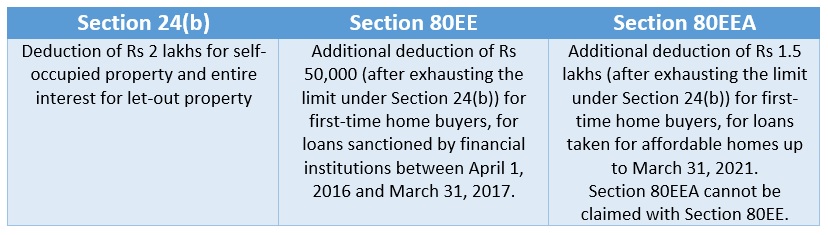

Income Tax Return Housing Loan Interest Web 2 M 228 rz 2023 nbsp 0183 32 You can claim the interest on your home loan under sections 24 and 80EEA of ITR You can claim a deduction of up to Rs 2 lakh on the interest paid on your home loan if you occupy your house How much can we show home loan benefits in income tax You can avail of tax benefits for your home loan

Web 7 Juni 2020 nbsp 0183 32 Home Loan Tax Benefit in 2020 21 In this video I have tried to explain the knowledge about how to show interest and principal amount in ITR Here I have also tried to provide the different Web There are certain conditions you must meet to be eligible for returns on your home loan interest rate They are The value of your home should be less than Rs 50 lakhs The loan amount must not be more than Rs 35 lakhs A government recognized housing finance company or financial institution must sanction the loan

Income Tax Return Housing Loan Interest

Income Tax Return Housing Loan Interest

https://assets-news.housing.com/news/wp-content/uploads/2020/02/26180556/Section-80EE.jpg

How To Fill Home Loan In Income Tax Return ITR Home Loan Tax

https://i.ytimg.com/vi/tJiWr1qxWOg/maxresdefault.jpg

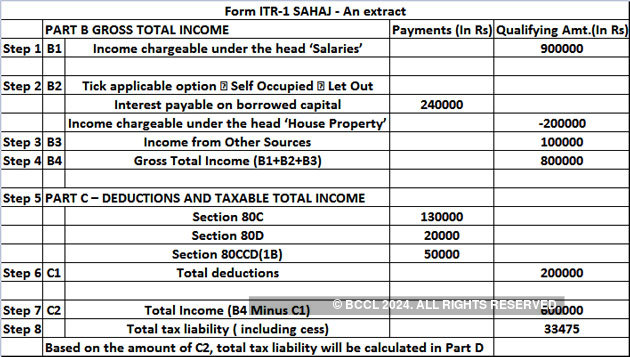

ITR For Salary Income An Illustration How To File ITR With Salary

https://img.etimg.com/photo/msid-64841383,quality-100/itr1.jpg

Web 18 Dez 2023 nbsp 0183 32 Interest Component approx 1 40 000 this varies but is higher in the initial years Principal Component approx 50 000 this increases gradually over the tenure Tax Benefits Under Section 80C Principal Repayment Web 18 Juli 2023 nbsp 0183 32 If you ve closed on a mortgage on or after Jan 1 2018 you can deduct any mortgage interest you pay on your first 750 000 in mortgage debt 375 000 for married taxpayers who file separately

Web 4 Jan 2023 nbsp 0183 32 Mortgage interest is tax deductible on mortgages of up to 750 000 unless the mortgage was taken out before Dec 16 2017 then it s tax deductible on mortgages of up to 1 million A mortgage calculator can help you determine how much interest you paid each month last year Web Let us know about the treatment of interest of housing loan interest under the new tax regime In case of a self occupied property taxpayers cannot claim a deduction on interest for a housing loan under the new tax regime The deduction of Rs 2 lakh allowable under the existing system is not available in the new tax regime

