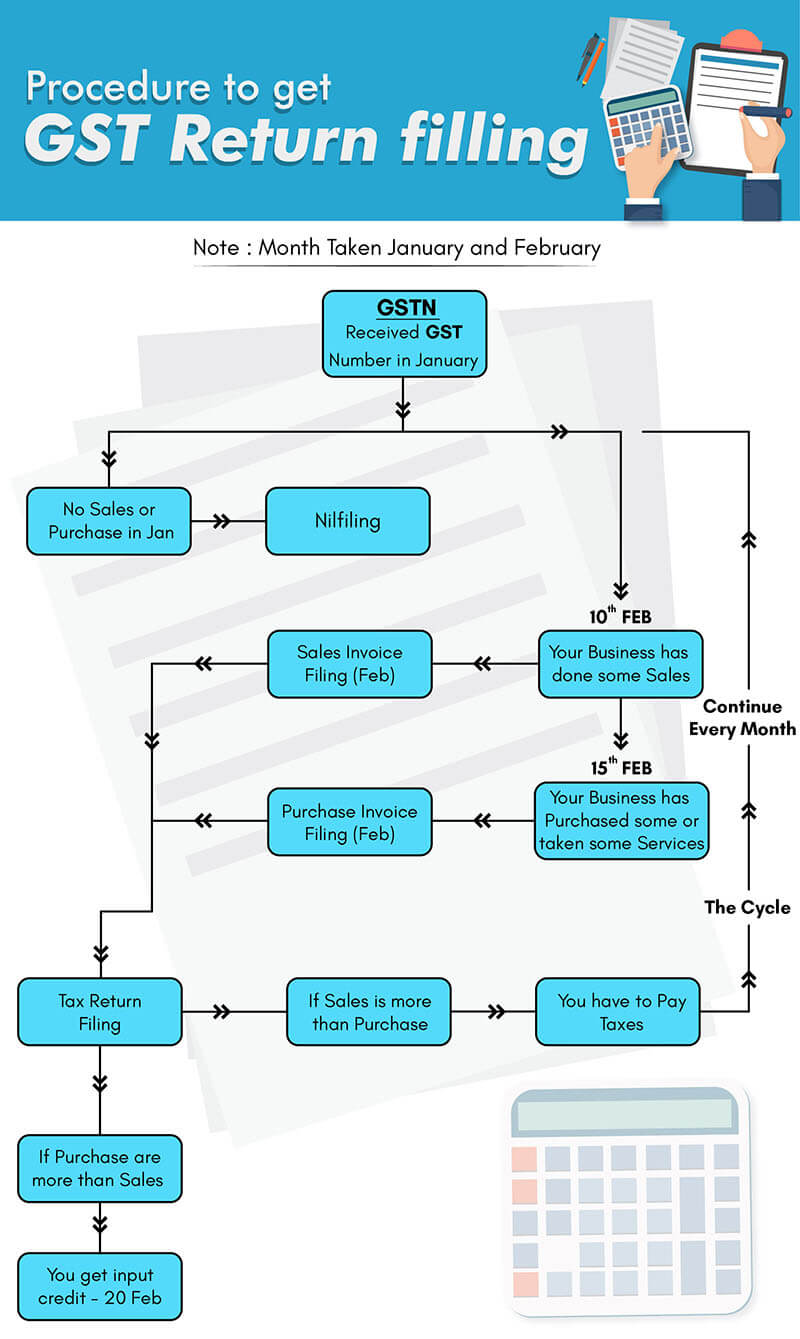

India Gst Return Filing Due Date The due date for filing GSTR 1 is the 11th month for monthly filers and the 31st of the next quarter for quarterly filers GSTR 2 and GSTR 2B GSTR 2A is an auto populated return generated for a

The Central Board of Indirect Taxes and Customs vide notification no 34 2018 Central Tax dated 10th August 2018 has Date 20 May 2021 The Income Tax Department extends the following due dates Income Tax Return filing date extended to 31st Dec 21 from 30th Sep 2021

