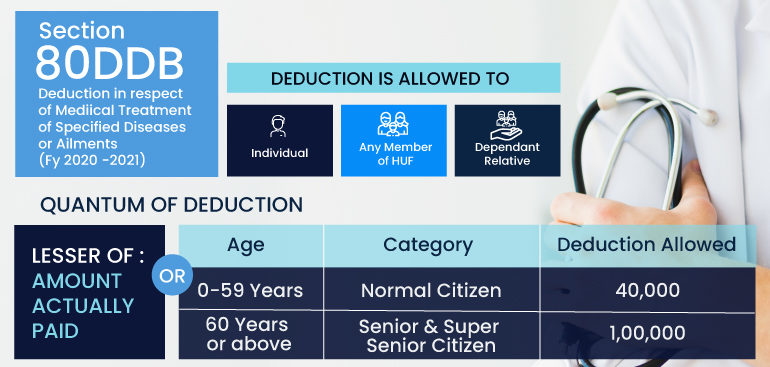

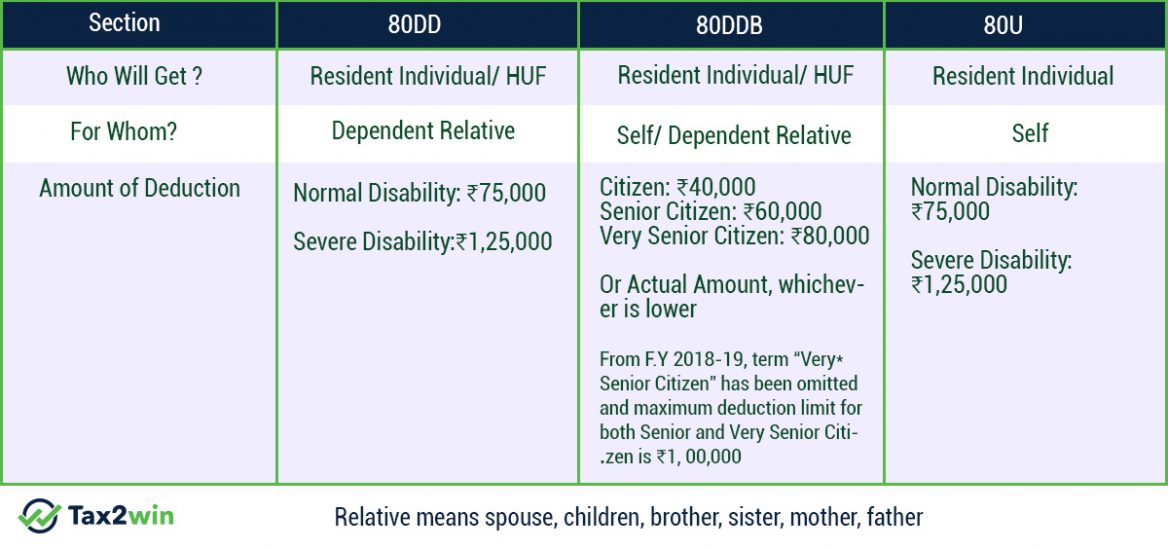

Income Tax Rebate Under 80ddb Web 17 juil 2019 nbsp 0183 32 Section 80DDB is a very important section of the Income Tax Act under which tax benefit can be claimed of Rs 1 00 000 in case of senior citizens and Rs

Web 6 juil 2023 nbsp 0183 32 Section 80DDB provides for a deduction to Individuals and HUFs for medical expenses incurred for treatment of specified diseases or ailments and should be deducted from the Gross Total Income while Web 29 juin 2018 nbsp 0183 32 1 Medical treatment of specified ailments under section 80DDB 2 Amount of deduction under section 80DDB 3 Points to be

