Income Tax Return Conditions Learn about the conditions and exceptions for filing Income Tax Returns ITR for the FY 2023 24 Find out who needs to file ITR and the conditions that apply

Published 26 Aug 2021 ICAEW s representation to the Tax Administration Framework Review pointed out that the criteria for who does and doesn t need to file a self Discover 9 situations making Income Tax Return ITR filing mandatory including conditions like turnover exceeding Rs 60 lakhs gross receipts over Rs 10

Income Tax Return Conditions

Income Tax Return Conditions

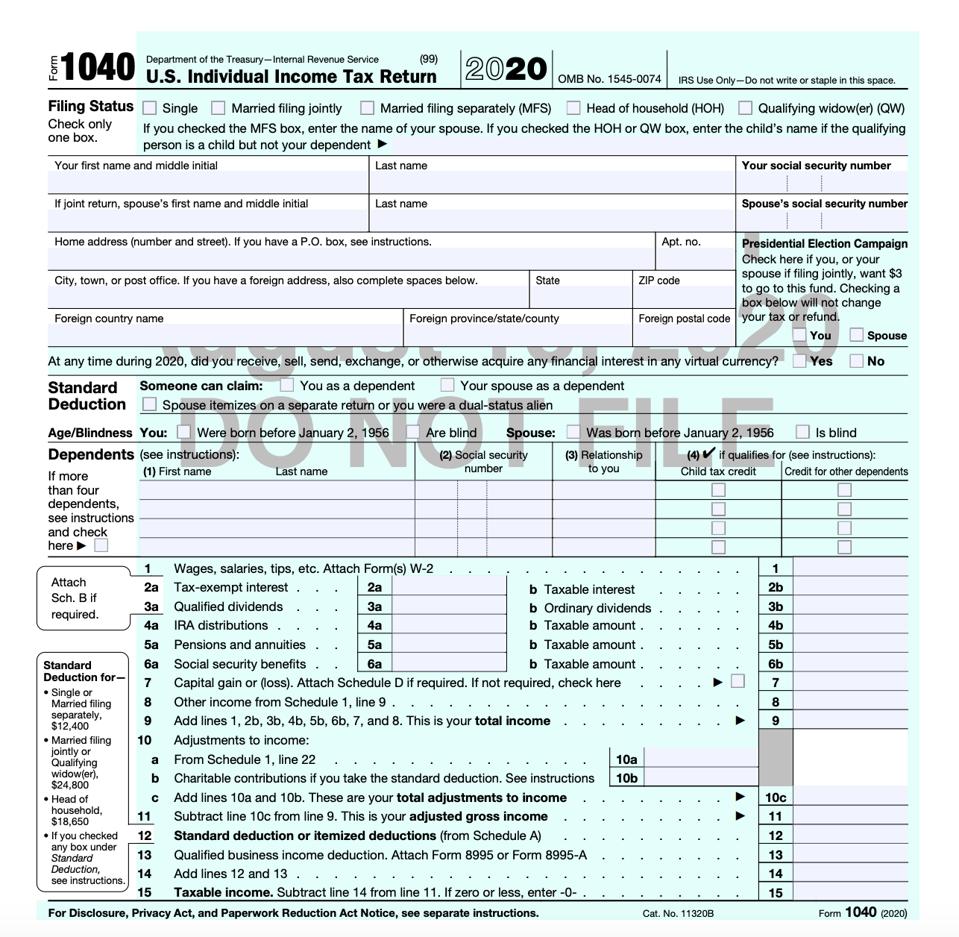

https://specials-images.forbesimg.com/imageserve/5f3ed50b6c322baa3b67a319/960x0.jpg?fit=scale

