Indiana Refunds 2023 Verkko 11 elok 2022 nbsp 0183 32 Indiana automatic taxpayer refunds new and old are on the way Here s what to know Those returns won t be accepted until January 2023 according to the Department of Revenue

Verkko 25 helmik 2022 nbsp 0183 32 To check the status of your Indiana state tax refund go online to the INTIME portal or call 317 232 2240 the automated refund line You ll need to provide your Social Security number as Verkko 19 tammik 2023 nbsp 0183 32 The 2023 individual income tax filing season is here The Indiana Department of Revenue DOR will start accepting filings for 2022 individual income tax returns on Monday Jan 23 2023 in concert with the Internal Revenue Service IRS You will have until Tuesday April 18 2023 to file both state and federal 2022 tax

Indiana Refunds 2023

Indiana Refunds 2023

https://phantom-marca.unidadeditorial.es/247b750ea71b499bdfe2764b40d6252b/resize/1200/f/jpg/assets/multimedia/imagenes/2022/10/29/16670012791640.jpg

![]()

Machine Translation Summit 2023

https://files.sciconf.cn/meeting/2023/15680/image/20230630/2023063016475774856102913.jpg

Display 2023 2024

https://501438041880-zoomcatalog-assets.s3.amazonaws.com/22325/35c0a1fb3f9c498793c4e66c8609ea3e/preview.jpg

Verkko 14 lokak 2023 nbsp 0183 32 The Indiana Automatic Taxpayer Refund ATR is a state fiscal policy that gives back some of the state s surplus revenue to eligible taxpayers The ATR has two components a 125 refund that was issued in 2022 and a 200 refund that is available in 2023 Verkko To receive the 200 refund they must file an Indiana resident tax return by Dec 31 2023 and claim the 200 ATR as a refundable tax credit Hoosiers who do not normally file a tax return due to their income will need to file a

Verkko To receive the 200 ATR refundable tax credit qualified taxpayers must file a 2022 Indiana resident tax return no later than Dec 31 2023 That means some Hoosiers who do not normally file a tax return due to their income will need to file a 2022 state tax return to claim the ATR as a tax credit Verkko 9 elok 2022 nbsp 0183 32 LOUISVILLE Ky WDRB Some Indiana residents could see their 200 rebate payments from the state as soon as next week Married couples who filed their taxes jointly will receive 400 The

Download Indiana Refunds 2023

More picture related to Indiana Refunds 2023

2023 Emerging Leadership Conference

https://emergingconference.com/2023/wp-content/uploads/2021/09/logo.png

Financial Information Shubhashraya Foundation

https://shubhashraya.org/admin_assets/images/logo.jpeg

Refunds Corefy Merchant Documentation

https://og-image.now.sh/Refunds.png?theme=dark&md=1&fontSize=150px&images=https:%2F%2Fassets.zeit.co%2Fimage%2Fupload%2Ffront%2Fassets%2Fdesign%2Fhyper-bw-logo.svg

Verkko 9 elok 2022 nbsp 0183 32 by Chad E Voss On August 5 2022 Indiana Governor Eric J Holcomb signed a bill providing for an additional 200 automatic taxpayer refund for the 2021 taxable year The bill also establishes a sales tax exemption for children s diapers and it caps the Indiana gasoline use tax rate at 0 295 per gallon through June 30 2023 Verkko Indiana Full Year Resident 2023 Individual Income Tax Return Form IT 40 State Form 154 R22 9 23 Refund Line 18 minus lines 19d and 20 Note If less than zero see line 23 instructions Your Refund 21 00 22 Direct Deposit see instructions a Routing Number b Account Number

Verkko You will be able to check the status of your refund in INTIME after DOR finishes processing your tax return Information regarding the 125 Automatic Taxpayer Refund ATR and 200 additional ATR issued in 2022 is not displayed or available via INTIME Verkko File Your 2022 Indiana Resident Tax Form by Dec 31 2023 Include all supporting documentation and fle no later than Dec 31 2023 Indiana Department of Revenue

Pro Towels 2023

https://501438041880-zoomcatalog-assets.s3.amazonaws.com/515/a340771a31bb461e80032c62347715c7/preview.jpg

Returns Refunds

https://therapeuticals.com.au/wp-content/uploads/2020/03/Png-1024x614.png

https://www.indystar.com/story/news/2022/08/11/refund-checks-are-on...

Verkko 11 elok 2022 nbsp 0183 32 Indiana automatic taxpayer refunds new and old are on the way Here s what to know Those returns won t be accepted until January 2023 according to the Department of Revenue

https://www.indystar.com/story/news/local/2022/02/25/indiana-tax...

