Income Tax Saving Options In Uk Learn how to avoid paying 40 tax in the UK with legal strategies Discover effective ways to minimize your tax liability and maximize your savings

Saving and investing money in a tax efficient manner in the UK doesn t have to be a dry topic best left to accountants and tax advisers With these four tax efficient investment You can save up to 2 880 each tax year with the government automatically topping up any contribution by up to 720 which is tax relief of 20 on your gross total contribution This means your contribution automatically

Income Tax Saving Options In Uk

Income Tax Saving Options In Uk

https://img.indiafilings.com/learn/wp-content/uploads/2021/11/12003509/TAX-SAVING-1.png

How To Reduce Tax In India Societynotice10

https://financialexpresswpcontent.s3.amazonaws.com/uploads/2020/03/tax-saving-table.jpg

Anon annon672 Twitter

https://pbs.twimg.com/media/Fr9yQ6mXsAA2vvs?format=jpg&name=4096x4096

High income earners can reduce their taxes by using tax free investments in the UK ISA allowance They can also contribute to their pension to get a 45 tax relief transfer Here we will take a look at tax efficient investing in the UK what it is and 4 different tax friendly investment options that you might want to consider What is Tax Efficient

Here are ten tax efficient investment options to consider 1 Individual Savings Accounts ISAs ISAs are a staple in the UK investment world allowing you to save or invest up to 20 000 for the 2023 24 and 2024 25 tax years without Investors in the UK can choose from several tax efficient investment options focused on different purposes and offering their respective set of benefits This allows you to save money towards specific goals Here are 5

Download Income Tax Saving Options In Uk

More picture related to Income Tax Saving Options In Uk

Tax Saving Options For Those In The 30 Tax Bracket Wealthzi

https://www.wealthzi.com/wp-content/uploads/2020/09/3-1.jpg

Best Income Tax Saving Schemes In India 2022

https://img.jagrantv.com/article/rc1028183/1645589067-best-tax-saving-schemes-in-india.jpg

How To Save On Your Taxes In 2023 A Cheat Sheet Chandan Agarwal

https://images.livemint.com/img/2023/01/01/original/section80C_1672562193578.png

Individual Savings Accounts ISAs are an effective way to invest up to 20 000 annually without paying income tax With a Stocks and Shares ISA any gains or dividends are tax free Other tax efficient savings accounts From 30 income tax relief on the value of your investment to capital gains tax exemption when selling shares inheritance tax exemption and loss relief the range of EIS tax reliefs combine to minimise the risk and

Tax relief on contributions Basic rate taxpayers receive 20 tax relief higher rate taxpayers can claim an extra 20 or 25 based on UK rates excluding Scotland Tax free growth Invest in a tax free savings account that allows you to earn interest on your savings without paying tax You qualify for tax free savings account if you make less than 18 500

