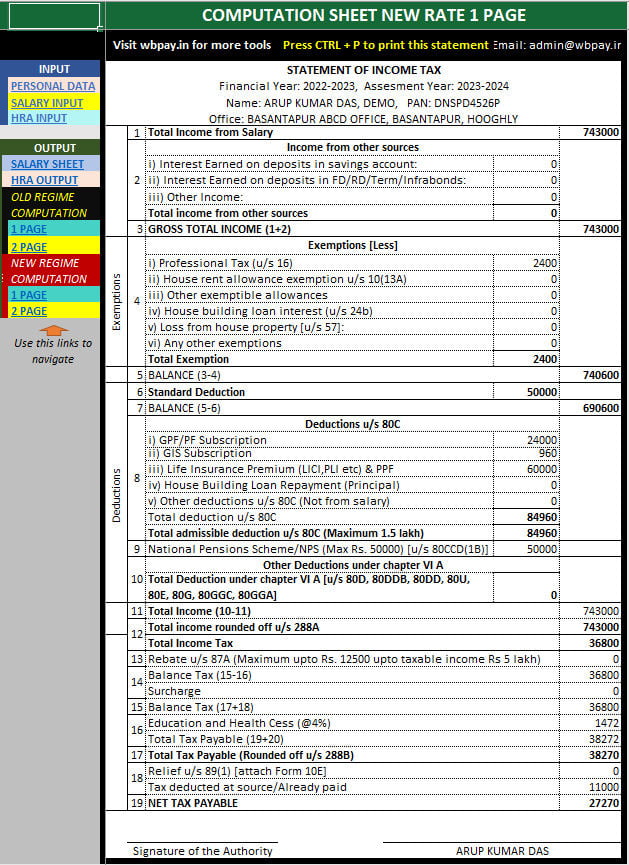

Income Tax Rebates For Fy 2022 23 Verkko Rebate u s 87A Resident Individual whose Total Income is not more than 5 00 000 is also eligible for a Rebate of up to 100 of income tax or 12 500 whichever is less

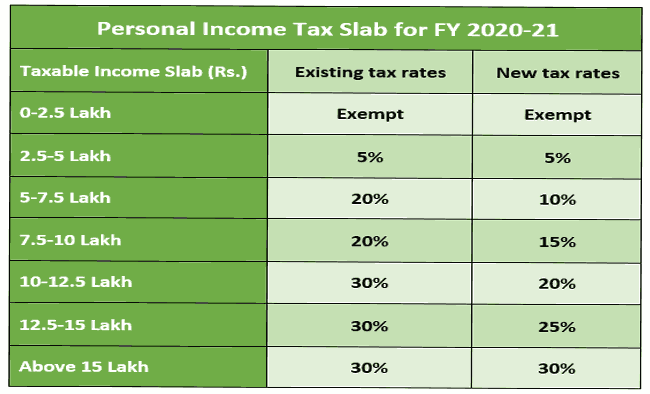

Verkko 1 marrask 2022 nbsp 0183 32 income tax rebates that you can utilise for fy 2022 23 80c deduction list do you know the rebates that doesn t require fresh investments Verkko 14 huhtik 2017 nbsp 0183 32 New Tax Regime FY 2022 23 AY 2023 24 New Tax Regime FY 2023 24 AY 2024 25 0 2 50 000 2 50 000 3 00 000 5 3 00 000

Income Tax Rebates For Fy 2022 23

Income Tax Rebates For Fy 2022 23

https://paytm.com/blog/wp-content/uploads/2022/04/1_Income-Tax_Income-Tax-Slab-Rate-for-FY-2021-2022-and-AY-2022-23.png

Income Tax Slab FY 2022 23 File IT Returns With Latest Income Tax

https://w3assets.angelone.in/wp-content/uploads/2023/01/Income-Tax-Slab-for-FY-2022-23.jpg

Income Tax FY 2022 23 AY 2023 24 Income Tax Act IT FY 2022 23 New And

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEiuBLR2sr4zdq6frnOvYmY4TMuEbMynEFSiCiVO9-h9YlyZVcz20Rnk1V34S46-X5dWuSxwpF5eEVHb9f_Y-PWQSvT6D5tOGCeOjc5Ffmu9hxfpK9DcrJcDq3faqy3aR4w7eexxY8DMrm13bqa9-CohjejrV7vWzHLgplcUb6NtDbK0V_2k8wdyiQ9e/w1200-h630-p-k-no-nu/Income Tax FY 2022-23 AY 2023-24 Income Tax Act - IT Slab Rates Income Tax Official Circular.png

Verkko 19 huhtik 2023 nbsp 0183 32 Eligibility to Claim Rebate Under Section 87A FY 2022 23 To claim a rebate under section 87A you must meet the following criteria Must be a resident Verkko 3 jouluk 2022 nbsp 0183 32 Steps to compute tax liability under new tax regime for FY 2022 23 i Compute the Gross Income including Income from all heads such as Salary House Property Capital Gains Other Sources

Verkko 5 jouluk 2023 nbsp 0183 32 For the corresponding period 7 76 crore returns have been filed till 02 12 2023 and more returns are expected to be filed till the last date i e 31 12 2023 b Verkko 1 PERSONAL INCOME TAX Currently those with income up to Rs 5 lakh do not pay any income tax in both old and new tax regimes I propose to increase the rebate limit

Download Income Tax Rebates For Fy 2022 23

More picture related to Income Tax Rebates For Fy 2022 23

LHDN IRB Personal Income Tax Rebate 2022

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEi4EoUCYcQMowVkFCssu_CdI43zIKHrVC46Kba3BHcmZh3oeO18l7EDF2MRUyAcTAsJGJ4xoe-Ekdnfv4_Pv7Vwf9uH3fIfSDaX5l9O3cEd7zdy7J1TPcGn75nLB59_9Nl_SqNTLkJeFhMTJtIwlgtqjSOzqw1iz42LdAJ22TGq8dO7vpInhBCvgVt7/s1600-e60/Tax rebates 2021.jpg