Verkko 25 helmik 2022 nbsp 0183 32 To check the status of your Indiana state tax refund go online to the INTIME portal or call 317 232 2240 the automated refund line You ll need to provide your Social Security number as

Tax Refunds For Expats 2023

Pro Towels 2023

GarthTensho

Forbes 30 Under 30 2023 Retail Ecommerce

Lodging Workshop 2023

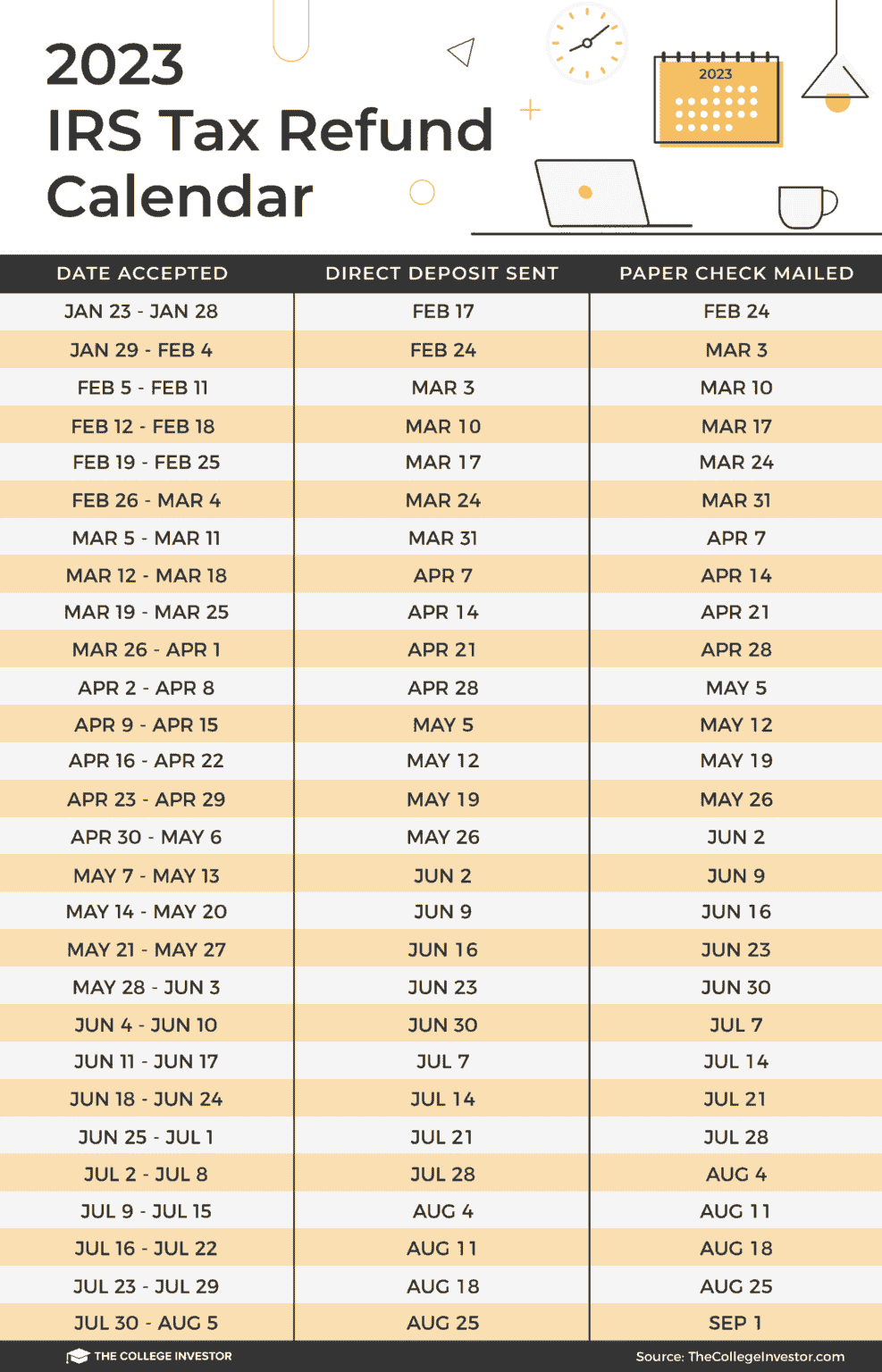

2023 Tax Return Timeline When To Expect Your Refund Texas Breaking News

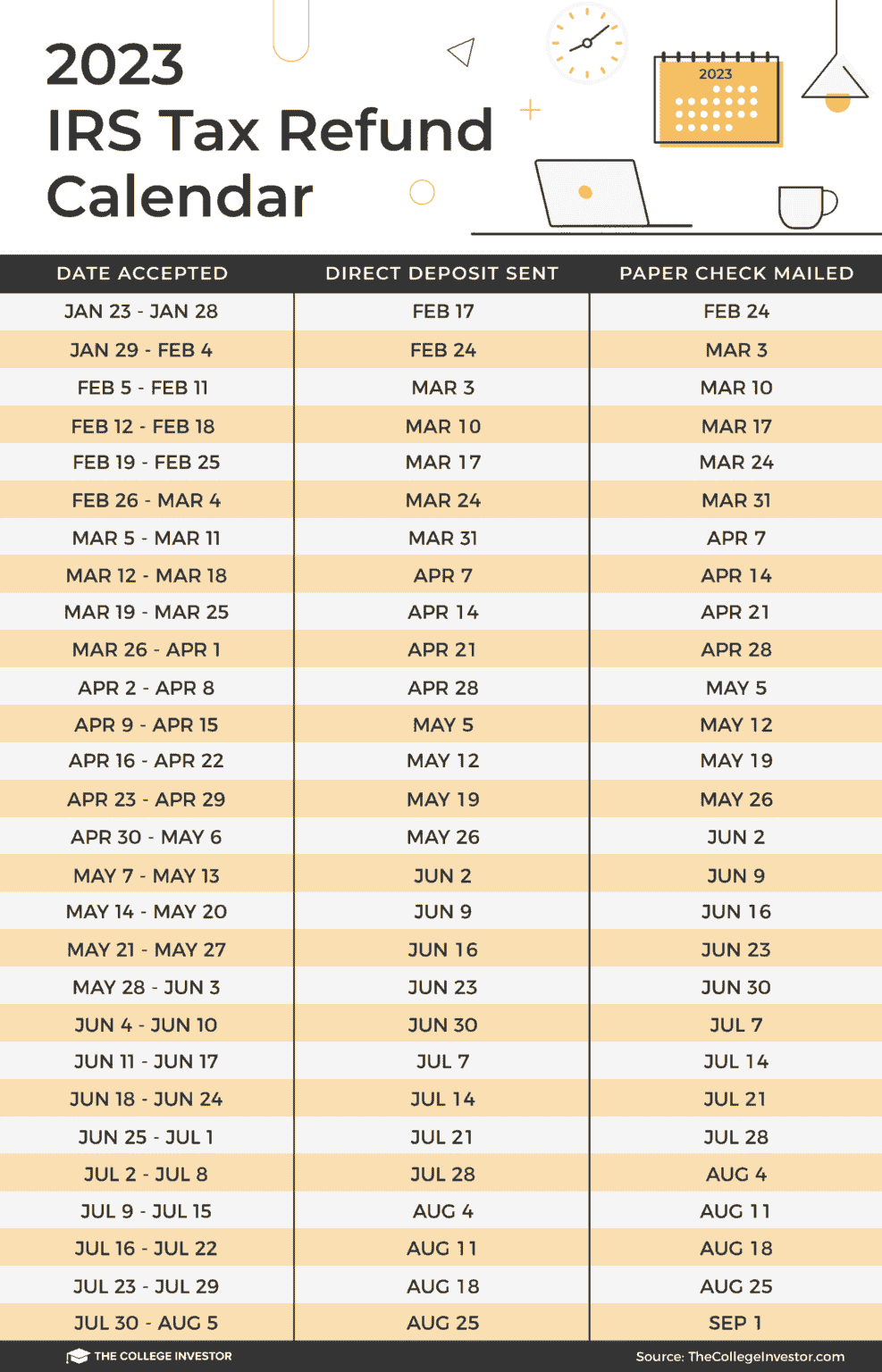

2023 Tax Return Timeline When To Expect Your Refund Texas Breaking News

Illinoisans Watch As Indiana Refunds Every Taxpayer From Surplus

2023 4 PALACE

Vol 1 No 5 2023 June 2023 International Journal Of Scientific

Indiana Refunds 2023 - Verkko 4 months ago Updated Follow For more information on this one time taxpayer refund go to dor in gov and click on quot Learn More quot under the Automatic Taxpayer Refund image You can access this page directly at dor in gov individual income taxes automatic taxpayer refund Facebook Twitter LinkedIn Where do I go for tax forms Need Help Have