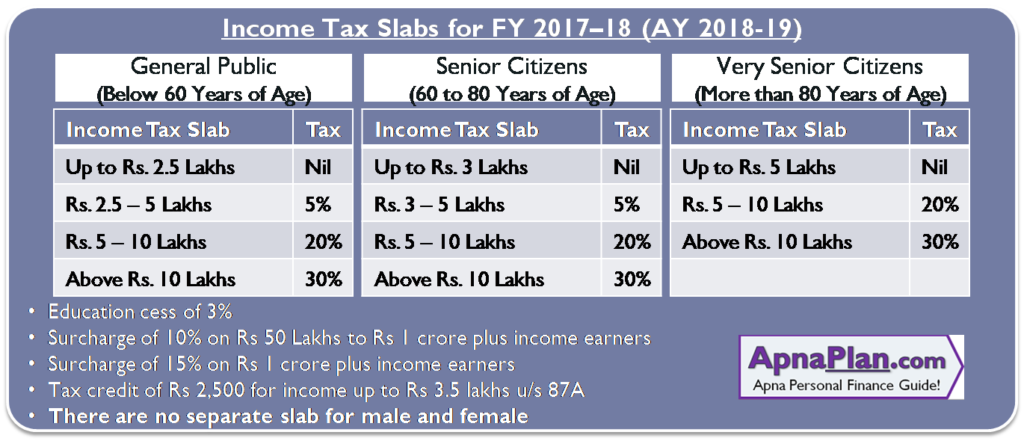

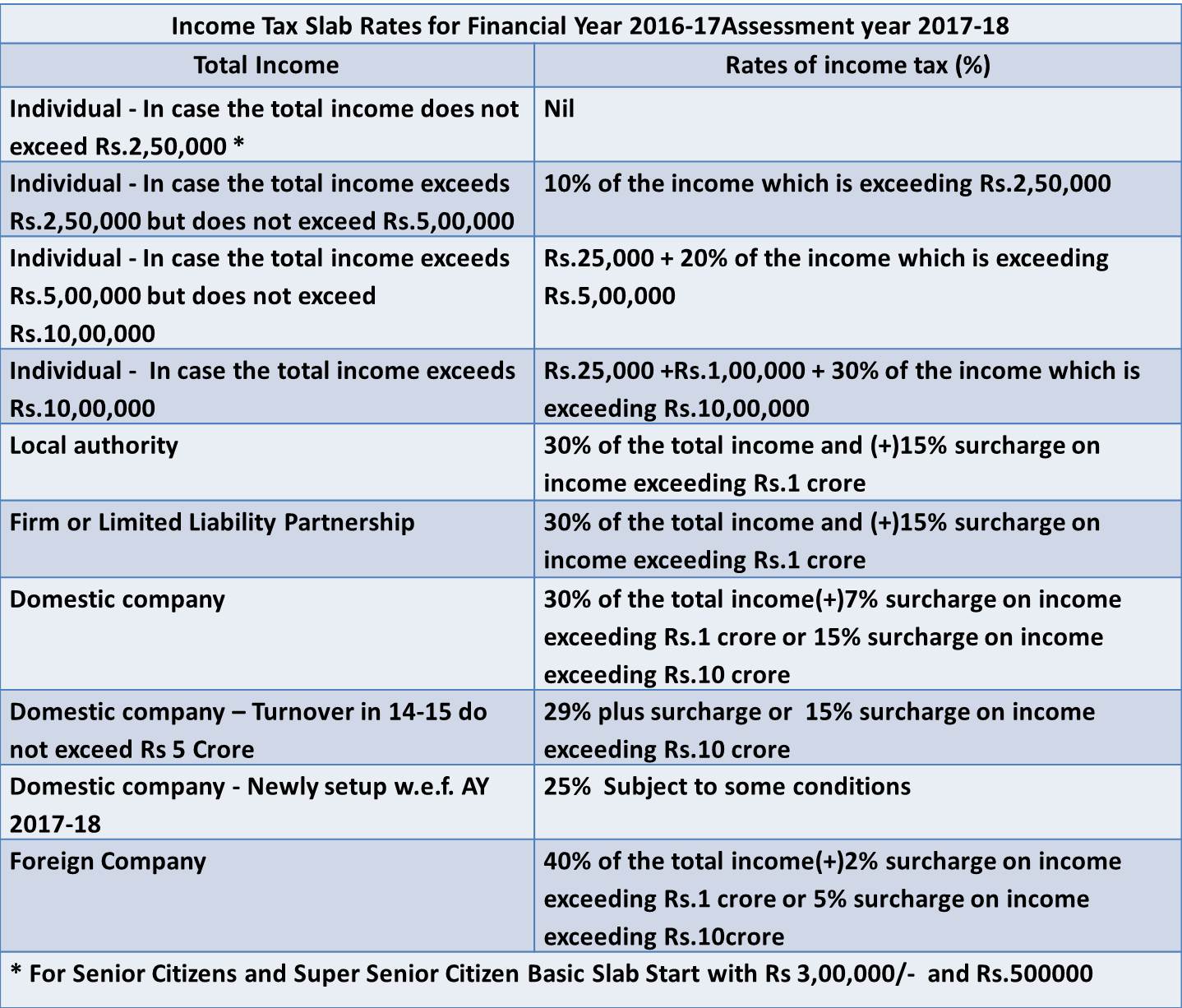

Income Tax Slab 17 18 Rebate Web 1 f 233 vr 2017 nbsp 0183 32 Budget 2017 has made slight changes to the tax slab rates Tax reduced from 10 to 5 for Income from Rs 2 50 000 Rs 5 00 000 Rs 2 500 or 100 rebate in

Web 3 ao 251 t 2017 nbsp 0183 32 The amount of rebate shall be 100 of income tax or Rs 2 500 whichever is less 4 Partnership Firm For the Assessment Year 2017 