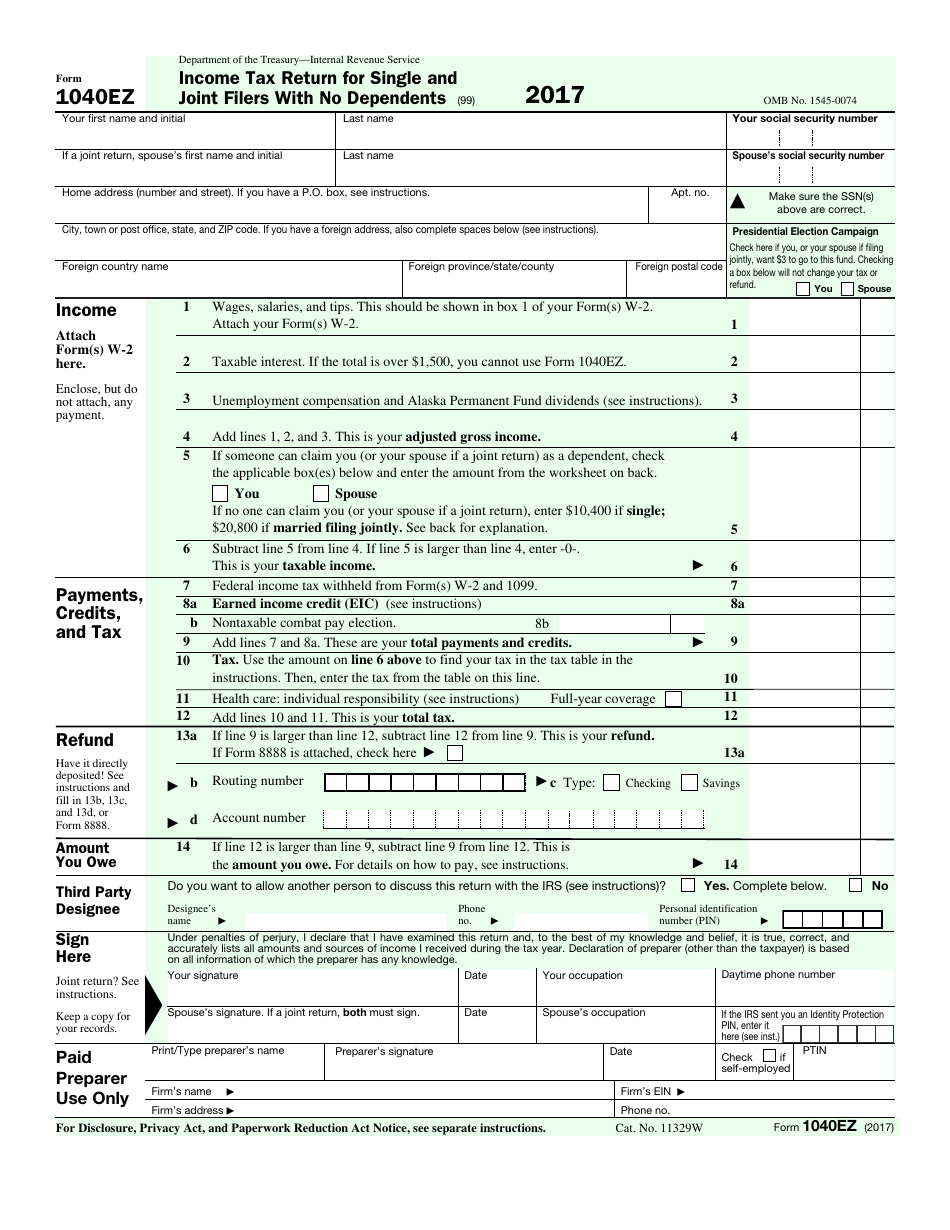

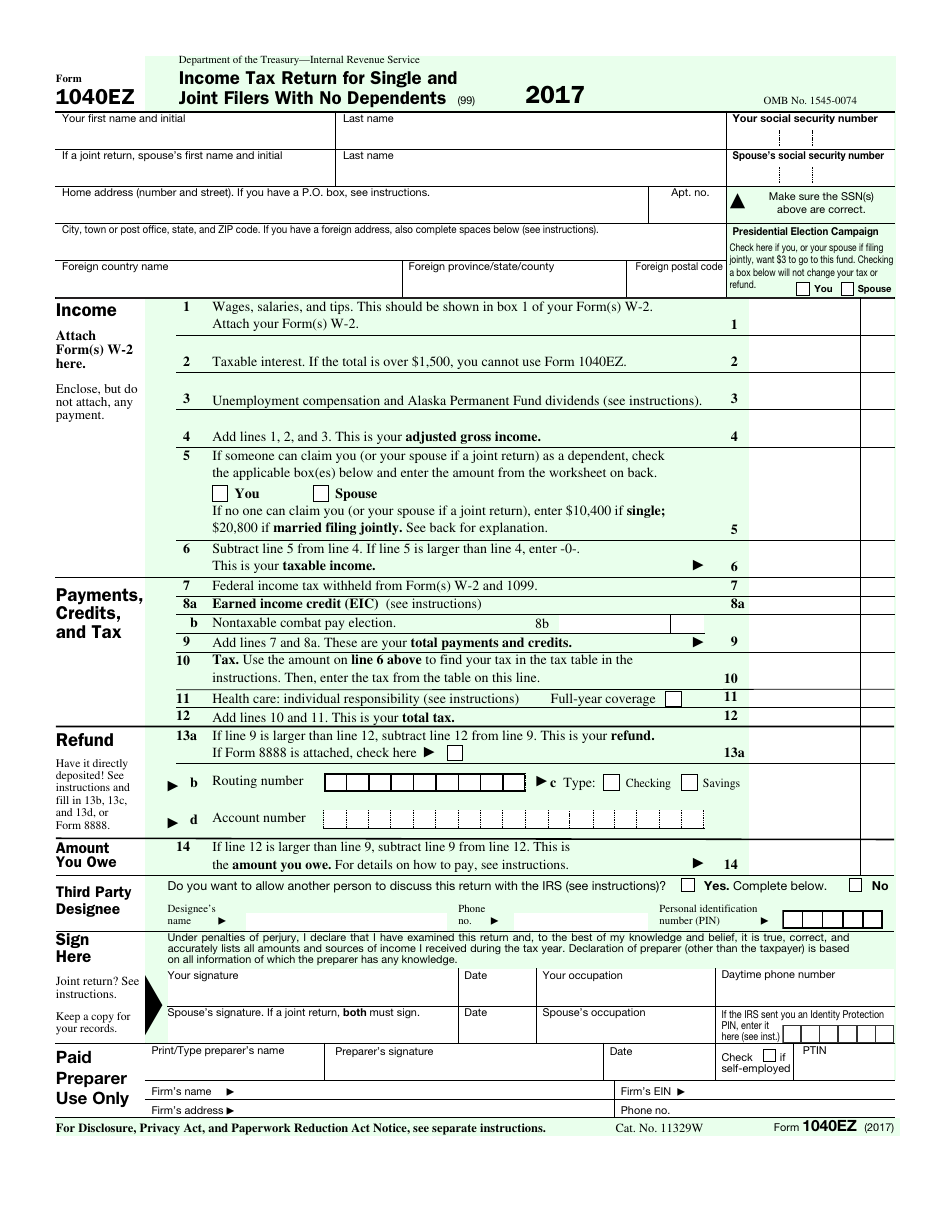

1040ez 2018 Printable Form

https://data.templateroller.com/pdf_docs_html/1352/13527/1352744/irs-form-1040ez-2017-income-tax-return-single-and-joint-filers-with-no-dependents_print_big.png

