India Tax Exemption Limit Verkko Every person being an Individual HUF AOP BOI or AJP shall be required to file return of income if his total income before claiming exemption or deduction under 10 38 10A 10B 10BA 54 54B 54D 54EC 54F 54G 54GA or 54GB or Chapter VI A exceeds maximum exemption limit

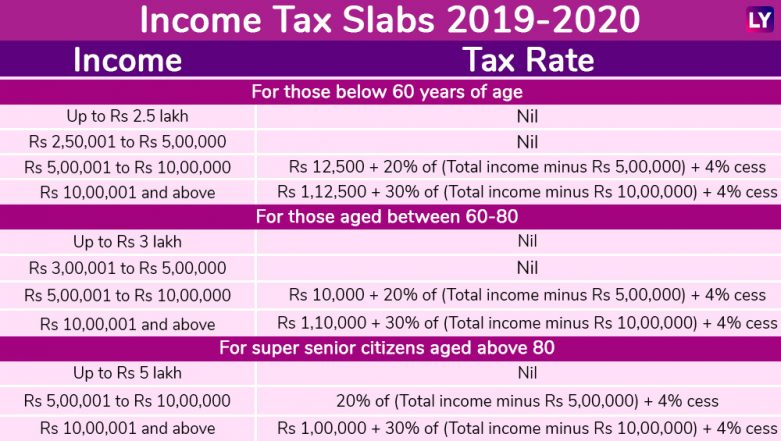

Verkko Income Tax Exemption Limit The basic exemption limit for individuals below the age of 60 years is Rs 2 50 lakhs For senior citizens the exemption limit is Rs 3 lakhs and for very senior citizen who are above 80 years it is Rs 3 50 lakhs The income tax slab is Verkko 13 kes 228 k 2023 nbsp 0183 32 The basic exemption limit for resident individuals who are 60 years of age or more but less than 80 years of age at any time during the tax year is INR 300 000 For resident individuals who are 80 years of age or more it is INR 500 000

India Tax Exemption Limit

India Tax Exemption Limit

https://www.basunivesh.com/wp-content/uploads/2022/02/Latest-Income-Tax-Slab-Rates-for-FY-2022-23-AY-2023-24.jpg

Budget 2023 How Much Income Tax Do You Pay Now Under New Tax Regime

https://akm-img-a-in.tosshub.com/indiatoday/styles/medium_crop_simple/public/2023-02/new_tax_slab_amounts_1.jpg?VersionId=TC39G4qOOdJwSvrqpSWZRhUDn99HRv3j

New Income Tax Slabs For 2019 2020 Will Increase In Tax Exemption

https://st1.latestly.com/wp-content/uploads/2019/02/Income-Tax-Final-Image-781x441.jpg

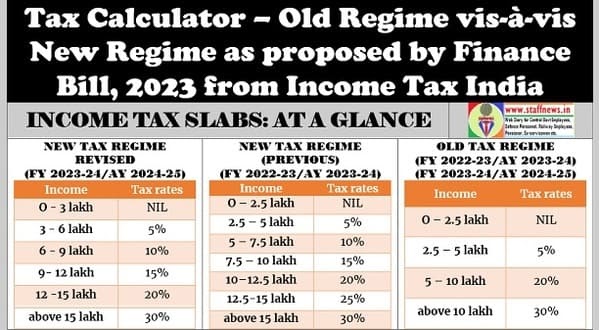

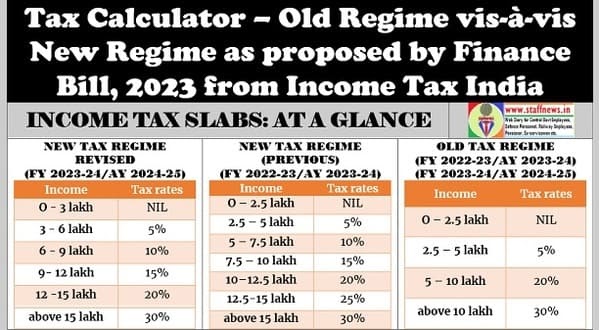

Verkko 4 helmik 2023 nbsp 0183 32 The government hiked the basic income exemption limit from Rs 2 5 lakh to Rs 3 lakh under the new tax regime Apart from this the government increased the rebate eligibility ceiling through Section 87A under the new tax regime from Rs 5 lakh to Rs 7 lakh taxable income Verkko Tax Slabs for AY 2023 24 Individuals and HUFs can opt for the Old Tax Regime or the New Tax Regime with lower rate of taxation u s 115 BAC of the Income Tax Act The taxpayer opting for concessional rates in the New Tax Regime will not be allowed certain Exemptions and Deductions like 80C 80D 80TTB HRA available in the Old Tax