18 and 2018 19 a partnership Web Tax Slab AY 2017 18 Individual HUF BOI AOP AJP India ITR In case of an Individual resident or non resident or HUF or Association of Person or Body of Individual or any

Income Tax Slab 17 18 Rebate

Income Tax Slab 17 18 Rebate

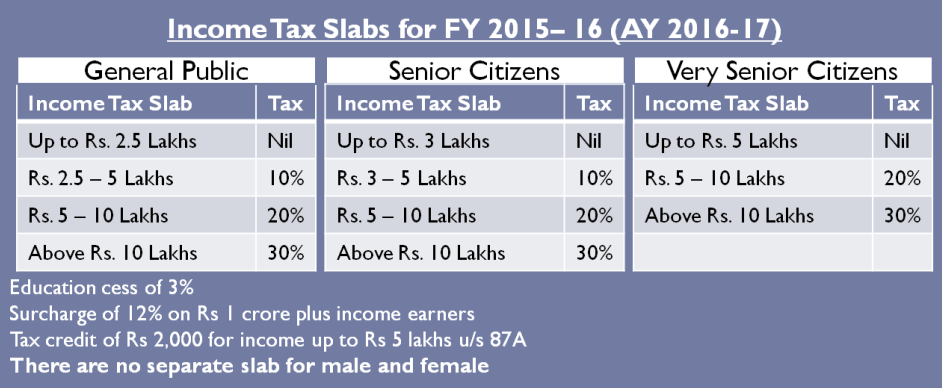

http://3.bp.blogspot.com/-rZnh5NVua-k/VtkpLaSa10I/AAAAAAAACmQ/2e5_urWQHHI/s1600/Income%2BTax%2BSlab%2BRates%2Bfor%2BAY%2B2017-18%252C%2BFY%2B2016-17.png