Income Tax Rebate Under 80ddb

Income Tax Rebate Under 80ddb

https://blog.tax2win.in/wp-content/uploads/2018/07/80DD-80DDB-80U-1168x550.jpg

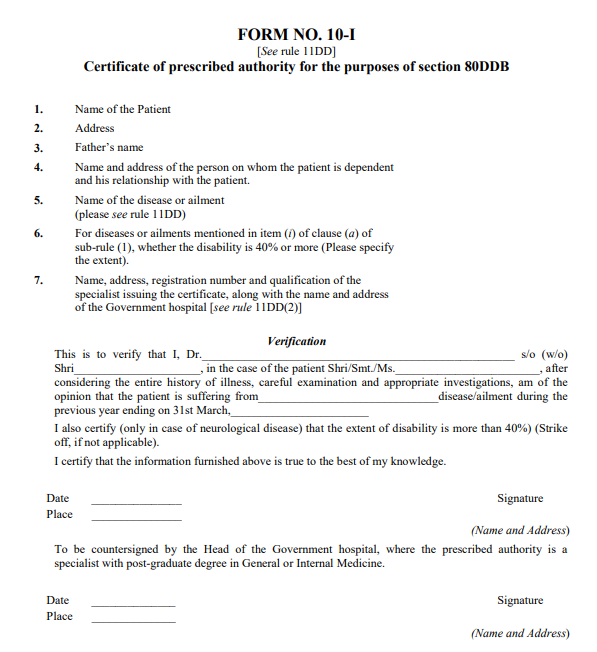

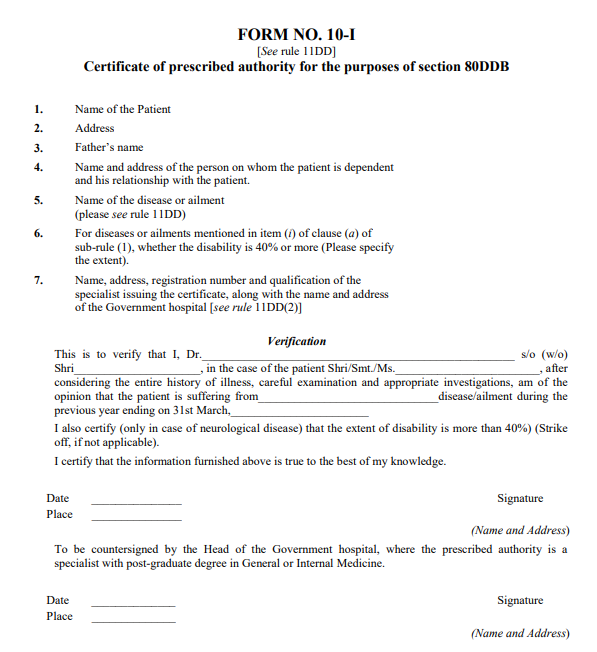

FORM 80DDB PDF

https://www.paisabazaar.com/wp-content/uploads/2017/06/Section-80DDB-Form-Format.png

Health Insurance Tax Benefits Under Section 80D

https://www.policybazaar.com/images/IncomeTax/section-80d-income-tax-act.jpg

Web 7 janv 2022 nbsp 0183 32 Individuals below 60 years of age will be able to claim an 80DDB deduction of Rs 40 000 or the actual amount of expenditure one has paid whichever is lower One Web Section 80DDB of Income Tax Act covers deductions on expenses incurred while availing medical treatment for specific ailments or disorders It states that if an individual or HUF

Web Income Tax Department gt Tax Tools gt Deduction under section 80DD As amended upto Finance Act 2023 Deduction Under Section 80DD Assessment Year Whether Web Section 80DDB Paying taxes to the government after a certain threshold is a must for every citizen Under Chapter VI A of the Income Tax Act 1961 citizens can claim tax

Download Income Tax Rebate Under 80ddb

More picture related to Income Tax Rebate Under 80ddb

Deduction Under Section 80DDB Of Income Tax Act Blog

https://cajiteshtelisara.com/blog/wp-content/uploads/2020/06/rule80ddb-770x367.jpg

Section 80DDB Tax Deduction Based On Medical Treatment Of Specified

https://www.succinctfp.com/wp-content/uploads/2020/06/80DDB-Deduction_Tax-Deduction-based-on-Medical-Treatment-of-specified-Diseases-or-Ailments.png

Section 80 Deduction Deduction U s 80DD 80DDB 80U Tax2win Blog

https://blog.tax2win.in/wp-content/uploads/2019/03/80U-Deduction-in-case-of-disability.jpg

Web Who can Claim Deductions under Section 80DDB Under Section 80DDB of the Income Tax Act 1961 taxpayers can claim deduction for medical treatment of certain specified Web 26 sept 2022 nbsp 0183 32 Section 80DDB of the Income Tax Act of 1961 allows tax deductions to taxpayers on the treatment of certain specified diseases According to Section 80DDB