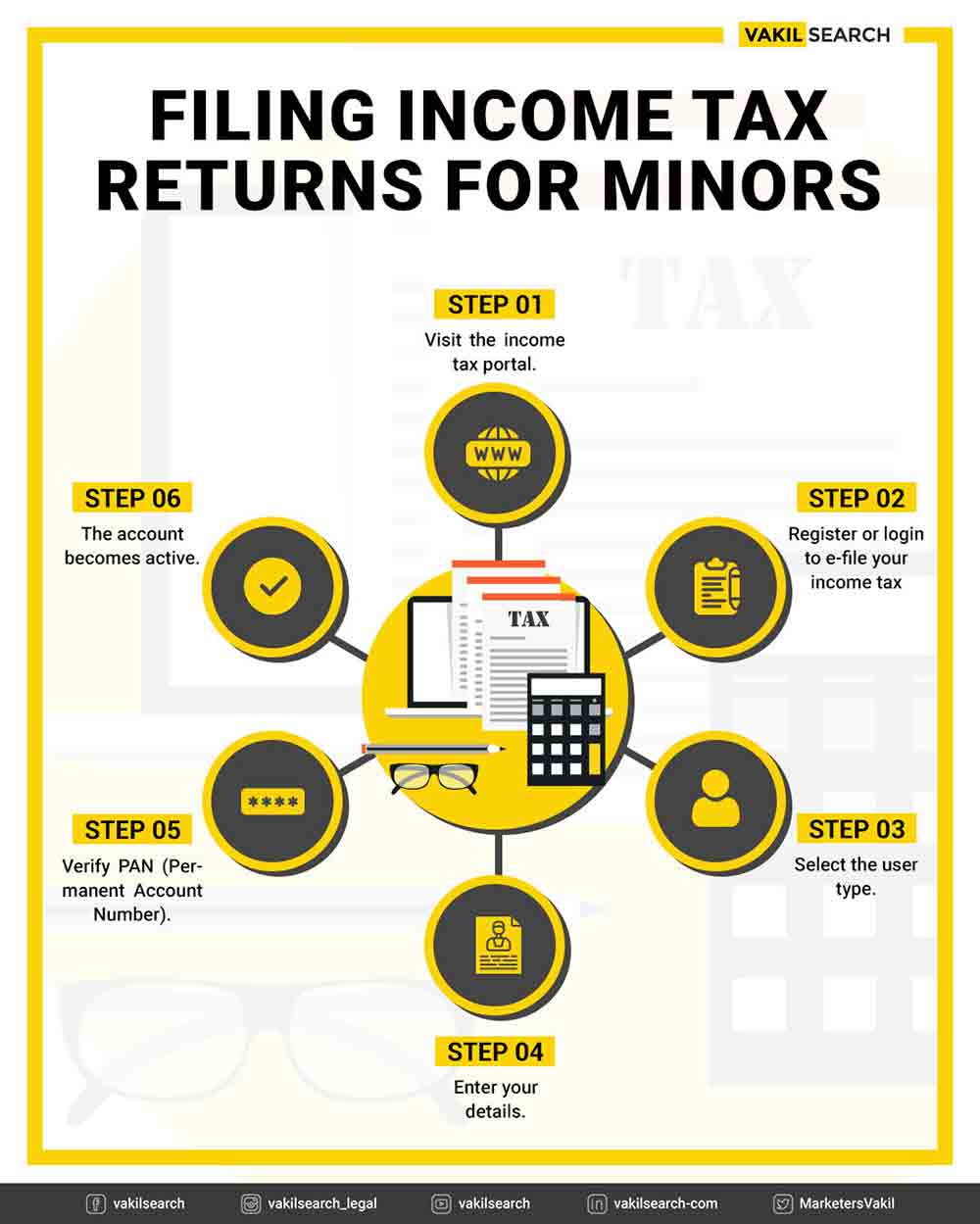

Income Tax Return Filing Online ITR EFiling Service Online

https://assets.vakilsearch.com/live-images/infographics/Income-Tax-Returnes-b4Artboard-1.jpg

Self Assessment tax returns deadlines who must send a tax return penalties corrections and returns for someone who has died ITR U or Updated Income Tax Return is the form that allows you to rectify errors or omissions and update your previous ITR It can be filed within two years from the end of the relevant assessment year The government

You must file income tax returns in accordance with Indian tax laws if your income is greater than the basic exemption threshold You must still pay tax if you meet For most salaried people the basic form is ITR 1 This form is for individuals with a total income up to Rs 50 lakh from salary one house property and other

Download Income Tax Return Conditions

More picture related to Income Tax Return Conditions

Streamline Your Individual Tax Forms And Returns With LodgeiT

http://www.lodgeit.net.au/wp-content/uploads/2017/04/Individual-Tax-Return-Form.png

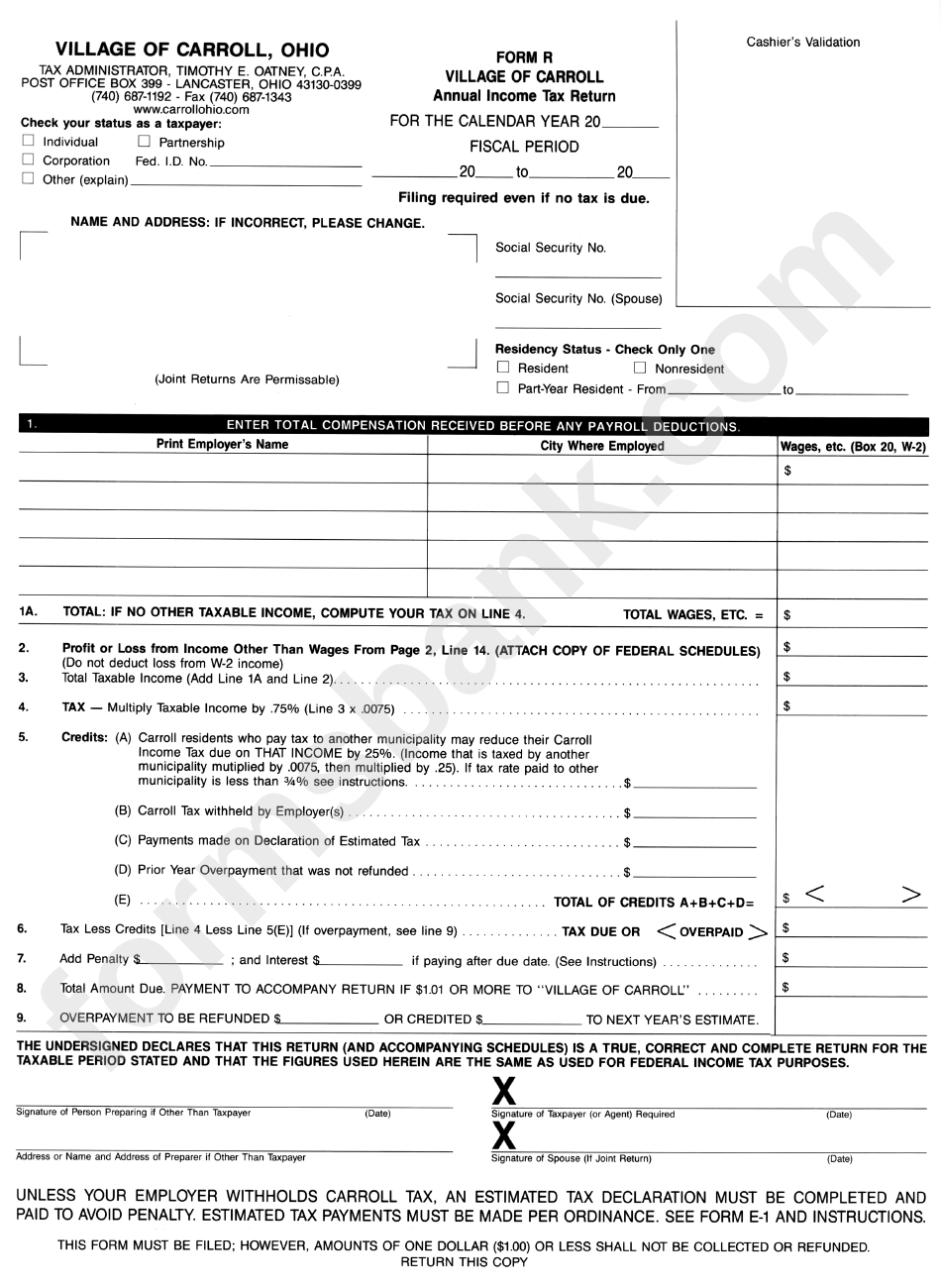

Form R Annual Income Tax Return Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/289/2895/289578/page_1_bg.png

