Incorrect Recovery Rebate Credit Web 10 d 233 c 2021 nbsp 0183 32 DO NOT file an amended tax return if you entered an incorrect amount for the 2020 Recovery Rebate Credit on your tax return If you entered an amount on line

Web 11 avr 2022 nbsp 0183 32 People who claimed the wrong amount of the recovery rebate credit don t need to file an amended return The IRS will correct their return and send a notice that Web 5 avr 2021 nbsp 0183 32 IR 2021 76 April 5 2021 WASHINGTON As people across the country file their 2020 tax returns some are claiming the 2020 Recovery Rebate Credit RRC The

Incorrect Recovery Rebate Credit

Incorrect Recovery Rebate Credit

https://www.usatoday.com/gcdn/presto/2022/01/31/PDTF/b7acf011-8827-427c-87dd-1b4ac9c5ff02-extra.jpg?crop=2015,1134,x0,y75&width=2015&height=1134&format=pjpg&auto=webp

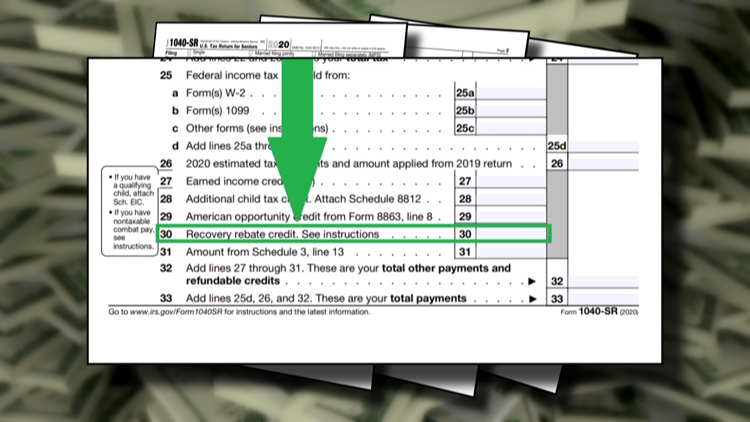

Recovery Rebate Credit Worksheet Explained Support

https://support.taxslayer.com/hc/article_attachments/4415858470797/mceclip3.png

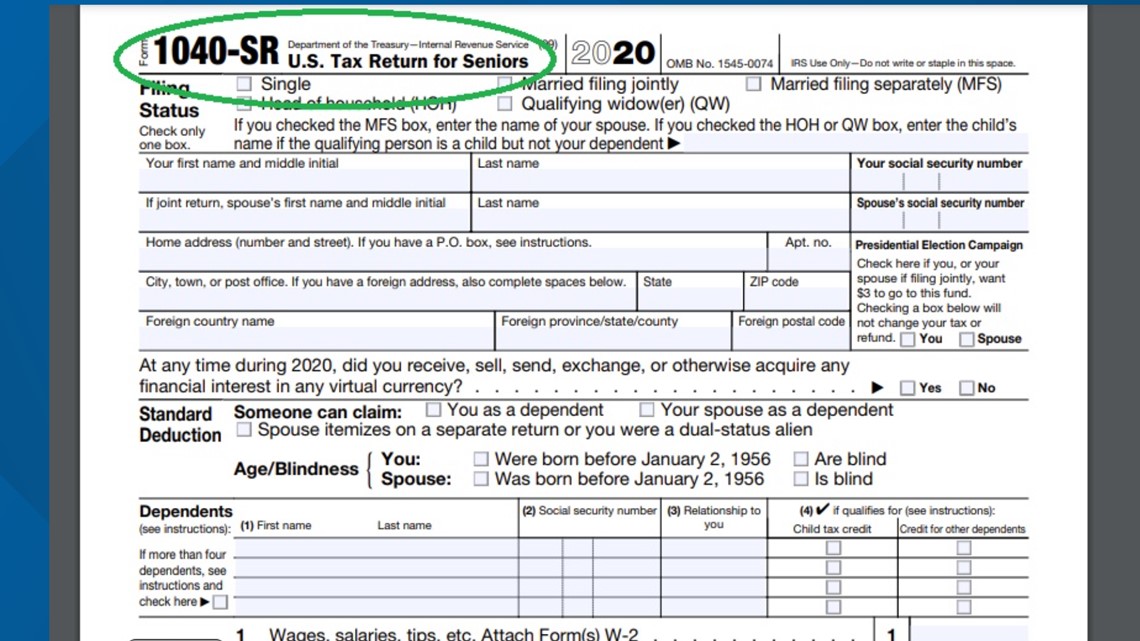

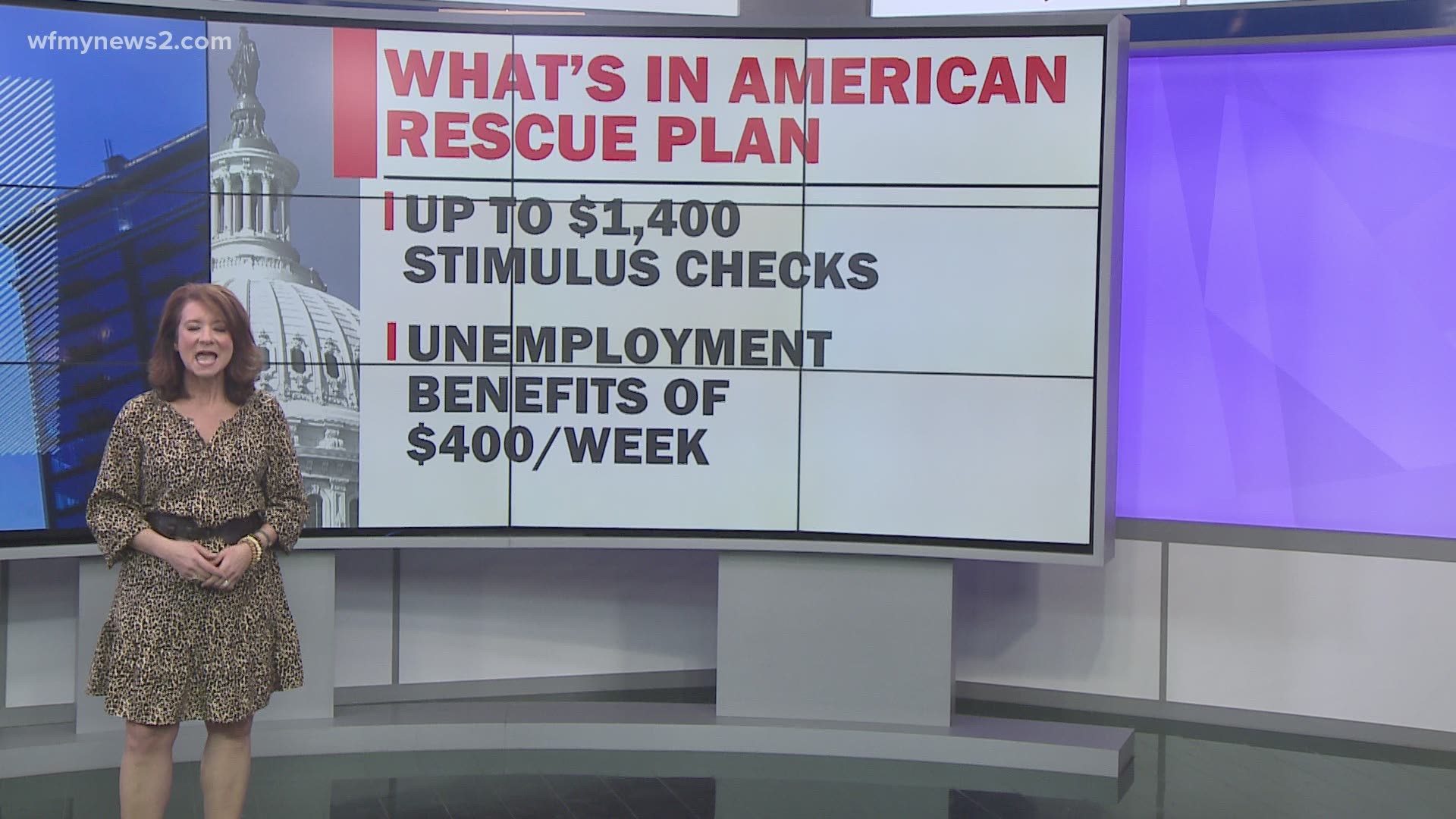

IT S NOT TOO LATE Claim A Recovery Rebate Credit To Get Your

https://media.cbs19.tv/assets/KYTX/images/3ca89be7-1360-4b18-a5ba-3c6279cb9539/3ca89be7-1360-4b18-a5ba-3c6279cb9539_750x422.png

