Incorrect Recovery Rebate Credit 2024 Yes The IRS will not reject a tax return if an error was made calculating the 2020 Recovery Rebate Credit If a taxpayer entered an amount on line 30 but made a

Page Last Reviewed or Updated 12 Feb 2024 Eligible individuals can claim the Recovery Rebate Credit on their Form 1040 or 1040 SR These forms can also be If you filed your 2020 and or 2021 taxes and failed to claim a Recovery Rebate Credit you can still try to file an Amended Tax Return

Incorrect Recovery Rebate Credit 2024

Incorrect Recovery Rebate Credit 2024

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/01/how-to-claim-recovery-rebate-credit-turbotax-romainedesign-1.png

The Recovery Rebate Credit Explained Expat US Tax

https://www.expatustax.com/wp-content/uploads/2021/03/Recovery-Rebate.jpg

2022 Irs Recovery Rebate Credit Worksheet Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2022/11/who-could-qualify-for-2nd-stimulus.jpeg

How To Claim the Recovery Rebate Credit on a Tax Return You will need to file your recovery rebate worksheet along with your 2020 or 2021 federal tax return If you didn t file a 2020 federal tax return you have until May 17 2024 to do so and claim this tax credit potentially worth thousands of dollars You may qualify if

The IRS will notice and they ll adjust your return accordingly Incorrect amounts Reporting the wrong amount of EIP received is a common mistake Ensure The new report found the IRS correctly calculated the allowable Recovery Rebate Credit for 99 7 of tax year 2021 tax returns that claimed a credit as of May 5

Download Incorrect Recovery Rebate Credit 2024

More picture related to Incorrect Recovery Rebate Credit 2024

Does A Tax Credit Give You Money Leia Aqui Do You Get Money From Tax Credit

https://img.money.com/2022/03/News-Recovery-Rebate-Credit.jpg

Recovery Rebate Credit 2023 2024 Credits Zrivo

https://www.zrivo.com/wp-content/uploads/2022/05/Recovery-Rebate-Credit-zrivo-1.jpg

2021 Recovery Rebate Credit R R Accountants RC SD

https://www.rnraccountants.com/wp-content/uploads/2022/02/Untitled-design-31-930x620.png

Taxpayers eligible for recovery rebate credits for tax year 2020 have until May 17 2024 to file a tax return to claim the payment By law taxpayers can make a The recovery rebate credit is 600 per eligible individual 1 200 for married filing jointly and 600 per eligible child The credit phases out starting at 75 000 of