CBDT Notifies Conditions For Compulsory Filing Of Income Tax Return

https://akhilamitassociates.com/blog/wp-content/uploads/2022/06/Untitled-Design-1024x536.jpg

Understanding income tax basics for first time filers including tax year definition assessment year explanation income sources tax slabs deductions TDS Once the income tax return ITR is filed it is mandatory to verify it within 30 days according to Income Tax I T e filing portal The last day to file ITR for the

Tax Slabs for AY 2024 25 The Finance Act 2023 has amended the provisions of Section 115BAC w e f AY 2024 25 to make new tax regime the default tax regime for the In India individuals Hindu Undivided Families HUFs and other entities are required to file their Income Tax returns subject to certain conditions Determine your Income Tax

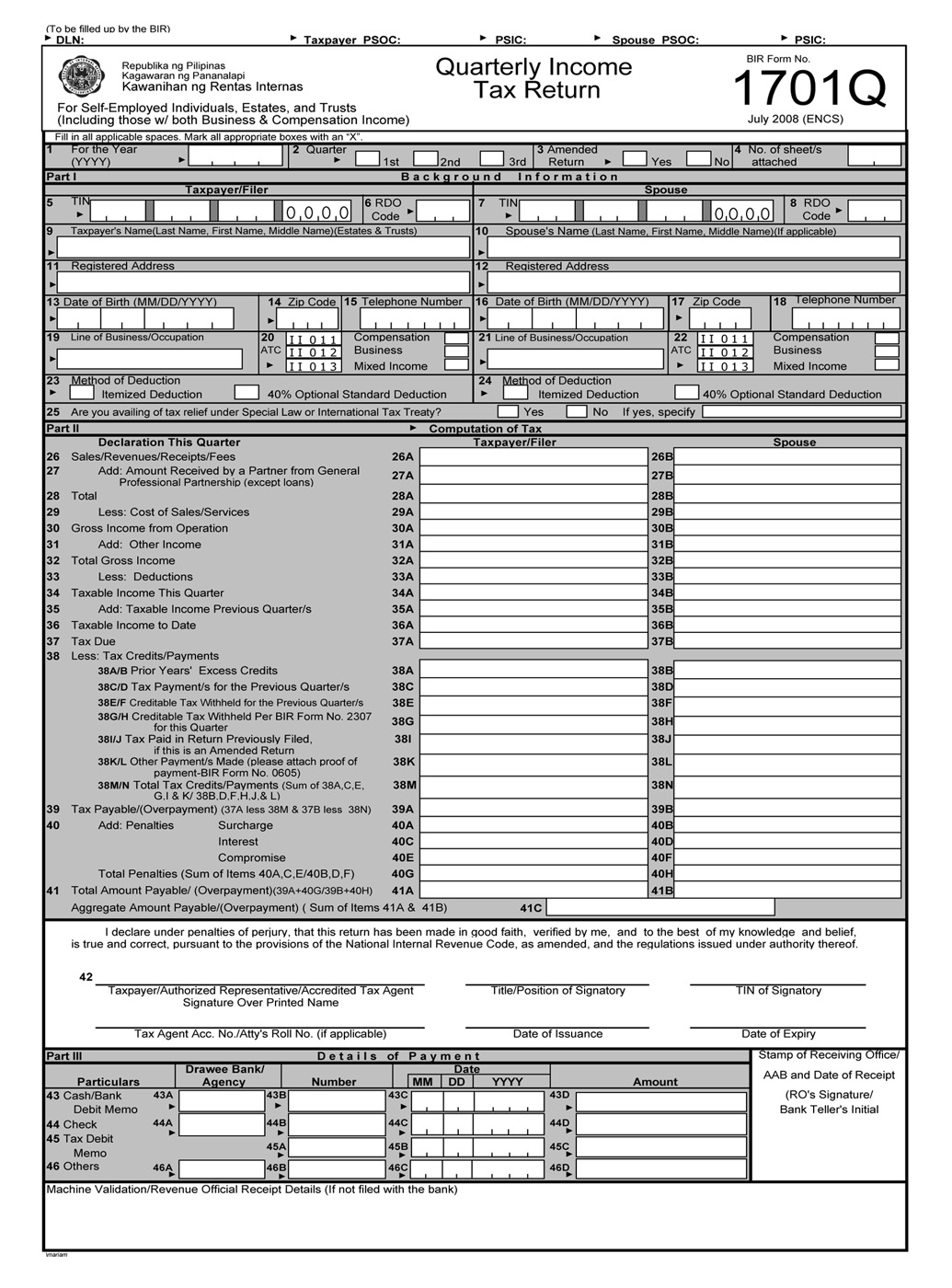

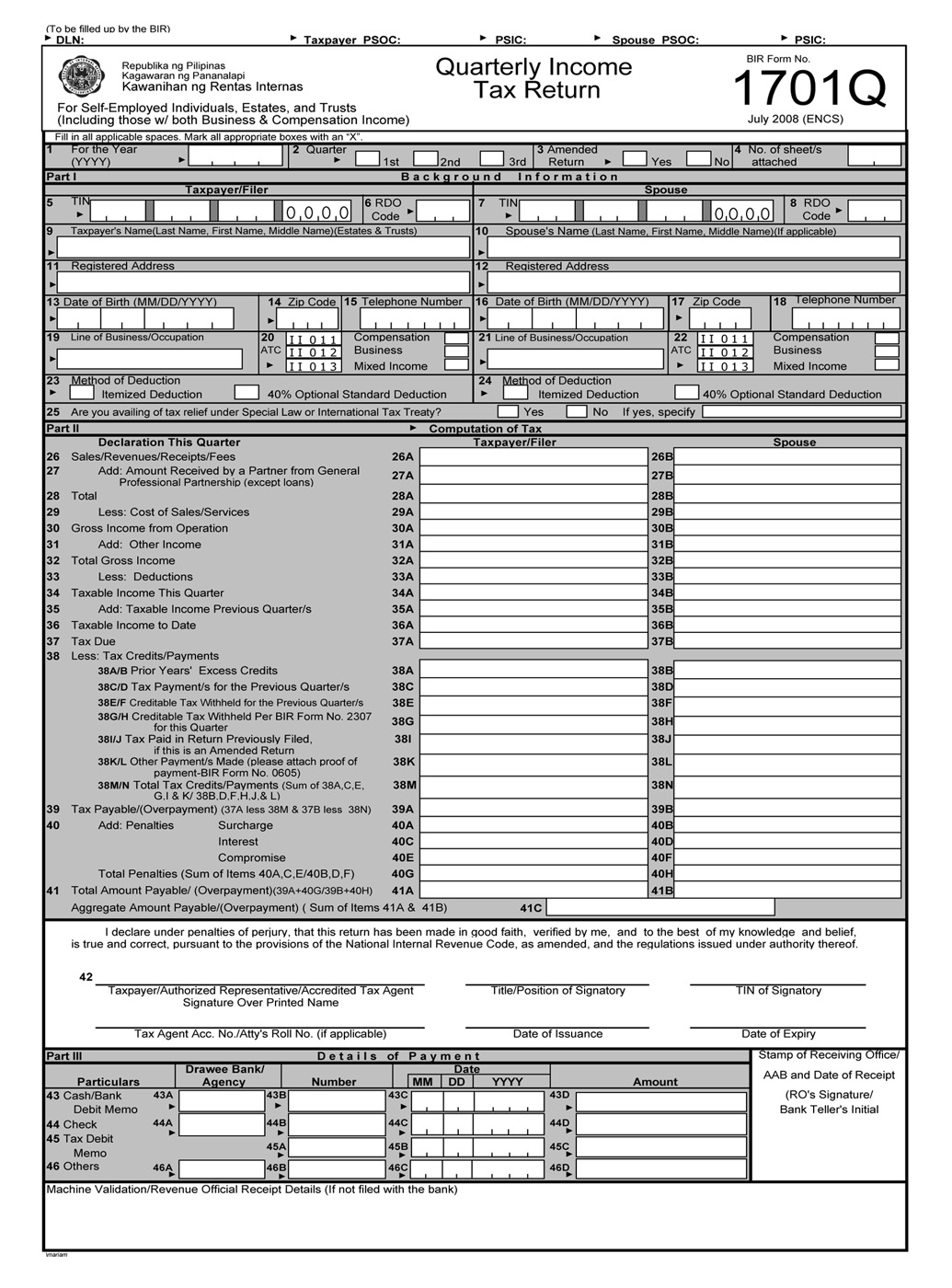

Tax Return Bir Income Tax Return

https://ifranchise.ph/wp-content/uploads/2017/06/BIR-Form-1701Q-Quarterly-Income-Tax-Return.jpg

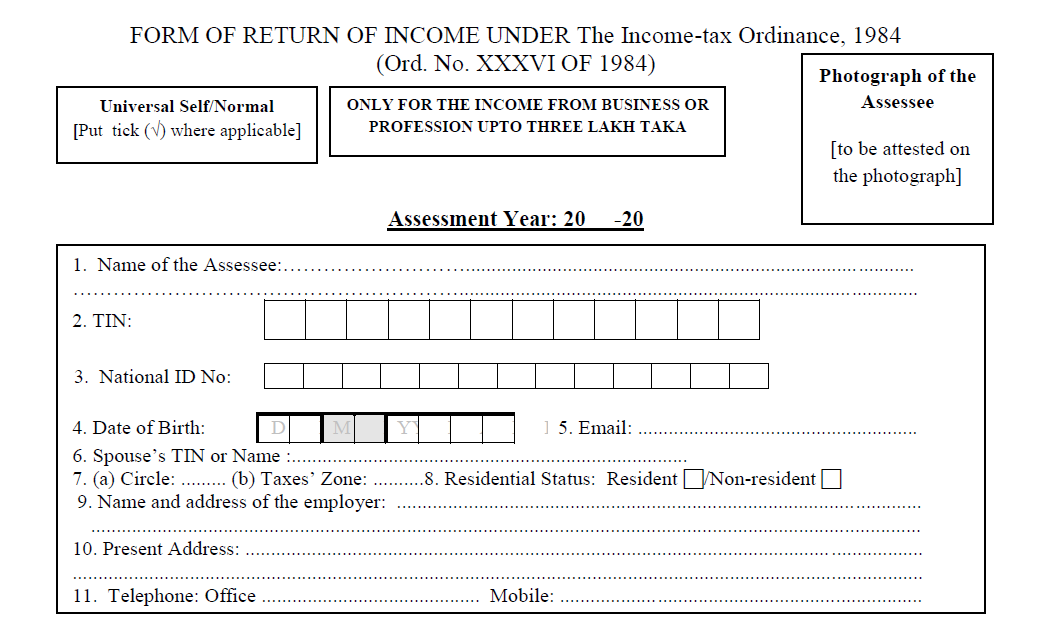

1 Page Income Tax Return Form BD 2021 22 PDF Excel Format Protibad Com

https://allresultbd.com/wp-content/uploads/2021/07/1-Page-Income-Tax-Return-Form.png

https://tax2win.in/guide/conditions-exceptions-itr...

Learn about the conditions and exceptions for filing Income Tax Returns ITR for the FY 2023 24 Find out who needs to file ITR and the conditions that apply

https://www.icaew.com/insights/tax-news/2021/aug...

Published 26 Aug 2021 ICAEW s representation to the Tax Administration Framework Review pointed out that the criteria for who does and doesn t need to file a self

