Income Tax Rebate Under Section 80c Web Real tax savings under Section 80C Assessment year 2023 24 Tax rates Tax saved for every 10 000 under Section 80C Maximum tax saving under Section 80C with 4 cess 5 500 7 800 20 2 000 31 200

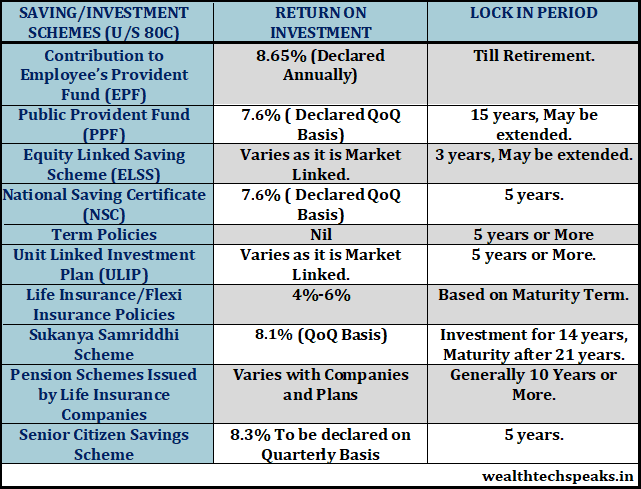

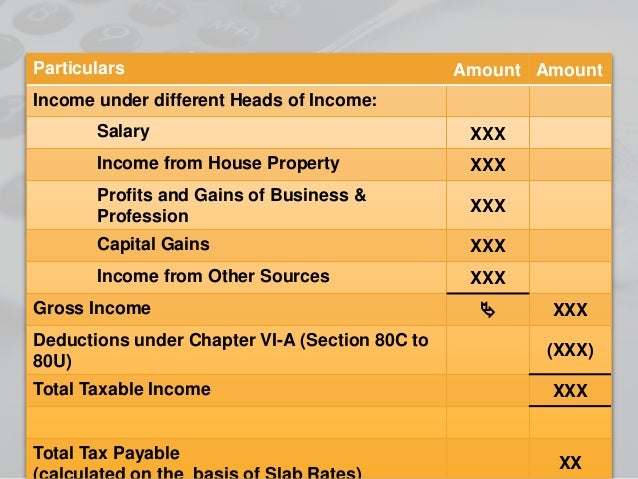

Web 13 juin 2019 nbsp 0183 32 Section 80C Income Tax Deduction under Section 80C Updated on 03 Aug 2023 01 19 PM Section 80C is the most popular income tax deduction for tax Web 30 janv 2022 nbsp 0183 32 Section 80C offers taxpayers the widest range of investment options that can help them save up to 1 5 lakh of their income from tax Given so many options it

Income Tax Rebate Under Section 80c

Income Tax Rebate Under Section 80c

http://wealthtechspeaks.in/wp-content/uploads/2017/04/Tax-Deduction-Under-Section-80C.png

80ccc Pension Plan Investor Guruji

https://enskyar.com/img/Blogs/Tax-deduction-under-section-80C-80CCC-and-80CCD.jpg

DEDUCTION UNDER SECTION 80C TO 80U PDF

https://www.relakhs.com/wp-content/uploads/2018/03/Income-Tax-Deductions-List-FY-2018-19-Income-tax-exemptions-tax-benefits-Fy-2018-19-AY-2019-20-Section-80c-limit-80D-80E-NPS-Home-loan-interest-loss-standard-deduction.jpg

