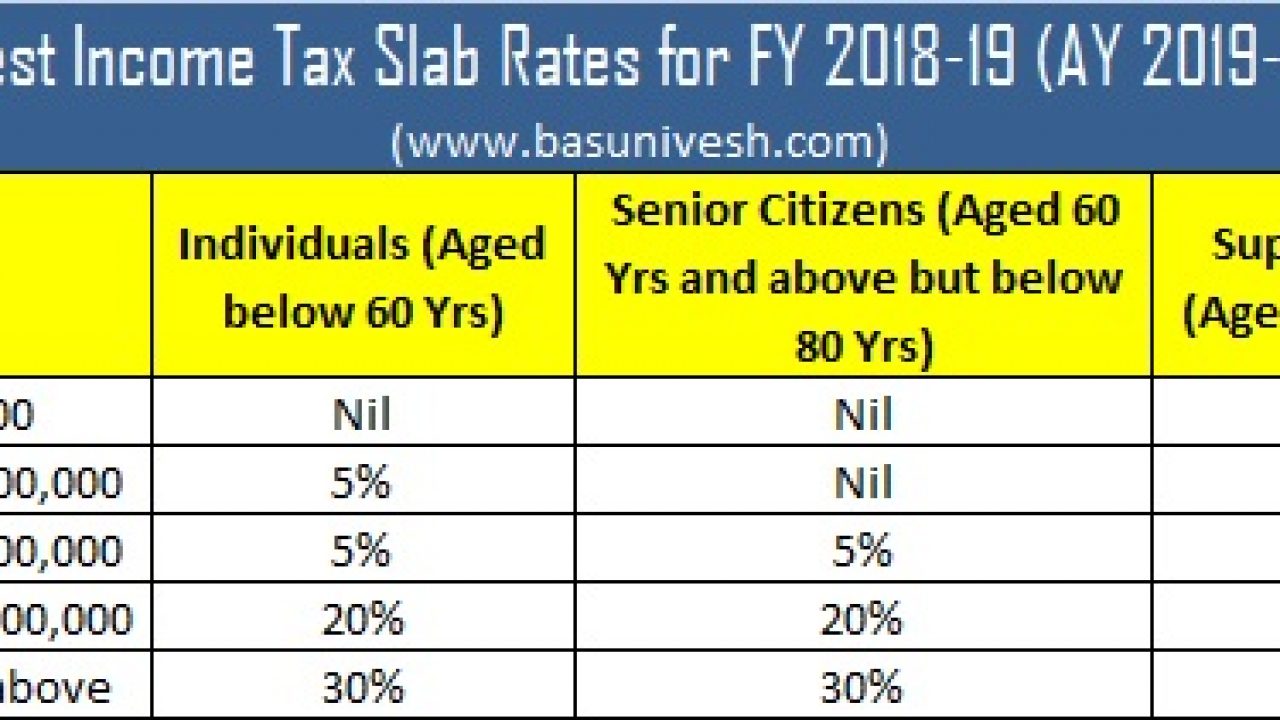

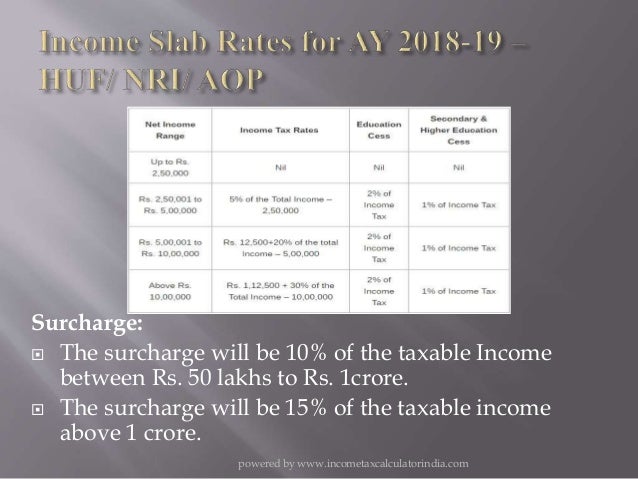

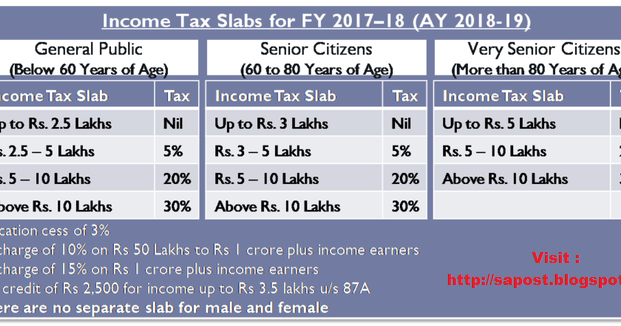

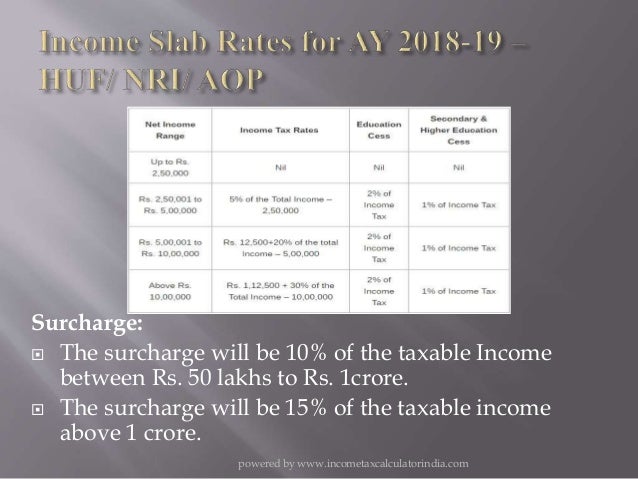

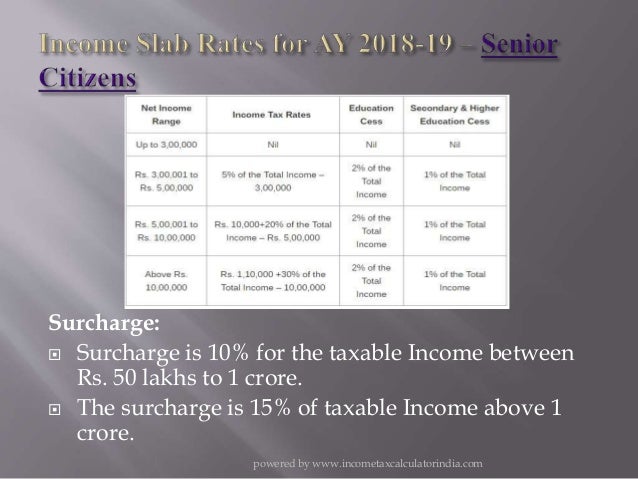

Income Tax Slab Rate For Ay 18 19 Rebate Web 16 nov 2017 nbsp 0183 32 Plus Surcharge 10 of tax where total income exceeds Rs 50 lakh 15 of tax where total income exceeds Rs 1 crore Education cess 3 of tax plus surcharge

