Income Tax Return Due Date Extension For Ay 2021 22 Penalty The due date of furnishing of Return of Income for the Assessment Year 2021 22 which was 31st October 2021 under sub section 1 of section 139 of the Act as extended to

The due date of furnishing of Return of Income for the Assessment Year 2021 22 which was 30 th November 2021 under sub section 1 of section 139 of the Act as extended to 31 st The ITR Filing Due Date is the date up to which taxpayers can file income tax returns without facing a penalty Hence Income Tax Return Filing Due Date Extended for AY 2021 22 is a major relief to taxpayers and one time

Income Tax Return Due Date Extension For Ay 2021 22 Penalty

Income Tax Return Due Date Extension For Ay 2021 22 Penalty

https://img.indiafilings.com/learn/wp-content/uploads/2019/07/12004316/Income-Tax-Due-Date-Extended.jpg

Knowledge Bank ThinkWrite

https://www.thinkwriteba.com/wp-content/uploads/2021/11/income-tax-return-filing-2021-last-date-extended-defd84d9.jpg

INCOME TAX RETURN DUE DATE FY 2021 22 AY 2022 23 WILL ITR DUE DATE

https://i.ytimg.com/vi/_z-Z3hV2SmQ/maxresdefault.jpg

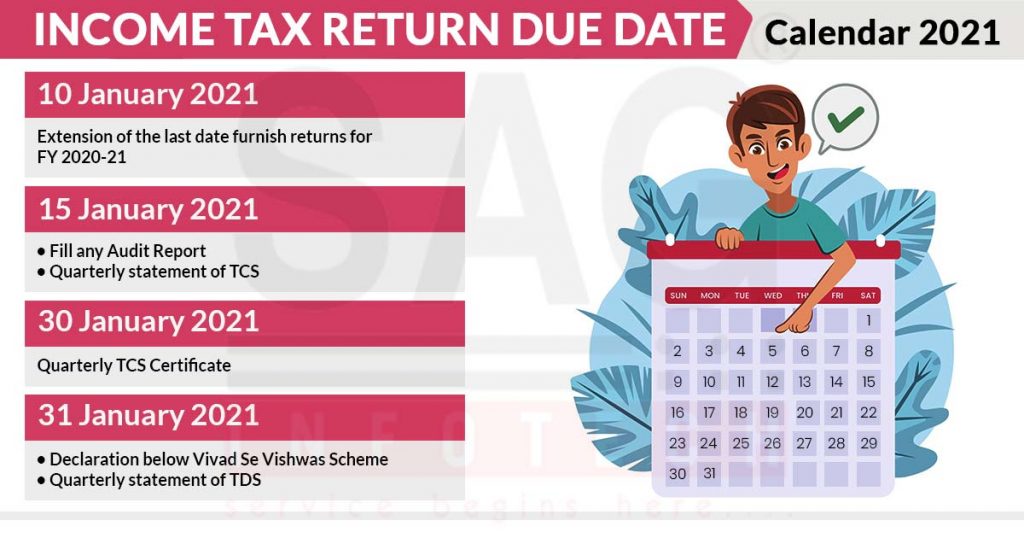

CBDT now announced that the due date of furnishing of Return of Income for the Assessment Year 2021 22 is extended to 15th February 2022 The earlier due date is as follows which is The due date of furnishing of Return of Income for the Assessment Year 2021 22 which was 31st July 2021 under sub section 1 of section 139 of the Act as extended to 30th September 2021 vide Circular No 9 2021 dated

ITR Filing Date 2021 The ITR filing last date for AY 2021 22 has now been extended and instead of 30th September 2021 the income tax return due date now stands at December 31 2021 As per the CBDT Notification on 9th September the last date for filing income tax return for AY 2021 22 is extended for Salaried employees and Pensioners from the

Download Income Tax Return Due Date Extension For Ay 2021 22 Penalty

More picture related to Income Tax Return Due Date Extension For Ay 2021 22 Penalty

