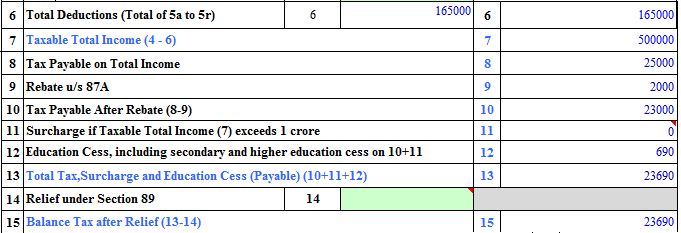

Income Tax Rebate Under Various Sections Web Tax rebate under Section 87A of the Income Tax Act 1961 is eligible for people whose taxable income is less than Rs 5 lakh in Financial Year 2022 23 The maximum amount

Web The government has provided numerous exemptions under various sections of the Income Tax Act that can be advantageous to eligible taxpayers This article covers an in depth Web 29 ao 251 t 2021 nbsp 0183 32 15 Tax Saving Options Other Than Section 80C Go beyond 80C tax benefits to become a smart tax saver Here is a complete list of tax free deductions

Income Tax Rebate Under Various Sections

Income Tax Rebate Under Various Sections

https://bemoneyaware.com/wp-content/uploads/2016/04/ITR-87a-rebate.png

DEDUCTION UNDER SECTION 80C TO 80U PDF

https://www.relakhs.com/wp-content/uploads/2018/03/Income-Tax-Deductions-List-FY-2018-19-Income-tax-exemptions-tax-benefits-Fy-2018-19-AY-2019-20-Section-80c-limit-80D-80E-NPS-Home-loan-interest-loss-standard-deduction.jpg

Income Tax Rebate On Home Loan Applicable Sections Under I T Act

https://assets-news.housing.com/news/wp-content/uploads/2022/09/09092126/Income-tax-rebate-on-home-loan.jpg

Web 28 mars 2019 nbsp 0183 32 Discover the comprehensive list of income tax deductions under Sections 80C to 80U for the FY 2022 23 AY 2023 24 Optimize your tax savings with these Web Income tax deductions under section 80C 80CCD 80D etc not only reduce the tax liability but also encourages savings and investments amongst taxpayers Not only in a

Web Income Tax Deductions Amount Under Section 24 Housing loan interest Rs 2 00 000 Under Section 87A Income tax rebate Rs 2 000 up to Rs 5 00 000 income Under Web 27 d 233 c 2022 nbsp 0183 32 How to save income tax under various sections in FY 22 23 5 min read 27 Dec 2022 10 29 PM IST Vipul Das The start of the new fiscal year FY 2022 23

Download Income Tax Rebate Under Various Sections

More picture related to Income Tax Rebate Under Various Sections

Income Tax Rebate Under Section 87A

https://image.slidesharecdn.com/incometaxrebateundersection87a2017-2018-180420103021/85/income-tax-rebate-under-section-87a-2-638.jpg?cb=1666685634

Education Rebate Income Tested

https://i2.wp.com/assets1.cleartax-cdn.com/s/img/2019/02/01163903/Budget-2019-middle-class-768x402.png

Income Tax Rebate Under Section 80 G Issued By Income Tax Department

https://cppunjab.org/wp-content/uploads/2023/05/AAEAC9089NF20231_signed-1_page-0002-1085x1536.jpg

Web 21 f 233 vr 2023 nbsp 0183 32 This was in the place of the transport allowance Rs 19 200 and medical reimbursement Rs 15 000 As a result salaried people could avail an additional Web 9 sept 2023 nbsp 0183 32 Income Tax Deductions under Section 80C to 80U Updated On 07 Sep 2023 Individuals can claim tax deduction benefits for payments made towards life insurance policies fixed deposits

Web 16 janv 2013 nbsp 0183 32 In this article we shall cover the tax saving sections of Income Tax Act discuss tax saving options under Section 80C Section 80CCC Section 80CCD Web 27 avr 2023 nbsp 0183 32 The most popular tax saving options available to individuals and HUFs in India are under Section 80C of the Income Tax Act Section 80C includes various

Income Tax Rebate Under Section 87A

https://www.wintwealth.com/blog/wp-content/uploads/2023/01/Income-Tax-Rebate-Income-Tax-Rebate-Under-Section-87A-768x402.jpg

What Is Rebate Under Section 87A For AY 2020 21 Financial Control

https://financialcontrol.in/wp-content/uploads/2018/06/Difference-between-exemption-and-deduction-and-rebate-768x1256.png

https://www.bankbazaar.com/tax/tax-rebate.html

Web Tax rebate under Section 87A of the Income Tax Act 1961 is eligible for people whose taxable income is less than Rs 5 lakh in Financial Year 2022 23 The maximum amount

https://www.deskera.com/blog/80-deductions

Web The government has provided numerous exemptions under various sections of the Income Tax Act that can be advantageous to eligible taxpayers This article covers an in depth

New Income Tax Slab And Tax Rebate Credit Under Section 87A With

Income Tax Rebate Under Section 87A

Rebate Under Section 87A Of Income Tax Act 1961 Section 87a Relief

Income Tax Rebate Under Section 87A

Tax Rebate For Individual Deductions For Individuals reliefs

Free Download Income Tax All In One TDS On Salary For Govt Non Govt

Free Download Income Tax All In One TDS On Salary For Govt Non Govt

Income Tax Rebate Under Income Tax Section 87 A For F Year 2017 18 AY 2

Know New Rebate Under Section 87A Budget 2023

Georgia Income Tax Rebate 2023 Printable Rebate Form

Income Tax Rebate Under Various Sections - Web 20 ao 251 t 2022 nbsp 0183 32 Through this article you can go through comprehensive knowledge and facts about provisions related to Rebates and Reliefs allowed under the Act Chapter 8 of