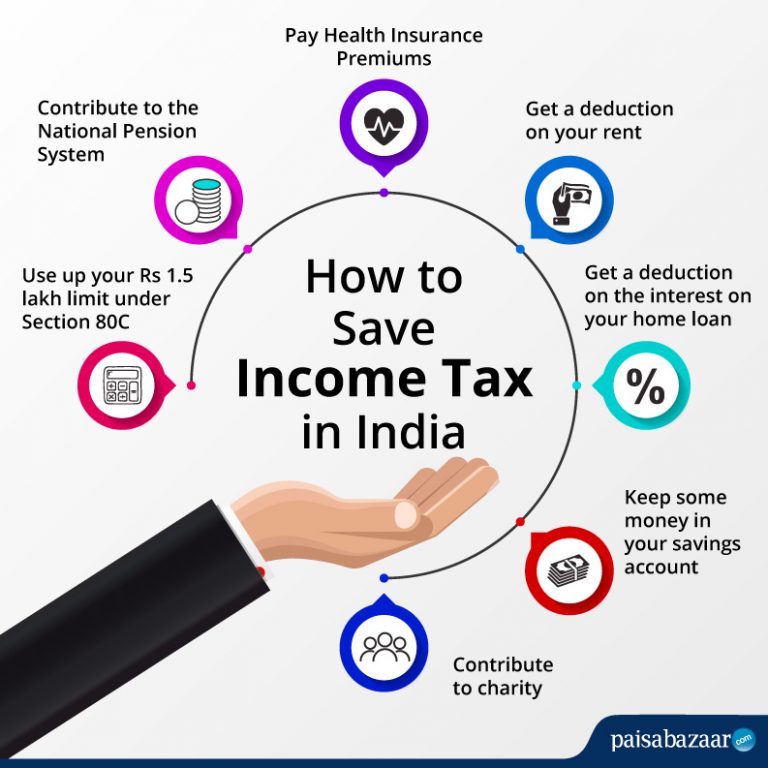

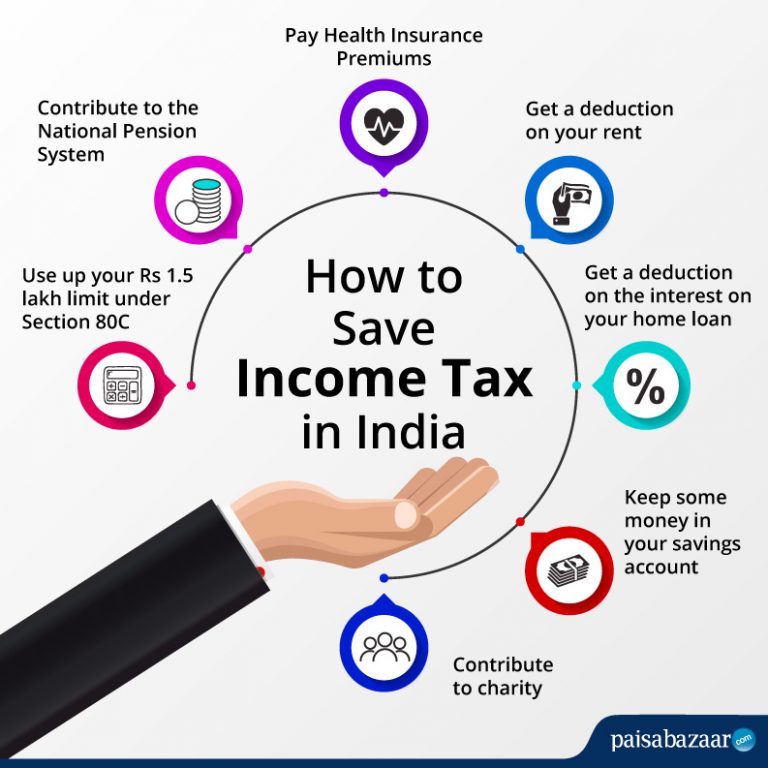

How To Save Income Tax On Salary Tax Saving Schemes Paisabazaar

https://www.paisabazaar.com/wp-content/uploads/2017/06/How-to-Save-Income-Tax-Photo-768x768.jpg