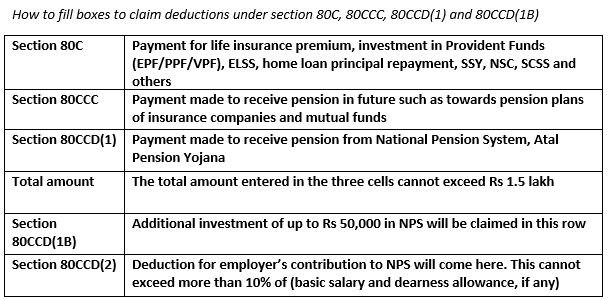

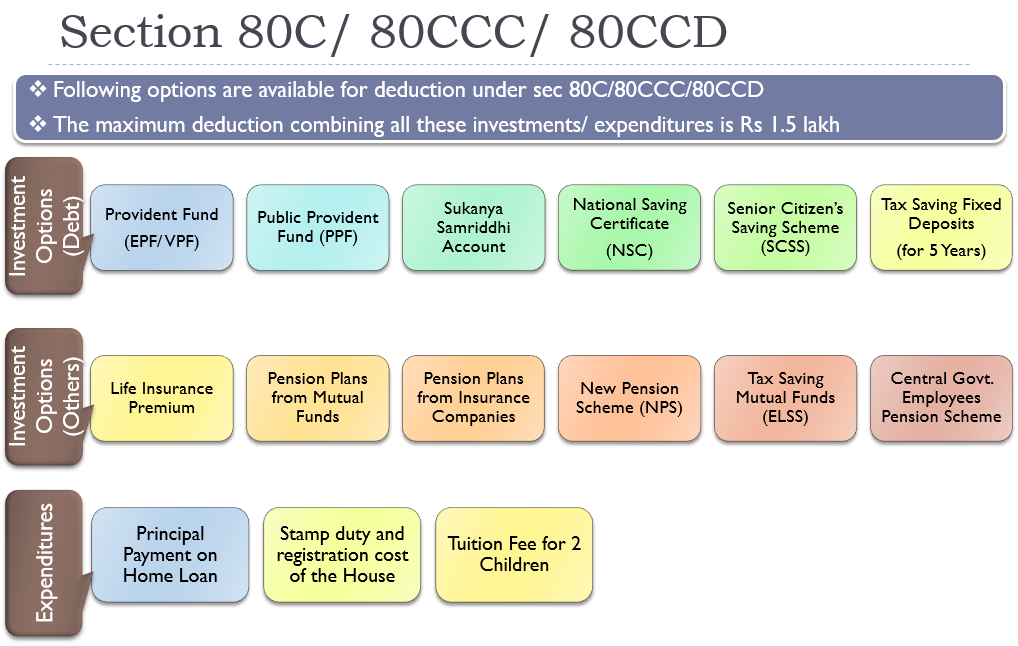

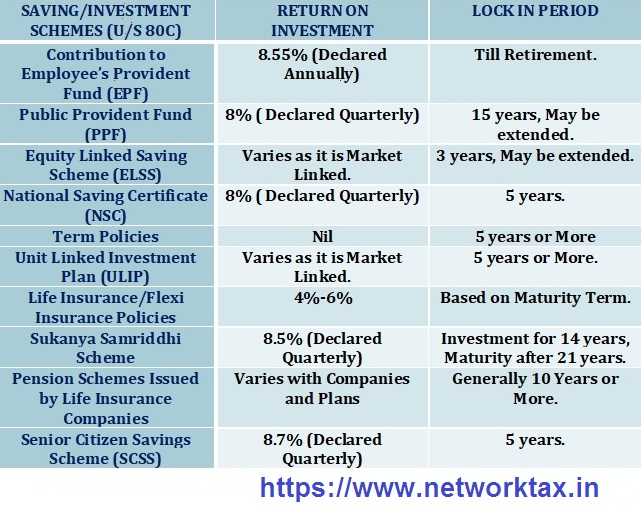

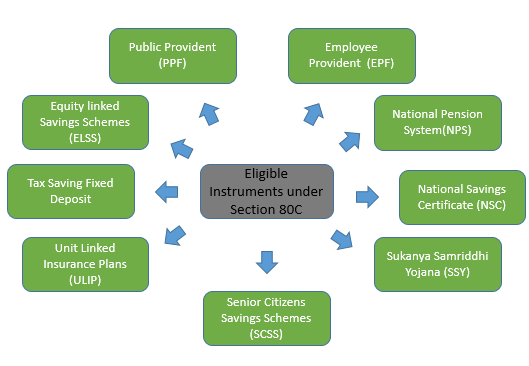

Web 28 mars 2019 nbsp 0183 32 Section 80C This section provides a deduction of up to Rs 1 5 lakh for investments in specified instruments such as EPF PPF NSC ELSS tax saving fixed Web 21 sept 2022 nbsp 0183 32 The National Pension System tax benefit under Section 80 CCD 1B alone can save 15 600 in taxes in a year The total tax deduction of 2 00 000 that can be claimed under Sections 80CCD 1 and 80

