Income Tax Return Updated Introduction The Finance Act 2022 has brought new Income Tax return filing facility to be known as U pdated Return For this purpose a new sub section 8 A has been added to section 139 of the Income Tax Act w e f

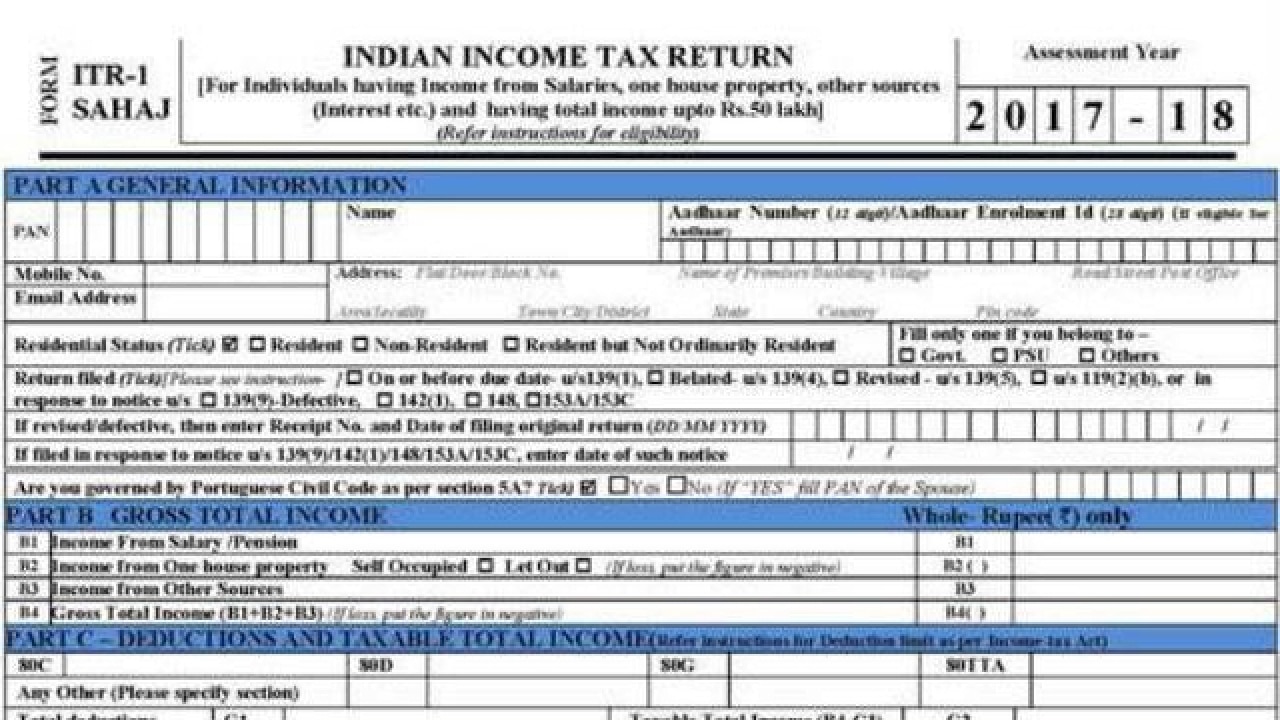

The ITR U or Updated Income Tax Return is a form introduced in the Union Budget 2022 It allows taxpayers to correct errors or omissions in their previous tax filings The Explore the dimensions of updated return under Section 139 8A Tax implications as per Section 140B of the Income Tax Act 1961 Learn the conditions time limits and additional tax rates for correcting omissions or errors

Income Tax Return Updated

Income Tax Return Updated

https://emailer.tax2win.in/assets/guides/itr-u/itr-u-income-tax-return-updated-1.jpg

PPT All About Updated Income Tax Return Section 139 8A PowerPoint

https://image6.slideserve.com/11360078/all-about-updated-income-tax-return-section-139-8a-n.jpg

