Income Tax Recovery Rebate Credit Web 13 janv 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your

Web 13 janv 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your Web 10 d 233 c 2021 nbsp 0183 32 2020 Recovery Rebate Credit Topic A Claiming the Recovery Rebate Credit if you aren t required to file a 2020 tax return Internal Revenue Service These

Income Tax Recovery Rebate Credit

Income Tax Recovery Rebate Credit

https://www.usatoday.com/gcdn/presto/2022/01/31/PDTF/b7acf011-8827-427c-87dd-1b4ac9c5ff02-extra.jpg?width=1320&height=990&fit=crop&format=pjpg&auto=webp

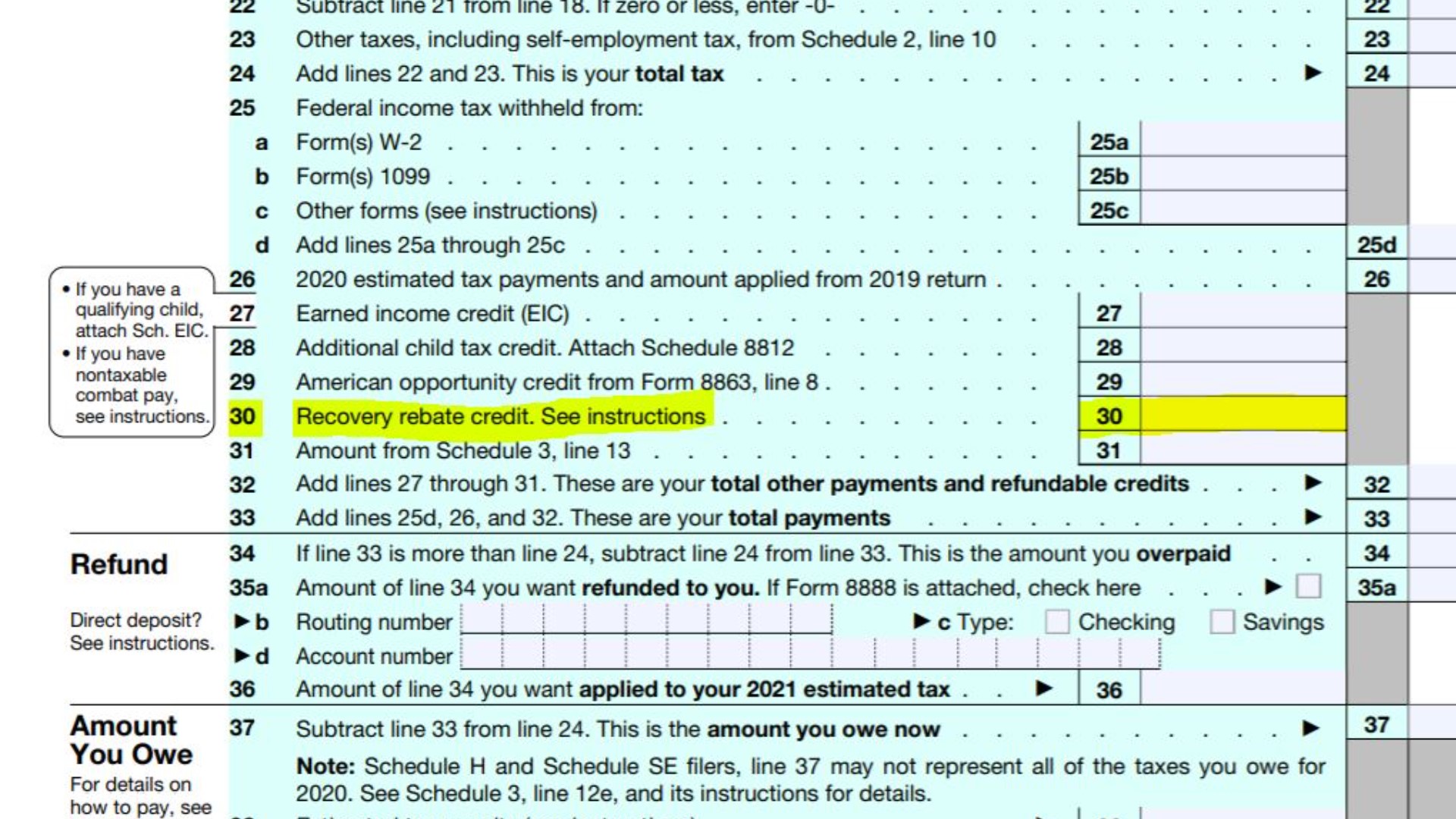

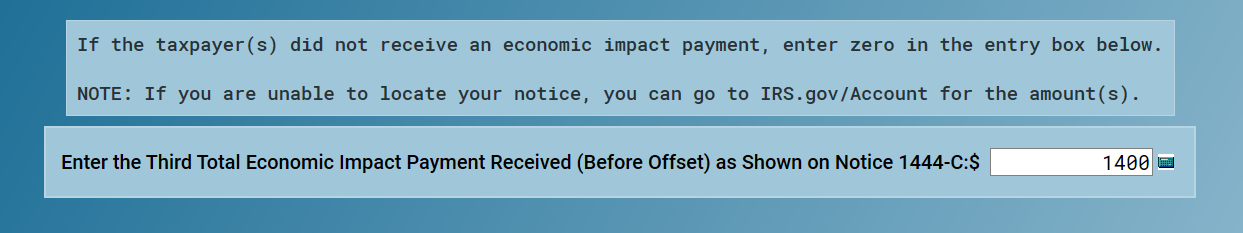

Recovery Rebate Credit Worksheet Explained Support

https://support.taxslayer.com/hc/article_attachments/4415858470797/mceclip3.png

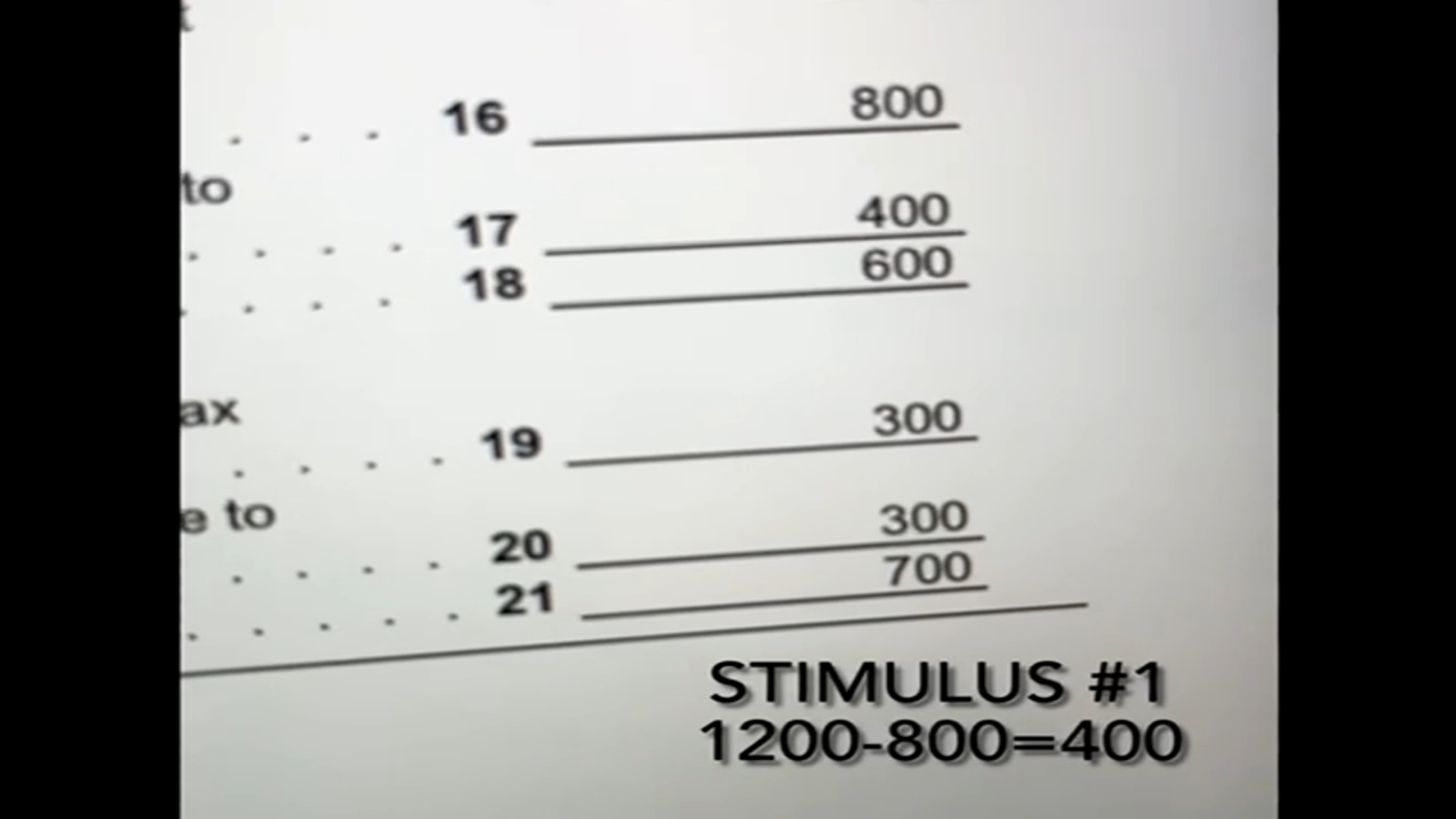

IT S NOT TOO LATE Claim A Recovery Rebate Credit To Get Your

https://media.cbs19.tv/assets/KYTX/images/3ca89be7-1360-4b18-a5ba-3c6279cb9539/3ca89be7-1360-4b18-a5ba-3c6279cb9539_1140x641.png

Web IRS Free File Prepare and file your federal income tax return for free 2020 Recovery Rebate Credit Must file a 2020 tax return to claim if eligible Get My Payment When Web 13 avr 2022 nbsp 0183 32 IR 2022 83 April 13 2022 WASHINGTON The Internal Revenue Service today updated frequently asked questions FAQs for the 2021 Recovery Rebate

