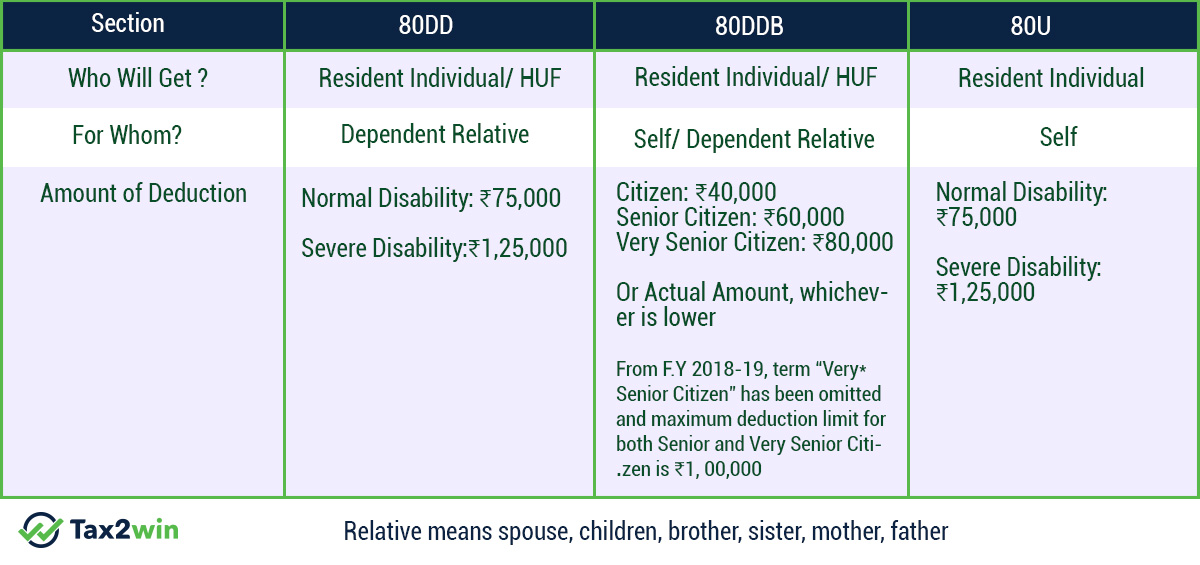

Section 80 Deduction Deduction U s 80DD 80DDB 80U Tax2win Blog

Income Tax Deductions FY 2016 17 AY 2017 18 Details

Top 5 Best Senior Citizen Health Insurance Plans 2020 21

Deduction Under Section 80D Of Income Tax For F Y 2018 19 A Y

Section 80D Deduction In Respect Of Health Or Medical Insurance

Section 80d Sec 80d Deduction In Income Tax Deduction Under 80c

Section 80d Sec 80d Deduction In Income Tax Deduction Under 80c

IndiaNivesh Section 80 Deductions Income Tax Deductions Under

Section 80d Of Income Tax Act Ay 2020 21 Worthen Althiche

Deduction 80D Upload Form 16

Income Tax Rebate Under 80d - Web 1 f 233 vr 2023 nbsp 0183 32 As per the Income Tax provisions the tax assessees can claim a deduction under section 80D of the Income Tax for the premium paid towards a mediclaim insurance In this article we will discuss in