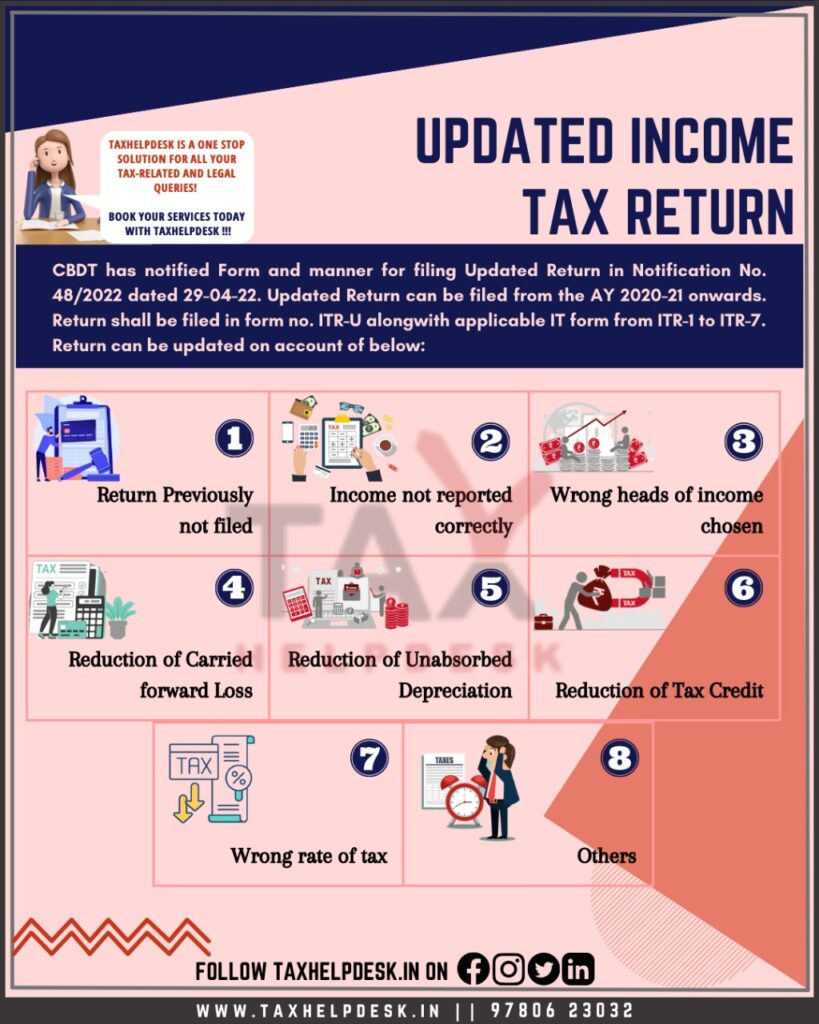

Updated Income Tax Return By TaxHelpdesk Expert

https://www.taxhelpdesk.in/wp-content/uploads/2022/06/Updated-Income-Tax-Return-819x1024.jpeg

IR 2024 273 Oct 22 2024 WASHINGTON The Internal Revenue Service announced today the annual inflation adjustments for tax year 2025 Revenue Procedure 2024 40 PDF provides E Filing of Income Tax Return or Forms and other value added services Intimation Rectification Refund and other Income Tax Processing Related Queries

The due date for filing returns has been extended from 31st October 2024 to 15th November 2024 for the assessees referred to in clause a of Explanation 2 to sub section 1 of section 139 of the Act Please refer E Filing of Income Tax Return or Forms and other value added services Intimation Rectification Refund and other Income Tax Processing Related Queries

Download Income Tax Return Updated

More picture related to Income Tax Return Updated

Updated Income Tax Return By TaxHelpdesk Expert

https://www.taxhelpdesk.in/wp-content/uploads/2022/06/Updated-Income-Tax-Return-by-TaxHelpdesk-Expert.png