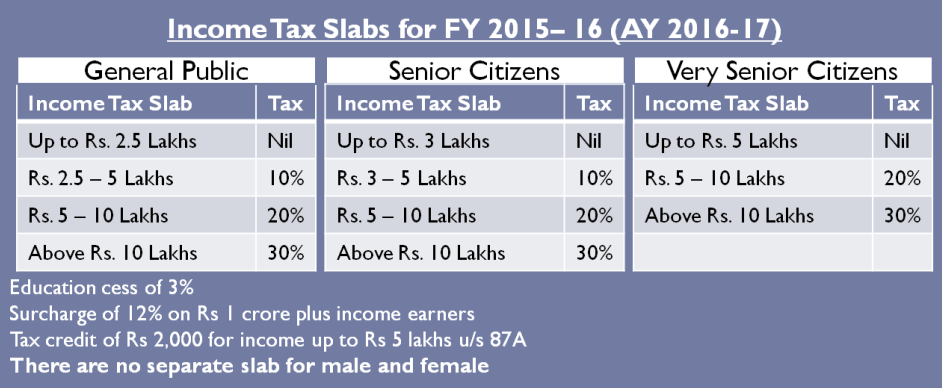

Web The Budget 2018 has proposed no changes in the income tax rates and slabs for the FY 2018 19 However cess has been hiked to 4 per cent from 3 percent across the board Web 26 janv 2017 nbsp 0183 32 With a reduction of tax rate to 5 in place of existing 10 the Government has reduced the rebate u s 87A to Rs 2500 for individuals having total income taxable income up to Rs 3 5 lakhs