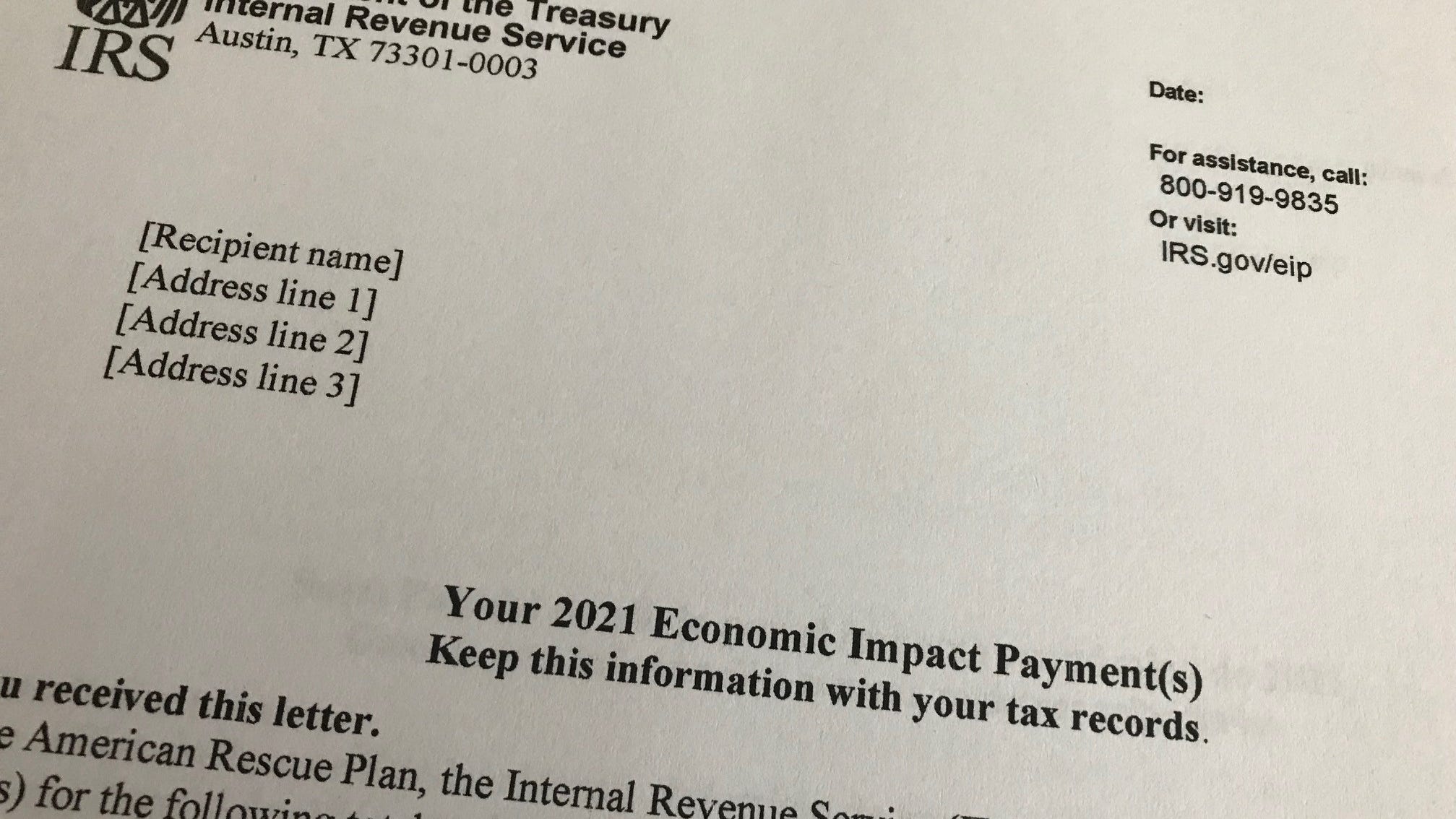

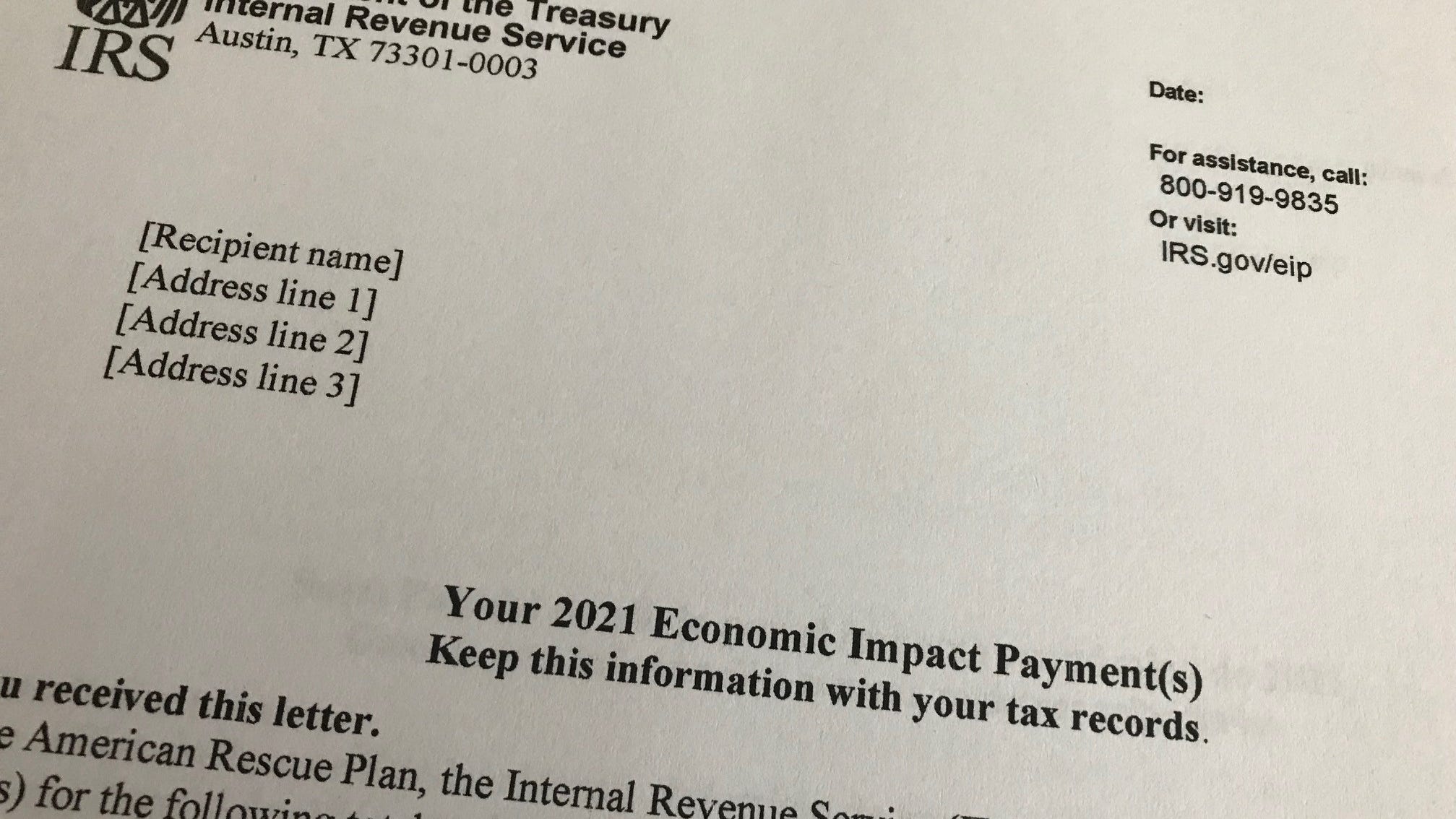

2020 Recovery Rebate Credit file a tax return by May 17 2024 2021 Recovery Rebate Credit file a tax return by April 15 2025 Get free help Qualified The key is to make sure that the amount of money you received in third round stimulus payments is cited accurately on your 2021 tax return and matches what the IRS

IRS Letter Needed To Claim Stimulus Check With Recovery Rebate Credit

https://www.gannett-cdn.com/presto/2022/01/31/PDTF/b7acf011-8827-427c-87dd-1b4ac9c5ff02-extra.jpg?crop=2015,1134,x0,y75&width=2015&height=1134&format=pjpg&auto=webp

Recovery Rebate Credit Stimulus Check 2022 Turbotax Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2022/11/how-to-claim-stimulus-recovery-rebate-credit-on-turbotax-7.png?fit=1003%2C552&ssl=1

https://www.irs.gov/newsroom/irs-information...

Yes The IRS will not reject a tax return if an error was made calculating the 2020 Recovery Rebate Credit If a taxpayer entered an amount on line 30 but made a

https://www.irs.gov/newsroom/recovery-rebate-credit

Page Last Reviewed or Updated 12 Feb 2024 Eligible individuals can claim the Recovery Rebate Credit on their Form 1040 or 1040 SR These forms can also be

IRS Updates Info On Recovery Rebate Credit And Pandemic Response Scott M Aber CPA PC

IRS Letter Needed To Claim Stimulus Check With Recovery Rebate Credit

Recovery Rebate Credit Cg Tax Audit Advisory

How To Claim Recovery Rebate Credit With No Income Recovery Rebate

The Recovery Rebate Credit Calculator ShauntelRaya

Can I Claim Recovery Rebate Credit In 2023 Recovery Rebate

Can I Claim Recovery Rebate Credit In 2023 Recovery Rebate

What Is The Recovery Rebate Credit 2023 Detailed Information

Line 30 Recovery Rebate Credit 2022 Recovery Rebate

Missed Or Incorrect 2020 Recovery Rebate Credit When Or When Not To Amend Income Tax Return

Incorrect Recovery Rebate Credit 2024 - The IRS will notice and they ll adjust your return accordingly Incorrect amounts Reporting the wrong amount of EIP received is a common mistake Ensure