Income Tax Return Filing Due Dates For FY 2020 21 Last Date

https://blog.saginfotech.com/wp-content/uploads/2021/04/latest-income-tax-tds-due-dates.jpg

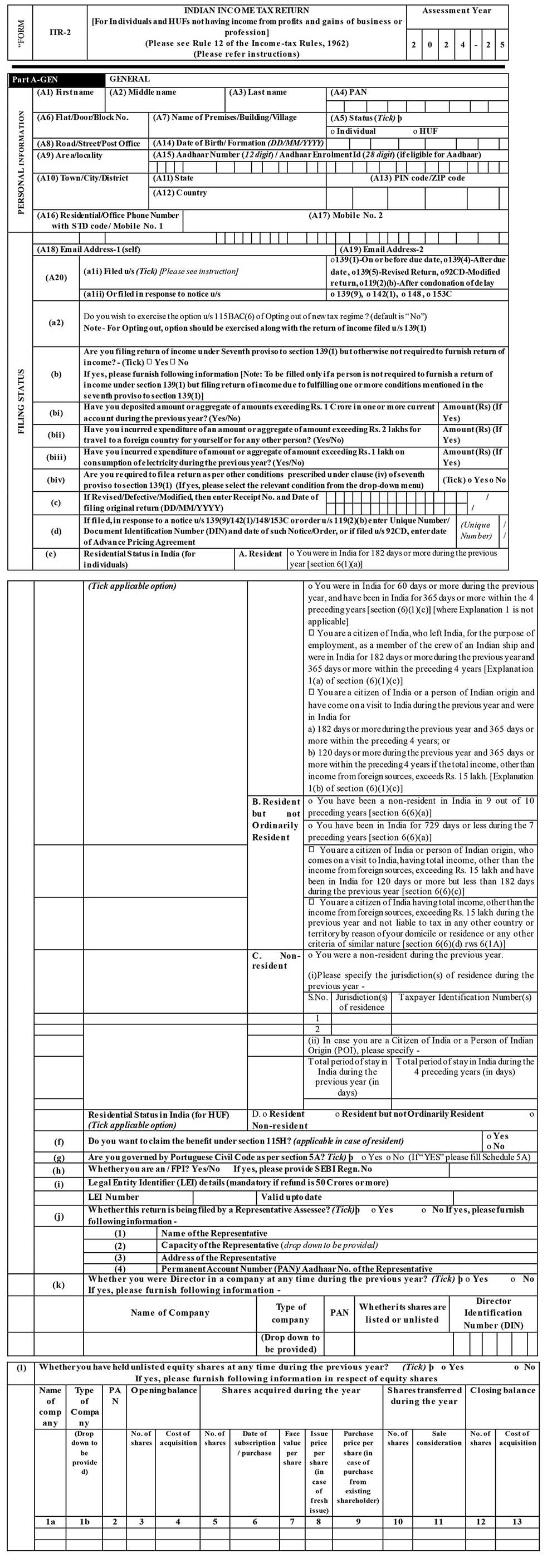

Updated Income Tax Return Form ITR U Ebizfiling

https://ebizfiling.com/wp-content/uploads/2022/05/An-Updated-Income-Tax-Return-Form-ITR-U-min-final.png

ITR filing last date for non audit tax payers for Financial Year 2023 24 AY 2024 25 was July 31 2024 However if you miss filing within the due date you can still file a Budget 2022 has introduced the new section 139 8A in Income Tax Act 1961 Refer budget update Introduction of new Income Tax Updated Return Type Section 139 8A enables the filing of Updated

Finance bill 2022 has introduced section 140B of the Income tax act wherein such person is required to pay additional tax for updated return Earlier one used to pay tax under section The Income Tax Act Section 139 8A allows you to update your ITR after two years The two year period will begin with the conclusion of the fiscal year in which the original return was

