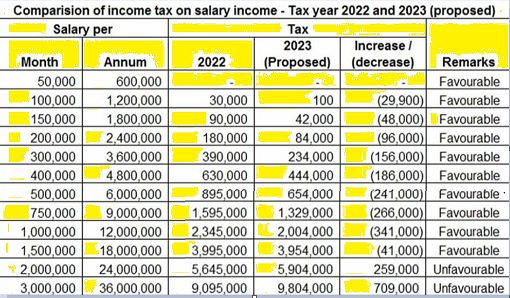

Income Tax Return For Salaried Person In Pakistan As per the latest income tax regulations for the year 2024 2025 the following slabs and income tax rates will be applicable for salaried persons 1 Where the taxable salary income does not

Tutorial for filing of Tax Returns for Tax Year 2023 in Urdu Tutorial for filing of Tax Returns for Tax Year 2023 in English Income Tax Return for Salaried Persons Part I Documents required for filing of Income Tax Return for a Sole Proprietor FreeLancer Self employed and Business Individual Every person other than

Income Tax Return For Salaried Person In Pakistan

Income Tax Return For Salaried Person In Pakistan

https://www.befiler.com/wordpress/wp-content/uploads/2022/08/WhatsApp-Image-2022-08-15-at-12.13.16-PM.jpeg

Income Tax Return Filing In Lahore Pakistan Tax Filing Procedure

https://www.taxcare.pk/wp-content/uploads/2020/04/INCOME-TAX-RETURN-FILING-IN-PAKISTAN-TAX-CARE.png

How To File Income Tax Return For Salaried Person 2023 In Pakistan

https://i.ytimg.com/vi/0yNBPKk7plI/maxresdefault.jpg

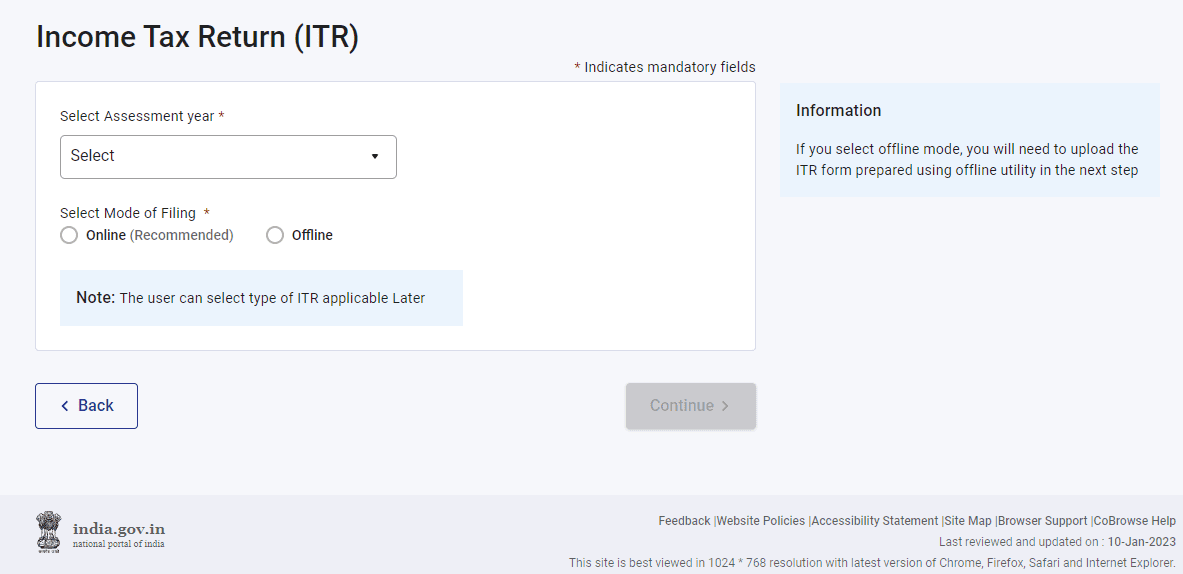

To file your income tax return the following information whichever applicable is required Details of any loan borrowed or given Obtain tax deduction certificate from the cellular company for the sim or internet You will need the following documents to file your tax return Your NTN number CNIC salary slip for the entire financial year 2022 23 and other documents that show your income such as rent receipts interest income

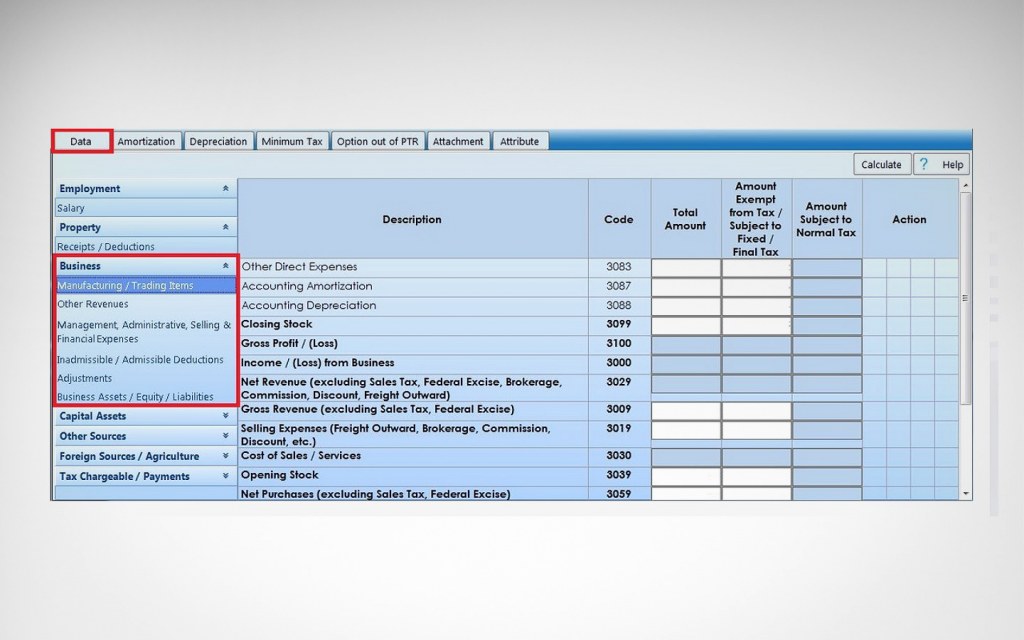

Filing income tax returns in Pakistan is a legal obligation for individuals and businesses earning above a certain income threshold This detailed guide will walk you Pakistan source Income Is defined in section 101 of the Income Tax Ordinance 2001 which caters for Incomes under different heads and situations Some of the common Pakistan source

Download Income Tax Return For Salaried Person In Pakistan

More picture related to Income Tax Return For Salaried Person In Pakistan

FBR Income Tax Calculator 2023 24

https://bslearning.com/fbr-income-tax-return/images/income-tax-return.webp

Income Tax Return Form 2017 Pakistan With Formula Download FBR Tax Payer

https://lahorecafe.pk/wp-content/uploads/2017/08/Income-Tax-Return-Salaried-Person-Pakistan-Form-Download.jpg

13161 Pdf Tax Saving Strategies A Study On Financial Planning For

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/c5e4dcf9aa033e3c571f177c87677452/thumb_1200_1698.png

The FBR Income Tax Return Form for salaried persons in Pakistan is known as the Income Tax Return for Salaried Individuals IT 1 It is a specific form designed to capture the income details deductions and tax calculations for The key differences between filers and non filers in Pakistan Learn about the tax benefits financial advantages and why it matters the most in 2025 Salaried Individuals If your

This comprehensive guide explains the step by step process of filing an income tax return in Pakistan supported by references to the Income Tax Ordinance 2001 and relevant case laws Pakistan levies tax on its residents on their worldwide income A non resident individual is taxed only on Pakistan source income including income received or deemed to

Income Tax Slab 2020 21 Pakistan Tax Rates For Salaried Non

https://i.ytimg.com/vi/OZ6BErG8xAY/maxresdefault.jpg

How To File Income Tax Return For Salaried Person In Pakistan 2019

https://i.ytimg.com/vi/C5KrAAVySIg/maxresdefault.jpg

https://taxconsultancy.pk › salary-tax-calculator

As per the latest income tax regulations for the year 2024 2025 the following slabs and income tax rates will be applicable for salaried persons 1 Where the taxable salary income does not

https://www.fbr.gov.pk › video-tutorials-income-tax-return-filing

Tutorial for filing of Tax Returns for Tax Year 2023 in Urdu Tutorial for filing of Tax Returns for Tax Year 2023 in English Income Tax Return for Salaried Persons Part I

Income Tax Rates 2022 23 For Salaried Persons Employees Slabs

Income Tax Slab 2020 21 Pakistan Tax Rates For Salaried Non

How To EFile Your Income Tax Return And Wealth Statement Online With

Income Tax Slab Rates For Salaried Class In Pakistan 2024 24

Calculate My Income Tax SuellenGiorgio

Fillable Online Employee s Income Tax Declaration Form For The

Fillable Online Employee s Income Tax Declaration Form For The

How To File Income Tax Returns For Businesses In Pakistan Zameen Blog

Income Tax Calculation Example 2 For Salary Employees 2023 24

How To File Income Tax Return Online For Salaried Employee

Income Tax Return For Salaried Person In Pakistan - Salary certificate details of profit from different sources including bank account and dividend and estimate of expenses are required for a salaried person On having these details