Income Tax Return Waiver Frequently Asked Questions Application for Waiver of Income Tax Return Form C S C Submission by a Dormant Company Updated on 6 Oct 2021 Contents 1 What are the

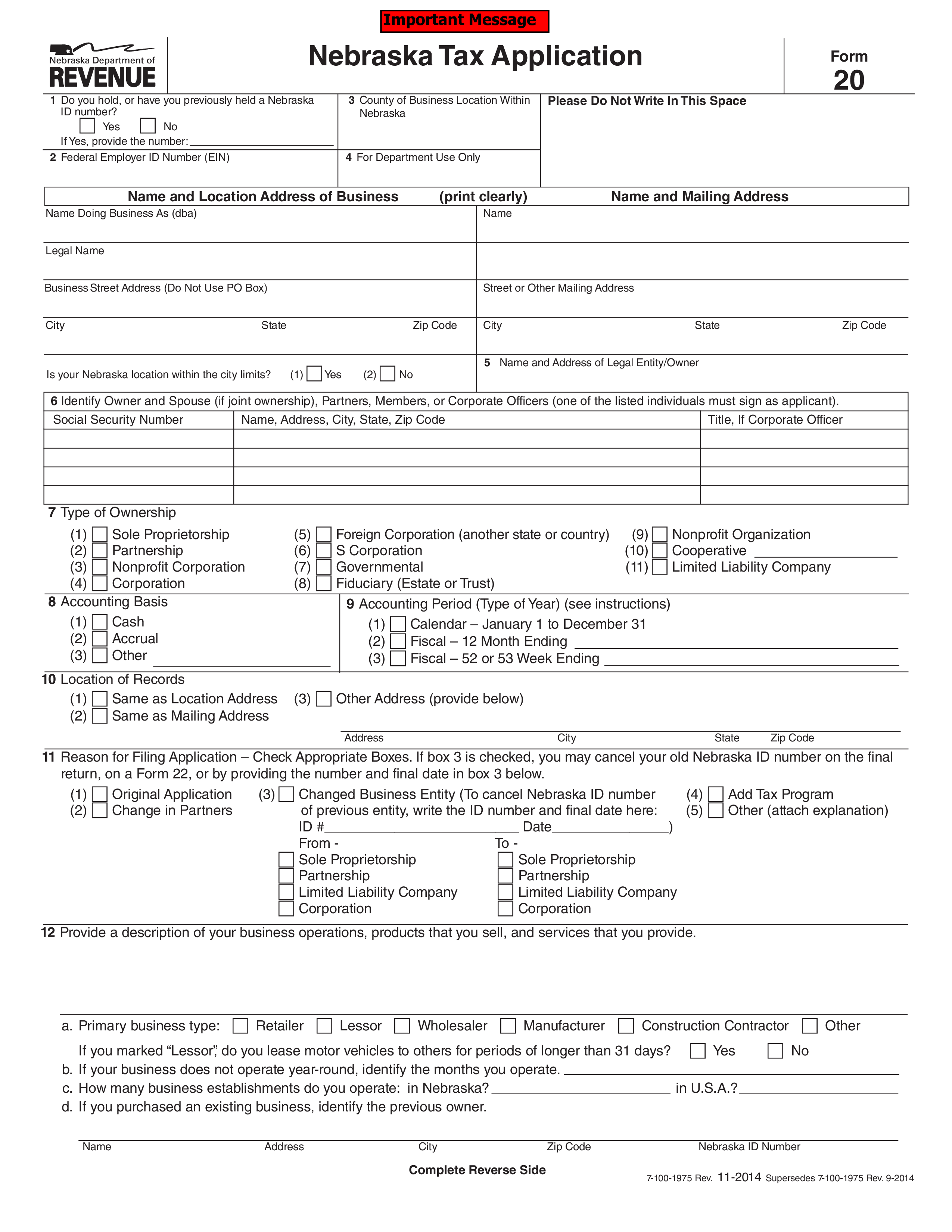

What are the qualifying conditions that a company must satisfy in order to use the Apply for Waiver File last Form C S C Dormant Striking Off digital service A company that What is a waiver application Where taxpayers fail to pay their taxes or file returns by stipulated due dates penalties and interest are charged in accordance with the law The penalty and

Income Tax Return Waiver

Income Tax Return Waiver

https://images.ctfassets.net/53fa87e167vu/4fUIo4n6IlUcJlHDa3Tl4B/7d1a3c58a6ff84cac3874642af1c3732/photo1.png