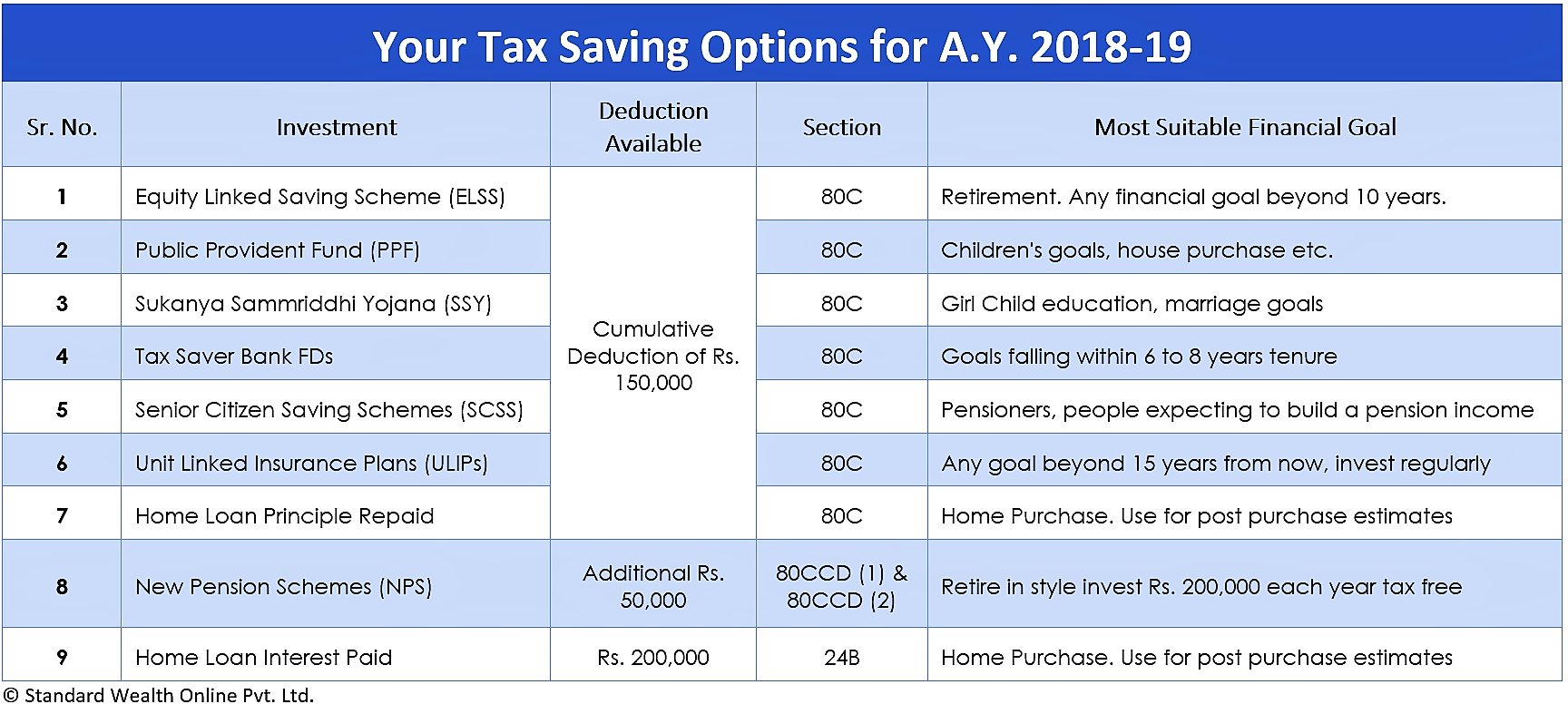

Tax Saving Options For AY 2018 19 For Last Quarter Investors TheSWO

http://www.standardwealthonline.com/wp-content/uploads/2018/01/Tax-Deductions-Table.png

https://www.aftertaxblog.co.uk

Learn how to avoid paying 40 tax in the UK with legal strategies Discover effective ways to minimize your tax liability and maximize your savings

https://www.sterlingandlaw.com › most-tax-efficient...

Saving and investing money in a tax efficient manner in the UK doesn t have to be a dry topic best left to accountants and tax advisers With these four tax efficient investment