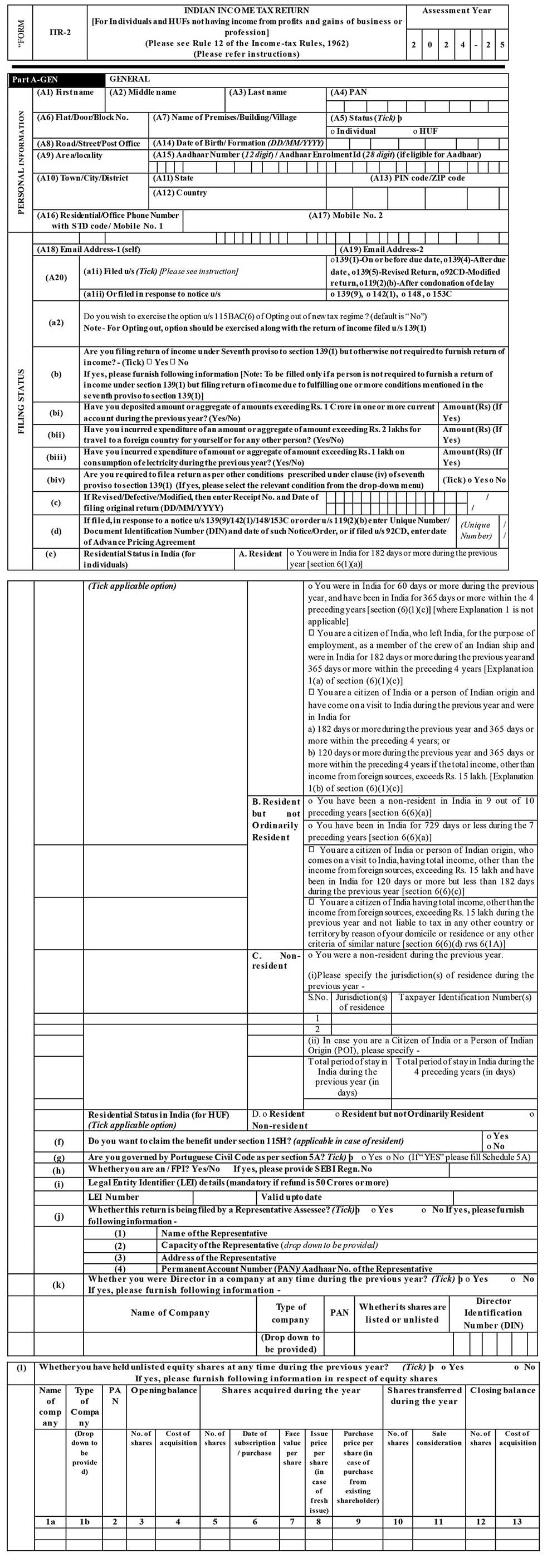

Step By Step Guide To Revised Income Tax Return Ay 2022 23 Hot Sex

https://blog.saginfotech.com/wp-content/uploads/2018/07/itr-2-general-information.jpg