Download Income Tax Return Housing Loan Interest

More picture related to Income Tax Return Housing Loan Interest

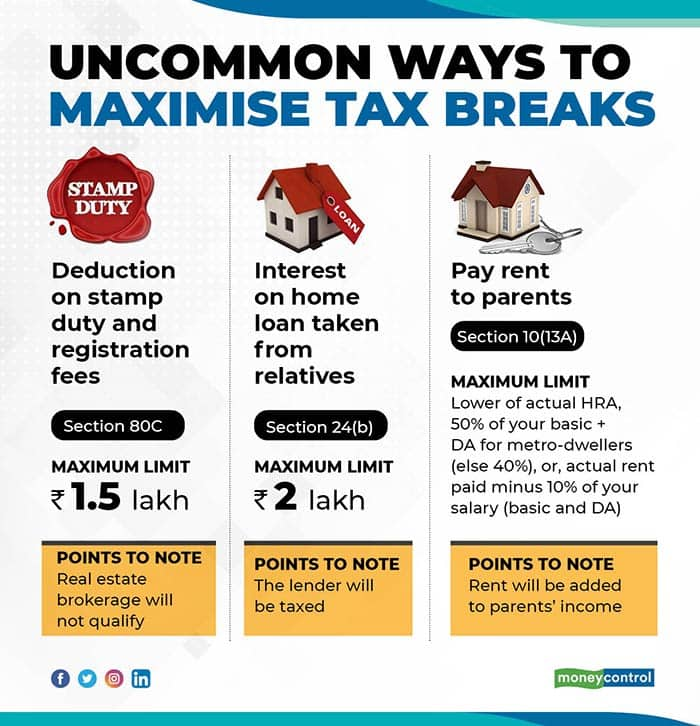

Tax Benefits Of Paying Home Loan EMI HDFC Sales Blog

https://www.hdfcsales.com/blog/wp-content/uploads/2021/10/benefits-of-paying-home-loan-emi.png

How To Claim Interest On Home Loan Deduction While Efiling ITR

https://mytaxcafe.com/how-to-e-file/images/ITR/12.jpg

Paying A Home Loan EMI Or Staying On Rent Know The Tax Benefits

https://images.moneycontrol.com/static-mcnews/2020/01/Preeti-Jan-14.jpg

Web Over the entire life of your loan you can deduct interest paid on up to 750 000 of your principal balance if you re single or married and filing taxes jointly If you re married filing Web 11 Sept 2023 nbsp 0183 32 How to declare a house loan in ITR Here is a step by step guide on how to declare home loans in income tax Step 1 Ensure you have all your property ownership documents certificates of construction and home loan approval with the interests and payments made municipal taxes receipt and your identity proof

Web Home mortgage interest You can deduct home mortgage interest on the first 750 000 375 000 if married filing separately of indebtedness However higher limitations 1 million 500 000 if married filing separately apply if you are deducting mortgage interest from indebtedness incurred before December 16 2017 Future developments Web Introduction Section 24b of income tax act allows deduction of interest on home loan from the taxable income Such loan should be taken for purchase or construction or repair or reconstruction of house property Such deduction is allowed on accrual basis not on paid basis In other words the interest payable for the year is allowed as

House Loan Interest Tax Deduction Home Sweet Home Insurance

https://www.loankuber.com/content/wp-content/uploads/2016/10/Image-5-1.png

Can I Claim Both Home Loan And HRA Tax Benefits

https://www.paisabazaar.com/wp-content/uploads/2019/05/HRA-Home-Loan.jpg

https://instafiling.com/how-to-show-interest-on-a-home-loan-in-an...

Web 2 M 228 rz 2023 nbsp 0183 32 You can claim the interest on your home loan under sections 24 and 80EEA of ITR You can claim a deduction of up to Rs 2 lakh on the interest paid on your home loan if you occupy your house How much can we show home loan benefits in income tax You can avail of tax benefits for your home loan

https://www.youtube.com/watch?v=yMP5hcap6_A

Web 7 Juni 2020 nbsp 0183 32 Home Loan Tax Benefit in 2020 21 In this video I have tried to explain the knowledge about how to show interest and principal amount in ITR Here I have also tried to provide the different

Income Tax Benefits On Housing Loan In India

House Loan Interest Tax Deduction Home Sweet Home Insurance

Claim Tax Benefit On HRA As Well As Tax Deduction On Home Loan

How To Claim Interest On Home Loan Deduction While Efiling ITR

Section 80EEA Deduction For Interest Paid On Home Loan For Affordable

House Loan Deduction In Itr Home Sweet Home Modern Livingroom

House Loan Deduction In Itr Home Sweet Home Modern Livingroom

Home Loan Deductions And Tax Benefits AY 2022 23 Home Loan Tax

Home Loan Tax Benefit Calculator FrankiSoumya

Comparing Interest Rates On Home Loan Archives Yadnya Investment Academy

Income Tax Return Housing Loan Interest - Web 4 Juli 2018 nbsp 0183 32 How to show Housing Loan interest and principal in Income Tax Return Housing loan details in ITR This video is to give you complete knowledge to show Housin