Income Tax Slab Rate For Ay 18 19 Rebate

Income Tax Slab Rate For Ay 18 19 Rebate

http://apnaplan.com/wp-content/uploads/2017/02/Income-Tax-Slab-for-FY-2017–18-AY-2018-19-1024x441.png

Tds Slab Rate Fy 2019 20

https://www.basunivesh.com/wp-content/uploads/2018/02/Latest-Income-Tax-Slab-Rates-for-FY-2018-19-AY-2019-20-1280x720.jpg

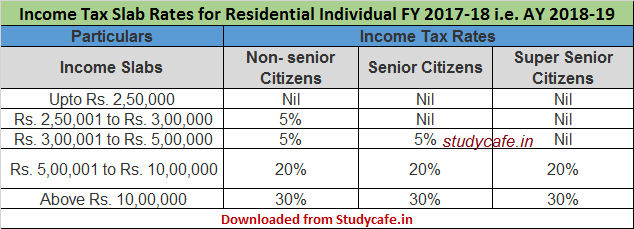

Income Tax Slab Rates For FY 2017 18 AY 2018 19 Studycafe

https://studycafe.in/wp-content/uploads/2017/04/Income-Tax-Slab-Rates-for-FY-2017-18-i.e.-AY-2018-19.png

Web 18 juil 2019 nbsp 0183 32 07 18 2019 by Amit Bansal 0 Understanding Income Tax Slab before calculation and assessment of tax is very important for tax expert as well as a common man Table of Contents Income Tax Slabs Web 3 mai 2019 nbsp 0183 32 A resident Individual whose Taxable Income does not exceed Rs 3 50 000 after deductions is eligible for rebate of 100 of Income tax or Rs 2 500 whichever

Web 16 ao 251 t 2023 nbsp 0183 32 Individuals with Net taxable income less than or equal to Rs 5 lakh will be eligible for tax rebate u s 87A i e tax liability will be NIL in both New and old existing Web 1 juin 2019 nbsp 0183 32 When income is between Rs 50 lakh and Rs 1 crore The amount of income tax shall be increased by a surcharge at the rate of 10 per cent of such tax where total

Download Income Tax Slab Rate For Ay 18 19 Rebate

More picture related to Income Tax Slab Rate For Ay 18 19 Rebate

Income Tax Calculator For FY 2018 19 AY 2019 20 Excel Download

http://www.apnaplan.com/wp-content/uploads/2018/02/Budget-2018-Income-Tax-Slabs-for-FY-2018-19-1024x493.png

Income Tax Slab Ay 2019 2020 In Pdf Carfare me 2019 2020

https://www.relakhs.com/wp-content/uploads/2019/02/Latest-income-tax-slab-rates-FY-2018-19-AY-2019-20-Tax-rates-for-individuals-budget-2019-2020-pic.jpg

Budget 2017 Highlights 10 Changes Every Investor Must Aware BasuNivesh

https://www.basunivesh.com/wp-content/uploads/2017/02/Income-Tax-Slab-Rates-for-FY-2017-18-or-AY-2018-19.jpg

Web 5 juil 2019 nbsp 0183 32 Income Tax Slab Rates FY 2018 19 AY 2019 20 Income tax slab rates for Individuals in India is based on the age of the assessee and their residential status Web 5 mai 2022 nbsp 0183 32 Surcharge amount of 10 or 15 as applicable shall not exceed the amount of income that exceeds Rs 50 lakhs or Rs 1 crore as applicable Health and Education Cess on Income tax The amount of

Web 4 nov 2017 nbsp 0183 32 30 Rebate under section 87A Individuals with income upto 3 50 000 are eligible for rebate with maximum limit of Rs 2 500 Surcharge limit and rate for Web 1 f 233 vr 2018 nbsp 0183 32 Below are the latest proposals that have been made in Budget 2018 19 Income Tax Slabs No change has been proposed on tax slab rates Standard Deduction A standard deduction of Rs 40 000 in lieu of