Verkko 10 helmik 2023 nbsp 0183 32 New Tax regime Budget 2023 Do not confuse this rebate with the basic exemption limit The Budget 2023 has hiked the basic exemption limit to Rs 3 lakh from Rs 2 5 lakh currently Thus an individual s income becomes taxable if it exceeds Rs 3 lakh in a financial year Verkko Income Tax Slab Budget 2023 LIVE Updates Finance Minister Nirmala Sitharaman announced a slew of measures for taxpayers in Budget 2023 With a hike in the basic exemption limit and rebate and tweaks to the income tax slabs Sitharaman has made the new income tax regime attractive for salaried individuals Budget 2023 has also

Download India Tax Exemption Limit

More picture related to India Tax Exemption Limit

How The Tax Cuts And Jobs Act Would Change Current Taxes

https://s.hdnux.com/photos/67/74/62/14666882/9/1200x0.jpg

Process Flow Of Applying For Tax Exemptions Of Corporations And

https://1.bp.blogspot.com/-prJpam_lFnI/XMdpYfbdIII/AAAAAAAABM4/sCP3PZywJyUQi6p7PqKutMirNe426OKGACLcBGAs/s1600/tax-exemption.jpg

Income Tax Deductions While Filling ITR In India RJA

https://carajput.com/blog/wp-content/uploads/2017/03/Income-Tax-Deductions-Financial-Year-2020-21..jpg

Verkko 28 hein 228 k 2022 nbsp 0183 32 If an individual opts for the new concessional income tax regime for FY 2021 22 AY 2022 23 then the basic exemption limit will be Rs 2 5 lakh irrespective of the age of the individual taxpayer Senior citizens and super senior citizens do not get any benefit of higher exemption limit Verkko 13 kes 228 k 2023 nbsp 0183 32 Certain income is eligible to be claimed as exempt from taxable income The exemption can be based on income or investment Some of them are detailed below Income source based Tax holiday of profits of business engaged in infrastructure development or development of Special Economic Zones SEZs

Verkko Income Tax Slabs amp Rates in India Tax Exemption Limit FY 2019 20 Do the Digit Insurance Trusted by 3 Crore Indians Pay as you Drive Car Bike Health Commercial Covers COVID 19 Travel More Registration Number Mobile Number Optional 91 View Prices Don t have Reg num keyboard arrow right It s a brand new Car Verkko 10 elok 2022 nbsp 0183 32 The basic tax exemption limit of INR 2 50 lakh also has not been revised for the past several years As a result it is important for the taxpayers to ensure that all permissible eligible tax deduc

Myitreturn Income Tax Return Mumbai

https://lookaside.fbsbx.com/lookaside/crawler/media/?media_id=100050685420472

Income Tax Diary Kolkata

https://lookaside.fbsbx.com/lookaside/crawler/media/?media_id=100064016445801

https://incometaxindia.gov.in/charts tables/threshold_limits.htm

Verkko Every person being an Individual HUF AOP BOI or AJP shall be required to file return of income if his total income before claiming exemption or deduction under 10 38 10A 10B 10BA 54 54B 54D 54EC 54F 54G 54GA or 54GB or Chapter VI A exceeds maximum exemption limit

https://www.bankbazaar.com/tax/tax-exemption.html

Verkko Income Tax Exemption Limit The basic exemption limit for individuals below the age of 60 years is Rs 2 50 lakhs For senior citizens the exemption limit is Rs 3 lakhs and for very senior citizen who are above 80 years it is Rs 3 50 lakhs The income tax slab is

Elite Universities Must Purpose Endowments To Subsidize Students

Myitreturn Income Tax Return Mumbai

Budget 2023 Not Compelling Anyone To Shift From Old To New Tax Regime

India Tax Changes On Remittances Delayed D A LLC

Deloitte Tax hand

Tax Calculator Old Regime Vs New Regime PO Tools

Tax Calculator Old Regime Vs New Regime PO Tools

Budget 2021 Income Tax Returns Exemption Senior Citizens Above 75 Years

Tax Exemption Certificate SACHET Pakistan

Tax Lecture Notes 11 India Tax Structure 2011 This Guide Provides

India Tax Exemption Limit - Verkko 4 helmik 2023 nbsp 0183 32 The government hiked the basic income exemption limit from Rs 2 5 lakh to Rs 3 lakh under the new tax regime Apart from this the government increased the rebate eligibility ceiling through Section 87A under the new tax regime from Rs 5 lakh to Rs 7 lakh taxable income