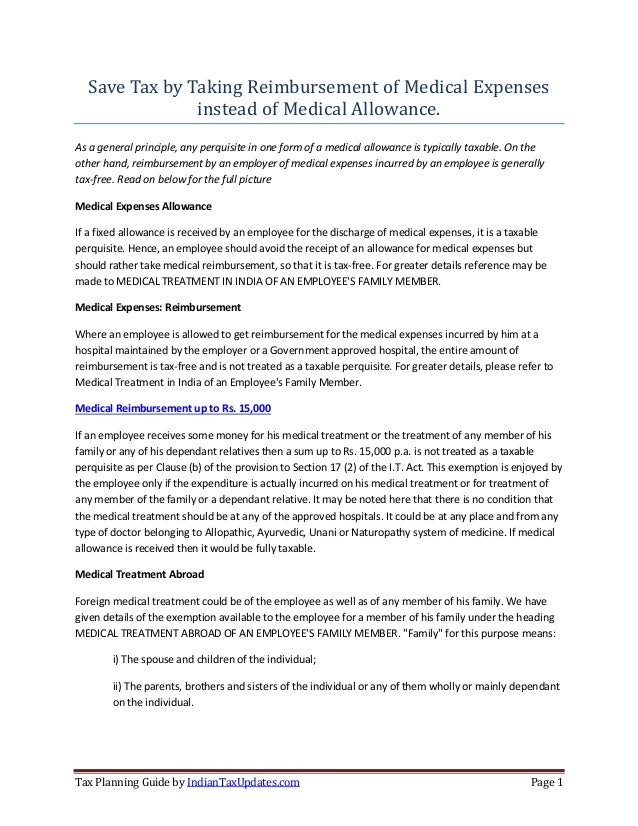

Web 18 nov 2021 nbsp 0183 32 Updated on 12 Jul 2023 Section 80DDB of the Income Tax Act 1961 has gained its popularity in recent years You can claim a tax deduction against the Web 15 mars 2019 nbsp 0183 32 Section 80D of the Income tax Act allows you to save tax by claiming medical expenditures incurred as a deduction from income before levy of tax You can

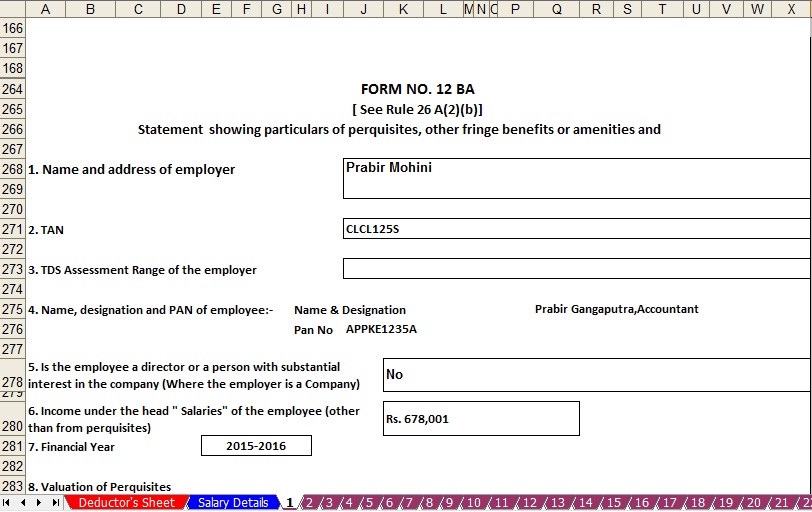

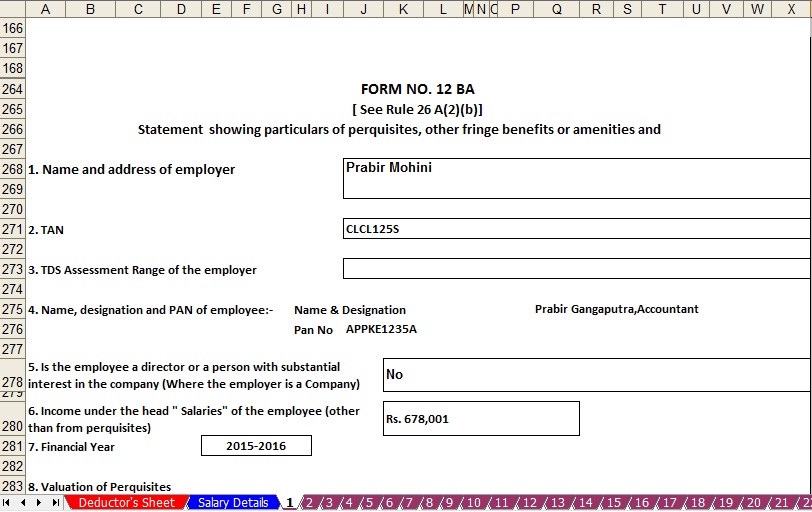

How To Claim IT Deduction Under Section 80DDB Which Is Now Becomes Easy

http://3.bp.blogspot.com/-U86ck01YIWA/Vmmg-OHP_3I/AAAAAAAAAs0/lWJ85UTccq0/s1600/12BA.jpg