Tax Savings Options That You Should Know

How To Save Income Tax On Salary Tax Saving Schemes Paisabazaar

Income Tax Saving Mutual Fund

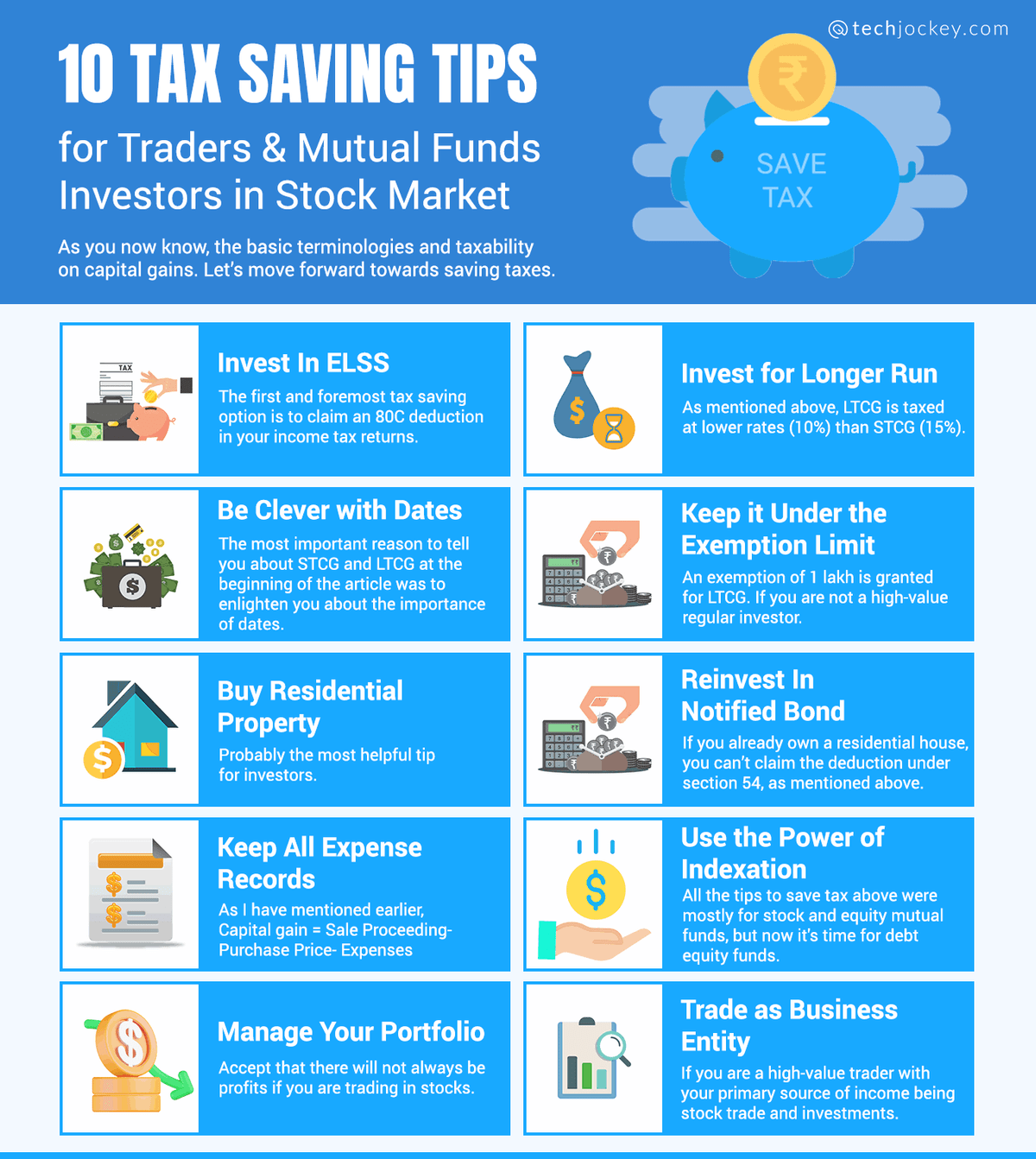

Smart Tax Saving Tips For Stock Traders And Investors

Income Tax Planning Best Tax Saving Options Under Section 80C Right

South Carolina s 2021 Agenda Why Income Tax Cuts Matter

South Carolina s 2021 Agenda Why Income Tax Cuts Matter

Looking For Income Tax Saving Options At The Last Moment Here s What

Fundviser

How To Choose Tax Saving Options Infographic Bourse

Income Tax Saving Options In Uk - Investing is one of the most effective ways to reduce your taxes in the UK By investing in certain types of investments you can take advantage of tax reliefs and other tax