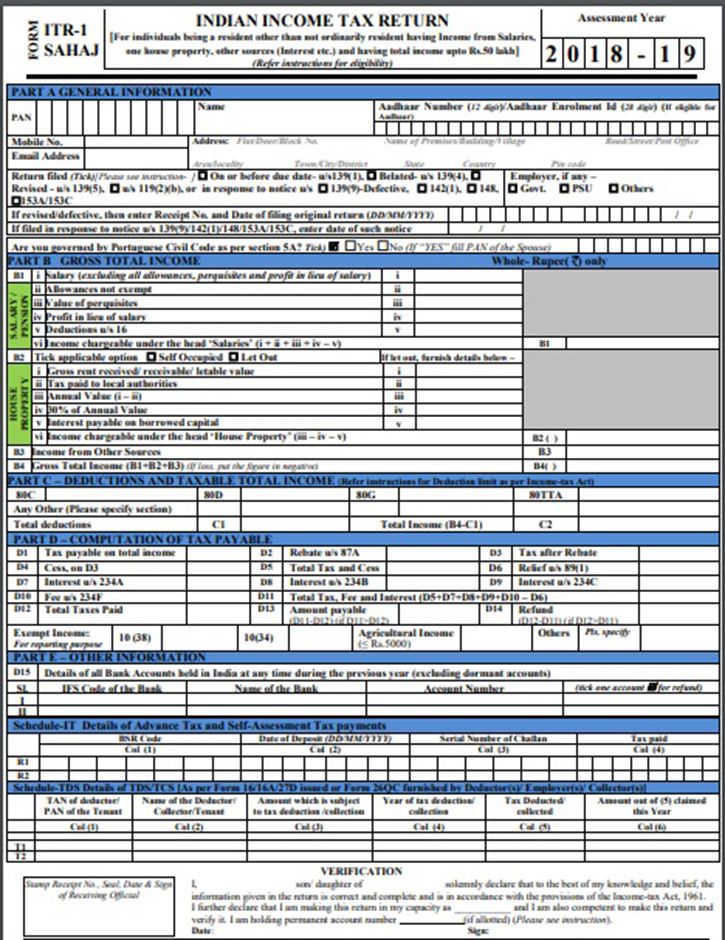

New I T Return Forms Notified Here s How It Is Different And What You

https://im.indiatimes.in/media/content/2018/Apr/income_tax_return_form_1522998544.jpg

https://taxguru.in/income-tax/updated-r…

Introduction The Finance Act 2022 has brought new Income Tax return filing facility to be known as U pdated Return For this purpose a new sub section 8 A has been added to section 139 of the Income Tax Act w e f

https://tax2win.in/guide/itr-u-income-tax-return-updated

The ITR U or Updated Income Tax Return is a form introduced in the Union Budget 2022 It allows taxpayers to correct errors or omissions in their previous tax filings The