Web 23 ao 251 t 2021 nbsp 0183 32 The amount adjusted by the IRS notice is 1 591 97 which I believe was adjusted for a disallowed Recovery rebate credit plus or minus interest and other Web If you claim an incorrect Recovery Rebate Credit amount the IRS will adjust your tax return to reflect the correct amount For example if your letters indicate you and your spouse both received the full third stimulus

Web 29 sept 2021 nbsp 0183 32 The IRS is sending taxpayers Letter 6470 notifying them of errors in the Recovery Rebate Credit claimed on their 2020 income tax return The letters are vague Web 5 avr 2021 nbsp 0183 32 April 05 2021 3 48 p m EDT 3 Min Read The Internal Revenue Service is mailing letters to taxpayers explaining why they may not be getting as much of a

Download Incorrect Recovery Rebate Credit

More picture related to Incorrect Recovery Rebate Credit

IRS Letters Explain Why Some 2020 Recovery Rebate Credits Are Different

https://i0.wp.com/southernmarylandchronicle.com/wp-content/uploads/2021/04/Recovery-Rebate-Credit.png?fit=1200%2C675&ssl=1

IT S NOT TOO LATE Claim A Recovery Rebate Credit To Get Your

https://media.cbs19.tv/assets/KYTX/images/81fe327c-4658-46bc-9bdb-03dd087512de/81fe327c-4658-46bc-9bdb-03dd087512de_1920x1080.jpg