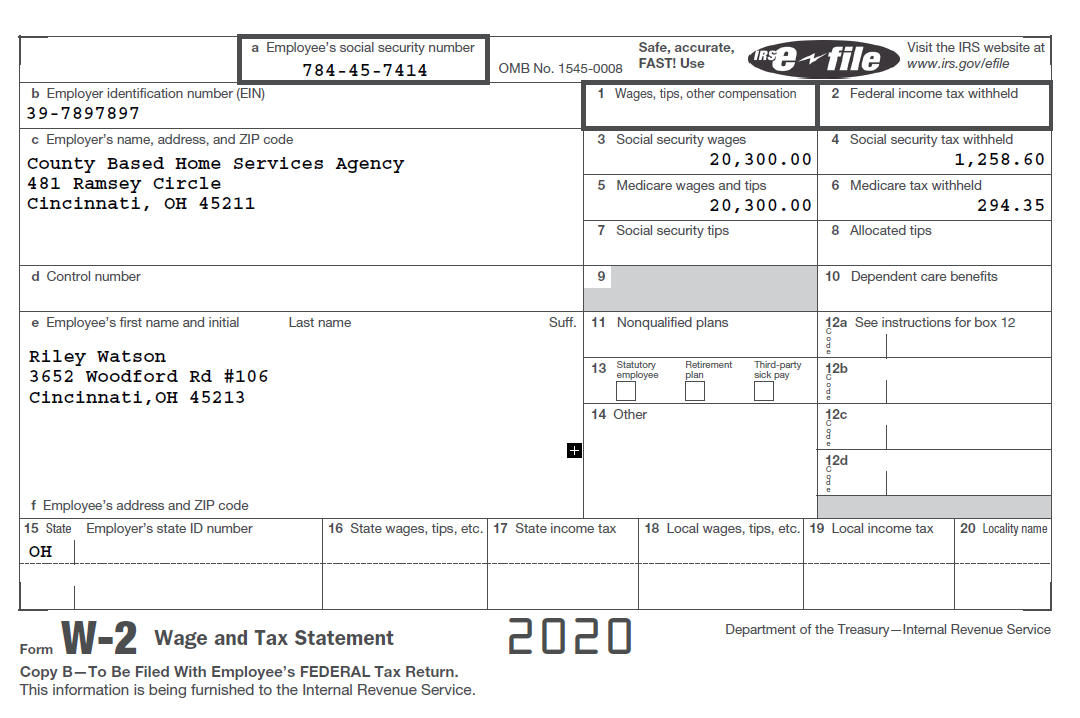

Kostenloses Income Tax Job Application Form

https://www.allbusinesstemplates.com/thumbs/9457204e-5366-4f57-8428-dbfe96dae55c_1.png

How To File Income Tax Return For The Deceased Person By Legal Heir

https://wealth4india.com/blogs/wp-content/uploads/2022/07/income-tax-return-for-the-deceased-person-2048x1152.png

IV To qualify for a waiver of Form C S C submission the company a must be dormant and has submitted either its Form C S C accounts and tax computations up to the date of The Principal Commissioner or Commissioner of Income Tax has powers to reduce or waive penalty as per powers conferred under Section 273A 1 273A 4 and 273AA

Circular No 15 2024 Order under section 119 1 of the IT Act 1961 fixing the monetary limits of the Income tax authorities in respect of reduction or waiver of interest paid In this article I will dive deeper and explain different dilemmas surrounding the penalty waiver On a few occasions taxpayers for one reason or the other find themselves in situations where

Download Income Tax Return Waiver

More picture related to Income Tax Return Waiver

Income Tax Return And The Key Changes

https://www.weandgst.in/wp-content/uploads/2019/04/1200px-Income_Tax_Department_May_2018.jpg.png

Latest ITR Forms Archives Certicom

https://i0.wp.com/certicom.in/wp-content/uploads/2022/06/Understanding-updated-and-revised-income-tax-returns.jpg?fit=1920%2C1080&ssl=1

Tax File Number Declaration Form Pdf Withholding Tax Payments Vrogue

https://i2.wp.com/universalnetworkcable.com/wp-content/uploads/2019/03/income-tax-filing-form-number.jpg

Section 273A 4 empowers the Principal Commissioner or Commissioner to waive or reduce any penalty imposable under the Income tax Act as well as to stay or compound any proceeding Section 273A 1 of Income Tax act authorizes the Principal Commissioner or Commissioner of Income Tax to grant waiver or reduction from penalty imposed under section

Under the new income tax rules there are provisions related to the waiver of interest on delayed payments The eligibility for such waivers mainly depends on the The application can be made even after penalty is confirmed by the Income Tax Appellate Tribunal Return should have been filed voluntarily before issue of notice u s 139 2

Withholding Tax Return

https://zatca.gov.sa/ar/eServices/PublishingImages/incom tax submission.png

1040 Individual Income Tax Return Form Stock Photo 1905001528

https://image.shutterstock.com/shutterstock/photos/1905001528/display_1500/stock-photo--individual-income-tax-return-form-and-tax-refund-check-concept-of-filing-taxes-taxable-1905001528.jpg

https://www.iras.gov.sg › media › docs › default-source › ...

Frequently Asked Questions Application for Waiver of Income Tax Return Form C S C Submission by a Dormant Company Updated on 6 Oct 2021 Contents 1 What are the

https://www.iras.gov.sg › media › docs › default-source › ...

What are the qualifying conditions that a company must satisfy in order to use the Apply for Waiver File last Form C S C Dormant Striking Off digital service A company that

Cases Where Filing Of The Income Tax Return Is Mandatory CA Cult

Withholding Tax Return

Income Tax Return Form

:max_bytes(150000):strip_icc()/IRSForm4506Page1-b54ccd93aa56416595fe32b49d670d67.jpg)

Income Tax Return Form

Tax Return Employment Self Employment Dividend Rental Property

Nice Audit Report Of Reliance 2019 International Accounting Standard 10

Nice Audit Report Of Reliance 2019 International Accounting Standard 10

Treatment Of Income From Different Sources AY 2023 24 FY 2022 23

ITR Income Tax Return E verification To Complete Filing Process All

Different Types Of Income Tax Assessments Under The Income Tax Act

Income Tax Return Waiver - IV To qualify for a waiver of Form C S C submission the company a must be dormant and has submitted either its Form C S C accounts and tax computations up to the date of