India Gst Return Filing Due Date

India Gst Return Filing Due Date

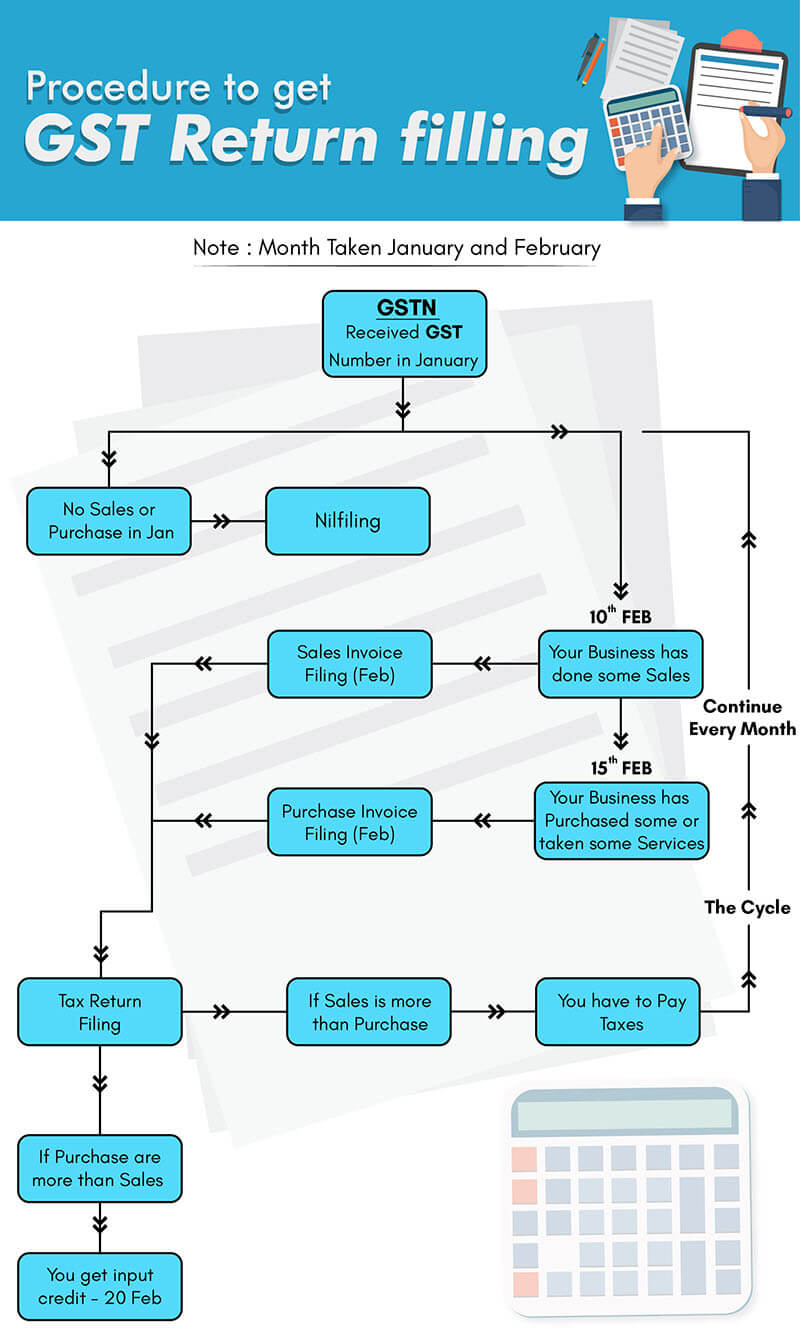

https://legaldocs.co.in/img/gst-filling/gst-return-filling.jpg

GST Annual Return Due Dates FinancePost

https://financepost.in/wp-content/uploads/2021/12/dd.jpg

Relief To Taxpayers Govt Extends GST Return Filing Date To Oct 25

https://cdn.statically.io/img/blog.ziploan.in/wp-content/uploads/2018/10/GST.jpg

Half yearly for AATO Rs 5 crore 25th October and 25th April where AATO exceeds Rs 5 crore AATO Annual aggregate turnover due dates Everything you 1 What Is The Due Date For Filing GST Returns The due date for GST returns is monthly yearly or quarterly depending on the return type 2 What Are The GST