Web 12 juil 2023 nbsp 0183 32 Section 80C of the Income Tax Act provides tax deduction up to Rs1 5 lakhs to individuals and HUF The tax deductions provide a means for individuals to reduce Web 6 sept 2023 nbsp 0183 32 Section 80C An individual can claim a deduction up to INR 1 5 lakh of the total income under Section 80C Rebate under section 80C is only available for HUF and individuals Apart from 80C there are

Download Income Tax Rebate Under Section 80c

More picture related to Income Tax Rebate Under Section 80c

Deduction Under Section 80C Its Allied Sections

https://www.taxhelpdesk.in/wp-content/uploads/2022/07/DEDUCTIONS-UNDER-SECTION-80C-80CCC-80CCD1-80CCD1b-80CCD2--819x1024.png

Section 80CCC Deduction For Contribution Towards Pension Funds Tax2win

https://emailer.tax2win.in/assets/guides/deductions_infographics/section-80ccc.jpg

Income Tax For Under Construction House The Property Files

https://blog.tax2win.in/wp-content/uploads/2019/03/80C-Deduction-in-respect-of-LIP-PF-PPF-NSC-etc-1024x819.jpg

Web 26 d 233 c 2022 nbsp 0183 32 In this article we are listing 10 ways that will help you to save tax other than 80C 1 Tax saving with NPS under Section 80CCD 1B Taxpayers can save Web Section 80 deductions are divided into numerous categories according to the type of investment Different Types of Deductions According to Sections 80C deductionis the

Web 9 d 233 c 2021 nbsp 0183 32 170 8 29 2 14 6 Moxsh Overse 111 25 12 7 10 25 Auranga Dist 209 5 23 25 9 99 Neulnd Labs 3763 404 6 9 71 Laxmi Gold 34 3 4 9 09 Web 11 sept 2023 nbsp 0183 32 Income Tax Deductions Under Section 80C 80CCC and 80CCD Updated On 08 Sep 2023 Section 80C of the Income Tax Act allows for deductions up to

Budget 2014 Impact On Money Taxes And Savings

http://i1.wp.com/apnaplan.com/wp-content/uploads/2014/07/Investments-to-Save-Tax-under-Section-80C.png?fit=757%2C475

Complete Guide On Income Tax Deduction U s 80C 80CCD 80CCC 80CCG

https://financialcontrol.in/wp-content/uploads/2018/08/Deduction-under-section-80C.jpg

https://www.etmoney.com/blog/guide-to-secti…

Web Real tax savings under Section 80C Assessment year 2023 24 Tax rates Tax saved for every 10 000 under Section 80C Maximum tax saving under Section 80C with 4 cess 5 500 7 800 20 2 000 31 200

https://tax2win.in/guide/income-tax-deduction-section-80-c

Web 13 juin 2019 nbsp 0183 32 Section 80C Income Tax Deduction under Section 80C Updated on 03 Aug 2023 01 19 PM Section 80C is the most popular income tax deduction for tax

Deduction Under Chapter VI A section 80C 80U Income Tax 1961

Budget 2014 Impact On Money Taxes And Savings

Download Complete Tax Planning Guide In PDF For Salaried And Professionals

All You Need To Know About Section 80C

Common Tax Benefits Under Section 80C Of Income Tax Act 1961 With

Section 80 Deduction Income Tax Deductions Under Section 80C 80CCD

Section 80 Deduction Income Tax Deductions Under Section 80C 80CCD

TAX DEDUCTION UNDER SECTION 80C Subrata Tax Blog

Income Tax Deductions Under Section 80

Deduction Under Section 80C A Complete List BasuNivesh

Income Tax Rebate Under Section 80c - Web 2 juin 2023 nbsp 0183 32 Section 80 investments refer to the investments made under Section 80C Section 80D Section 80E Section 80GG etc of the Income Tax Act 1961 These