Due Date To File Income Tax Return For AY 2023 24 Is 31st Of July 2023

https://taxguru.in/wp-content/uploads/2023/06/Income-tax-return-filing-1.jpg

Know The Last Date To File Income Tax Return For FY 2021 22 AY 2022 23

https://studycafe.in/wp-content/uploads/2022/07/ITR.jpg

Last Date To File Revised Itr For Ay 2022 23 Printable Forms Free Online

https://www.taxmann.com/post/wp-content/uploads/2021/12/01_Blog-Post-2.jpg

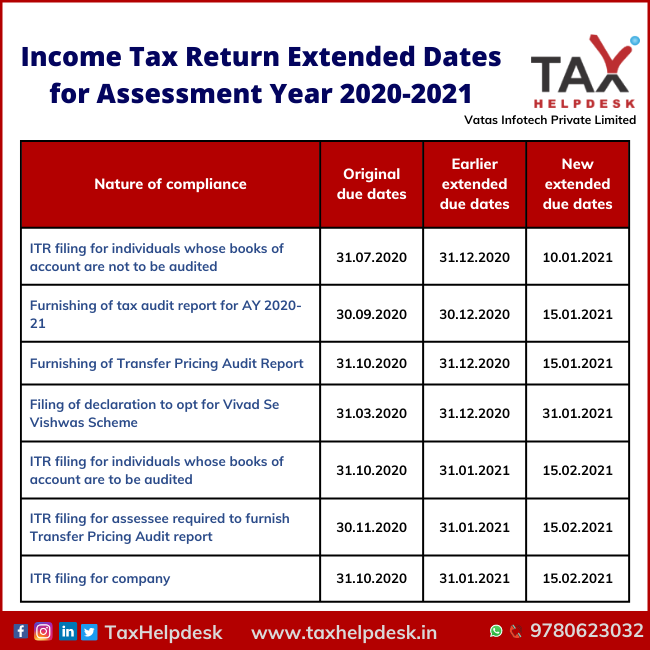

The due date of furnishing of Return of Income for the Assessment Year 2021 22 which is 31st October 2021 under sub section 1 of section 139 of the Act as extended to 30th November 2021 vide Circular NO 9 2021 dated The due date of furnishing of Return of Income for the Assessment Year 2021 22 which is 31st October 2021 under sub section 1 of section 139 of the Act as extended to 30th November 2021 vide Circular

15 rowsThe Central Board of Direct Taxes in exercise of its power under section 119 of the Income tax Act 1961 provides relaxation on Income Tax due dates as per The last date for filing of belated ITR filing for AY 2021 22 is 31st March 2022 According to the Income Tax Rules under Section 234F the penalty for belated ITR could be

What Is Standard Deduction For Ay 2021 22 Standard Deduction 2021

https://standard-deduction.com/wp-content/uploads/2020/10/latest-income-tax-slab-rates-fy-2020-21-ay-2021-22-12.jpg

Due Date ITR Fiing For AY 2023 24 Is July 31st 2023 Academy Tax4wealth

https://academy.tax4wealth.com/public/storage/uploads/1686567553-file-income-tax-return-for-ay-2023-24-by-july-31st-2023.jpg

https://pib.gov.in › PressReleasePage.aspx

The due date of furnishing of Return of Income for the Assessment Year 2021 22 which was 31st October 2021 under sub section 1 of section 139 of the Act as extended to

https://www.incometax.gov.in › iec › foportal › sites...

The due date of furnishing of Return of Income for the Assessment Year 2021 22 which was 30 th November 2021 under sub section 1 of section 139 of the Act as extended to 31 st