Income Tax Return Due Dates Penalties FY 2022 23 AY 2023 24

Step By Step Guide To Revised Income Tax Return Ay 2022 23 Hot Sex

2022 1040 Schedule A

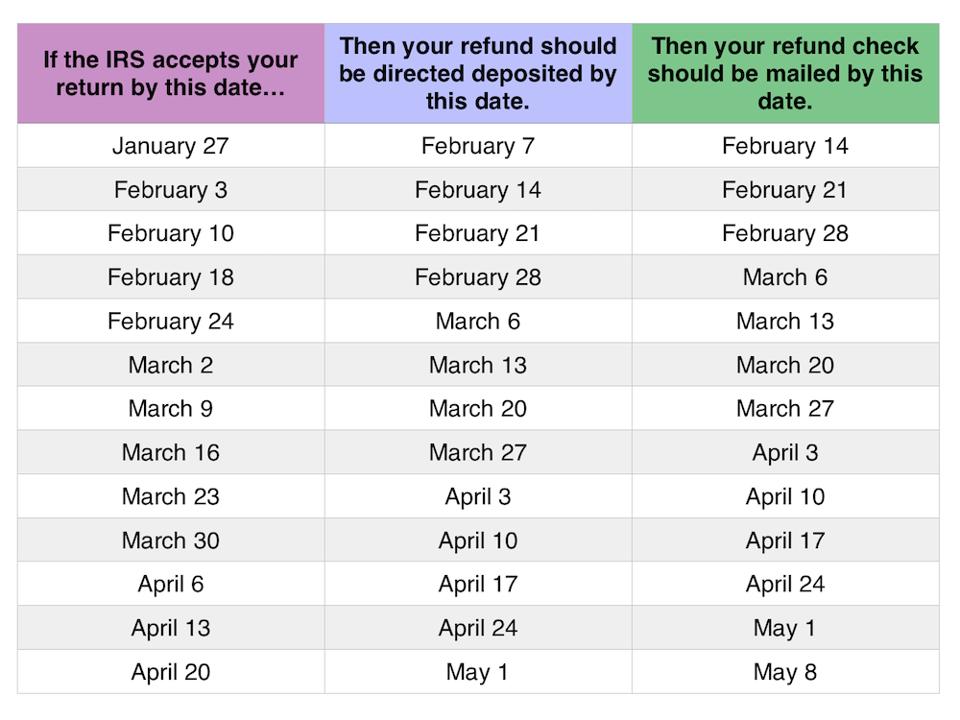

Irs Updates On Refunds 2023 Calendar 2023 Get Calender 2023 Update

AY 2020 21 Income Tax Deadlines FY 2019 20 ITR Filing Last Date

Simplified One page Form How To File Your Income Tax Returns ITR

Simplified One page Form How To File Your Income Tax Returns ITR