Income Tax Calculator For FY 2017 18 AY 2018 19 Excel Download

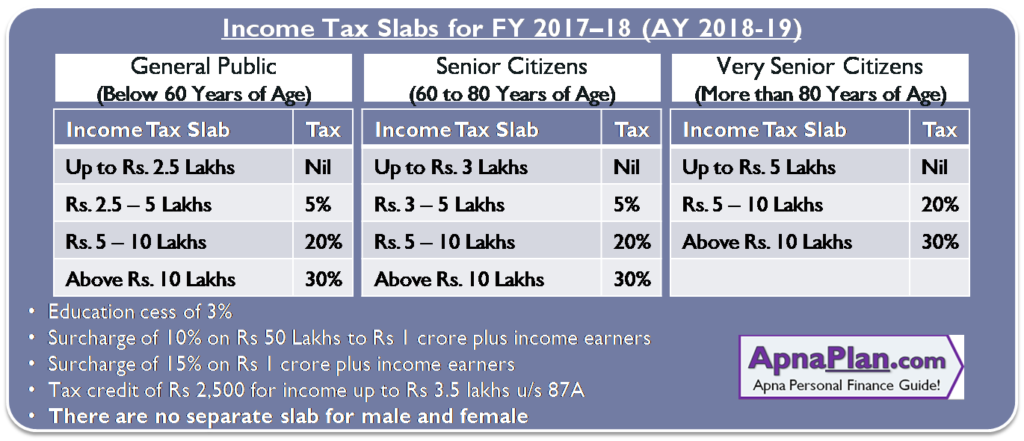

https://www.apnaplan.com/wp-content/uploads/2017/02/Income-Tax-Slab-for-FY-2017–18-AY-2018-19-1024x441.png

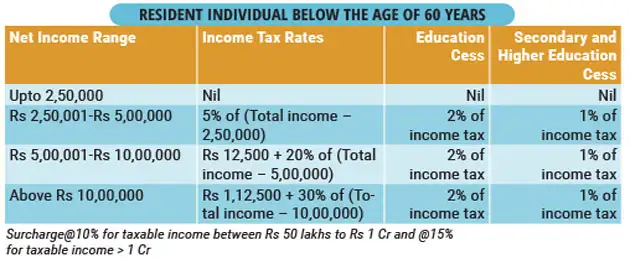

Income Tax Slab Rates Income Tax In India Public Finance Gambaran

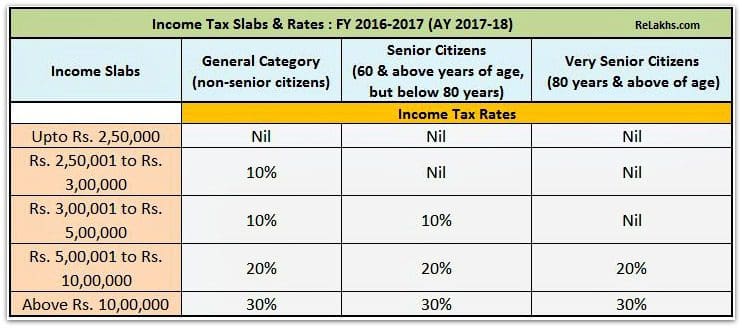

http://www.relakhs.com/wp-content/uploads/2016/02/Income-Tax-Slab-Rates-for-FY-2016-17-AY-2017-18-pic.jpg

Web 3 f 233 vr 2022 nbsp 0183 32 A resident Individual whose Taxable Income does not exceed Rs 3 50 000 after deductions is eligible for rebate of 100 of Income tax or Rs 2 500 whichever Web 17 f 233 vr 2017 nbsp 0183 32 HDFC Life provides the latest income tax slab rates in India for different age groups and tax benefits offered by various life insurance policies for the financial year

Web 2 mai 2023 nbsp 0183 32 A resident individual with taxable income up to Rs 5 00 000 will be eligible for a tax rebate of Rs 12 500 or the amount of tax payable whichever is lower Under the Web 15 f 233 vr 2017 nbsp 0183 32 This video explains the Income Tax Changes that have been made in Income Tax Slab Rates and Tax Rebate in the budget announced in February 2017 Examples use

