Indiana College Savings Plan Tax Credit In addition to lowering costs and expanding investment options Indiana offers a special tax credit that potentially makes the Indiana529 Plans an even more attractive option

Indiana529 Advisor Savings Plan can help education dreams become reality Tax Benefits Enjoy tax deferred growth and a generous Indiana state tax credit only available You may be eligible for a credit if you made a contribution s to Indiana s CollegeChoice 529 education savings plan However if you made a non qualified withdrawal s from

Indiana College Savings Plan Tax Credit

Indiana College Savings Plan Tax Credit

https://www.consistentlycurious.com/wp-content/uploads/2021/05/Financial-1024x655.jpg

How Did Using A Credit Card For Daily Expenses Fund A College Savings Plan

https://media.licdn.com/dms/image/D4E12AQE4rqRPQ_YgbA/article-cover_image-shrink_720_1280/0/1684358208720?e=2147483647&v=beta&t=5Ehxa0OVdfHmtUAFSib3Kdft06bfskI4nuRaMJI5rQs

529 College Savings Plans What Are The Tax Benefits Borshoff Consulting

https://borshoffconsulting.com/wp-content/uploads/2020/12/529-College-Savings-Plans-What-Are-the-Tax-Benefits-Borshoff-Conulting-Blog-Image-1200x630-1.jpg

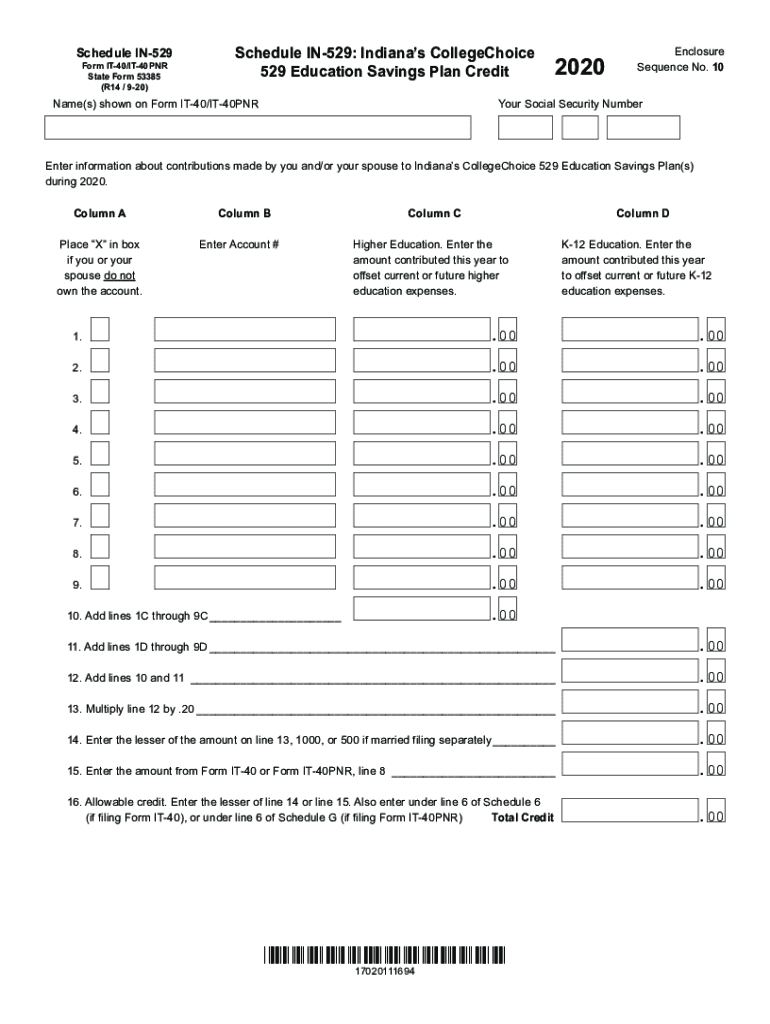

Sponsored by the state Indiana529 is a tax advantaged investment plan that helps families save for future educational expenses like tuition fees equipment computers Indiana offers a 20 tax credit worth up to 1 500 750 for married filing separately for contributions made to an Indiana 529 Plan regardless of tax filing status Minimum 10

Taxpayers in Indiana who contribute to the state s CollegeChoice 529 Savings Plan can get the lesser of a tax credit on 20 back on their contribution or a 1 000 tax credit Starting in January State residents can take a tax credit on contributions to an Indiana 529 up to 20 on 5 000 contributed In Indiana you can contribute up to 450 000 in total to college savings plans Indiana also

Download Indiana College Savings Plan Tax Credit

More picture related to Indiana College Savings Plan Tax Credit

How Do Student Loans Work In Canada TeenLearner

https://teenlearner.com/wp-content/uploads/2021/12/How-Do-Student-Loans-Work-in-Canada-1.jpg