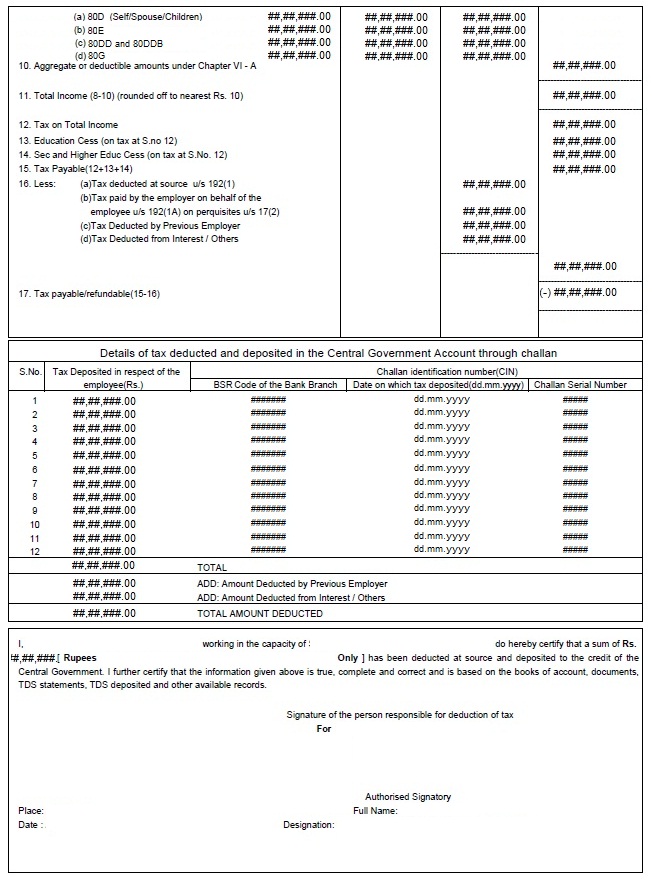

89 INFO FORM FOR 80DDB PDF ZIP DOCX PRINTABLE DOWNLOAD Form

https://4.bp.blogspot.com/-jeFd6_KXPAM/T_7M7XexpSI/AAAAAAAAG6w/67Z-QMZ_tqY/s1600/Form+16+Part+B+Page+2.jpg

https://tax2win.in/guide/section-80ddb

Web 17 juil 2019 nbsp 0183 32 Section 80DDB is a very important section of the Income Tax Act under which tax benefit can be claimed of Rs 1 00 000 in case of senior citizens and Rs

https://www.paisabazaar.com/tax/section-80ddb

Web 6 juil 2023 nbsp 0183 32 Section 80DDB provides for a deduction to Individuals and HUFs for medical expenses incurred for treatment of specified diseases or ailments and should be deducted from the Gross Total Income while