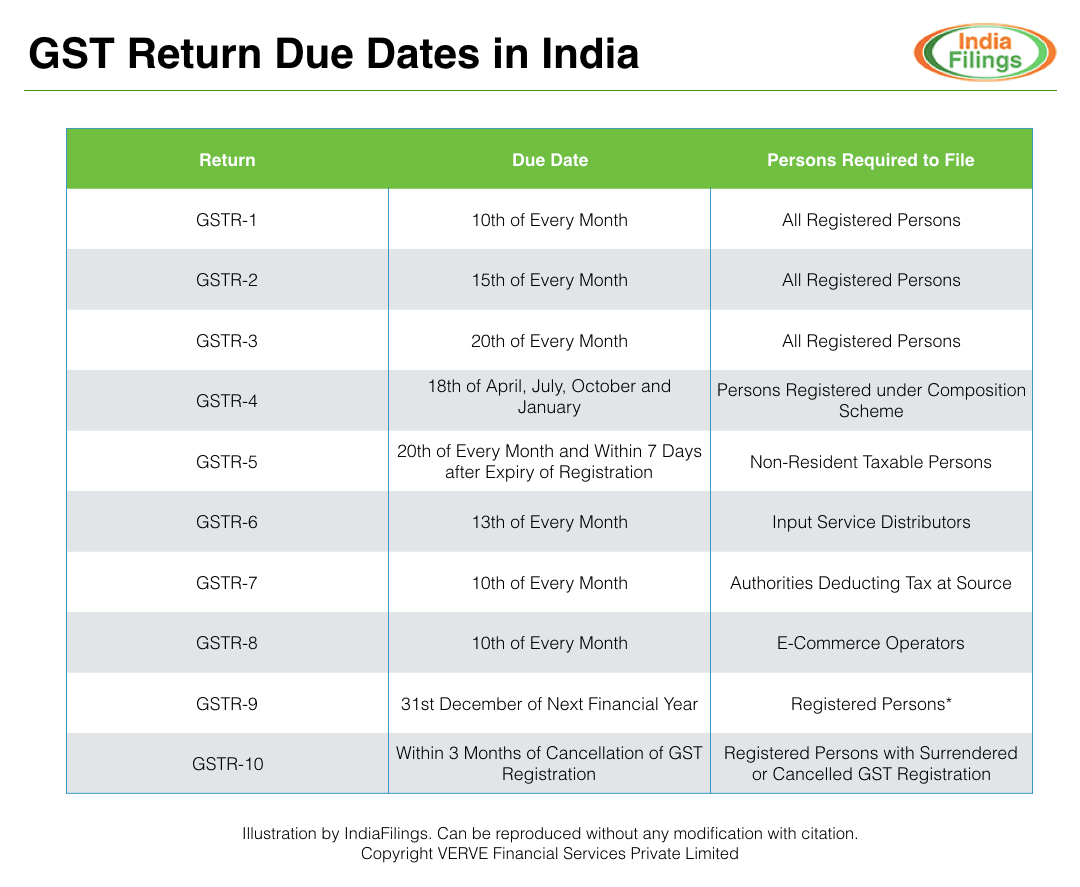

The due date for filing GSTR 4 is 18th of every month following the quarter for which such a return needs to be filed Say for instance Kapoor Pvt Ltd is a Every taxpayer needs to submit the GSTR 9 form within the given time frame If this deadline is missed there s a significant penalty to be aware