Saving For Your Child s College Fund Can Be Overwhelming And

https://i.pinimg.com/originals/93/95/61/9395614d531011145d868d9f35c9e22e.jpg

529 College Savings Plan And Student Loan Blog

https://3stepsolutions.s3-accelerate.amazonaws.com/assets/custom/000008/images/blogs/how-students-can-maximize-their-financial-literacy.jpg

How to save for a 529 college savings plan in Indiana The Indiana529 Direct Savings Plan only takes 10 to start and is better than keeping money in your bank account because Indiana residents who sign up for the Indiana 529 Direct Savings Plan get even more benefits including no annual account maintenance fee and a state income tax credit

The Plans many unique features from low fees to tax advantaged investing make them one of the most popular ways to save for future education expenses Indiana tax payers Discover the tax advantages of Indiana s 529 Direct Plan for saving for your child s education Learn about tax benefits deductions and incentives that can help you

Indiana 529 Login 2020 2024 Form Fill Out And Sign Printable PDF

https://www.signnow.com/preview/563/641/563641079/large.png

Cash Management Account CMA Or College Savings Plan 529 pros Vs

https://i.ytimg.com/vi/XKZ2Ch-4s24/maxresdefault.jpg

https://www.in.gov/tos/iesa/tax-credit

In addition to lowering costs and expanding investment options Indiana offers a special tax credit that potentially makes the Indiana529 Plans an even more attractive option

https://www.indiana529advisor.com

Indiana529 Advisor Savings Plan can help education dreams become reality Tax Benefits Enjoy tax deferred growth and a generous Indiana state tax credit only available

College Savings Plans T Rowe Price

Indiana 529 Login 2020 2024 Form Fill Out And Sign Printable PDF

What Is A 529 College Savings Plan Your Dream Blog

Five Tips For Buying A 529 College Savings Plan By Newscolleges Medium

College Savings Plan College Cost Calculator College Budget By

What Type Of College Savings Account Is Best The Inspiration Edit

What Type Of College Savings Account Is Best The Inspiration Edit

Virginia College Savings Plan 529 Save For Your Kid s Education

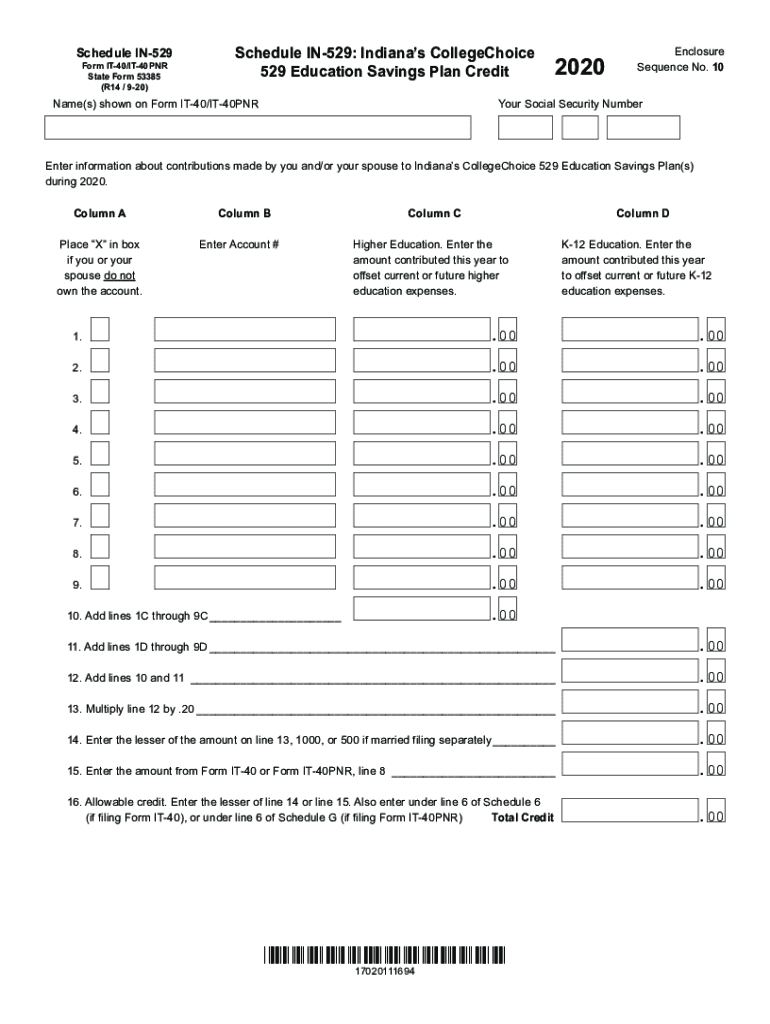

The Tax Benefits Of College 529 Savings Plans Compared By State

:max_bytes(150000):strip_icc()/close-up-of-diploma-and-banknotes--studio-shot-150973797-b97794ab5e8f4535b64517d016b1220e.jpg)

How Virginia s 529 Education Savings Plan Works

Indiana College Savings Plan Tax Credit - Indiana taxpayers who contribute to a CollegeChoice 529 may receive a state income tax credit equal to 20 of their contributions For contributions occurring