Income Tax Rebate Under Sec 80d Web Deduction Under Section 80D Payment for medical insurance premium mode other than cash contribution to CGHS Payment of medical insurance premium for resident Sr

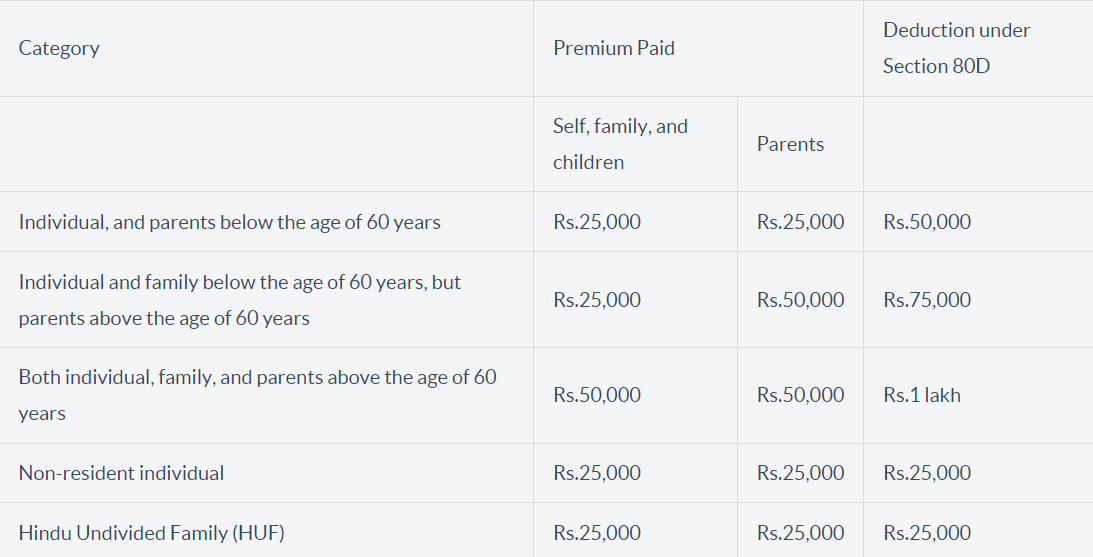

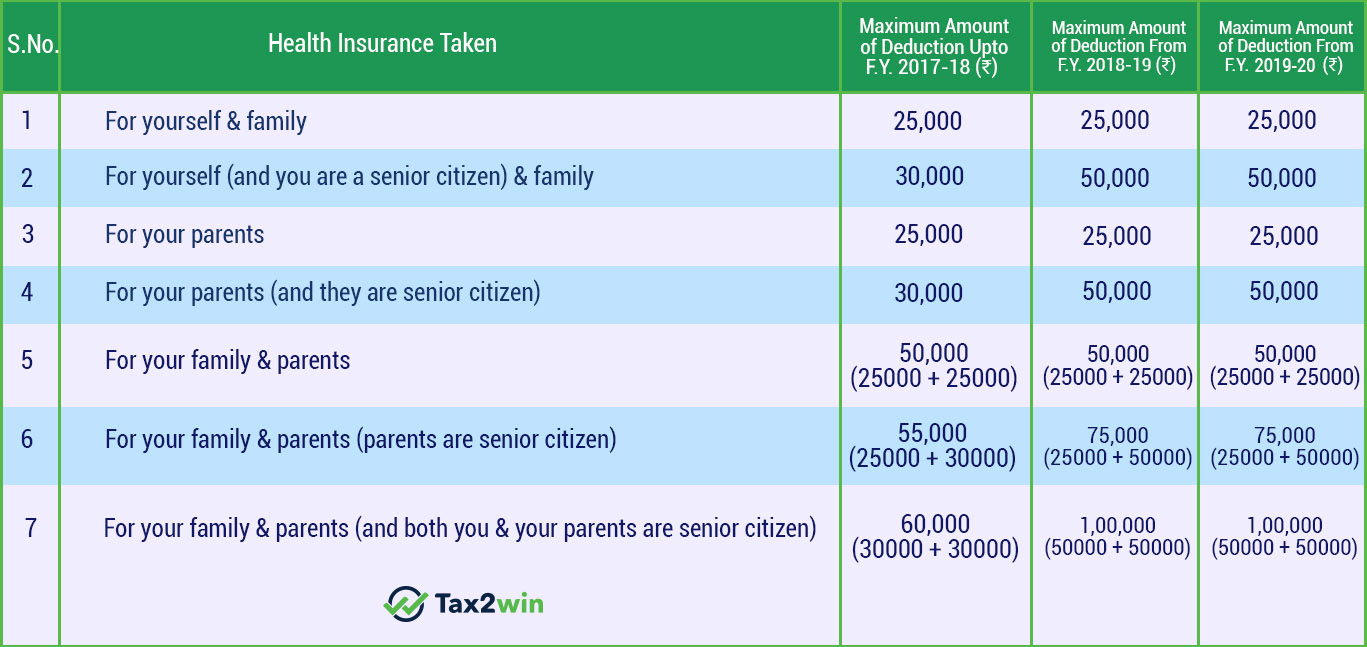

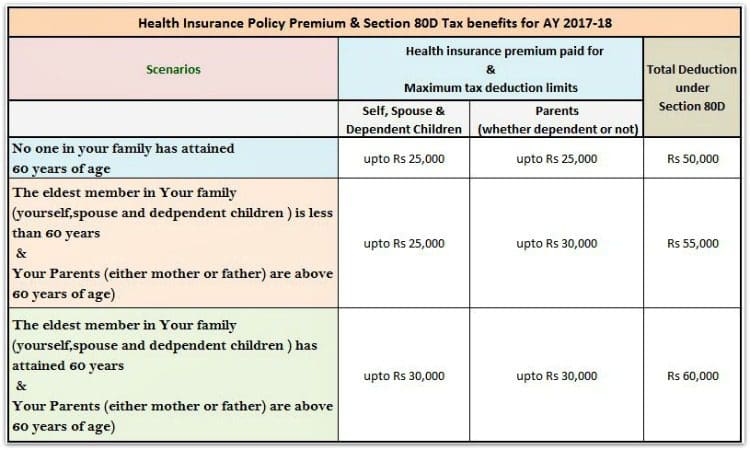

Web 15 f 233 vr 2023 nbsp 0183 32 Section 80D of the Income tax Act 1961 allows an individual to claim deduction from gross taxable income The deduction can be claimed if an individual Web The total tax deduction that can be claimed under Section 80D is based on members insured and their age criterion which ranges from INR 25 000

Income Tax Rebate Under Sec 80d

Income Tax Rebate Under Sec 80d

https://www.policybazaar.com/images/IncomeTax/section-80d-income-tax-act.jpg

Section 80D Tax Benefits Health Or Mediclaim Insurance FY 2017 18

http://www.relakhs.com/wp-content/uploads/2016/03/Section-80D-Health-insurance-premium-Income-Tax-Deductions-FY-2016-17-pic.jpg

Section 80D Income Tax Deduction For Medical Insurance Preventive

https://blog.tax2win.in/wp-content/uploads/2019/03/Section-80D-Income-Tax-Deduction-For-Medical-Insurance-Preventive-Check-Up-1024x866.jpg

Web 9 mars 2023 nbsp 0183 32 Tax deduction under Section 80D Rs 39 000 Rs 12 000 Rs 22 000 Rs 5 000 Web 12 sept 2023 nbsp 0183 32 Deductions under Section 80D provide tax savings benefits for expenses related to health and critical illness insurance You can take advantage of Section

Web 26 nov 2020 nbsp 0183 32 Section 80D of the IT Act provides a deduction to the extent of 25 000 in respect of the premium paid towards an insurance on the health of self spouse and dependent children Income tax Web There is one more benefit of subscribing to a Mediclaim policy and that is tax rebate Under Sec 80D you are eligible for deduction up to Rs 75 000 with the following conditions