Download India Gst Return Filing Due Date

More picture related to India Gst Return Filing Due Date

Due Dates For GST Returns Types Of GST Returns Ebizfiling

https://ebizfiling.com/wp-content/uploads/2020/02/Due-date-for-different-type-of-GST-Returns.png

GST Return Filing Due Dates IndiaFilings Learning Centre

https://www.indiafilings.com/learn/wp-content/uploads/2017/06/GST-Return-Filing-Due-Dates.png

Income Tax Returns Filing Due Dates Extended Ebizfiling

https://ebizfiling.com/wp-content/uploads/2020/12/Income-Tax-Return-filing-due-dates-extended1-1.png

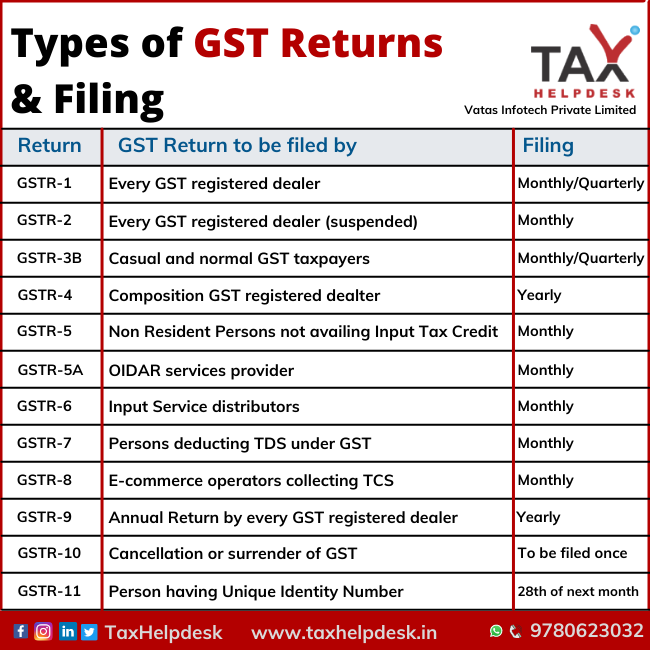

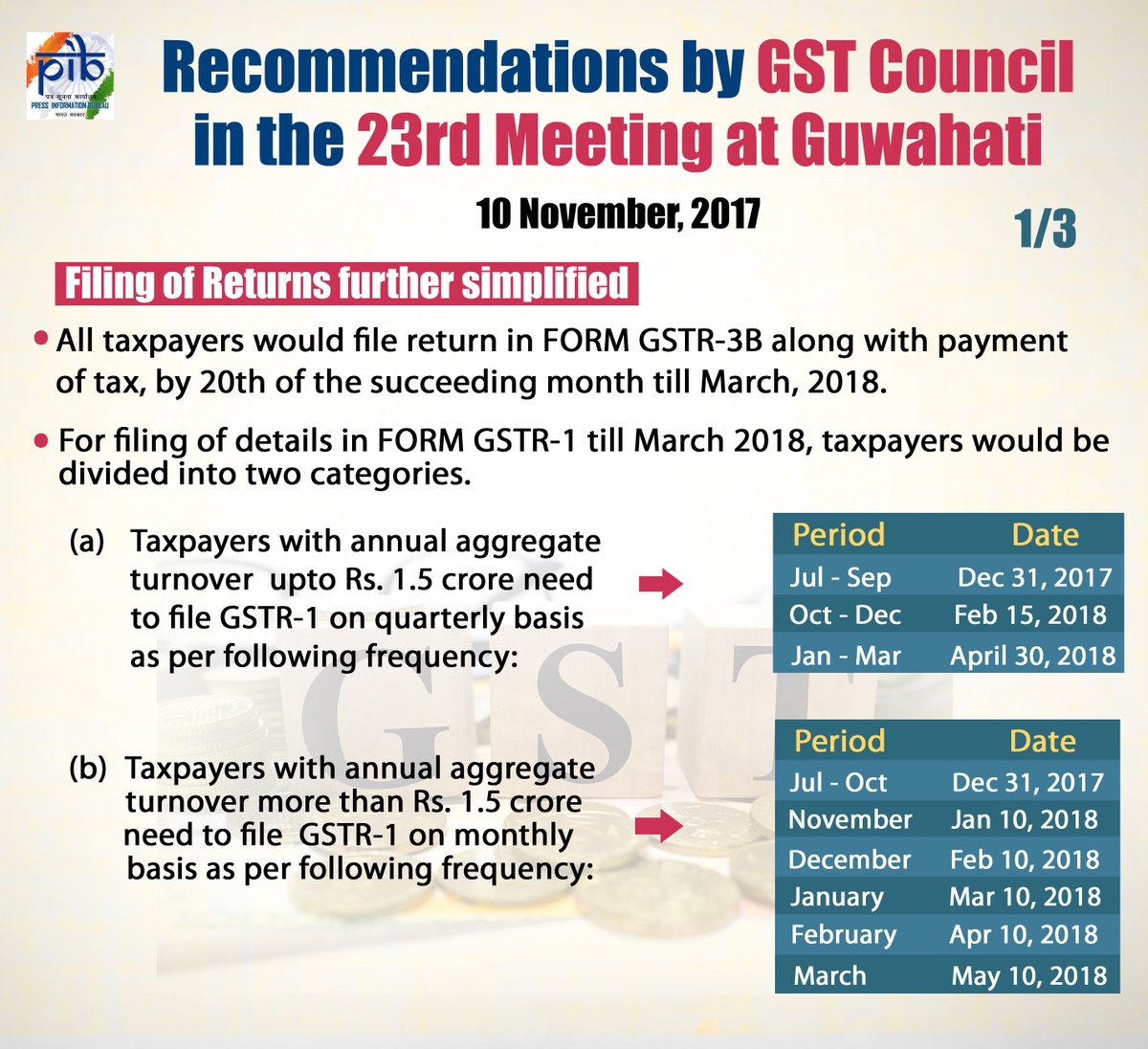

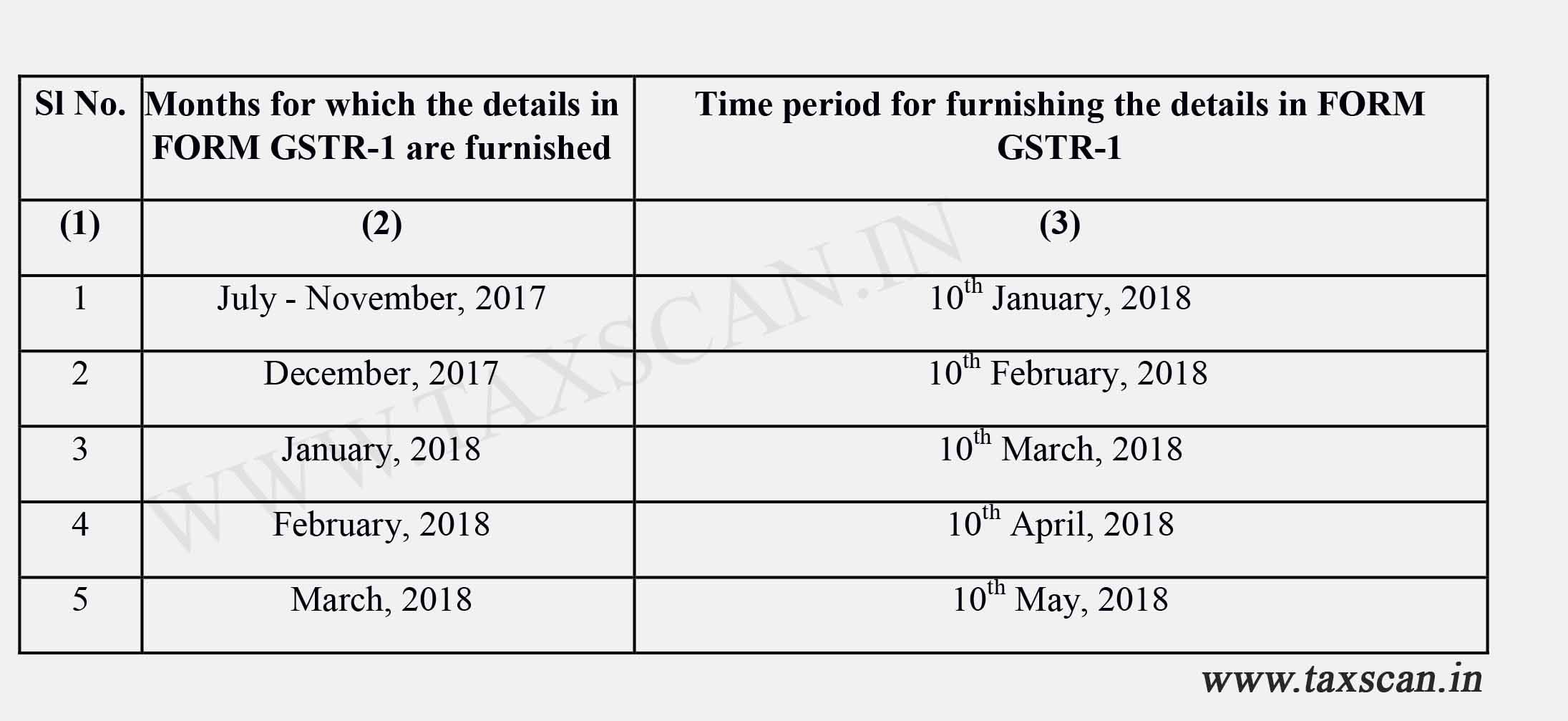

The tax return forms known as GST returns should be filed by companies to the Income Tax authorities of India The GST return is filed monthly quarterly and annually depending upon which GST Return form Due date Filing frequency GSTR 1 11th day of the next month Monthly 13th day of the month after the quarter Quarterly for those under the QRMP