IRS Ends Up Correcting Tax Return Mistakes For Recovery Rebate Credit

https://www.freep.com/gcdn/presto/2020/04/20/PDTF/c6616583-646a-4e98-bafe-d684cd3ba149-IMG_6440.jpg?width=660&height=495&fit=crop&format=pjpg&auto=webp

Web 16 mai 2023 nbsp 0183 32 This may include corrections to any incorrect Recovery Rebate Credit or Child Tax Credit amounts You ll get a notice explaining the changes Where s My Web IRS tax refund update Recovery rebate error notices sent The Internal Revenue Service sent 5 million correction notices to filers who claimed a Recovery Rebate Credit but it

Web Made a mistake on recovery rebate credit I was filing my taxes on turbo taxes and got to the part where they ask you to enter the amount for third stimulus check I check the irs Web 19 avr 2022 nbsp 0183 32 1 Reply Bookmark Icon ErnieS0 Expert Alumni Form 1040 line 30 would be 0 is you are single and received the full Rebate Recovery Credit of 1 400 Putting

Income Tax Return Deadline May 15 Recovery Rebate Credit Other Info

https://www.gannett-cdn.com/media/2020/04/15/USATODAY/usatsports/247WallSt.com-247WS-682482-a3d32abb.jpg?width=1320&height=744&fit=crop&format=pjpg&auto=webp