Where s My Payment Summary FACTX

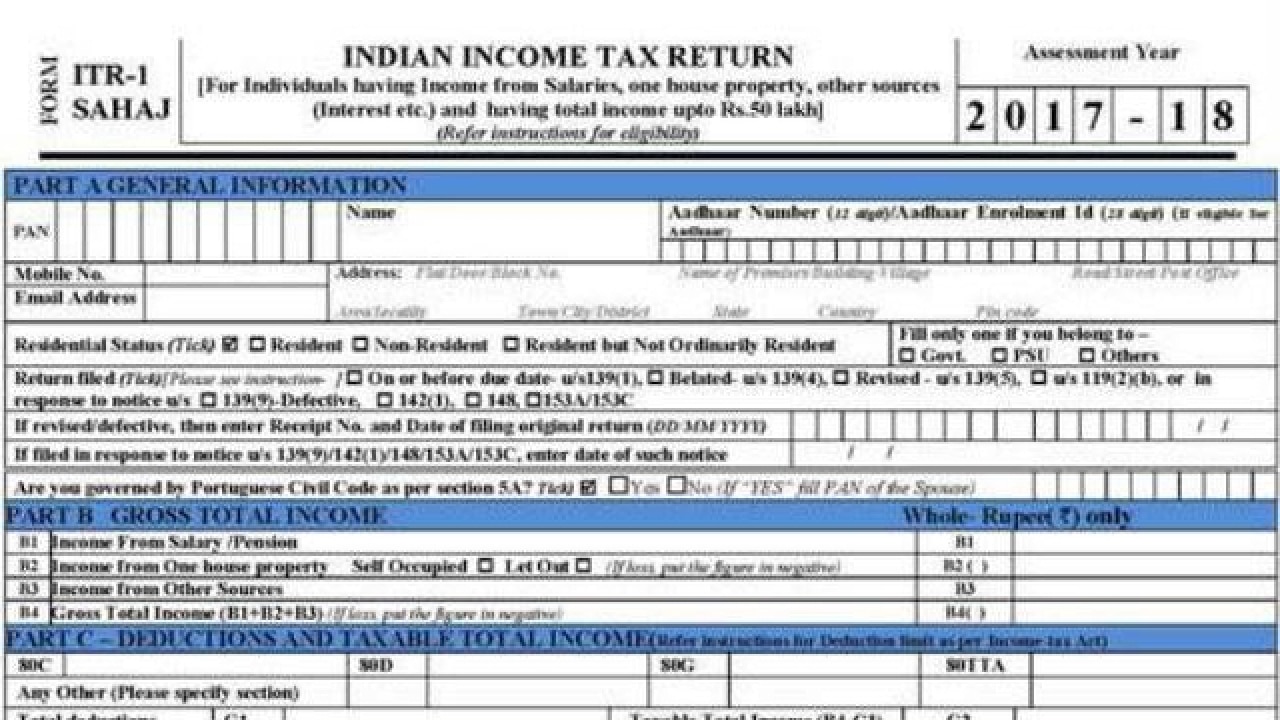

Form 1701A

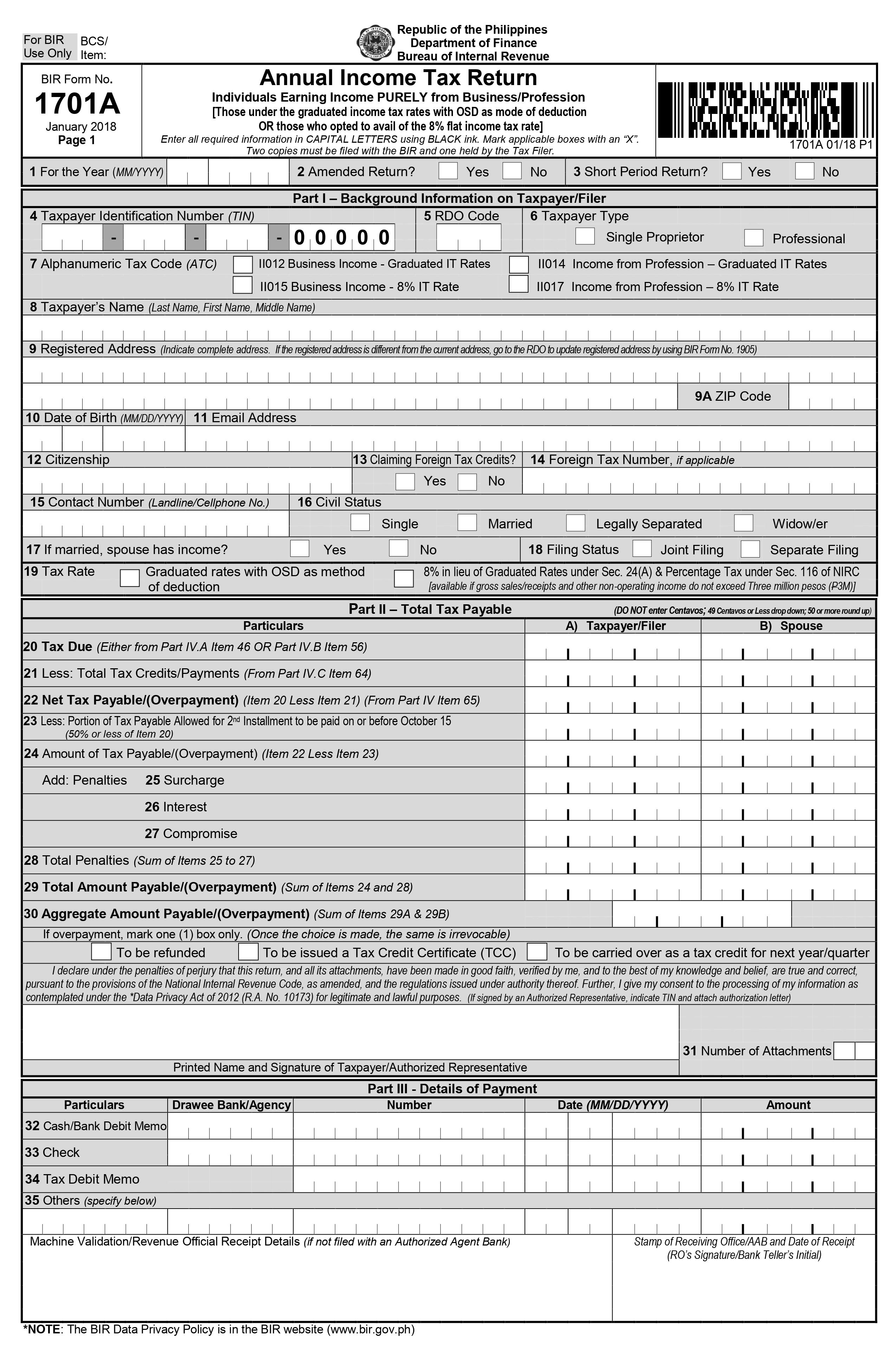

Top 10 Federal Income Tax Prep Tips For The 2019 Filing Year The

Income Tax Return Updated - Eligible taxpayers need to file their updated income tax return ITR U for AY 2021 22 FY 2020 21 by March 31 2024 as this is the last date to do so ITR U can be used to fix