Web 10 d 233 c 2021 nbsp 0183 32 If you didn t get the full first and second Economic Impact Payments you may be eligible to claim the 2020 Recovery Rebate Credit and need to file a 2020 tax return Web 15 mars 2023 nbsp 0183 32 You may be eligible to claim the 2020 Recovery Rebate Credit by filing a 2020 tax return Claim 2020 Recovery Rebate Credit For the latest updates check IRS gov coronavirus More Information

Download Income Tax Recovery Rebate Credit

More picture related to Income Tax Recovery Rebate Credit

Recovery Rebate Credit Worksheet Explained Support

https://support.taxslayer.com/hc/article_attachments/4415864484109/mceclip1.png

Learn About The Recovery Rebate Credit ATC Income Tax

https://www.atcincometax.com/wp-content/uploads/2021/01/Picture1-1.png

Recovery Rebate Credit Santa Barbara Tax Products Group

https://www.sbtpg.com/wp-content/uploads/2021/01/recovery-rebate-credit-768x403.jpg

Web Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal tax return Web 17 ao 251 t 2022 nbsp 0183 32 The Recovery Rebate Credit allowed certain taxpayers to lower their taxes via a credit for the full Economic Impact Payment if it was not received for some reason in 2020 and or 2021 If you

Web 1 janv 2021 nbsp 0183 32 To claim a recovery rebate credit taxpayers will need to reconcile their economic impact payment with any recovery rebate credit amount for which they are Web 12 oct 2022 nbsp 0183 32 What s the Recovery Rebate Credit If you didn t get a third stimulus check or you didn t get the full amount you may be able to claim the recovery rebate credit on

Recovery Rebate Credit On The 2020 Tax Return

https://www.taxgroupcenter.com/wp-content/uploads/2021/05/Recovery-rebate-credit.jpg

Didn t Get Your Stimulus Check Claim It As An Income Tax Credit

https://media.wfmynews2.com/assets/WCNC/images/7710c714-dfb9-48c1-b286-e0823fd4abe6/7710c714-dfb9-48c1-b286-e0823fd4abe6_1920x1080.jpg

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-topic-e...

Web 13 janv 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-topic-c...

Web 13 janv 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your

Desktop 2021 Recovery Rebate Credit Support

Recovery Rebate Credit On The 2020 Tax Return

Recovery Rebate Credit Won t Be Applied To Past due Federal Income Tax

T20 0262 Additional 2020 Recovery Rebates For Individuals In The

Recovery Rebate Credit 2022 2023 Credits Zrivo

T20 0233 Additional 2020 Recovery Rebates For Individuals In Senate

T20 0233 Additional 2020 Recovery Rebates For Individuals In Senate

What s The Recovery Rebate Credit Kiplinger

Wheres My Stimulus How To Redeem Payment With IRS Recovery Rebate Tax

T20 0132 Alternative Definitions Of An Eligible Dependent For Senate

Income Tax Recovery Rebate Credit - Web 19 janv 2022 nbsp 0183 32 The IRS states that your recovery rebate credit will reduce any tax you owe for 2021 or be included in your tax refund This means you will either shave off the