How To Claim The Stimulus Money On Your Tax Return Wltx

https://media.wltx.com/assets/WFMY/images/aa59dc39-833b-4a3b-bc79-50c40f0b3c4b/aa59dc39-833b-4a3b-bc79-50c40f0b3c4b_1140x641.jpg

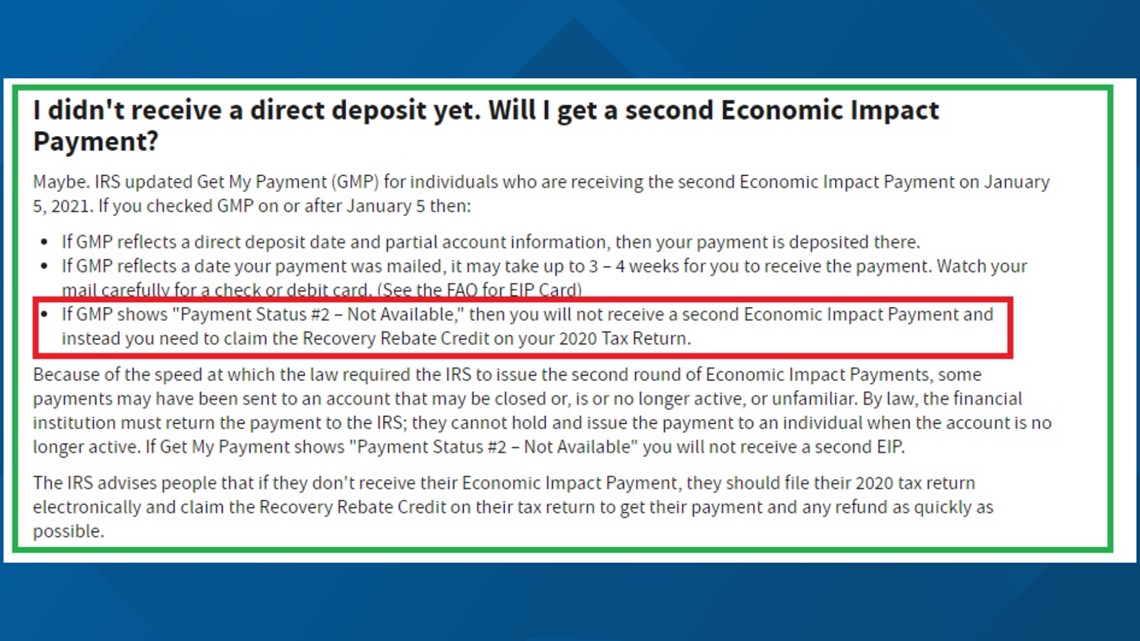

https://www.irs.gov/newsroom/2020-recovery-rebate-credit-topic-g...

Web 10 d 233 c 2021 nbsp 0183 32 DO NOT file an amended tax return if you entered an incorrect amount for the 2020 Recovery Rebate Credit on your tax return If you entered an amount on line

https://www.irs.gov/newsroom/what-people-should-do-if-their-third...

Web 11 avr 2022 nbsp 0183 32 People who claimed the wrong amount of the recovery rebate credit don t need to file an amended return The IRS will correct their return and send a notice that

Recovery Rebate Credit Worksheet Explained Support

Income Tax Return Deadline May 15 Recovery Rebate Credit Other Info

Eligibility For Recovery Rebate Credit Ft Myers Naples Markham Norton

What s The Recovery Rebate Credit Kiplinger

Recovery Rebate Credit Santa Barbara Tax Products Group

Payment Status not Available On IRS Tracker Sorry Your Stimulus

Payment Status not Available On IRS Tracker Sorry Your Stimulus

How To Claim The Recovery Rebate Credit FAQs Charlotte Center For

The Recovery Rebate Credit Explained Expat US Tax

Recovery Rebate Credits IRS Says Amount Might Be Less For Some Wwltv

Incorrect Recovery Rebate Credit - Web 13 janv 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal