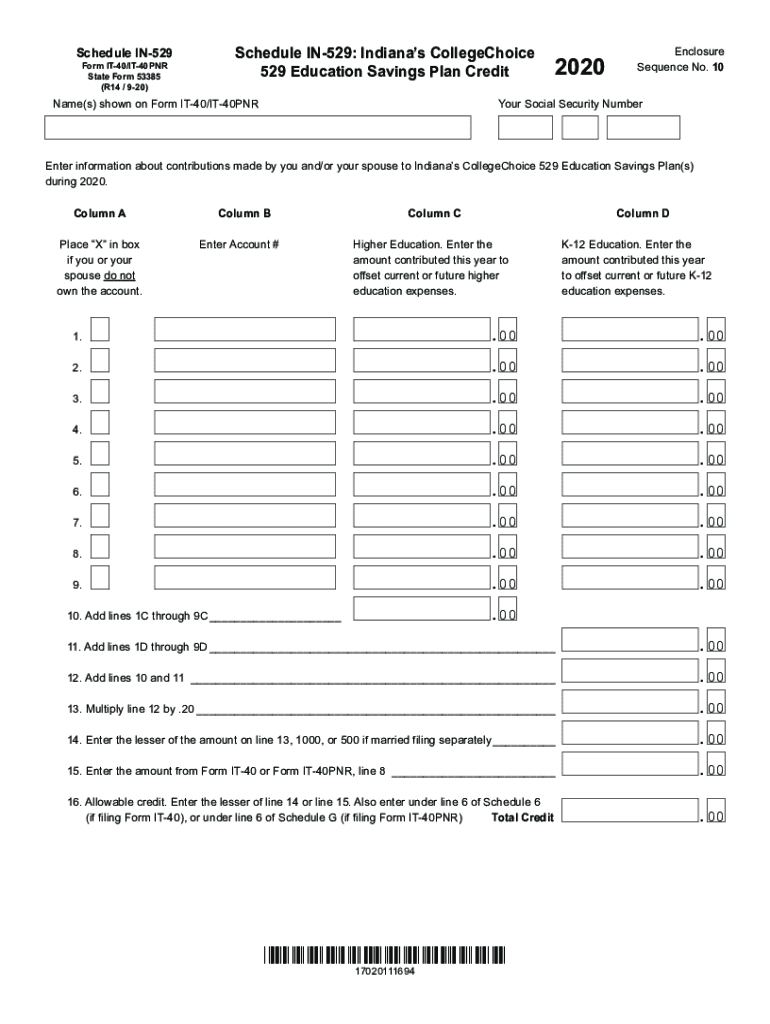

Indiana 529 Tax Credit Recapture Qualified withdrawals from an Indiana529 Plan account are already state and federally tax exempt Additionally Indiana taxpayers who contribute to an Indian529 account may be

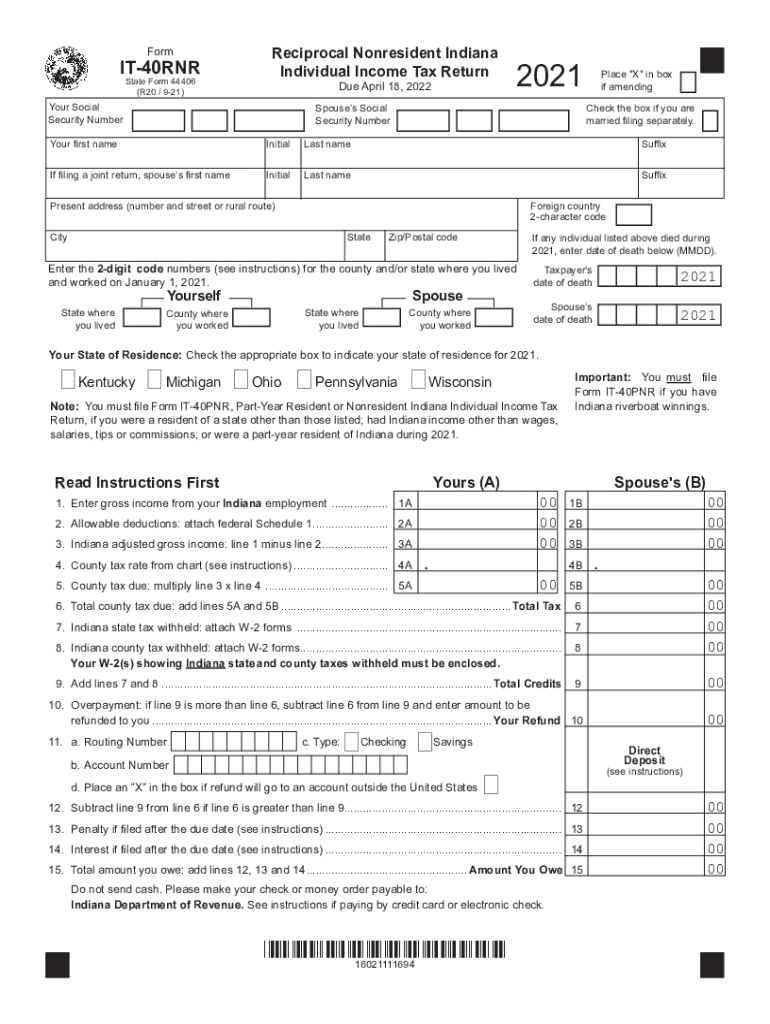

6 Indiana taxpayers are eligible for a state income tax credit of 20 of contributions to an Indiana529 Direct Savings Plan account up to 1 500 credit per year 750 for married Indiana enacts 529 tax recapture A new law in Indiana provides that an account owner of an Indiana College Choice 529 account must repay a portion of a previously claimed

Indiana 529 Tax Credit Recapture

Indiana 529 Tax Credit Recapture

https://www.upromise.com/articles/wp-content/uploads/sites/3/2021/02/AdobeStock_208780418-2048x1367.jpeg

Breaking Down The Minnesota 529 State Tax Benefit

https://media-exp1.licdn.com/dms/image/C4E12AQGiF_qQwU3qfQ/article-cover_image-shrink_600_2000/0/1520177306827?e=2147483647&v=beta&t=taC40a_ZhT6MW-Ng9enZvsGYTa1sc4gkdNmB25T75MM

Indiana 529 Login 2020 2024 Form Fill Out And Sign Printable PDF

https://www.signnow.com/preview/563/641/563641079/large.png

In Indiana and nation wide only contributions made to the CollegeChoice 529 education savings plan are eligible for an Indiana tax credit Who must file Schedule IN 529R An 1 Indiana taxpayers are eligible for a state income tax credit of 20 of contributions to an Indiana529 Advisor account up to 1 500 per year This credit may be subject to

Indiana taxpayers can get a state income tax credit equal to 20 of their contributions to a Indiana529 account up to 1 500 per year 750 for married filing separately 1 You will be contacted by IEDC and or the Indiana Department of Revenue regarding repayment or reduction of those credits Currently Indiana has two offset non

Download Indiana 529 Tax Credit Recapture

More picture related to Indiana 529 Tax Credit Recapture

Giving Tax Credit Where Credit Is Due

https://www.chevyhardcore.com/image/2023/12/giving-tax-credit-where-credit-is-due-2023-12-29_09-27-16_080592.jpg

Indiana It 40rnr 2021 2024 Form Fill Out And Sign Printable PDF

https://www.signnow.com/preview/594/959/594959474/large.png

Indiana 529 Tax Credit Increase 50 In 2023 YouTube

https://i.ytimg.com/vi/l3aat-dafCM/maxresdefault.jpg

Complete this schedule if you are reporting a recapture of an offset credit that was claimed in a prior year We last updated the Credit Recapture in February 2024 so this is the Non Qualified Distributions Taxes Penalties Recapture A non qualified withdrawal from an Indiana 529 is subject to recapture of previous tax credits or 20 Indiana state income

This credit may be subject to recapture from the account owner not the contributor in certain circumstances such as rollovers to another state s 529 plan federal nonqualified 6 Indiana taxpayers are eligible for a state income tax credit of 20 of contributions to an Indiana529 Direct Savings Plan account up to 1 500 credit per year 750 for married

YERSAN 529 Willi Hats Heaven Ekskluzywne Nakrycia G owy

https://willi.pl/31016-large_default/yersan-529.jpg

How To Get Education Tax Credits With A 529 Plan Bankrate

https://www.bankrate.com/2009/07/25183933/Heres-how-to-get-education-tax-credits-if-you-used-a-529-plan.jpg

https://www.in.gov/tos/iesa/tax-credit

Qualified withdrawals from an Indiana529 Plan account are already state and federally tax exempt Additionally Indiana taxpayers who contribute to an Indian529 account may be

https://www.indiana529direct.com/home/help-center-taxes.html

6 Indiana taxpayers are eligible for a state income tax credit of 20 of contributions to an Indiana529 Direct Savings Plan account up to 1 500 credit per year 750 for married