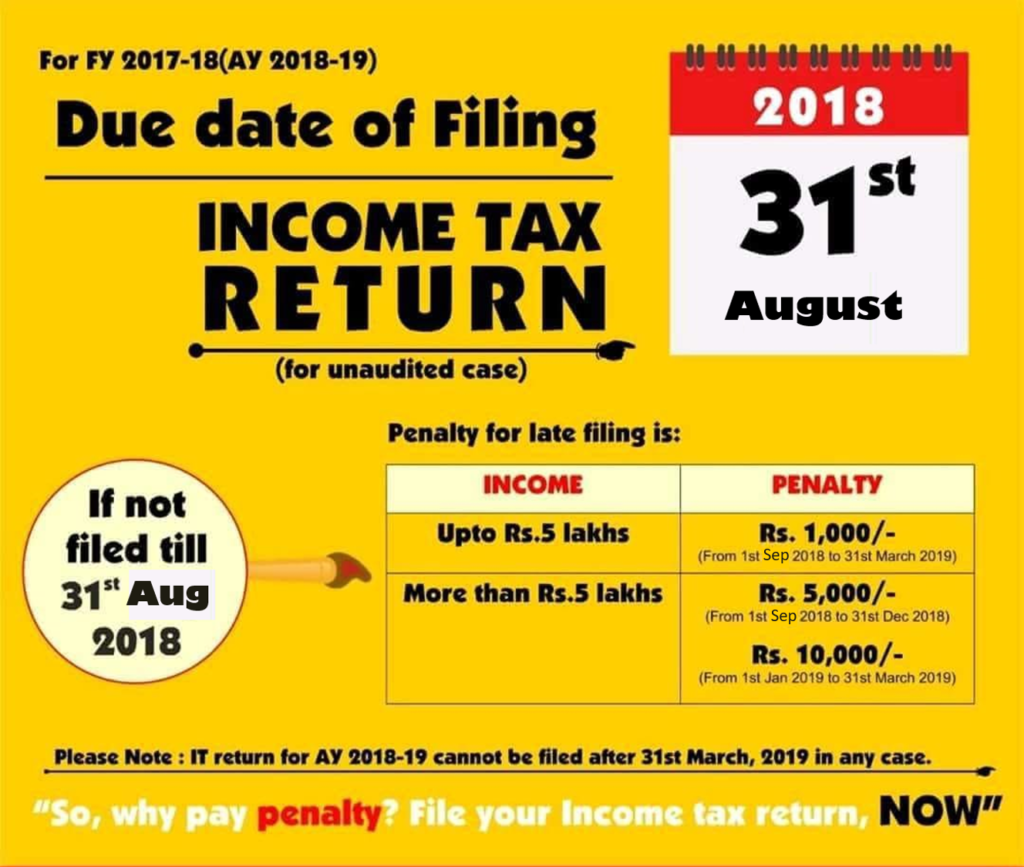

Income Tax Return Due Dates Types Penalties FY 2018 19 AY 2019 20

Tax Return Bir Income Tax Return

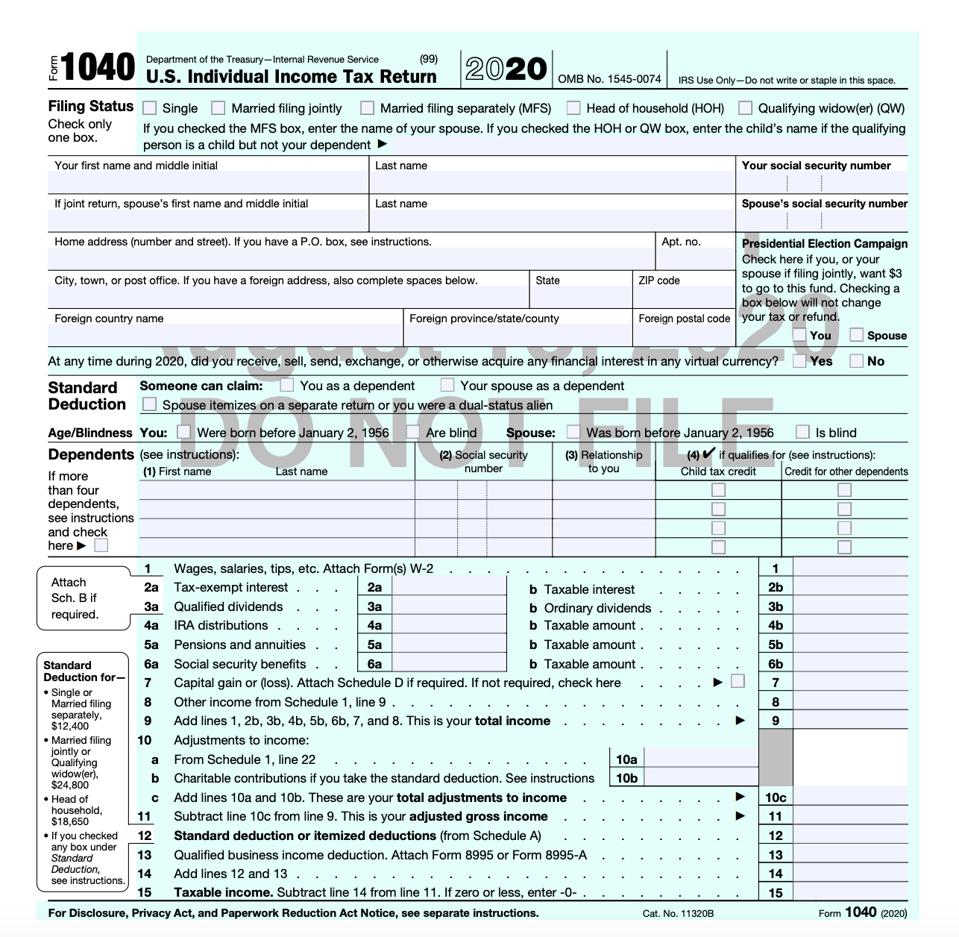

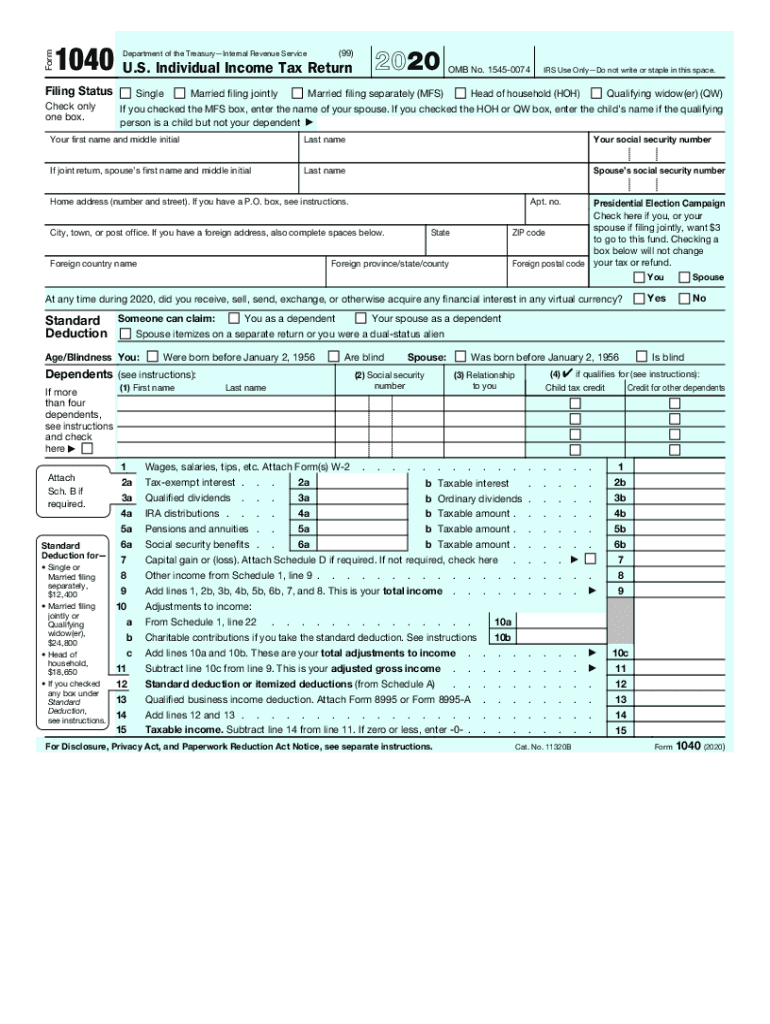

1040 Tax 2020 2023 Form Fill Out And Sign Printable PDF Template

Income Tax Return ITR Filing Aapka Consultant