Last Date To File Income Tax Return ITR For FY 2022 23 AY 2023 24

What Is Standard Deduction For Ay 2021 22 Standard Deduction 2021

Extend Due Dates Of Income Tax Returns From 31 07 2022 To 31 08 2022

Income Tax Return Filing Due Date Extended For FY 2019 20

Tax Compliances In Fy 2021 22 Imp Statutory Compliances Due Dates Hot

Four Days To ITR 2021 22 Filing Deadline Don t Forget To E verify Your

Four Days To ITR 2021 22 Filing Deadline Don t Forget To E verify Your

2021 E calendar Of Income Tax Return Filing Due Dates For Taxpayers

How To File Income Tax Return Online Itr Last Date

Taxation Updates Mayur J Sondagar On Twitter Income Tax Return And

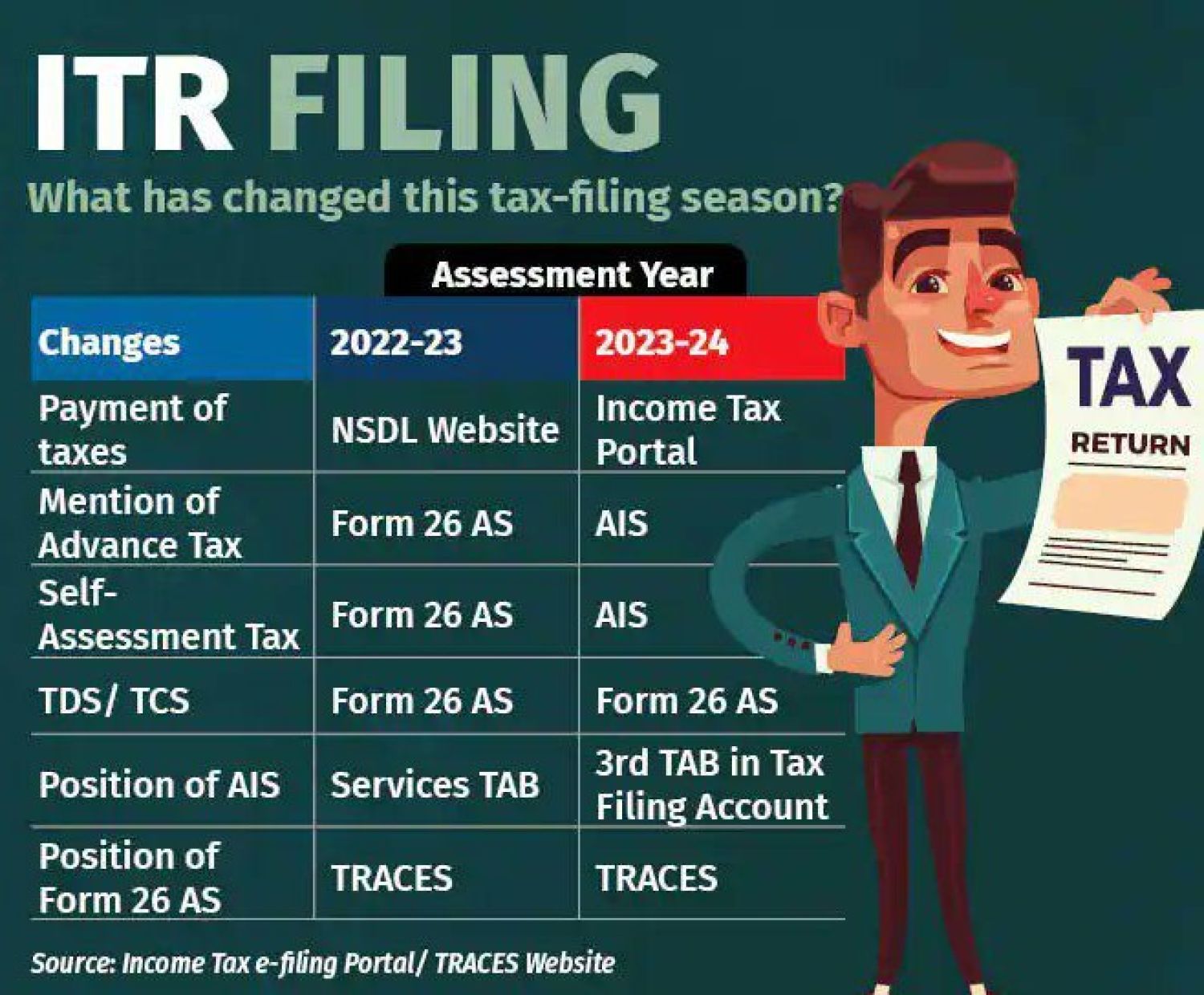

Income Tax Return Due Date Extension For Ay 2021 22 Penalty - This means in this case for the financial year 2021 22 AY 2022 23 the due date of filing ITR would be 31st October 2022 Please note with effect from the assessment year