Download Income Tax Rebate Under Sec 80d

More picture related to Income Tax Rebate Under Sec 80d

Deduction For Health Insurance U s 80D Of Income Tax 91 7838904326

https://www.mohindrainvestments.com/wp-content/uploads/2022/06/tax-us-80d-chart.png

Section 80D Income Tax Deduction For Medical Insurance Preventive

https://blog.tax2win.in/wp-content/uploads/2019/10/Section-80D-Summary.jpg

Section 80 Deduction Deduction U s 80DD 80DDB 80U Tax2win Blog

https://blog.tax2win.in/wp-content/uploads/2018/07/80DD-80DDB-80U-1168x550.jpg

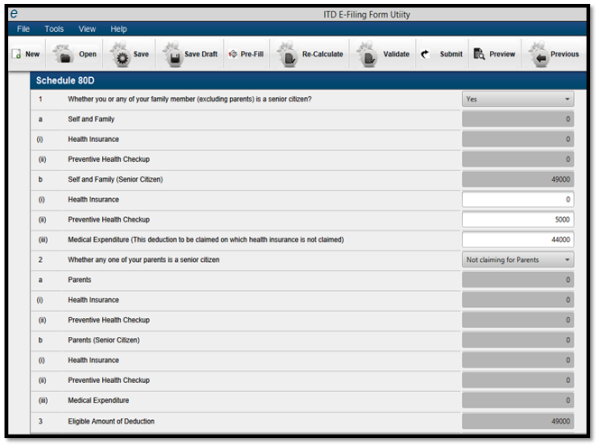

Web 20 sept 2019 nbsp 0183 32 Deduction under section 80D is available basically for two types of payment namely 1 Medical insurance premium including preventive health check up and 2 Web Section 80D of the Income Tax Act 1961 offers tax deductions of up to Rs 25 000 on health insurance premiums paid in a financial year The tax deduction limit increases to Rs

Web 8 juil 2020 nbsp 0183 32 Case 1 When the policyholder who is under the age of 60 has opted only for self spouse and children the limit of deduction is fixed at only 25 000 Case 2 Web Section 80D provides for tax deduction from the total taxable income for the payment by any mode other than cash of medical insurance premium paid by an Individual or a

6 Tax Saving Tips And Tricks For Salaried Employees RTDS Blog

https://www.myrealdata.in/wp-content/uploads/2019/07/tax-deductions-under-section-80D.png

Deduction Under 80D Tips Before Investing In A Health Insurance Plan

https://www.caclubindia.com/editor_upload/71160_20200610140948_g.png

https://incometaxindia.gov.in/Pages/tools/deduction-under-section-80d.a…

Web Deduction Under Section 80D Payment for medical insurance premium mode other than cash contribution to CGHS Payment of medical insurance premium for resident Sr

https://economictimes.indiatimes.com/wealth/tax/you-can-claim-maximum...

Web 15 f 233 vr 2023 nbsp 0183 32 Section 80D of the Income tax Act 1961 allows an individual to claim deduction from gross taxable income The deduction can be claimed if an individual

Section 80D Of Income Tax Act Know The Deduction Limit For AY 2020 21

6 Tax Saving Tips And Tricks For Salaried Employees RTDS Blog

Tax Benefit Of Buying Health Insurance In India For NRI Section 80D

Top 5 Best Senior Citizen Health Insurance Plans 2020 21

Section 80D Deductions For Medical Health Insurance For Fy 2021 22

How To Claim Health Insurance Under Section 80D From 2018 19

How To Claim Health Insurance Under Section 80D From 2018 19

Tax Saving On Health Insurance Section 80D Detailed Guide For FY

Tax Deduction Under Section 80C 80CCC 80CCD How To Earn Money Through

Income Tax Calculator Section 80D Allows You This Much Of Tax

Income Tax Rebate Under Sec 80d - Web 14 mars 2022 nbsp 0183 32 Section 80D allows taxpayers to avail tax deductions on the premiums paid towards health and medical insurance in a financial year In short it is a vital policy for