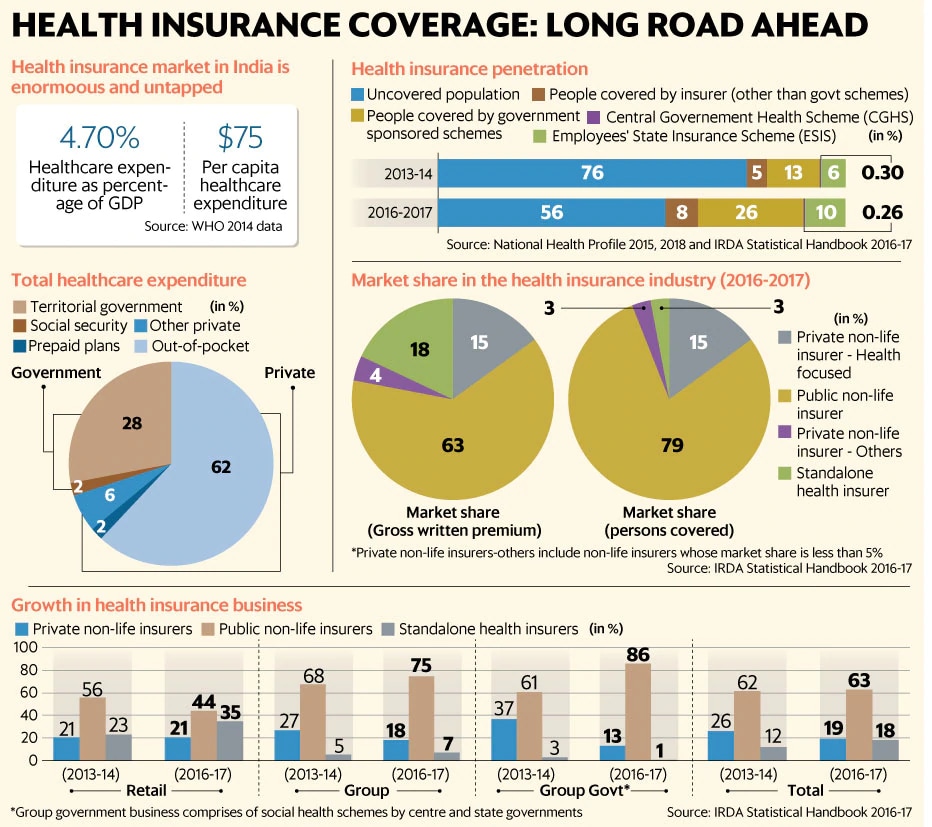

Income Tax Rebate Under Section 80d Web Deduction under section 80D Income Tax Department gt Tax Tools gt Deduction under section 80D As amended upto Finance Act 2023 Deduction Under Section 80D