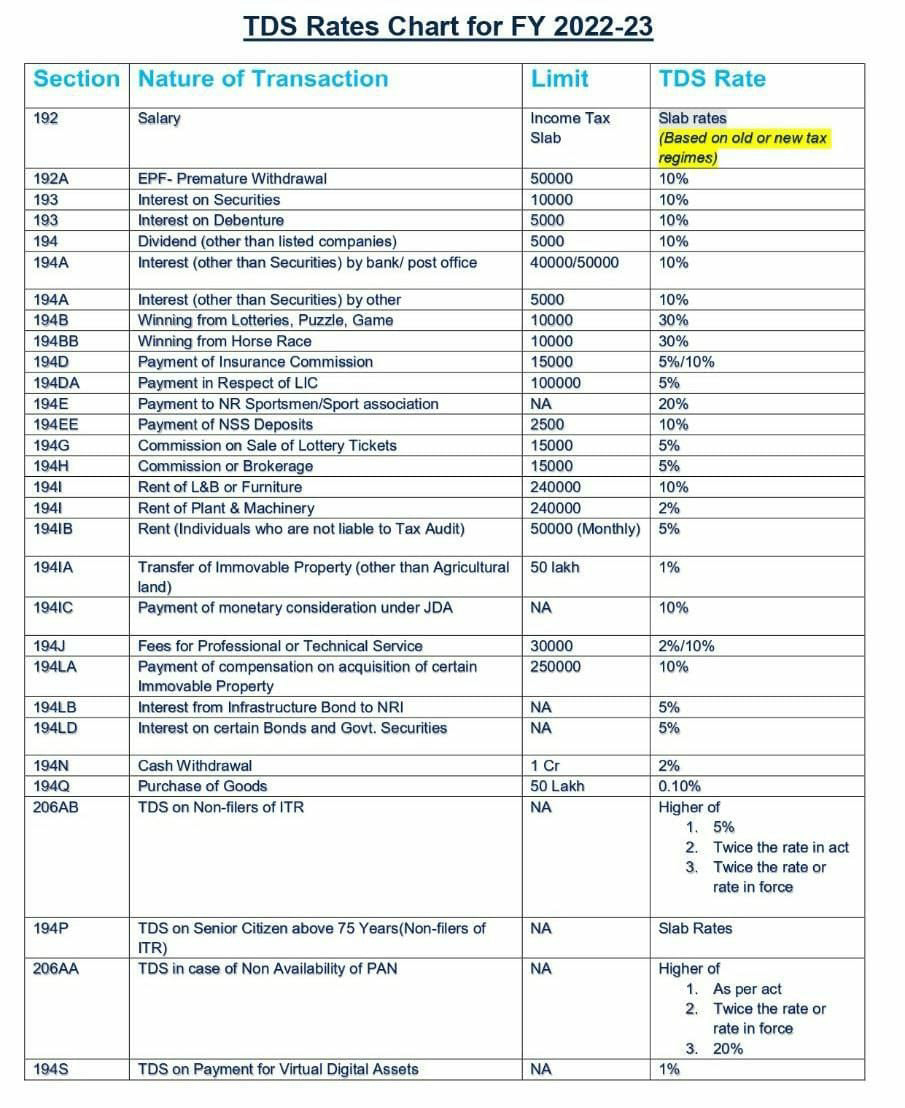

TDS Rate Chart For FY 2022 23 AY 2023 24 SimBizz

https://simbizz.in/wp-content/uploads/2022/06/simbizz.in-blog-768x433.png

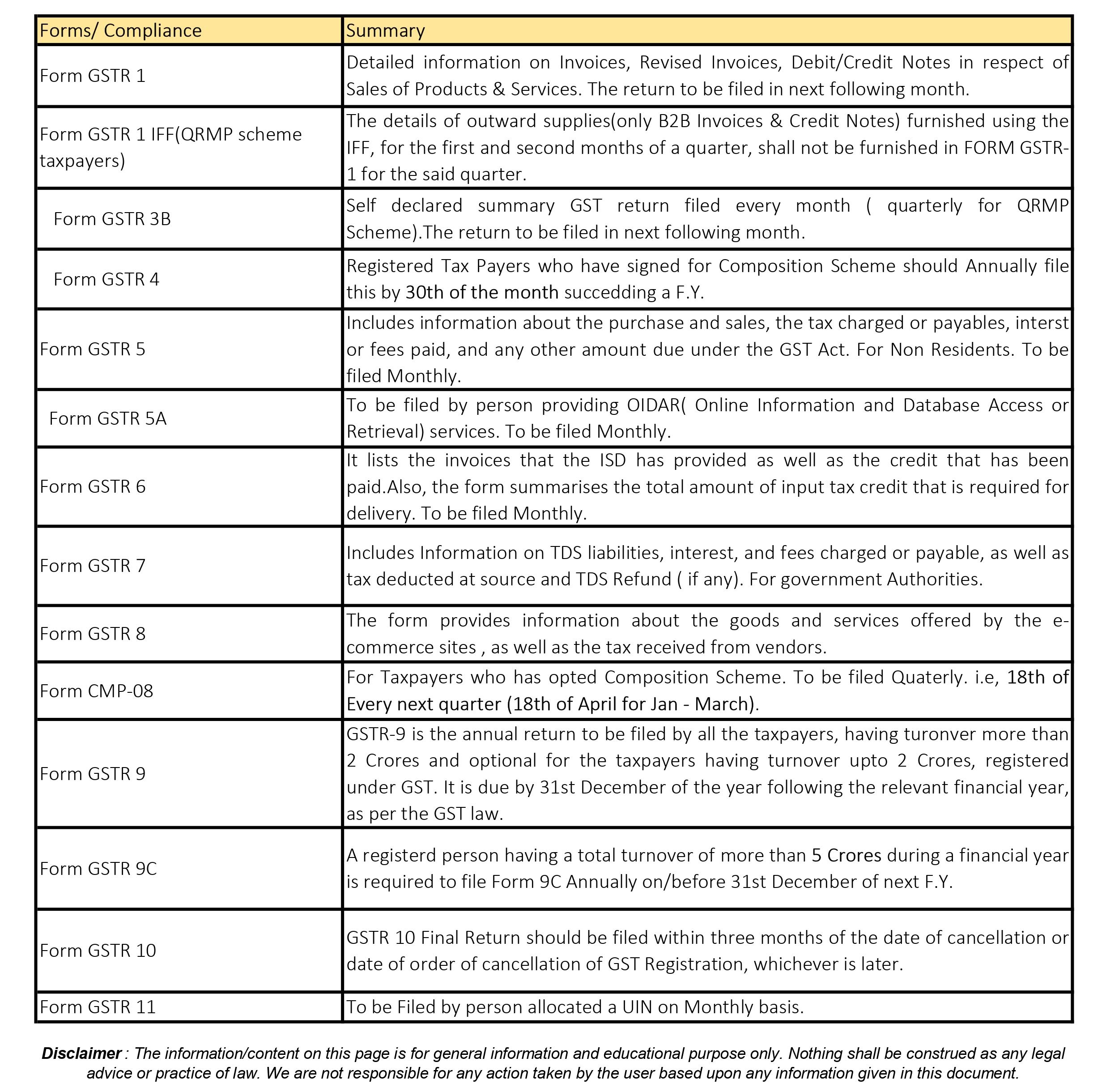

GST COMPLIANCE CALENDAR FOR THE FY 2022 23 CA Rajput Jain

https://carajput.com/blog/wp-content/uploads/2022/04/0002.jpg

Verkko 6 hein 228 k 2023 nbsp 0183 32 Rebate Under New Tax Regime FY 2022 23 Rebate Under New Tax Regime FY 2023 24 Rebate Under Old Tax Regime FY 2022 23 amp 2023 24 Less Verkko This page provides all the details you need to know about the Income Tax for the financial year 2022 23 Table of Contents Income Tax Financial Year amp Assessment

Verkko A Taxpayer can claim the benefit of rebate under section 87A for FY 2022 23 and 2023 24 only if the following conditions are satisfied You are a resident individual Your total Verkko 26 kes 228 k 2023 nbsp 0183 32 NRI income tax slab rates FY 2022 23 Note Income tax exemption limit for NRI taxpayers is up to Rs 2 50 000 NRIs opting for the new tax regime with

Income Tax Return Know Why Taxpayers Shouldn t File ITR For FY 2021 22

https://studycafe.in/wp-content/uploads/2022/04/Income-Tax-Return-Filing.jpg

Standard Deduction For Assessment Year 2021 22 Standard Deduction 2021

https://standard-deduction.com/wp-content/uploads/2020/10/latest-income-tax-slab-rates-fy-2020-21-ay-2021-22-6.jpg

https://www.incometax.gov.in/iec/foportal/help/individual/return-applicable-1

Verkko Rebate u s 87A Resident Individual whose Total Income is not more than 5 00 000 is also eligible for a Rebate of up to 100 of income tax or 12 500 whichever is less

https://www.plannprogress.com/income-tax-rebates-fy-22-23.html

Verkko 1 marrask 2022 nbsp 0183 32 income tax rebates that you can utilise for fy 2022 23 80c deduction list do you know the rebates that doesn t require fresh investments