The GST return date for filing GSTR 4 is 18th of the subsequent month Here is the due date for filing the GSTR 4 GSTR 5 Due on either on 20th of the The due date for filing GST returns in India varies depending on the type of return being filed The charges and due dates mentioned in the article are subject to

GST Enrollment Or Registration Dates For Indian States

https://blog.saginfotech.com/wp-content/uploads/2016/11/GST-Enrolment-Plan-for-Indian-States.jpg

![]()

GST Return Forms Types Due Dates And Late Filing Penalties

https://cdn.shortpixel.ai/client/q_lossless,ret_img,w_793/https://www.paisabazaar.com/wp-content/uploads/2017/07/GST-Return-forms.png

https://www.indiafilings.com/learn/types-of-g…

The due date for filing GSTR 1 is the 11th month for monthly filers and the 31st of the next quarter for quarterly filers GSTR 2 and GSTR 2B GSTR 2A is an auto populated return generated for a

https://www.indiafilings.com/learn/gst-retur…

The Central Board of Indirect Taxes and Customs vide notification no 34 2018 Central Tax dated 10th August 2018 has

Types Of GST Returns Filing Period And Due Dates

GST Enrollment Or Registration Dates For Indian States

Types Of GST Return And Their Due Dates Enterslice

GST Returns And Due Dates GST Service And Support Bangalore

Company Act Archives Ebizfiling

How To File GST Returns Online In India

How To File GST Returns Online In India

GST RETURN FILING DUE DATE AND PROCESS CHANGED SIMPLE TAX INDIA

Govt Notifies Due Dates For Filing GST Returns Read Notifications

GST RETURN DUE DATE APRIL TO JUNE 2018 SIMPLE TAX INDIA

India Gst Return Filing Due Date - The due date for filing GSTR 4 is 18th of every month following the quarter for which such a return needs to be filed Say for instance Kapoor Pvt Ltd is a