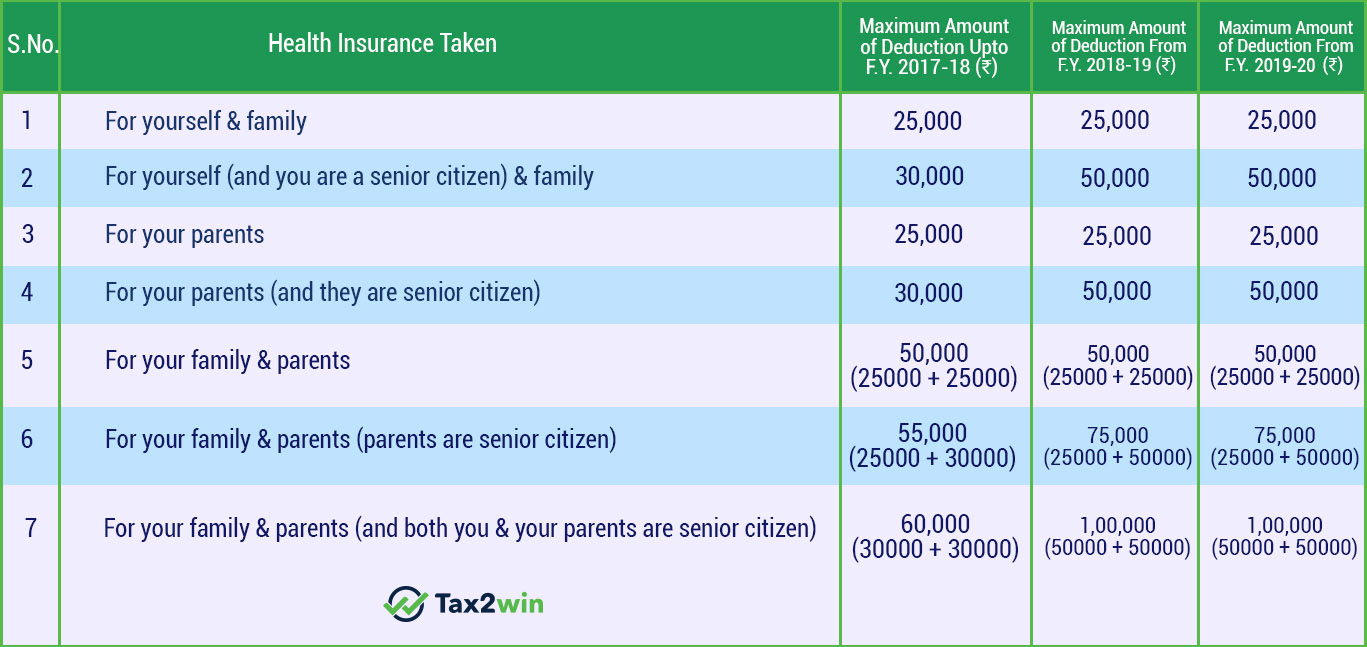

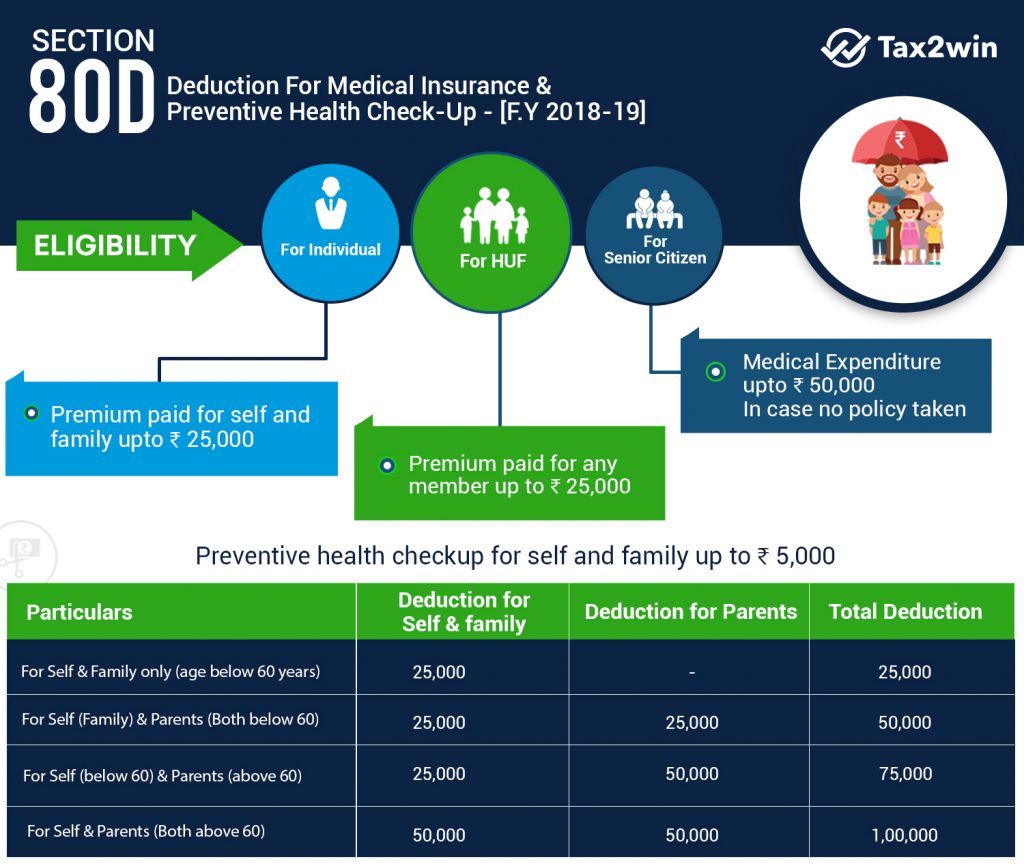

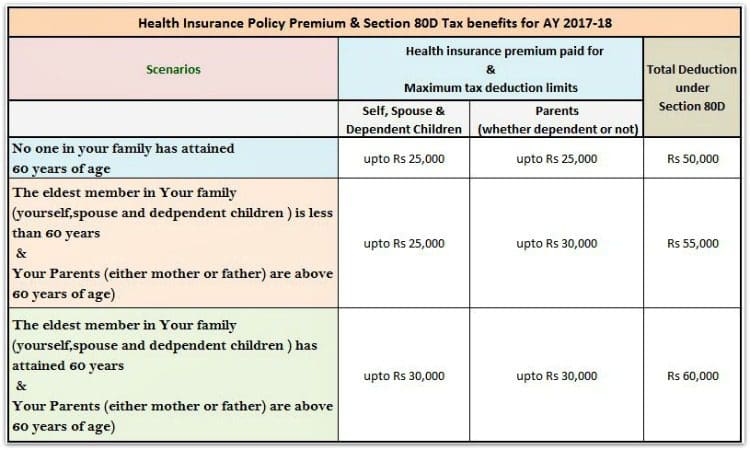

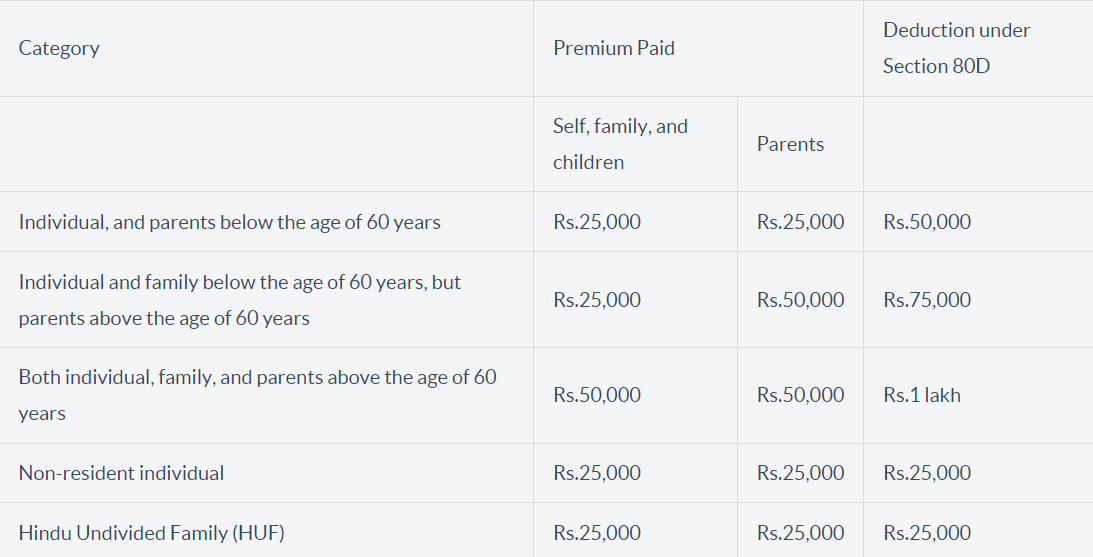

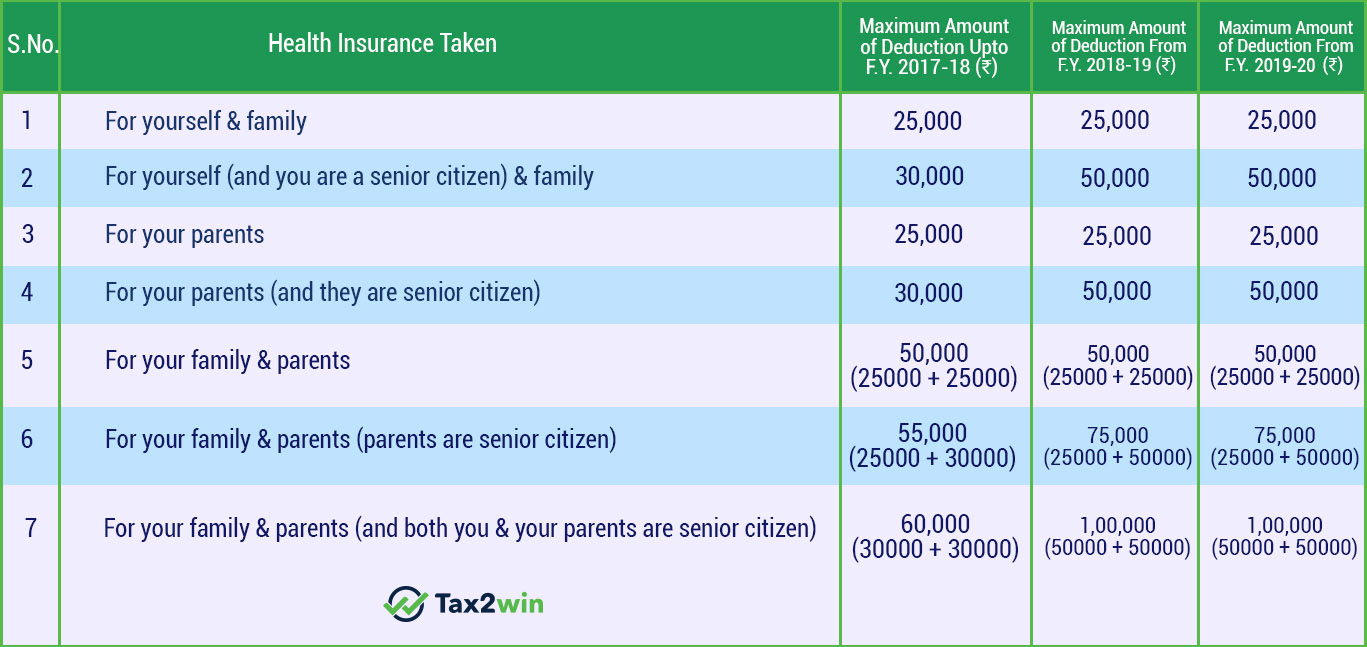

Web Tax Deduction Under Section 80D of Income Tax Act 1961 Under Section 80D tax deduction can be claimed on premium paid on health Web 9 mars 2023 nbsp 0183 32 The limits to claim tax deduction under Section 80D depends on who is included under the health insurance coverage Hence depending on the taxpayer s

Income Tax Rebate Under Section 80d

Income Tax Rebate Under Section 80d

https://blog.tax2win.in/wp-content/uploads/2019/03/Section-80D-Income-Tax-Deduction-For-Medical-Insurance-Preventive-Check-Up-1024x866.jpg

Section 80D Tax Benefits Health Or Mediclaim Insurance FY 2017 18

http://www.relakhs.com/wp-content/uploads/2016/03/Section-80D-Health-insurance-premium-Income-Tax-Deductions-FY-2016-17-pic.jpg

