Income Tax Rules Regarding Hra HRA tax exemption rules The HRA tax exemption reduces the total salary before calculating taxable income helping employees save on taxes It s important to note that if an employee lives in their

Learn about House Rent Allowance HRA exemptions and how they affect tax savings Understand the rules calculations and potential benefits for salaried employees Know the HRA Exemption Rules how to calculate HRA on your salary Check out the eligibility criteria understand how HRA helps you to utilise Section 80C

Income Tax Rules Regarding Hra

Income Tax Rules Regarding Hra

https://fincalc-blog.in/wp-content/uploads/2022/03/hra-exemption-calculation-house-rent-allowance-excel-examples-video.webp

HRA Exemption Rules How To Save Tax On House Rent Allowance House

https://coffeecakebreak.com/22c30fde/https/747fca/img.etimg.com/thumb/width-1200,height-900,imgsize-382255,resizemode-75,msid-56625469/wealth/tax/all-you-need-to-know-about-claiming-tax-break-on-hra.jpg

Tax Rules For Rental Income Access Wealth

https://access-wealth.com/wp-content/uploads/2021/08/rental-income-1536x793.jpeg

Salaried individuals are eligible to claim exemptions for HRA under Section 10 13A rule number 2A of the Income Tax Act Self employed individuals are not eligible to claim Section 80GG of the Income Tax Act in India allows individuals who pay rent but don t receive House Rent Allowance HRA to claim deductions for that rent on their taxes This benefit applies to both

HRA is paid as a part of the salary to meet accommodation expenses Learn how to save tax by claiming HRA exemption and their rules Learn what is house rent allowance HRA including eligibility criteria documents required Check out HRA taxation rules in India HRA calculator FAQs

Download Income Tax Rules Regarding Hra

More picture related to Income Tax Rules Regarding Hra

HRA Exemption Calculator In Excel House Rent Allowance Calculation

https://fincalc-blog.in/wp-content/uploads/2021/09/hra-exemption-calculator-house-rent-allowance-to-save-income-tax-salaried-employees-video.webp

House Rent Allowance What Is HRA HRA Exemptions Deductions Tax2win

https://emailer.tax2win.in/assets/guides/hra/available_tax_exemptions.png

House Rent Allowance Hra Tax Exemption Hra Calculation Rules Free

https://wp.sqrrl.in/wp-content/uploads/2019/08/FOR-ANAND-3-1024x796.png

House Rent Allowance is an allowance given by an employer to an employee to cover the cost of living in rented housing HRA is not entirely taxable even though it is a part of HRA tax exemption rules offer benefits under specific conditions in the Income tax Act 1961 It provides tax saving opportunities for employees living in rented accommodation under the old tax regime

The exemption on HRA is covered under Section 10 13A of the Income Tax Act and Rule 2A of the Income Tax Rules It is to be noted that the entire HRA is not What is House Rent Allowance HRA Rule 2A of the Income Tax Rules intricately governs the treatment of House Rent Allowance HRA for salaried

HRA Exemption Calculator For Salaried Employees FinCalC Blog

https://fincalc-blog.in/wp-content/uploads/2021/12/how-to-calculate-hra-to-save-income-tax-1024x576.webp

Pin Auf NEWS You Can USE

https://i.pinimg.com/originals/4b/35/2c/4b352c55ac0959e4b980ff968f94f4f0.jpg

https://economictimes.indiatimes.com…

HRA tax exemption rules The HRA tax exemption reduces the total salary before calculating taxable income helping employees save on taxes It s important to note that if an employee lives in their

https://taxguru.in/income-tax/house-ren…

Learn about House Rent Allowance HRA exemptions and how they affect tax savings Understand the rules calculations and potential benefits for salaried employees