Download Income Tax Slab 17 18 Rebate

More picture related to Income Tax Slab 17 18 Rebate

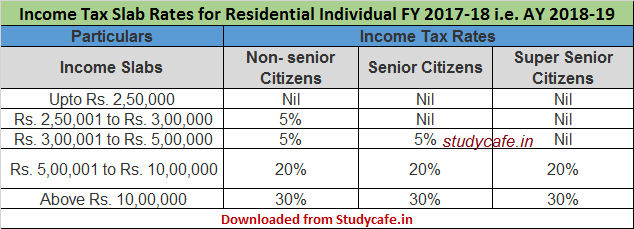

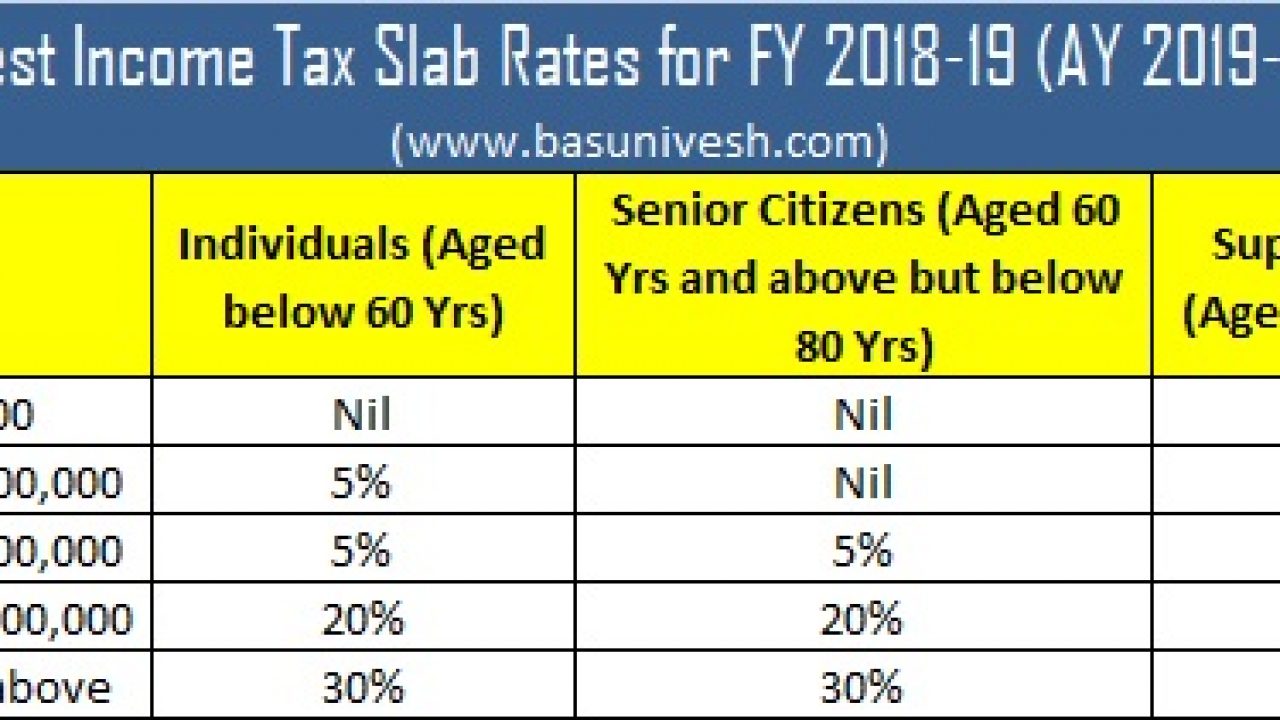

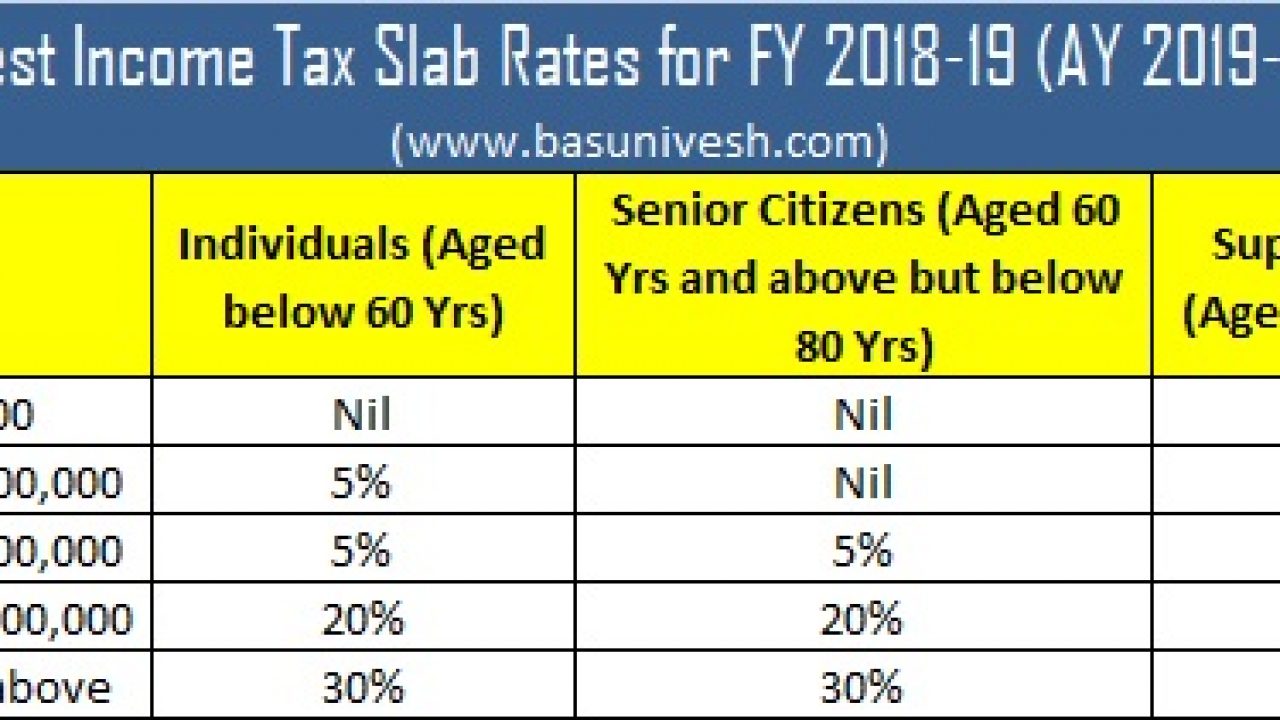

Income Tax Slab Rates For FY 2017 18 AY 2018 19 StudyCafe

http://studycafe.in/wp-content/uploads/2017/04/Income-Tax-Slab-Rates-for-FY-2017-18-i.e.-AY-2018-19.png

Income Tax Slab Change 2017 18 Current Income Tax Slabs For The

http://img.etimg.com/photo/56917786/tt1.jpg

Income Tax Return Forms For FY 2017 18 Released Newsakt

https://www.basunivesh.com/wp-content/uploads/2017/02/Income-Tax-Slab-Rates-for-FY-2017-18-or-AY-2018-19.jpg

Web 26 janv 2017 nbsp 0183 32 With a reduction of tax rate to 5 in place of existing 10 the Government has reduced the rebate u s 87A to Rs 2500 for individuals having total Web 3 ao 251 t 2023 nbsp 0183 32 For the FY 2021 22 and FY 2022 23 AY 2022 23 AY 2023 24 this limit is Rs 5 00 000 This means under both the old and new tax regimes a resident individual

Web 27 lignes nbsp 0183 32 Rebate u s 87A for AY 2018 19 FY 2017 18 as per Budget 2017 With reduction in tax rate of 5 for the income group in Rs 2 50 lakhs to rs 3 00 lakhs Web 16 ao 251 t 2023 nbsp 0183 32 Individuals with Net taxable income less than or equal to Rs 5 lakh will be eligible for tax rebate u s 87A i e tax liability will be nil of such individual in both New