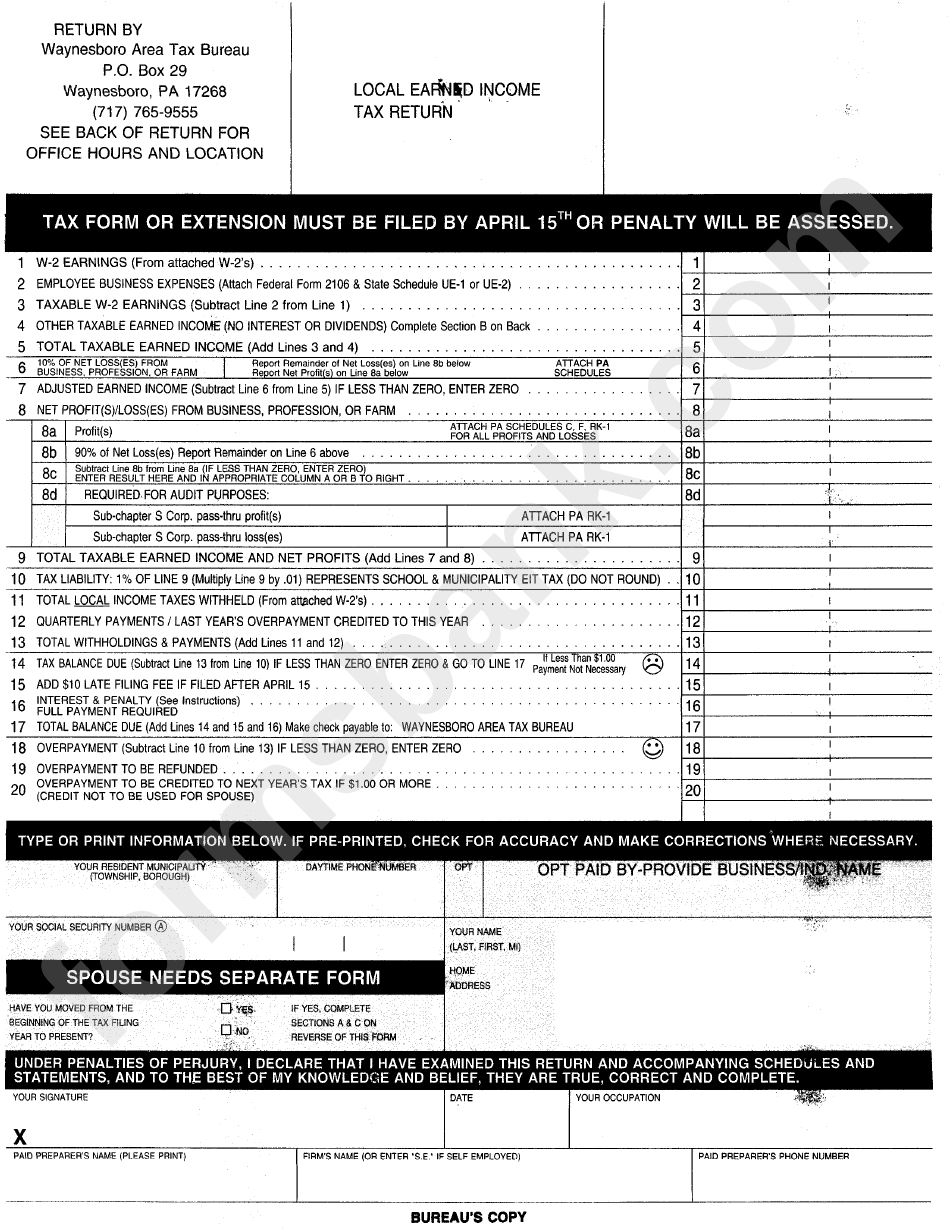

Local Earned Income Tax Return Form Printable Pdf Download

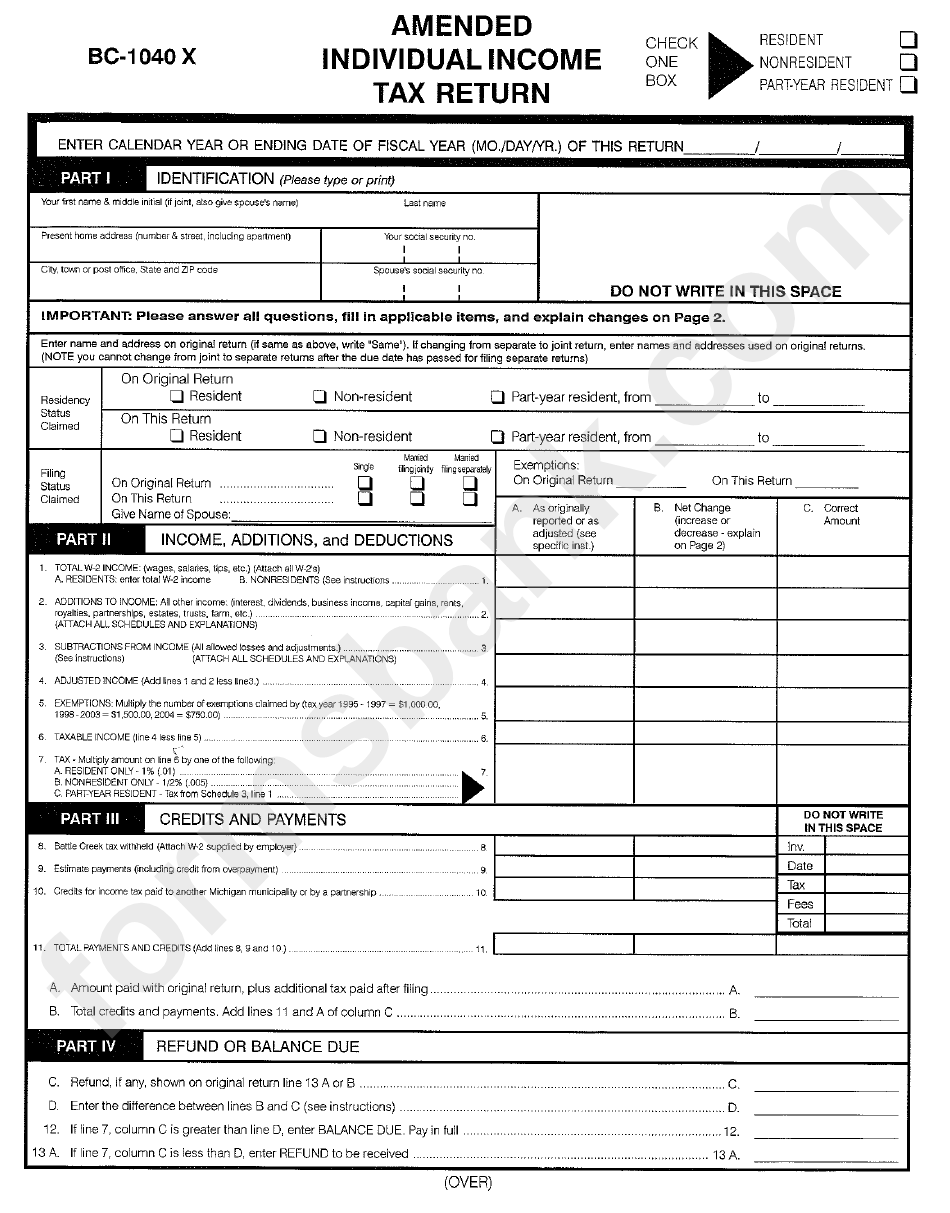

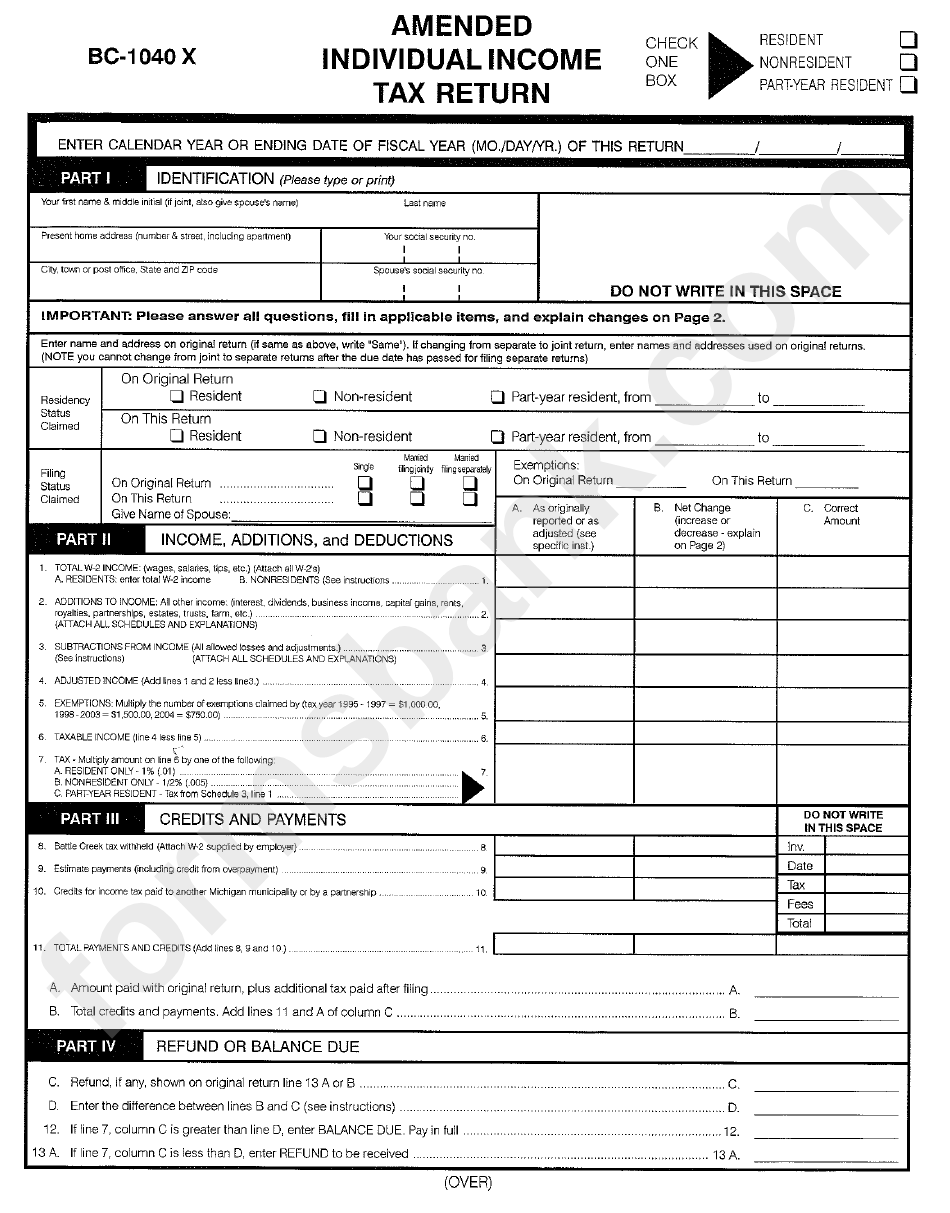

Form Bc 1040 X Amended Individual Income Tax Return Printable Pdf

Form Bc 1040 X Amended Individual Income Tax Return Printable Pdf

Who Should File Income Tax Return A Y 2023 24

8 Reasons To Hire Someone To Help With Your Income Tax Planning Black

Can I File Income Tax Return For AY 2017 18

Income Tax Return Conditions - You must file income tax returns in accordance with Indian tax laws if your income is greater than the basic exemption threshold You must still pay tax if you meet