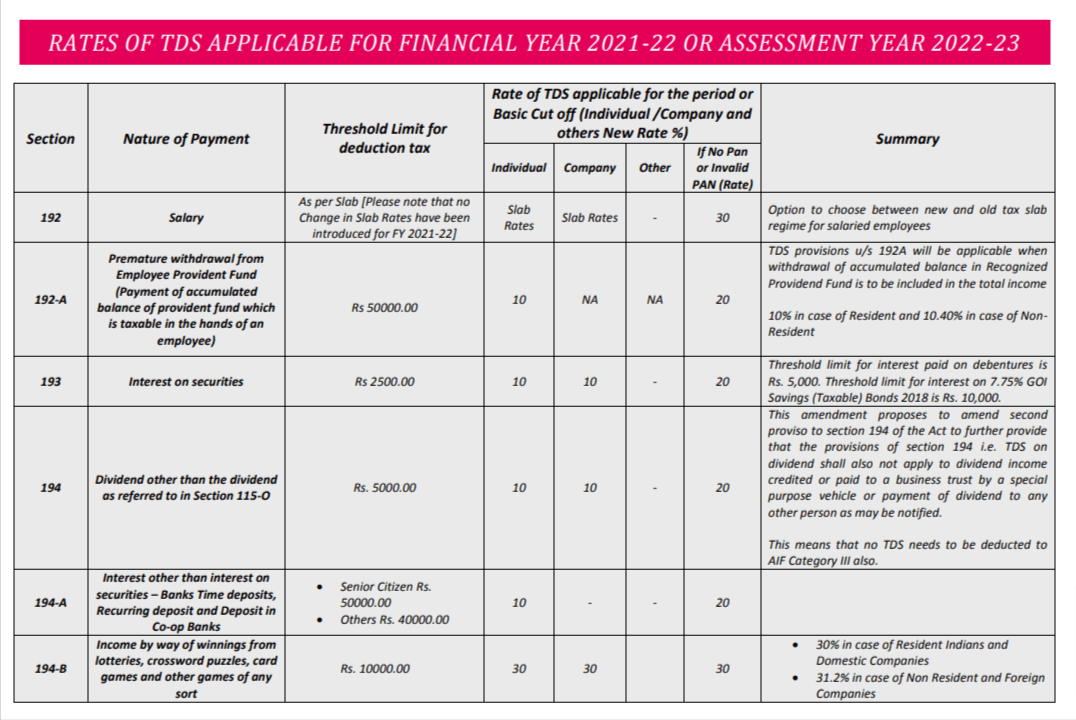

Latest TDS Rates Chart For FY 2022 23 PDF AFD CSD AFD CSD

Income Tax Return Know Why Taxpayers Shouldn t File ITR For FY 2021 22

TDS Rate Chart For Financial Year 2022 23 SA POST

Personal Income Tax Slab For FY 2020 21

Income Tax Calculator For FY 2022 23 Kanakkupillai

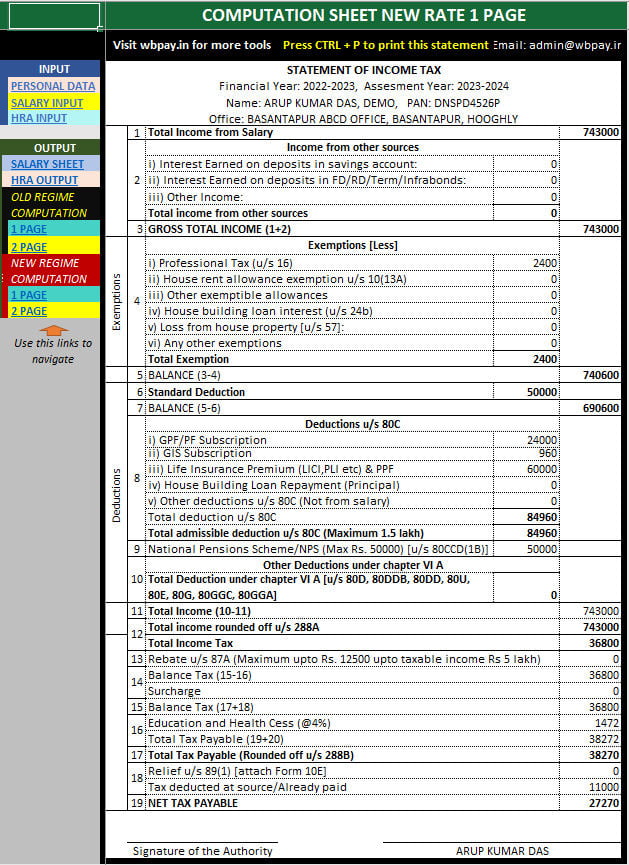

All In One Income Tax Calculator For The FY 2022 23

All In One Income Tax Calculator For The FY 2022 23

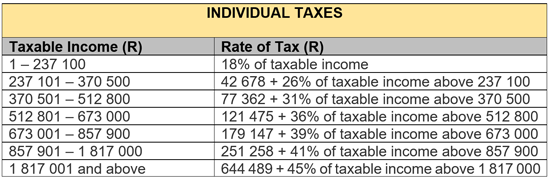

Budget 2023 Your Tax Tables And Tax Calculator SJ A Chartered

Pennsylvania s Property Tax Rent Rebate Program May Help Low income

Income Tax Slab Rates For FY 2021 22 Budget 2021 Highlights

Income Tax Rebates For Fy 2022 23 - Verkko 3 jouluk 2022 nbsp 0183 32 Steps to compute tax liability under new tax regime for FY 2022 23 i Compute the Gross Income including Income from all heads such as Salary House Property Capital Gains Other Sources