Modernizing Investment Tax Credit Recapture Rules

YERSAN 529 Willi Hats Heaven Ekskluzywne Nakrycia G owy

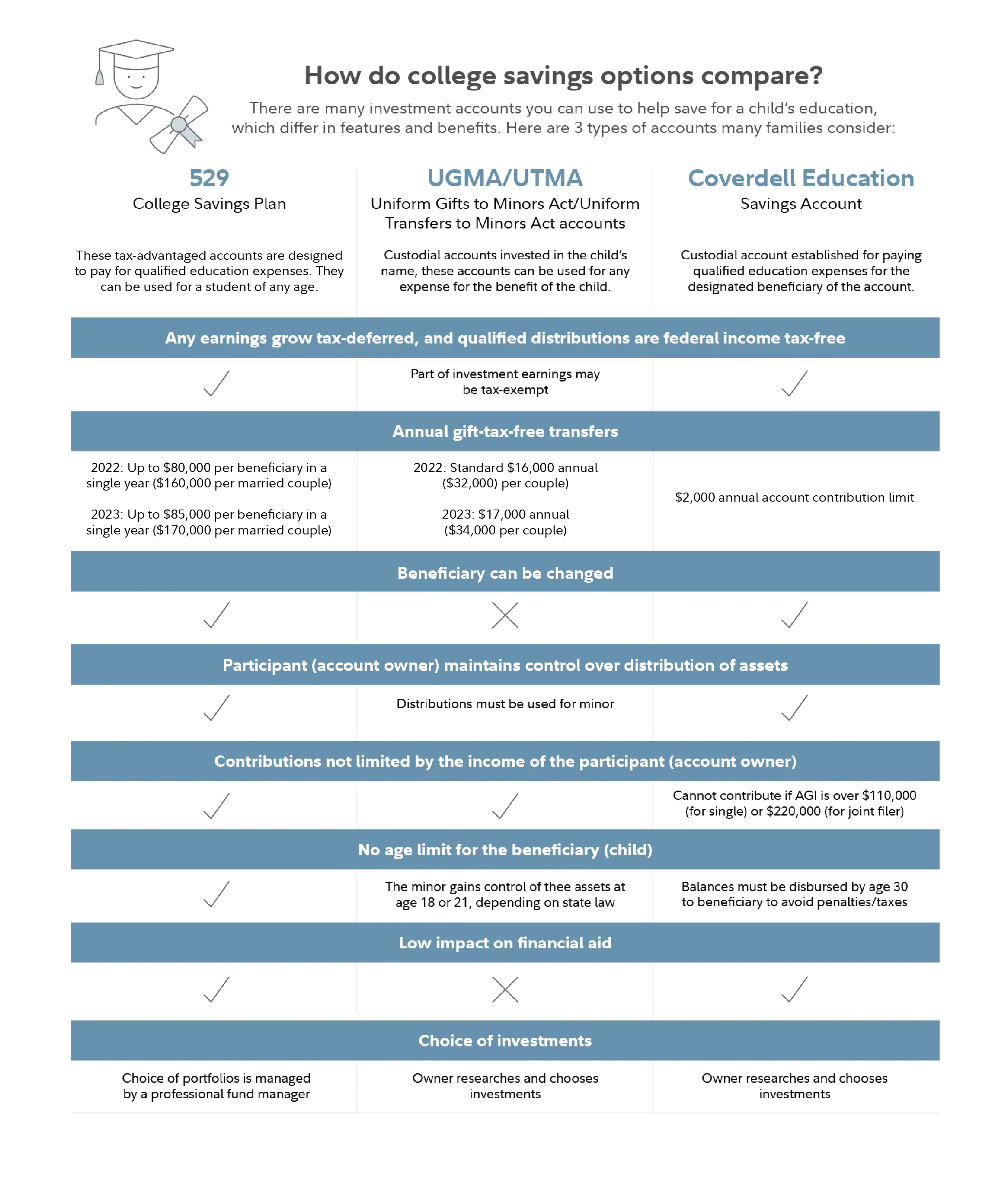

Benefits Of A 529 Plan District Capital 48 OFF

If You Use Your 529 College Savings Plan For This You May Get A Tax

Benefits Of A 529 Plan District Capital 48 OFF

Benefits Of A 529 Plan District Capital 48 OFF

Indiana 529 Plan 5 Common Questions Inside INdiana Business

Benefits Of A 529 Plan District Capital 48 OFF

2023 Financial Update What You Need To Know

Indiana 529 Tax Credit Recapture - In Indiana and nation wide only contributions made to the CollegeChoice 529 education savings plan are eligible for an Indiana tax credit Who must file Schedule IN 529R An