Income Tax Return Due Date For Company To be furnished one month before the due date for furnishing the return of income under sub section 1 of section 139 Report from a chartered accountant containing details of all

Last Date to File Income Tax Return ITR for FY 2023 24 AY 2024 25 Without Late Fees was 31st July 2024 If you missed this deadline you can still file a belated return by 31st December 2024 However late filing may The due date for filing returns has been extended from 31st October 2024 to 15th November 2024 for the assessees referred to in clause a of Explanation 2 to sub section 1 of section 139 of the Act Please refer

Income Tax Return Due Date For Company

Income Tax Return Due Date For Company

https://cacube.in/wp-content/uploads/2018/08/pexels-photo-6863259.jpeg

Income Tax India On Twitter Have You Filed Your ITR Yet Due Date To

https://pbs.twimg.com/media/FXhKfnhUUAAxG68.jpg:large

File Your Income Tax Return Now For AY 2023 24 Only 28 Days Left

https://www.nbaoffice.com/wp-content/uploads/2023/06/Green-and-White-Tax-Day-Social-Media-Graphic.png

CBDT Extends Due Date for furnishing Return of Income for Assessment Year 2024 25 The due date for assessees under clause a of Explanation 2 to Sub Section 1 of To be furnished one month before the due date for furnishing the return of income under sub section 1 of section 139 Report in case of a foreign company to which section 115JB

For persons having business professional income the income tax return is required to be filed electronically on or before 31 October of the succeeding tax year In case the transfer pricing provisions are applicable the The last date to file your income tax return ITR for the assessment year 2024 25 in India is July 31 2024 If you file your ITR after the due date you ll be liable to pay a late fee

Download Income Tax Return Due Date For Company

More picture related to Income Tax Return Due Date For Company

Due Date To File Income Tax Return For AY 2023 24 Is 31st Of July 2023

https://taxguru.in/wp-content/uploads/2023/06/Income-tax-return-filing-1.jpg

Estate Income Tax Return Due Date 2021 Anibal Greenlee

https://images.moneycontrol.com/static-mcnews/2022/07/Penalties-2-belate-returns-ITR-.jpg

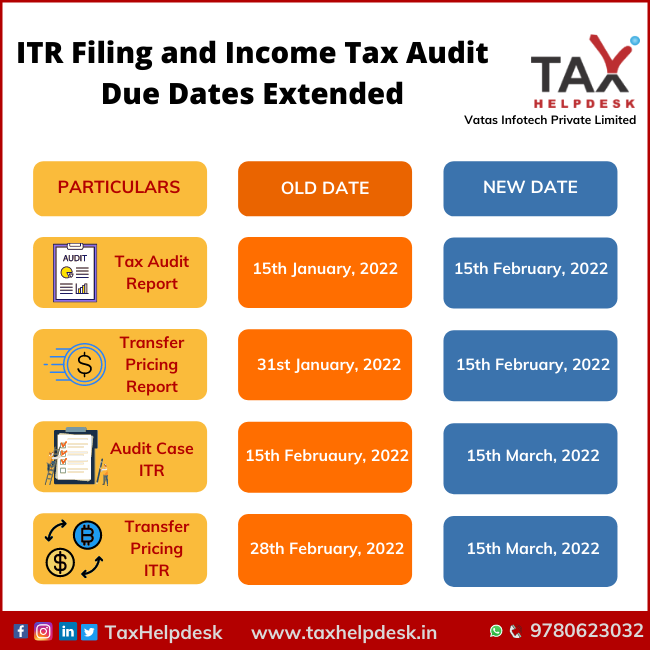

ITR Filing Income Tax Audit Due Dates Extended FY 2020 21 TaxHelpdesk

https://www.taxhelpdesk.in/wp-content/uploads/2022/01/ITR-Filing-and-Income-Tax-Audit-Due-Dates-Extended.png

Last date to file Income Tax Return ITR for Financial Year 2023 24 Assessment Year 2024 25 without late fees is 31st July 2024 However if you fail to file within the due date you can still You need to lodge a tax return each year to report your assessable income and claim deductions You may also need to lodge yearly reports or returns for PAYG withholding

For FY 2023 24 AY 2024 25 the original ITR filing deadline is July 31 2024 with no late fee If the return is filed after the due date you may be liable to pay interest under Section 234A In Discover the due dates for filing Income Tax Returns online for FY 2022 23 Learn about ITR forms deadlines for individuals companies LLPs firms and HUFs

Due Date ITR Fiing For AY 2023 24 Is July 31st 2023 Academy Tax4wealth

https://academy.tax4wealth.com/public/storage/uploads/1686567553-file-income-tax-return-for-ay-2023-24-by-july-31st-2023.jpg

Estate Income Tax Return Due Date 2021 Anibal Greenlee

https://ebizfiling.com/wp-content/uploads/2022/03/Due-date-ITR.png

https://www.incometax.gov.in › ... › return-applicable

To be furnished one month before the due date for furnishing the return of income under sub section 1 of section 139 Report from a chartered accountant containing details of all

https://tax2win.in › guide › itr-filing-due-…

Last Date to File Income Tax Return ITR for FY 2023 24 AY 2024 25 Without Late Fees was 31st July 2024 If you missed this deadline you can still file a belated return by 31st December 2024 However late filing may

Income To File Tax Return INCOMEBAU

Due Date ITR Fiing For AY 2023 24 Is July 31st 2023 Academy Tax4wealth

Taxation Updates Mayur J Sondagar On Twitter Income Tax Return And

Last Date To File Income Tax Return ITR For FY 2022 23 AY 2023 24

Latest ITR Forms Archives Certicom

Income Tax Returns Filing Due Dates Extended Ebizfiling

Income Tax Returns Filing Due Dates Extended Ebizfiling

Corporate Tax Filing Deadline 2023 Singapore Pay Period Calendars 2023

File Your Income Tax Return By 31st July Ebizfiling

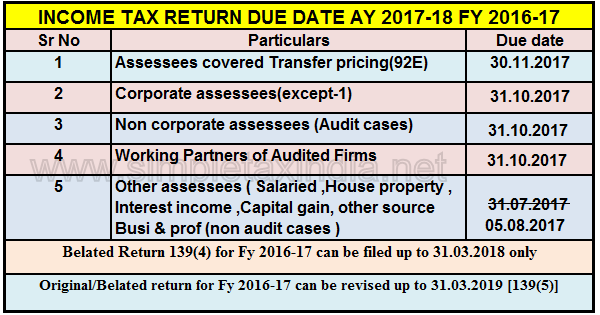

DUE DATE TO FILE INCOME TAX RETURN AY 2017 18 FY 2016 17 SIMPLE TAX INDIA

Income Tax Return Due Date For Company - For persons having business professional income the income tax return is required to be filed electronically on or before 31 October of the succeeding tax year In case the transfer pricing provisions are applicable the