Income Tax Deductions FY 2016 17 AY 2017 18 Details

How To Claim IT Deduction Under Section 80DDB Which Is Now Becomes Easy

46 INFO HOW TO GET 80DDB CERTIFICATE WITH VIDEO TUTORIAL Certificate

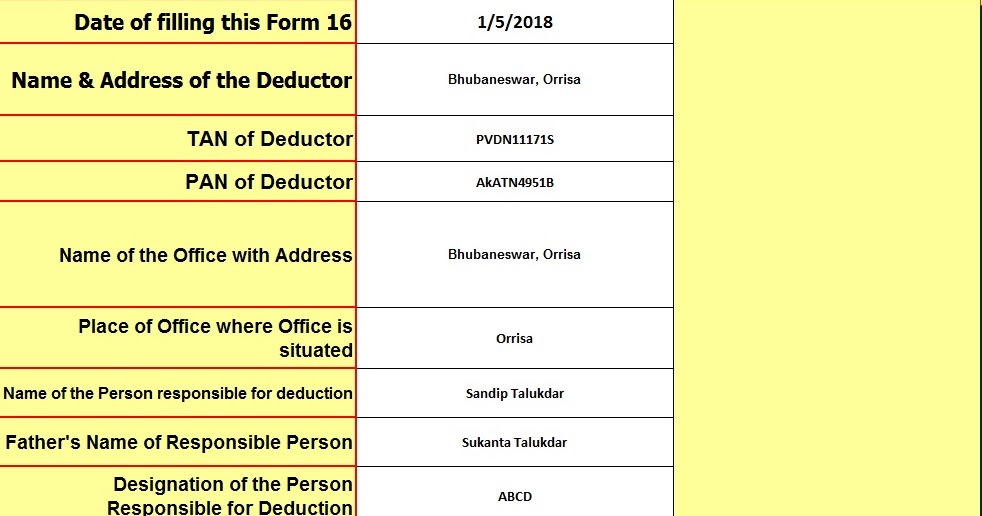

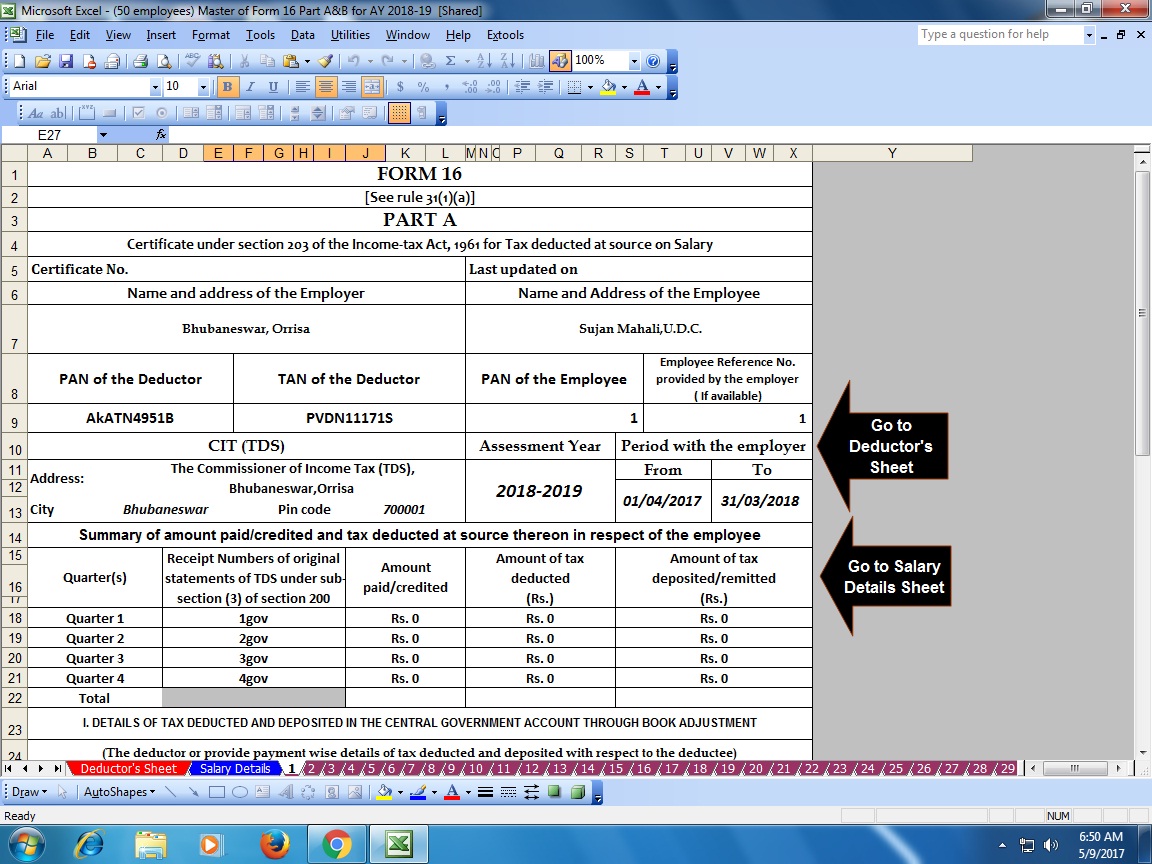

Tax Section 80DDB Tax Rebate From Sever Diseases Plus Automatic Master

Tax Section 80DDB Tax Rebate From Sever Diseases Plus Automatic Master

Section 80DDB Deductions For Specified Diseases And Ailments

Section 80DDB Deductions For Specified Diseases And Ailments

80C 80U

Income Tax Deductions 1 Section 80D 80DD 80DDB 80E 80G 80GG 80U 80CCD1B

DEDUCTION UNDER SECTION 80C TO 80U PDF

Income Tax Rebate Under 80ddb - Web Income Tax Department gt Tax Tools gt Deduction under section 80DD As amended upto Finance Act 2023 Deduction Under Section 80DD Assessment Year Whether