Health Insurance Tax Benefits Under Section 80D

https://www.policybazaar.com/images/IncomeTax/section-80d-income-tax-act.jpg

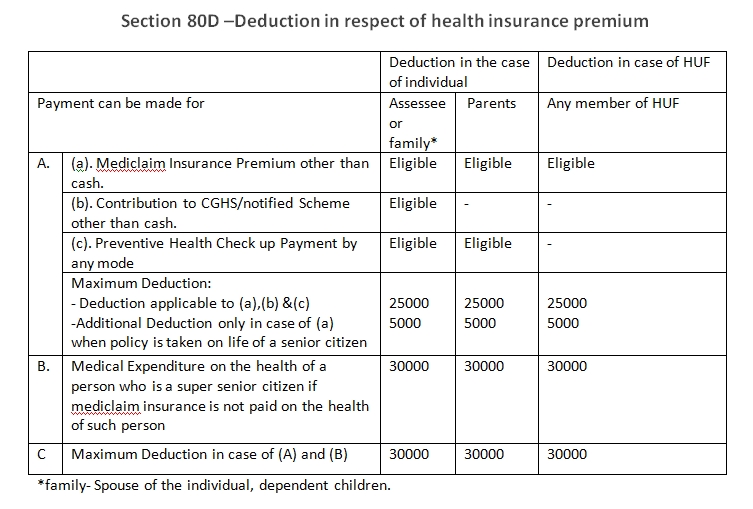

Web 15 f 233 vr 2023 nbsp 0183 32 Tax savings due Section 80D deduction Income tax rate Maximum deduction of Rs 25 000 Maximum deduction of Rs 50 000 Maximum deduction of Web 15 mars 2019 nbsp 0183 32 Section 80D of the Income tax Act allows you to save tax by claiming medical expenditures incurred as a deduction from income before levy of tax You can claim this deduction if these two conditions

Web 12 sept 2023 nbsp 0183 32 Deductions under Section 80D provide tax savings benefits for expenses related to health and critical illness insurance You can take advantage of Section 80D s Web 1 f 233 vr 2023 nbsp 0183 32 The individual or HUF taxpayers must claim the deduction under section 80D while e filing their income tax returns online Here it is essential to know in detail about this tax deduction How to claim the

Download Income Tax Rebate Under Section 80d

More picture related to Income Tax Rebate Under Section 80d

6 Tax Saving Tips And Tricks For Salaried Employees RTDS Blog

https://www.myrealdata.in/wp-content/uploads/2019/07/tax-deductions-under-section-80D.png

Section 80 Deduction Deduction U s 80DD 80DDB 80U Tax2win Blog

https://blog.tax2win.in/wp-content/uploads/2018/07/80DD-80DDB-80U.jpg

80D Tax Deduction Under Section 80D On Medical Insurance

https://www.bajajfinservmarkets.in/content/dam/bajajfinserv/banner-website/tax-savings/section-80d.png

Web 20 sept 2019 nbsp 0183 32 Deduction under section 80D is available basically for two types of payment namely 1 Medical insurance premium including preventive health check Web In India senior citizens can avail of the health insurance tax benefits under Section 80D of The Income Tax Act 1961 These benefits can be claimed by the senior citizen

Web 4 ao 251 t 2020 nbsp 0183 32 Section 80D provides that the single premium paid should be divided over the years for which the benefit of health insurance is available While filing the Income Tax Web What is Section 80D of the Income Tax Act Section 80D of the Income Tax Act 1961 offers tax deductions of up to Rs 25 000 on health insurance premiums paid in a

Section 80D Income Tax Deduction For Medical Insurance Preventive

https://blog.tax2win.in/wp-content/uploads/2019/10/Section-80D-Summary.jpg

Income Tax Act 80D Deduction For Medical Expenditure INVESTIFY IN

https://www.investify.in/wp-content/uploads/2020/08/Income-Tax-Act-80D-1.jpg

https://incometaxindia.gov.in/Pages/tools/deduction-under-section-80d.a…

Web Deduction under section 80D Income Tax Department gt Tax Tools gt Deduction under section 80D As amended upto Finance Act 2023 Deduction Under Section 80D

https://www.forbes.com/advisor/in/tax/sectio…

Web Tax Deduction Under Section 80D of Income Tax Act 1961 Under Section 80D tax deduction can be claimed on premium paid on health

Deduction For Health Insurance U s 80D Of Income Tax 91 7838904326

Section 80D Income Tax Deduction For Medical Insurance Preventive

How To Claim Health Insurance Under Section 80D From 2018 19

Section 80d Of Income Tax Act Ay 2020 21 Worthen Althiche

Deduction Under Section 80D Of Income Tax For F Y 2018 19 A Y

Section 80D Deduction In Respect Of Health Or Medical Insurance

Section 80D Deduction In Respect Of Health Or Medical Insurance

Section 80d Preventive Health Check Up Tax Deduction The Gray Tower

Section 80D Deductions For Medical Health Insurance For Fy 2021 22

Section 80d Preventive Health Check Up Tax Deduction The Gray Tower

Income Tax Rebate Under Section 80d - Web 15 f 233 vr 2023 nbsp 0183 32 Tax savings due Section 80D deduction Income tax rate Maximum deduction of Rs 25 000 Maximum deduction of Rs 50 000 Maximum deduction of