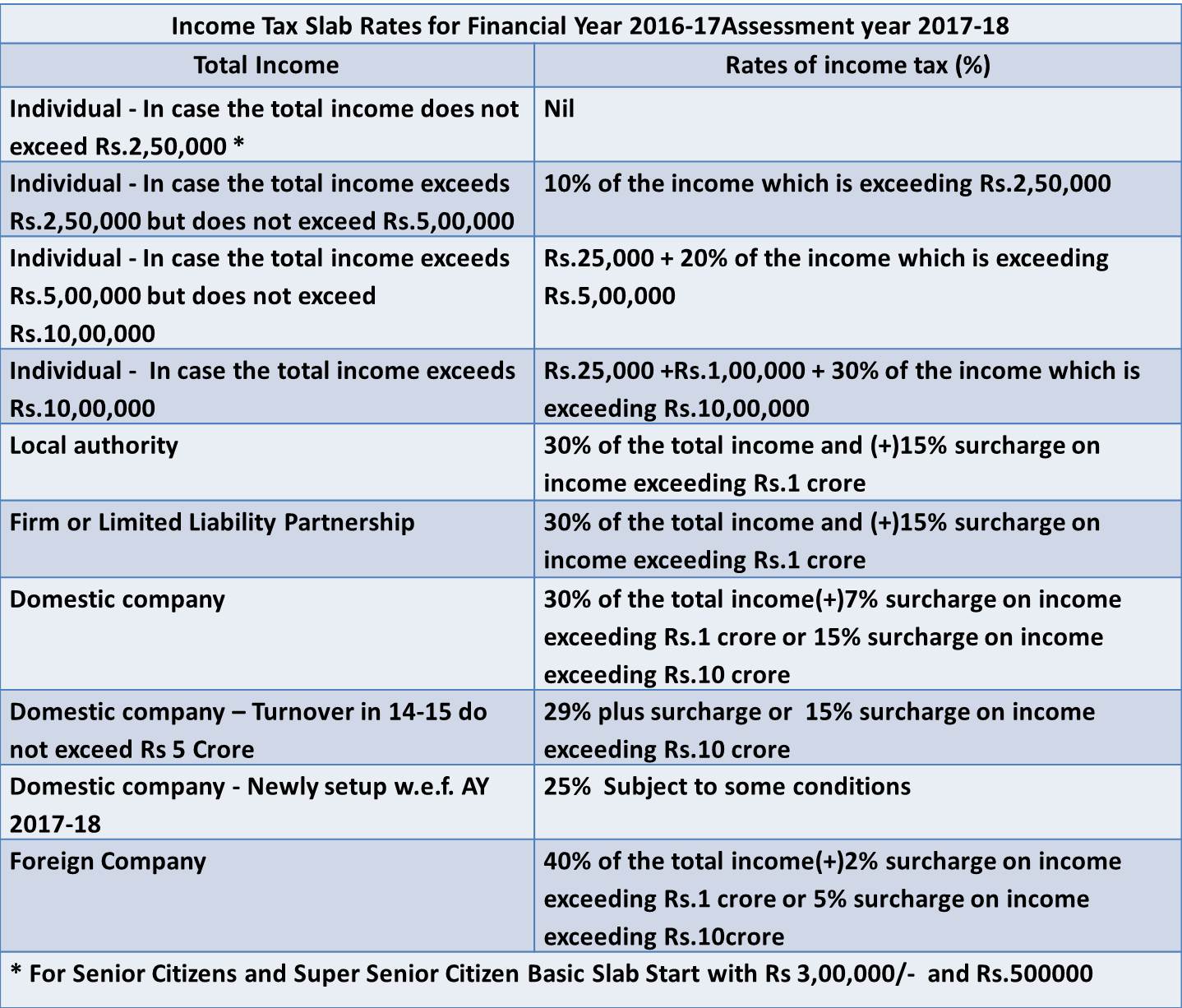

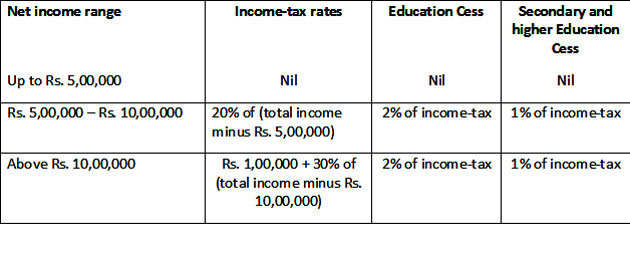

Slab Rates For The Assessment Year 2017 18 Financial Year 2016 17

https://2.bp.blogspot.com/-VutiPb0y8S0/WHdWqfB2DDI/AAAAAAAAFxg/vBCFaUu_OmArDb8s2ulSDJMFKMaNLGI3QCLcB/s1600/Income-Tax-Slab-Rates-for-Financial-Year-2016-17-Assessment-year-2017-18.jpg