Income Tax Savings HRA

HRA Exemption Calculator For Salaried Employees FinCalC Blog

Income Tax Rules

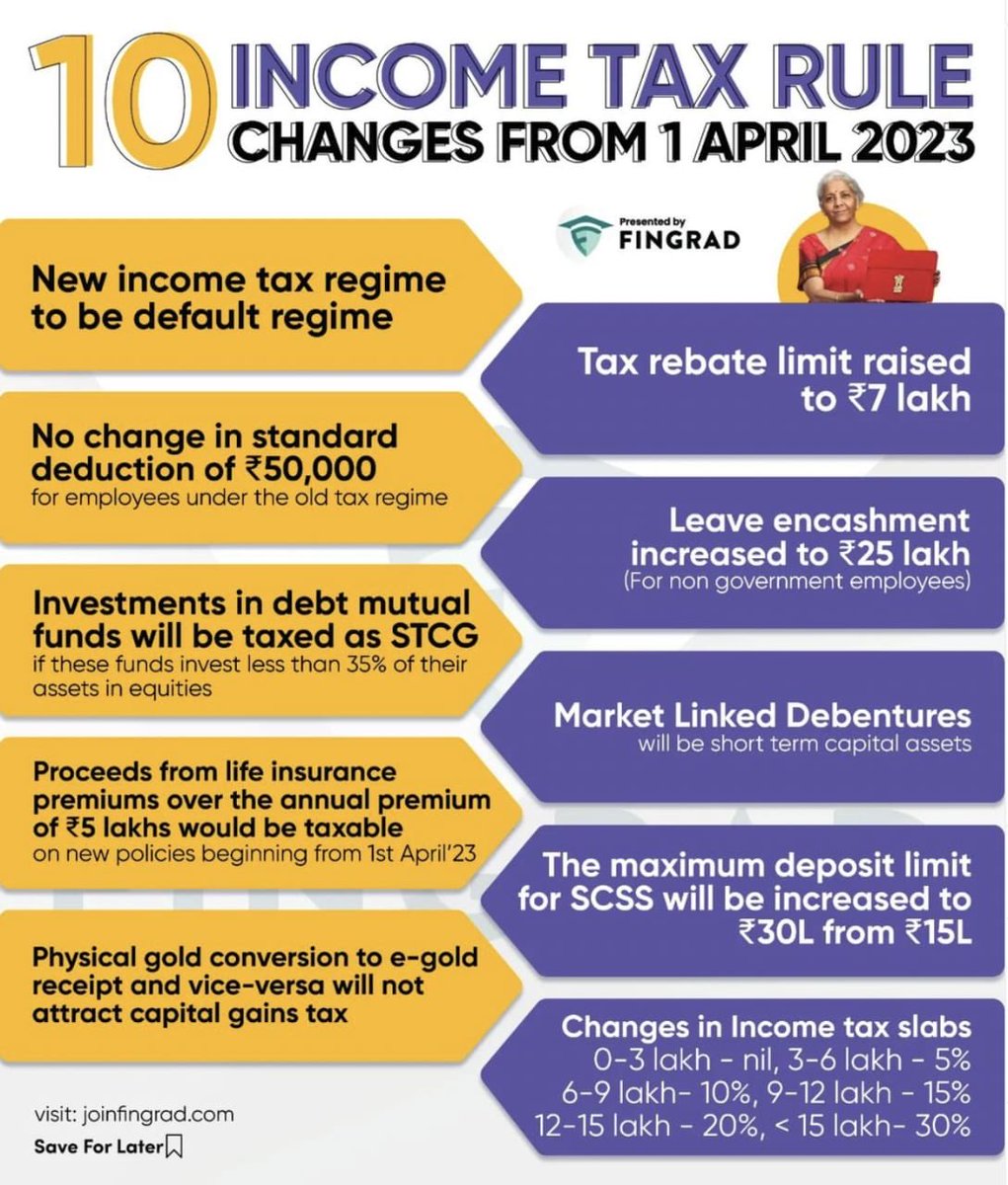

New Income Tax Rules To Come Into Effect From Today 01 04 2023 New

HRA Exemption Calculator For Income Tax Benefits Calculation And

Income Tax Rules 5th e Buy Income Tax Rules 5th e Online At Low Price

Income Tax Rules 5th e Buy Income Tax Rules 5th e Online At Low Price

HRA Exemption In Income Tax 2023 Guide InstaFiling

Income Tax Rules

New Income Tax Rules For Salaried Taxpayers From September 1st 2023

Income Tax Rules Regarding Hra - For most employees House Rent Allowance HRA is a part of their salary structure Although it is a part of your salary HRA unlike basic salary is not fully