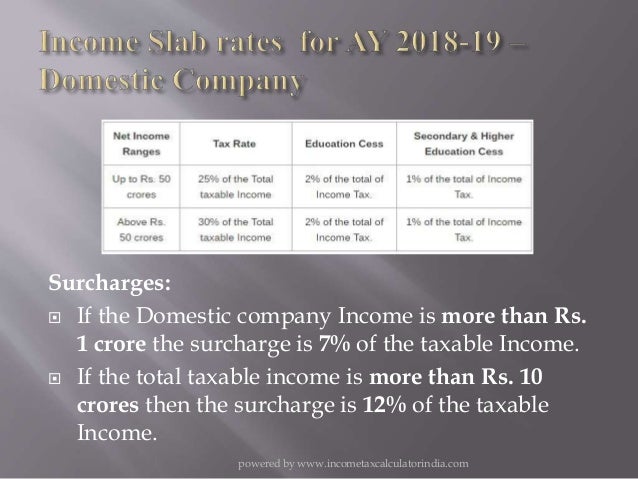

Income Slab Rates For Ay 2018 19

https://image.slidesharecdn.com/incomeslabratesforay2018-19-170301044729/95/income-slab-rates-for-ay-2018-19-6-638.jpg?cb=1488343765

Income Slab Rates For Ay 2018 19

https://image.slidesharecdn.com/incomeslabratesforay2018-19-170301044729/95/income-slab-rates-for-ay-2018-19-11-638.jpg?cb=1488343765

https://www.taxmann.com/.../208/tax-rates-income-tax-slab-for-ay-2018 …

Web 16 nov 2017 nbsp 0183 32 Plus Surcharge 10 of tax where total income exceeds Rs 50 lakh 15 of tax where total income exceeds Rs 1 crore Education cess 3 of tax plus surcharge

https://www.hostbooks.com/in/income-tax-slabs-rate-2018-2019

Web The Budget 2018 has proposed no changes in the income tax rates and slabs for the FY 2018 19 However cess has been hiked to 4 per cent from 3 percent across the board

All India Association Of Inspectors And Assistant Superintendent Of

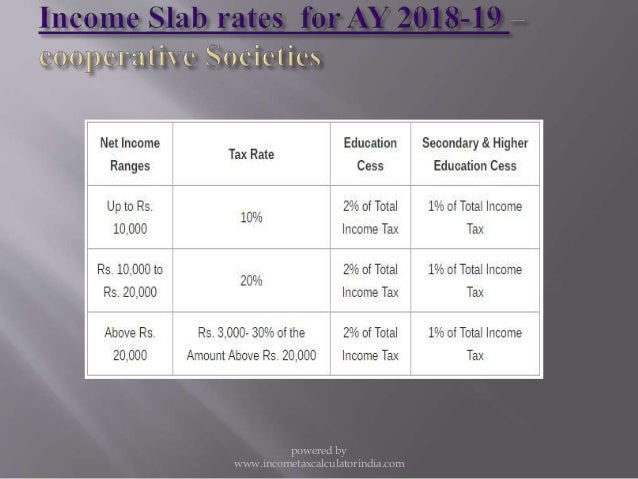

Income Slab Rates For Ay 2018 19

Income Tax Slab For Ay 2019 20 Income Tax Slab For Fy 2018 2018 08 02

Income Slab Rates For Ay 2018 19

Income Tax Slab Rates For AY 2017 18 FY 2016 17

Income Tax Slab 2018 19 Budget 2018 19 Income Tax Slab Rate YouTube

Income Tax Slab 2018 19 Budget 2018 19 Income Tax Slab Rate YouTube

Income Slab Rates For Ay 2018 19

Income Tax Slab For Ay 2019 20 Income Tax Slab For FY 2018 2018 08 02

Income Tax Rates For Fy 2019 2020 Pdf Carfare me 2019 2020

Income Tax Slab Rate For Ay 18 19 Rebate - Web 12 sept 2023 nbsp 0183 32 INCOME SLABS INCOME TAX RATES Upto Rs 2 50 000 NIL Rs 2 50 000 to 5 00 000 5 of the amount exceeding Rs 2 50 000 Rs 5 00 000 to