Income Tax Calculator 2017 18 Know Your Income Tax Slabs Rates

http://www.india.com/wp-content/uploads/2017/02/income-tax-slab.png

https://www.apnaplan.com/income-tax-slabs-fy2017-18

Web 1 f 233 vr 2017 nbsp 0183 32 Budget 2017 has made slight changes to the tax slab rates Tax reduced from 10 to 5 for Income from Rs 2 50 000 Rs 5 00 000 Rs 2 500 or 100 rebate in

https://taxguru.in/income-tax/income-tax-slabs-ay-201819-fy-201718.html

Web 3 ao 251 t 2017 nbsp 0183 32 The amount of rebate shall be 100 of income tax or Rs 2 500 whichever is less 4 Partnership Firm For the Assessment Year 2017 18 and 2018 19 a partnership

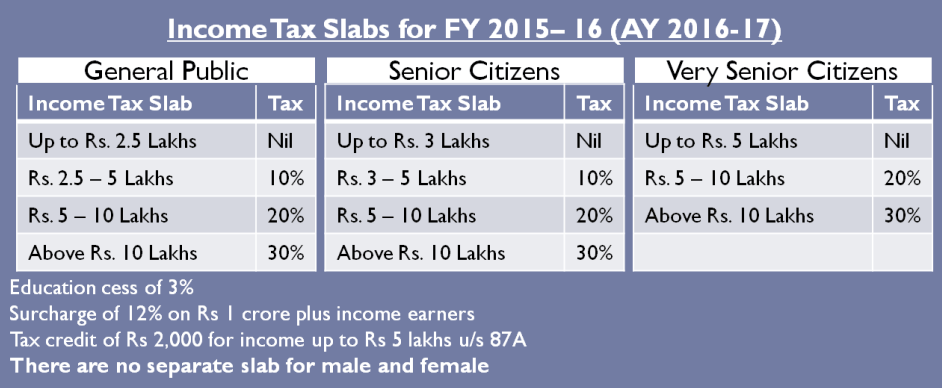

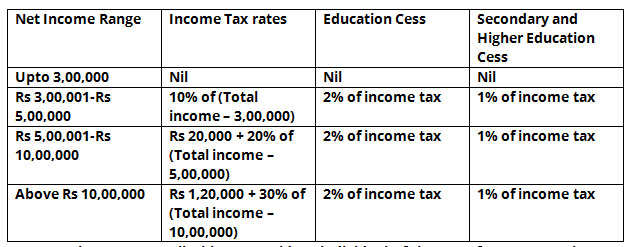

Current Income Tax Slabs Latest Income Tax Slabs For The Financial

Slab Rates For The Assessment Year 2017 18 Financial Year 2016 17

Income Tax Slab Change 2017 18 Current Income Tax Slabs For The

Income Tax Rebate U s 87A For A Y 2017 18 F Y 2016 17

Income Tax Changes FY 2017 18 Slab Rates Tax Rebate Calculation

Tds Slab Rate Fy 2019 20

Tds Slab Rate Fy 2019 20

Income Tax Slab Rate For New Tax Regime Fy 2020 21 Gambaran

Income Tax Slab Rate Taxation Policy Tax2win

Difference Between Income Tax Slabs 2019 20 And 2020 21 Gservants

Income Tax Slab 17 18 Rebate - Web 3 f 233 vr 2022 nbsp 0183 32 A resident Individual whose Taxable Income does not exceed Rs 3 50 000 after deductions is eligible for rebate of 100 of Income tax or Rs 2 500 whichever